Silver bulls have been confounded lately by the metal’s inability to get up off the floor and run. There are lots of reasons why silver should go higher. After all, we are at prices only slightly higher than they were after fallback from the Hunt brothers trying to corner the silver market back in 1980. You’d think 30+ years later prices would be MUCH higher just from normal inflation, huge Federal deficits, and plenty of uncertainty in the world. Heck, back in 1988 gold closed the year at $410 and silver was $12.90. Now — well, you can clearly see gold has done MUCH better over time.

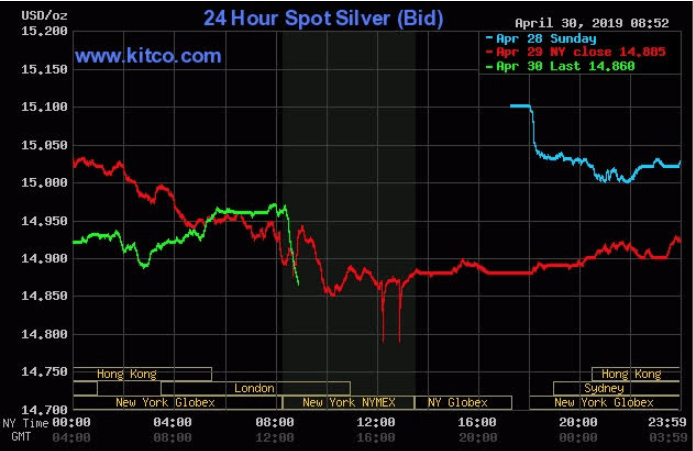

But as we know this hasn’t been the case. In fact, precious metals traders are starting to get used to intraday charts that look like this.

(credit Kitco.com)

Just after today’s New York 8 am open, someone (or a set of someones) obviously dropped a downside trade on the market, halting another building move. We saw this with gold a few weeks ago, when a single futures trade crossed the wire with 11,000 contracts on the downside. Trust me, very few traders can afford a $1.5 billion short trade… All these instances seem to add up to pretty clear evidence that the powers that be are either ignoring position size limits, or that some large institutions want to drive down precious metal prices for whatever reason.

So let’s call that Reason #1 why precious metals aren’t heading higher – “some big guy” wants to keep them down for the moment.

Reason #2 would have to be the continuing bull market in equities, meaning stocks. US traders are still enjoying the longest bull market in history; stocks continue to climb the wall of worry. We don’t need to elaborate more on that. The effect is that attention and investment money goes toward equities and not toward precious metals such as silver, so silver can’t climb higher. Remember Econ 101 – for prices to rise there have to be more buyers than sellers. There only needs to be 1 seller to drive prices down if there are no buyers in the room.

Reason #3 is perhaps a bit more subtle, so we won’t be. We’re going to lay this one at the feet of the Chinese market. Not Chinese officials, mind you, because this is a consequence of an action, not a direct action itself. You see, Chinese policy has moved to economic reforms and away from monetary accommodation policies such as the US Fed’s quantitative easing. Fiscal easing typically results in higher precious metals prices, because there is more money sloshing around. And as we all know, more money sloshing around means all prices head higher. We usually call this “inflation” so no need to belabor that. What we have to recognize is that economic reforms mean targeted actions in specific areas of an economy, which have ripple-down effects on inputs, outputs, and competition. But usually no direct effect on precious metals. So once again, no more buyers for silver, and the price is left unsupported.

There is a reason #4 in small letters, and that would be apparently decreasing demand. The base support under silver is manufacturing demand, with consumer demand being a highly uncertain factor on top of that. While US manufacturing confidence is high, it has been slowly decreasing since October, and that means manufacturers are not laying out big pre-orders for raw materials. If anything they would be running steady-state, or possibly pulling back just a tad. You don’t want to be caught with big inventories in the face of a downturn. But because this change is more subtle than the rest, we’ll keep this one in small letters for now. If the world economy doesn’t show signs of firming up soon, this small-letter factor could turn into large-letter Reason #4, and we could see silver quickly down in the $13 range.

Signed,

The Gold Enthusiast

DISCLAIMER: The author holds no positions in any mentioned security. His only positions in the silver sector are very small holdings in Fortuna Silver Mines (FSM) and Silver Bull Resource (SVBL), with no plans to trade these in the next 72 hours.

About the Author: Mike Hammer

For 30-plus years, Mike Hammer has been an ardent follower, and often-times trader, of gold and silver. With his own money, he began trading in ‘86 and has seen the market at its highest highs and lowest lows, which includes the Black Monday Crash in ‘87, the Crash of ‘08, and the Flash Crash of 2010. Throughout all of this, he’s been on the great side of winning, and sometimes, the hard side of losing. For the past eight years, he’s mentored others about the fine art of trading stocks and ETFs at the Adam Mesh Trading Group More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!