So you can see that Apple stands to benefit immensely if the trade war ends, or merely even de-escalates. And keep in mind that the main reasons behind the recent price crash (speculation that iPhone XR was a flop) have been debunked by the company. On November 28th, Greg Joswiak, Apple’s VP of product marketing told Reuters,

“Since the iPhone XR became available, it’s been the best-selling iPhone each and every day that it’s been on sale.”

That bodes well for the company being able to achieve analysts long-term and realistic mid-single digit revenue growth and 13% EPS growth (driven by epic share buybacks from $123 billion in net cash and over $50 billion in annual post-dividend free cash flow).

And keep in mind that it’s not iPhone growth that’s going to be the main driver of that sales and earnings growth, but services.

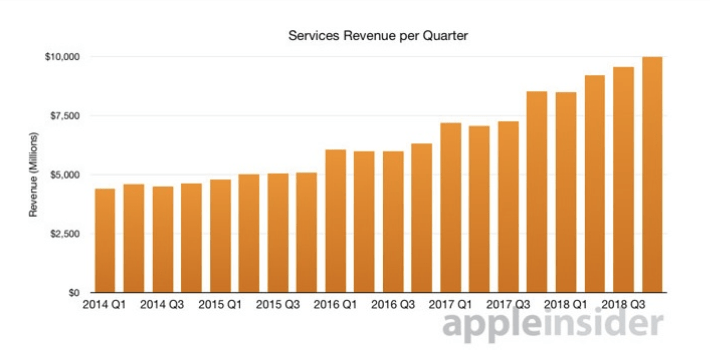

In 2017 Tim Cook stated the company’s goal was to hit $50 billion in annual service revenue (recurring subscription based and high margin) by 2020. Thanks to four years of about 30% annual growth service revenue are now at a $40 billion annual run rate putting the company well on track to crush that guidance.

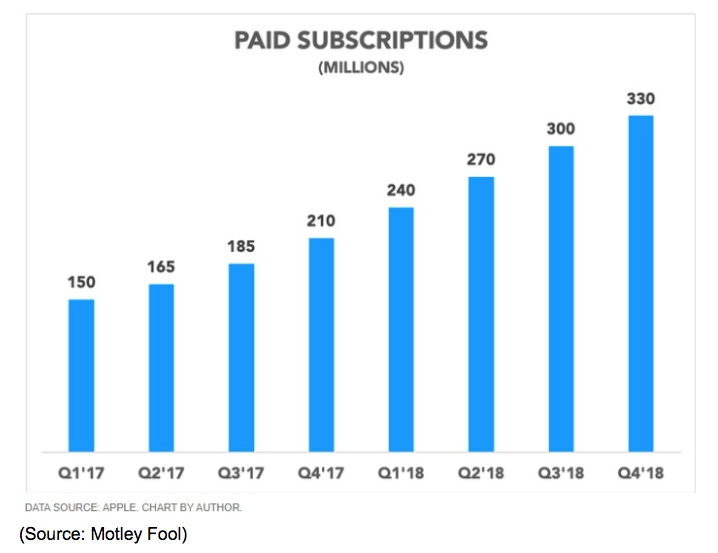

That’s thanks to Apple effectively monetizing its 1.3 billion iOS device user base and converting that in more monthly subscribers than there are people living in the US.

By 2023 Morgan Stanly’s Katy Huberty, who has accurately predicted service revenue growth for the last six straight quarters, estimates that Apple Music alone will have 164 million subscribers. And service revenue over the next five years is expected to nearly triple from $37 billion in 2018 to $101 billion. As a result, Morgan Stanley estimates Apple’s EPS will grow by 20% annually over the next five years. But even if you use just the current analyst consensus (13.1% growth rate) that still equates to Apple delivering 15% to 16% total returns, or roughly double what the S&P 500 is likely to deliver, in the coming years. That makes this low-risk dividend growth blue-chip a fantastic buy today, ahead of the potential end to the trade war.

Here’s another one to keep an eye on…

Click on the Next Page to Continue Reading

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!