That high and rising profitability, combined with growing off a small base, means that Innovative Industrial is growing at rates that would put most tech stocks to shame. For example in Q3 2018 revenue rose 150% and here are the REIT’s YTD 2018 results:

- Revenue growth: 142%

- AFFO: 297% (rising profitability from growing economies of scale)

- Share count growth: 94% (funding 100% of growth with equity)

- AFFO/share growth (REIT bottom line): 111%

- Dividend Growth: 183%

- AFFO Payout Ratio: 91% (dividend sustainable and covered by cash flow)

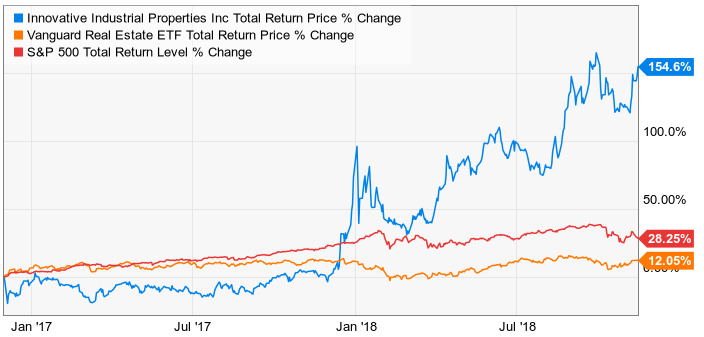

Such growth is fueling amazing total returns for investors.

(Source: Ycharts)

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!