No one likes losing money, much seeing their portfolio, which represents years or even decades of hard earned savings, fall for weeks or even months on end. While investors understandably focus on what specific strategy is the best way for them to make money from stocks over the long-term, the simple fact is that even the best strategy in the world will fail if you can’t stick with it when the market turns ugly.

So here are three ways to avoid making emotional and likely costly investing mistakes during corrections like these.

Always Keep Things In Perspective

One of the hardest parts about corrections is that they are rarely ever V-shaped and come in unpredictable clusters. Or to put another way, if stocks were to quickly (and on a predictable schedule) plunge to their final low, and then start their gradual but consistent recovery, then they would be brief and cause investors far less emotional turmoil.

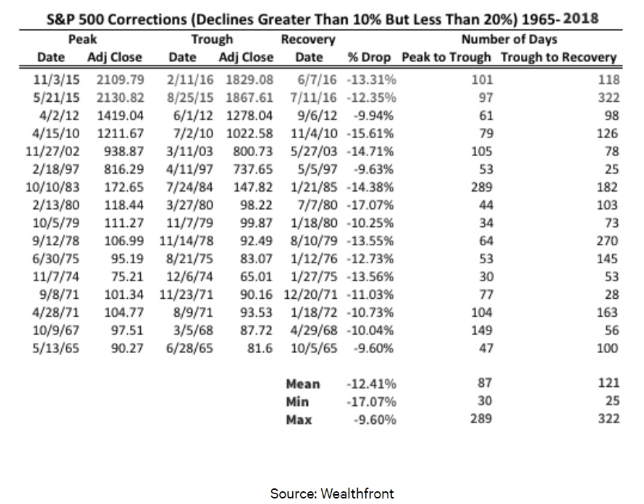

Unfortunately, while there have been 18 corrections since 1965 (including the two this year), the three year average between such 10% to 19.9% declines from all-time highs can be highly unpredictable. For example, in 1971, 2015 and 2018 we had two corrections in the same year but sometimes go as long as four or five years without one.

What’s worse, corrections usually have several cycles of stocks falling quickly, then appearing to recover, before retracing to former lows (or even new ones). This is why the average time it takes stocks to bottom (in the last 18 corrections) is three months. That’s a brief period in the grand scheme of things, but during those months it can feel like you’re in market hell (assuming you check your portfolio frequently).

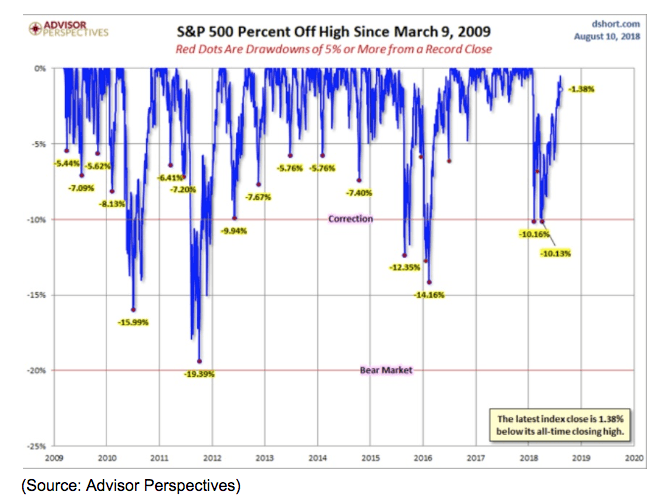

But this is where keeping every correction in the proper context can help you stay calm. For example, right now the market is pretty much flat for the year. After nearly quadrupling since 2009 the S&P 500 is NOT giving up several years of gains right now.

In fact, let’s perform a thought experiment. Assume stocks spend the next week falling, say to December 20th. Say the S&P 500 also ends up declining another 2.5% before it bottoms on that date (which coincides with the Fed’s December meeting which if it confirms a dovish interest rate stance could very well lock in a market bottom). At that point, the correction, which began on September 20th, will have seen stocks fall 12.3% over three months. That’s the exact average for corrections over the last 53 years.

Since 2009, during the longest bull market in US history, we’ve faced longer and far more violent corrections, such as 2011’s freakout that came very close to becoming an official bear market (also triggered by recession fears and great global uncertainty including in the EU). None of those corrections ended up becoming bear markets, nor did they signal that a recession was near or soon to arrive.

Which brings me to my second strategy for coping with the emotions of a correction.

Focus On The Fundamentals And Ignore The Noise

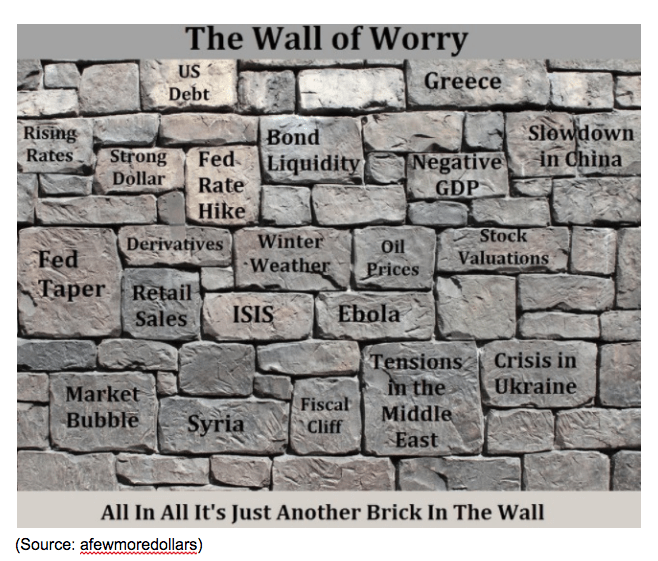

During corrections, the market becomes hypersensitive to every risk factor it ignored during the steady climb higher (stocks rise in 74% of years).

But while stock prices can swing wildly, including 3%, 4% sometimes 5% intraday during based on headlines, tweets, and rumours, ultimately it’s important to remember that the fundamentals, both for the economy and for corporate earnings, are what matter.

For example, right now the three biggest worries investors have are the Fed over hiking, the trade war, and that a recession may be coming soon (yield curve flattening).

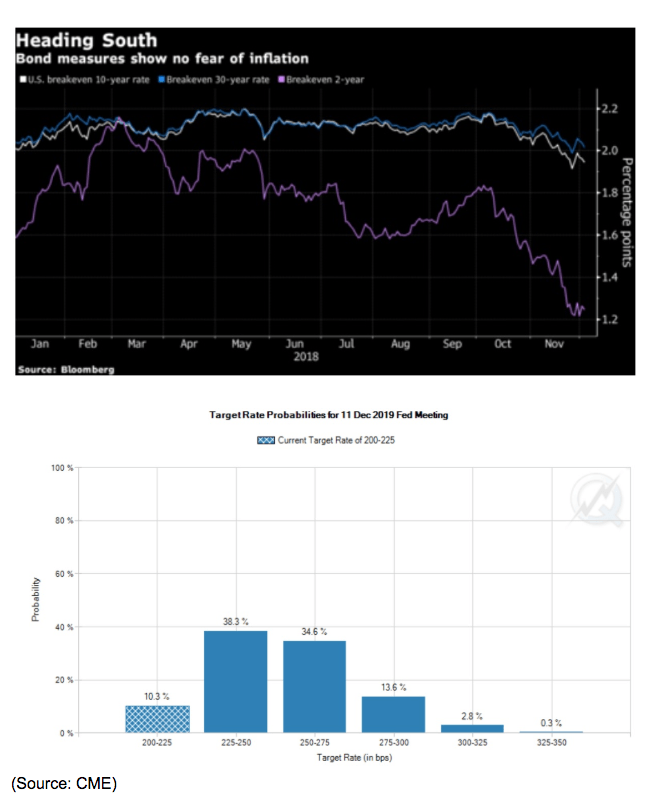

In reality, the Fed is now signalling a far more dovish stance, thanks to inflation expectations falling.

That’s why the bond market is now pricing in just two more rate hikes this cycle, not the five or six the Fed’s dot plot was projecting through the end of 2020.

As for the trade war? Well despite what the wildly contradictory headlines and statements from various administration officials (including Trump himself) would have you believe, negotiations are actually going very well. That’s why a definitive trade deal that ends the trade war completely is likely by February, which should finally allow the market to exit this correction (historical average date of new all-time high would be May 20th).

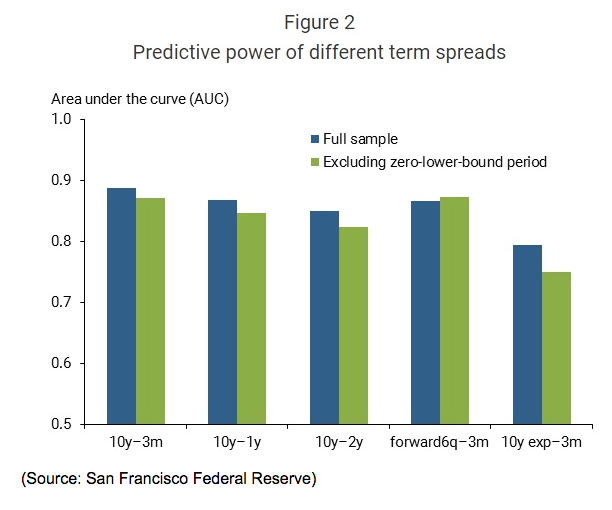

What about the yield curve inverting last week (the 5y-3y warning curve)? That had the media in a frenzy over the imminent risks of a recession. However, it’s important to remember that the 10y-3m yield curve is the most accurate recession predictor ever discovered (according to a study by the San Francisco Fed), and more importantly, it’s what the banks are closely watching to determine how much lending they do and at what terms.

The 10y-3m curve is currently at 0.5% and is actually rising. In fact, all four of the important curves (10y-3m, 10y-1y, 10y-2y, 30y-2y) are now headed higher. The bond market, due to the far simpler and long-term focused nature of bonds, is less volatile and short-term focused than stocks. This is why it’s historically been far more accurate at forecasting recessions. If you must check something every day, check bond yields. Not stock prices. As long as the four most accurate yield curves are positive then the chances of a recession are small. In fact, since 1955 as long as these curves have been positive there has NEVER been a recession.

What is the actual risk of a recession in the short to medium-term?

- Risk that we’re in a recession now: 0.58% (according to the St. Louis Federal Reserve)

- Risk that we enter a recession within 3 months: 1.52% (Jeff Miller Weekly Economic report)

- Risk that we enter a recession within nine months: 17% (Jeff Miller)

And based on the 10y-3m yield curve, and its long-term rate of flattening, we’re actually 23 to 32 months away from starting a recession (Nov 2020 to August 2021). Stocks generally start falling before a recession begins but keep in mind that typically stocks spend a long time rising after an inversion (usually 13 to 19 months and totaling a 22% gain).

Given the actual fundamental facts right now, about the Fed’s interest rate plans, the trade negotiations, and the positive and rising yield curves, we are likely merely in a correction and set to see stocks rise significantly higher before the bull market finally ends.

Which brings me to the most important way you can control your emotions during a correction.

Focus On What You Can Control And Test Your Risk Tolerance

One of the reasons that investors hate corrections is that it feels like you lose control of your financial future. So take it back by focusing on what you CAN control. Think of your portfolio like a conglomerate, much like Warren Buffett’s Berkshire Hathaway. It’s a holding company that owns stakes in other companies. That’s literally what a stock portfolio is, partial ownership in real companies.

I’ll use myself as an example. My portfolio’s goal is to maximize long-term income (and total returns) by three strategies:

- Maximum safe yield (portfolio yield on cost 6.0%)

- Fast long-term dividend growth (1-year dividend growth rate 20.5%, 5-year average growth rate 16.5%)

- Buy deeply undervalued stocks (high margin of safety) – average holding 33% undervalued

My entire portfolio strategy is centered around buying the highest-quality deep value stocks I know of (I maintain five watchlists for this) during market declines. I use my dry powder to buy my highest conviction ideas when the market is running deep red, and then keep buying for as long as my liquidity allows. This maximizes my portfolio’s income (annual dividends) which currently stands at over $19,700. It also maximizes my yield on cost and minimizes my cost basis, thus de-risking my portfolio (lower cost basis means lower risk of permanent loss of capital as long as company fundamentals are sound).

During the first two stages of this correction, I was able to keep buying stocks and thus rather than fear further declines I was gleefully buying great companies like AbbVie (ABBV), Iron Mountain (IRM), Brookfield Property Partners (BPY), Apple (AAPL), and Texas Instruments (TXN). Then I ran out of dry-powder. So what do I do now?

Well, I focus on the fact that each quarter most of my midstream stocks raise their dividends. And Enbridge (ENB), another stock I was buying with both hands during the slide, just hiked its dividend 10%. So my primary portfolio goal is being met, and my safe dividends (well covered by recession-resistant cash flows and strong balance sheets) are doing what I want them to. By the end of 2019, my portfolio’s annual income will have risen to $23,000 and my yield on cost will be 7%. Thus even if my portfolio were to trade sideways for the next year, I’ll still earn a solid return.

But more importantly than “being greedy when others are fearful” is what else I’m doing. That would be looking at the silver lining of this correction. There’s a famous quote from author and economic commentator George Goodman that is perfect for times like these.

“If you don’t know who you are, the stock market is an expensive place to find out.”

Specifically, Goodman means that you have to know your risk profile, and thus the right asset allocation that is most likely to meet your long-term goals. If you can’t emotionally stomach corrections and bear markets then being 100% in stocks is wrong for you, no matter what investment strategy you use.

The tricky thing about knowing your risk tolerances is they change over time, as you approach retirement, but also as your life circumstances change. Thus pullbacks (5% to 9.9% declines) and corrections (10% to 19.9% declines) are a great way to remind yourself of what it feels like to experience months of high volatility and strong declines. Late cycle corrections, where fear of a recession and bear market are highest, are the best way to test that your risk tolerance is what you think it is.

If you can’t sleep at night right now? When stocks are merely down 10% from their all-time highs? Well, then you are too heavily in stocks and need more bonds or cash to smooth out volatility during downturns. The good news is, that as I showed in the previous section, we’re very likely in a regular correction right now. Stocks will probably once more hit new all-time highs, most likely rising 20% to 30% above today’s levels before the bull market finally runs out of steam. That means that if your risk tolerance is lower than you thought, you’ll likely be able to shift your asset allocation to the right mix of cash/bonds/stocks that will help you emotionally survive the next actual bear market. All without having to sell at deeply discounted prices like you may be tempted to do now.

When you think about it from that perspective, that this correction, and a few harrowing months, might potentially end up saving you hundreds of thousands or even millions of dollars (from panic selling into a bear market in a few years), then suddenly it becomes a blessing and not a curse.

Bottom Line: Emotional Control During Downturns Is The Only Way You Can Rich Over Time In The Stock Market

We’re all human and so can’t avoid feeling at least some angst when bears run wild on Wall Street. Periods of apparent wild volatility and peak fear, uncertainty, and doubt, while opportunities to earn vast riches over the long-term, are also potential pitfalls where even smart investors can make disastrous mistakes that sink their long-term financial dreams.

This is why it’s so important to always keep every correction in context, and never obsess over the market’s manic daily swings. Understand that stock corrections, as scary as they fell at the time, are normal, healthy, and the very thing that drives the market’s incredible wealth compounding power over years and decades.

Rather than obsessing over share prices, which are at the mercy of fickle and irrational investor sentiment, focus on what you can control. Whether that’s deploying your cash reserves into great bargains, or merely waiting patiently for your safe and steadily rising dividends to come in, never forget your portfolio is an income generating business. So run it like one and remember that vast financial empires are not built in a day but require years and decades of patience and discipline to amass.

Finally, never forget that every apparent crisis is an opportunity. Not just do corrections allow you to go bargain hunting, and thus lock in fat profits and great yields in the future, but they are a great way to prepare yourself emotionally for the inevitable bear market that will arrive at some point. During a bull market, it’s easy to overestimate your risk tolerances, which are changing over time and with different life circumstances. During corrections, especially late cycle ones, you get a far better sense of what a recession and bear market will feel like. This means that you can test your mental fortitude and discipline, as well as confirm whether or not your specific asset allocation is indeed appropriate.

If you can’t sleep now, when stocks are merely bouncing around a 10% decline from all-time highs, that’s a good sign that you’re over-allocated in equities and might want to trim your stock exposure (once the recovery comes in February). That will help you avoid far worse panic (and huge realized losses) when the actual bear market arrives in a few years.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!