I think we can all agree that it sucks to see your portfolio steadily fall over time. As I write this the market is down close to 1% more after falling 0.85% yesterday, and the Dow Jones Industrial Average is now poised to decline for the 7th consecutive week. That would be the longest weekly losing streak since 2011, and the S&P 500 is hardly doing much better (down 5.7% from its May 3rd high).

But such painful periods (in this case created by rising trade war and recession fears) are inevitable and good long-term investing returns require you be able to deal with them. So here are three time tested methods (that I use myself with my retirement portfolio) for not just surviving scary market volatility, but ultimately profiting from it.

Method One: Ignore It

Noted financial writer Jared Dillian (author of “Street Freak: Money and Madness at Lehman Brothers”) calls checking your portfolio too frequently the “F9” problem. By which he means that you can refresh your browser whenever you want and thus become obsessed and despondent over mounting short-term losses.

In a recent article, Mr. Dillian pointed out that:

“Michael Batnick, director of research at Ritholtz Wealth Management, published an important finding a few weeks ago on Twitter. He noted that if a hypothetical investor were to check his P&L on a daily basis, there would be a 46% chance that he would show a loss. But if he were to check his P&L once a year, there would only be a 26% chance that he would show a loss (because markets go up over time). The goal here is to stay invested and continue compounding, and if you are regularly showing losses, you are more likely to get frustrated and liquidate your investment—and stop compounding. Which would be catastrophic.” – Jared Dillian (emphasis added)

In fact, a big reason that private equity funds tend to achieve great returns is due to their illiquid nature. While stocks trade second to second, private assets like infrastructure and commercial real estate transactions are far less common, meaning that investors are blissfully unaware of any unrealized losses they may have.

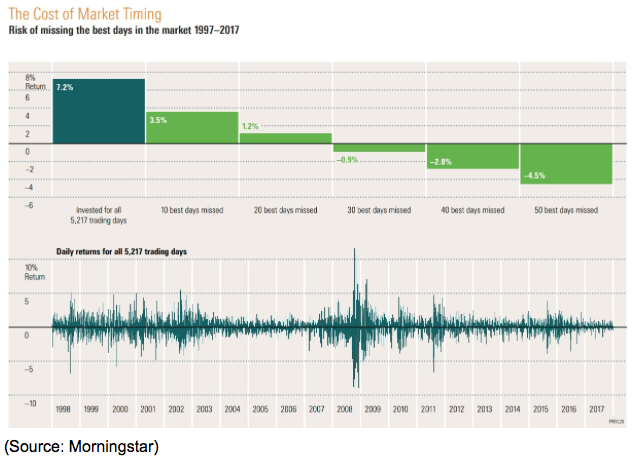

This points out the ironic problem of how too much information, about something we care deeply about (our hard earned money), can work against us. Studies show it hurts twice as much to lose a dollar as make a dollar. This is the principle behind loss aversion and why market timing has cost so many investors their financial dreams over the years.

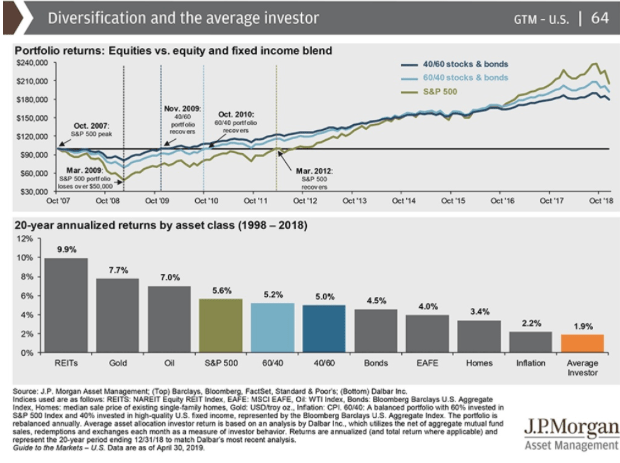

Despite two 50+% crashes over the past 20 years (78% above the average bear market decline since WWII) the S&P 500 has still delivered 5.6% CAGR total returns over the past 20 years. That’s good enough to triple your money over that time (double it in inflation-adjusted terms).

But note that the average investor’s gains were just 1.9% CAGR, worse than a 100% bond portfolio, or, in fact, any asset class he/she could have owned. The reason for that is that market timing, or rather effective market timing, is all but impossible. And the data is clear if you do market timing wrong, it’s could prove disastrous for your wealth.

From 1997 to 2017 missing just 50 of the best single day gains would have turned a 7.2% CAGR total return over that time into a 4.5% CAGR annual loss. What does that mean in dollar terms? A buy and hold investor would have quadrupled his/her money while the market timer who missed 0.1% of the best days (80% of which happen within 2 weeks of the worst days) would have lost 60% of their wealth.

In other words, the biggest risk of failing to achieve your long-term financial goals is to try to time the market, such as selling ahead of a bear market or correction. None other than Peter Lynch, the second best investor in history said

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves.” – Peter Lynch

Lynch, who delivered 29% CAGR total returns at Fidelity’s Magellan Fund from 1977 to 1990 (while value investing and owning up to 1,000 companies at a time) isn’t being cute with his famous warning against market timing. The historical data backs him up 100% and explains why Ritholtz Wealth Management, and many other asset managers, recommends checking your portfolio as infrequently as possible.

This is an approach I’ve adopted myself for my retirement portfolio, where I keep 100% of my net worth. Not just does ignoring short-term volatility help you avoid the dangerous temptation of market timing (which even Wall Street’s highest paid analysts can’t do well) but it also helps with the second method for dealing with market volatility.

Method Two: Embrace It

The difference between speculation (gambling) and investing is that investors accumulate income producing assets over time while speculators buy securities purely with the goal of selling them at a higher price (the so-called “greater fool” theory).

The reason that I’m personally 100% invested in blue-chip dividend stocks is that I know myself and that, despite being a professional analyst, I might not be able to remain disciplined in the face of long periods of underperformance if I owned non-dividend paying growth stocks.

And as Warren Buffett, the greatest investor in history (20.5% CAGR total returns over 54 years) said about the secret to his success “We don’t have to be smarter than the rest. We have to be more disciplined than the rest.”

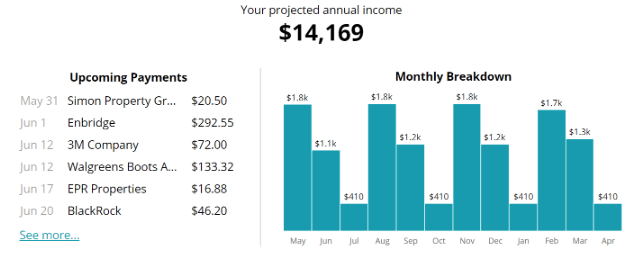

My portfolio is designed to maximize safe and growing income so that one day I can afford to pay 100% of my expenses with just 50% (or less) of post-tax dividends. That is my definition of financial independence and what will allow me to retire.

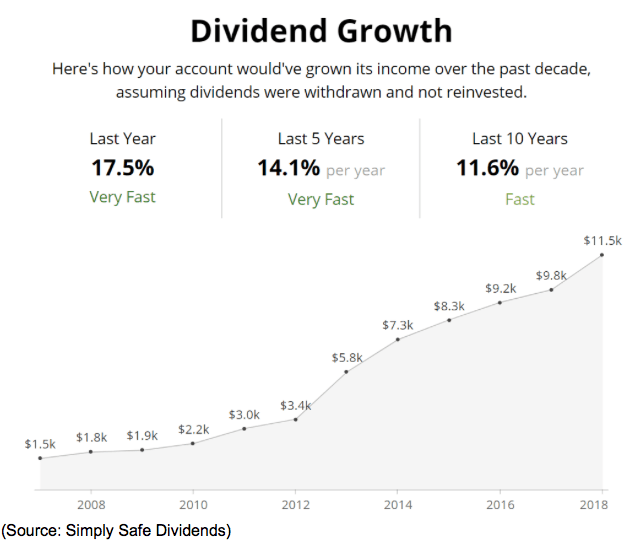

Here is the dividend data from my retirement portfolio. I getting paid a handsome 5.2% yield on invested capital, which amounts to over $14,000 per year in dividends. Better yet, those dividends are all from blue-chip quality companies whose dividends didn’t just survive the Financial Crisis intact but actually grew at double-digit compound rates during the Great Recession.

And better still, I bought my average company at a 15% discount to fair value, according to Morningstar’s highly conservative discounted cash flow models. Which brings me to the second way that I’m personally dealing with this market volatility, embracing it as my greatest ally.

Right now my watchlist (which tracks over 180 blue-chip dividend stocks) is showing dozens of highly undervalued companies. I’m able to buy $2,000 per week, and even highly undervalued companies (some 30% to 50% below Morningstar’s fair value estimate) are getting hit hard by this market pullback.

In recent weeks I’ve been able to:

- Buy 3M at one of its highest yields in 25 years

- Buy Lazard at its lowest PE ratio and highest yield since its 2005 IPO

- Buy Albemarle (which becomes a dividend aristocrat in 2020) at a PE of 11 (and PEG ratio of 0.8)

- My recent investments have been at an average weighted forward PE of 11.0

- My recent investments have been at a price/free cash flow of 9.3

- My recent investments have been at an average yield of 4.0%

- My recent investments have been at an average discount to Morningstar’s fair value of 23%

What’s more this Friday I plan to double my position in British American Tobacco, which is now yielding a safe 7.3% and growing its dividend at 4% annually for three years and then 6% to 9% after that (per management guidance).

My point is that if you have discretionary savings to put to work then you should LOVE not fear downturns like this. Being able to buy quality income producing assets at deep discounts to fair value is the smartest thing you can do with your money and such bargains only happen during times of high market volatility and fear.

After all, as Buffett famously said “You pay a very high price in the stock market for a cheery consensus.” But at the same time Peter Lynch reminds us that “time is on your side when you own shares in superior companies.”

I don’t know about you, but I consider a collection of companies that can put together 10 years of double-digit dividend growth, even during the worst economic disaster since the Great Depression, “superior companies”.

And being able to steadily add to them, at yields of 5% to 9% and discounts to fair value of 20% to 40% is a great long-term opportunity. One that allows me to cheerfully keep buying in the face of all this market fear, uncertainty and doubt.

Ok, so maybe those with lots of time and high savings can profit from market declines like this. But what about those with smaller risk tolerances, like retirees, or those approaching retirement? For them there is method three for dealing with market volatility.

Method Three: Mitigate It…the Smart Way

Remember that market timing doesn’t work, and is in fact, the absolute worst thing you can try. Instead the right asset allocation is the best way to protect your wealth by avoiding costly mistakes like panic selling during downturns.

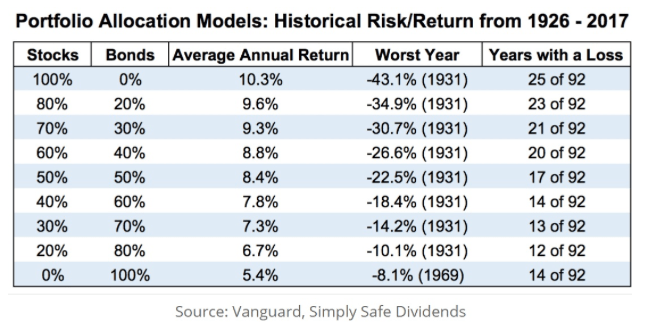

Stocks might be the best performing asset class in history, but those strong long-term returns come at the expense (and because of) high volatility. In contrast bonds (including cash equivalents like T-bills) are a lower volatility and typically countercyclical asset class. The reason most people need to own between 20% and 60% bonds (the rest in stocks) is because this helps you maximize your personal potential total returns over time.

It doesn’t matter if a 100% stock portfolio will grow the biggest over time, if the gut wrenching declines (57% in the Great Recession) make it impossible for you to avoid selling at the exact wrong time.

Remember that JPMorgan study showing investor returns over the past 20 years? Well even a 60/40 bond/stock portfolio, something ultra conservative 80 year old retirees use, managed to deliver 5.0% CAGR total returns, more than double what the typical market timing investor enjoyed.

What’s more that 60/40 portfolio suffered half the volatilty of the broader market while enjoying 89% of the returns of a 100% S&P 500 portfolio. In other words, on a risk-adjusted basis it was the superior option for anyone who simply can’t emotionally stand big losses.

The precise asset allocation that’s right for you will vary depending on your personal needs, goals, savings rate, and time horizon. You can consult a certified financial advisor (a fiduciary who is legally obligated to put your interests first) if you want to get a personalized asset allocation. Or you can just use the above asset return table to find a reasonable allocation that balances strong historical returns with peak declines that won’t cost you any sleep during the market’s inevitable down periods.

Bottom Line: Scary Market Declines Are Inevitable But These Three Approaches Can Help You Protect And Grow Your Wealth Over Time

Even I, someone who has spent many years studying the market professionally, and with 23 years of investing experience behind me, doesn’t enjoy painful declines. However, ultimately I know that there are some undeniable truths that, if you keep them in mind, can result in large and sustainable profits.

- Market downturns are inevitable, with 5% to 9.9% pullbacks occurring every six months on average, with the typical 10% to 19.9% correction coming once every three years (though occasionally clustering closer together)

- Stocks values are ultimately a function of cash flow, and quality companies will grow this (and dividends) over time

- The market’s great long-term returns don’t happen despite painful downturns, but because of them (so embrace volatility as your greatest ally)

If you don’t have much cash to put to work decades of market studies show that ignoring your portfolio during scary times like these is your best bet.

If you do have discretionary savings to invest, then embracing market volatility, to buy bargain blue-chips at great prices, is a time tested approach to exponentially compounding both income and wealth.

And if you are approaching the point where you’ll need to finance expenses from your portfolio (like retirees looking to live off the 4% rule) then asset allocation, not market timing, is the smartest strategy.

Always remember that the stock market, despite its wild short-term swings, is ultimately about owning partial stakes in real companies. The intrinsic value of your holdings doesn’t actually change significantly from day to day, week to week, or quarter to quarter.

So as long as you have an appropriate long-term plan, for constructing your portfolio, and maintain the right asset allocation (to prevent yourself from becoming a forced seller) you don’t have to lose sleep over volatile times like these.

The market has been climbing a wall of worry, fearful of one risk or another,

for well over 100 years and smart investors, who best harness its wealth compound power, are the ones who remember the famous words of Benjamin Graham that

“In the short run, the market is like a voting machine–tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine–assessing the substance of a company.”

As far as the stock portion of your portfolio goes, as long as you own quality companies, bought at good to great prices, then you literally have nothing to fear from painful short-term corrections or even outright recessionary bear markets. The bonds/cash you own as part of proper asset allocation are what will allow you to pay the bills during times like these, no matter how painful they may get or how long they may last.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!