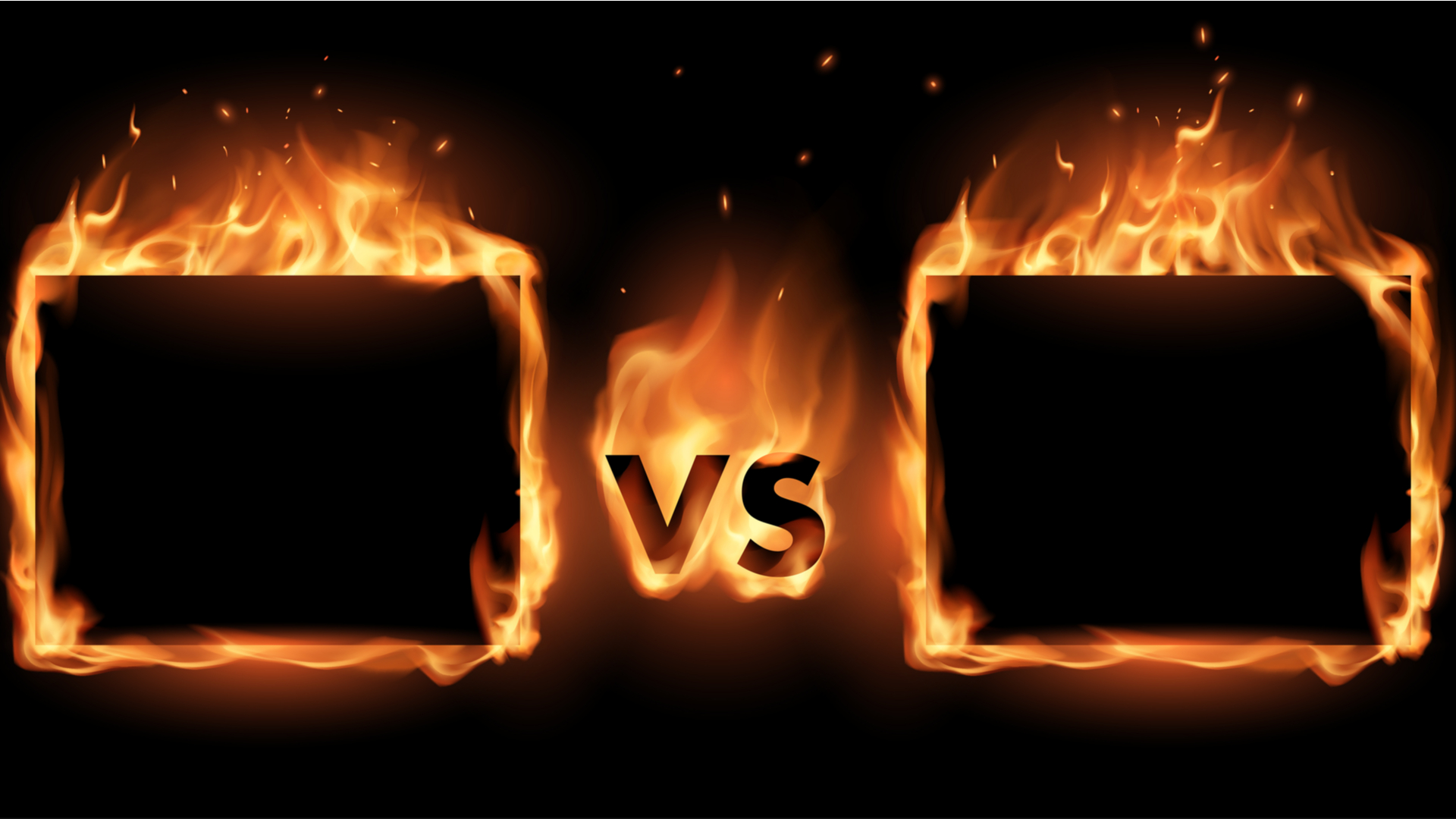

It’s fast building a leading network across that country’s largest cities, as well as smaller urban markets. That includes partnering with top national retailers, the Home Depot and Lowe’s of India. And given that India’s middle class is expected to reach 273 million households in 2020 and 322 million in 2030, A.O Smith has a massive growth runway ahead of it. In 2017 India sales (less than 1% of the company’s total) grew at 44%, signaling the company might be able to recreate its earlier Chinese success in that even larger potential market.

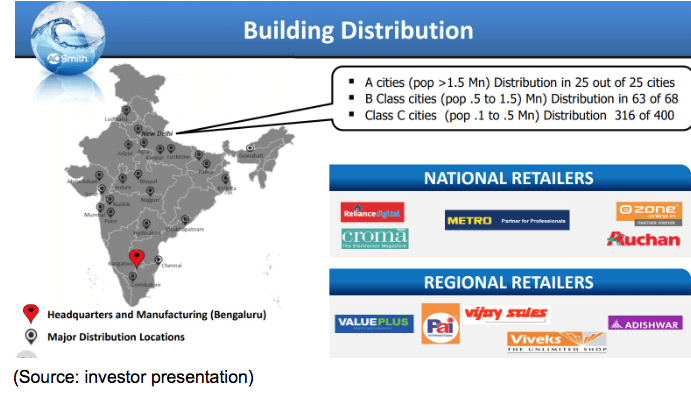

The combination of China and India is expected to help drive 8% long-term organic sales growth, which analysts expect to translate into 10% EPS growth over the long-term, even factoring in the current trade war (which will have to end eventually).

That doesn’t sound like much BUT when you factor in the company’s dividend and it’s current 40% discount to fair value you get the potential for 17% total returns over the coming decade. That’s more than double what the S&P 500 is likely to deliver, and from a low-risk dividend aristocrat (25 consecutive years of dividend growth) with a fortress-like balance sheet no less.

Bottom Line: Times Of High Market Volatility And Fear Are The Perfect Time To Buy Grade A Dividend Growth Stocks At Bargain Prices

While it’s far from guaranteed that we get a handshake agreement to end the trade war on Saturday, the fact is that both the US and Chinese economies are starting to feel the growing negative effects of escalating tariffs. Thus both Trump and Xi have strong incentives to at least announce a “deal to make a future deal” that prevents even further damage, such as 25% tariffs on another $267 billion in US imports from China next year.

If a deal is struck, either this week or soon after, then Apple and A.O Smith are poised to rocket higher, far off their recent bear market lows. And given the Grade A nature of both of these blue-chips, that makes today a great time for value-focused income growth investors to buy these coiled springs before they pop. And if a deal isn’t struck? Well then the low valuations of both stocks mean there is relatively little downside risk in the short-term, compared to the massive upside potential you can lock in by investing in both companies today.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!