I think we can all agree that December’s crash, in which the S&P 500, Dow Jones Industrial Average, and Nasdaq all plunged 17% to 20% in just three weeks, was a scary time for investors.

A big reason for that severe correction (the worst since 2009) was trade war fears, which have just come roaring back with a vengeance. So let’s take a look at four important facts you need to know about what’s happening with trade negotiations now that’s giving the market fits (S&P 500 fell 2.2% last week and is down 2.5% today as I write this).

That includes a look at how bad the escalating trade war might get, how soon, and what it means for the economy, corporate earnings, and your portfolio.

Why the Trade War Is Escalating Now

On May 3rd the stock market hit a new all-time high, partly on expectations that the May 10th US/China trade meeting (11th round of talks) would culminate in a final deal that would end the trade war.

The bond market was betting the talks would fall apart (via bond futures estimating a 66% chance of a Fed rate hike in 2019 that only made sense if something severely hurt US economic growth). Well, there is a reason the bond market is considered “smart money” and the stock market “dumb money” and in this case, the bond market was once more proven right.

After tweeting on May 3rd about how great the talks were going, President Trump abruptly changed course on Sunday, May 5th and tweeted that talks were going “too slow” and that the US would be raising tariffs on $200 billion worth of Chinese imports on Friday, May 10th from 10% to 25%. What’s more 25% tariffs on all remaining Chinese imports were coming “shortly”.

Later Bloomberg reported that what caused this sudden reversal was China’s final draft agreement deleting previously agreed consensions on important topics like patent protection, and forced technology transfer from US companies to their Chinese JV partners.

On Monday, May 6th US trade Rep Robert Lightheizer confirmed that tariffs would rise on Friday unless Thursday/Friday’s trade talks were successful. They weren’t and the increased tariffs went into effect. That day Mr. Lightheizer also confirmed that Trump had ordered him to draw up the final list of Chinese imports on which 25% tariffs would go into effect (details to arrive by Monday, May 13th). A 90 day comment period requirement means the earliest these final tariffs can go into effect is August or September 2019.

China, after the trade talks ended Friday without a deal said talks would continue (though the 12th round of negotiations has yet to be scheduled) but that it would retaliate against the latest increase.

Over the weekend President Trump warned the Chinese that things would get much worse for them should they retaliate and that any deal he offered now would be on far friendlier terms than that China would obtain post-2020 (he expects to win the election due to a strong US economy).

Vice Premier Liu He, who is leading China’s trade delegation, went on Chinese TV over the weekend and publically laid out China’s views on any trade deal which must include; an end to all recent tariffs, China buying additional US goods in reasonable quantities (that fit with Chinese demands for things like agricultural goods and energy) and most importantly, respected its sovereignty.

Experts interpret this to mean no deal is likely coming soon because the US has insisted that tariffs remain in effect upon the signing of a deal to ensure Chinese compliance. What’s more, China’s focus on respecting of its sovereignty is being interpreted by analysts at Bloomberg and Reuters to mean China isn’t willing to change its existing IP and forced transfer laws, key sticking points for the US.

Goldman Sachs explained in a recent note that the new higher tariffs only apply to goods shipped after May 10th, and since it takes three to four weeks for container ships to cross the Pacific, there is a brief window before 25% tariffs start impacting company profits or consumer prices (the tariffs that just went up are partially on consumer products like apparel).

The remaining $300 billion worth of imports that have yet to see tariffs are nearly all consumer-facing, and including things like apparel, and electronics.

Ok, so that’s what just happened, and how quickly the trade war is likely to escalate. But what does all this actually mean for the economy, corporate earnings and the stock market?

What it Could Mean for the Economy

It’s not just important to consider how badly these new tariffs might hurt the US economy, but also China’s economy (because so many US corporations do business there) and the entire global economy (41% of S&P 500 revenue is from overseas).

According to UBS, the proposed tariffs (25% on 100% of Chinese imports) would slow global growth by about 0.5% within 12 months of going into effect. That’s certainly not great since the IMF and OECD are both estimating just 3.3% growth this year, and 3.4% and 3.6% growth next year, respectively.

In other words, the trade war threats might potentially reduce global growth by about 15% and push weak economies (like the EU) into mild recessions. However, the proposed tariffs aren’t likely to trigger a global recession on their own.

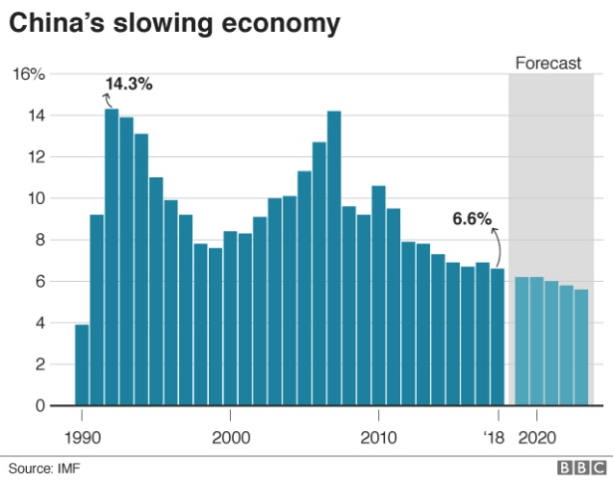

China’s economy already posted the weakest growth in 2018 in nearly three decades, and in Q1 growth came in at 6.4%, weaker than last year, despite significant stimulus from Beijing. Bloomberg’s economists estimate that 25% tariffs on all Chinese imports would reduce China’s annual GDP growth by 1%, pushing growth down to about 5% in the coming years should tariffs remain in effect long-term.

Over the past decade, China has directly or indirectly accounted for about 80% of global economic growth (due to driving growth in emerging countries whose raw materials it was importing). Thus, sufficiently weaker Chinese growth could potentially slow global growth for several years, and possibly even trigger a mild global recession, should growth slow enough to trigger a financial crisis created by that country’s mountain of bad debt (China hasn’t had a recession in over 30 years).

What about US growth? Moodys Analytics estimates that the 25% tariffs on $250 billion in imports now in effect will reduce US GDP growth by 0.8% through the end of 2020 or about 0.6% per year. If the final $300 billion tariff round occurs then US growth would take the biggest pounding, resulting in 3 million job losses by the end of next year (about 167,000 per month) and US growth would come in 2.6% lower (1.8% slower annual growth) by Q4 2020.

For context over the past three months, the US created 163,000 net monthly jobs, and next year’s growth is expected to be about 2%. This means that if Moody’s is right, the worst case scenario (full China tariffs by September) could mean zero net jobs growth through 2020 and flat economic growth as well.

Since the strong labor market (lowest unemployment since 1969) and steadily rising wage growth is a big reason that consumer spending has been so strong (nearly 6% YOY retail sales growth last month) and consumer spending drives 70% of the US economy, there is a real risk that these tariffs, if fully implemented, could lead to a mild US recession.

The good news is that such a recession would likely be a historical one, meaning last about 12 to 18 months and see a peak GDP decline of about 1%. It would not likely be a repeat of the Great Recession’s almost 5% GDP decline which doubled unemployment to 10%, threatened the entire global financial market and caused the S&P 500 to plunge 57% at its peak.

Further good news is that a big reason that Trump seems willing to impose tariffs so aggressively (during the presidential campaign he said he’d like to see 45% tariffs on all Chinese imports) is that he truly believes that tariffs are not harmful to the economy.

Should US economic growth fall off a cliff (and the stock market with it) then the “Trump Put” would likely kick in. In late 2018 Trump enacted the trade war ceasefire precisely because he interpreted the crashing stock market to signal a possible recession which would spell doom for his re-election chances.

Should US growth fall to near zero next year, and the stock market into a bear market long before that, we’d likely see him reverse course and cut a deal, even if it’s far from ideal in his eyes.

What if we do, in fact, get a trade war-induced recession (and bear market)? Well here too there is good news. Specifically that the downturn would be entirely caused by a single event, that can be undone with the stroke of a pen by a new president as early as February 2021.

While the economy wouldn’t spring back overnight (the stock market likely would) the point is that if what nearly all economists say about the damage a trade war would cause are true, then it’s nearly certain that such a horrible thing won’t persist indefinitely (and would thus represent a potentially great long-term buying opportunity).

What it Could Mean for Corporate Earnings

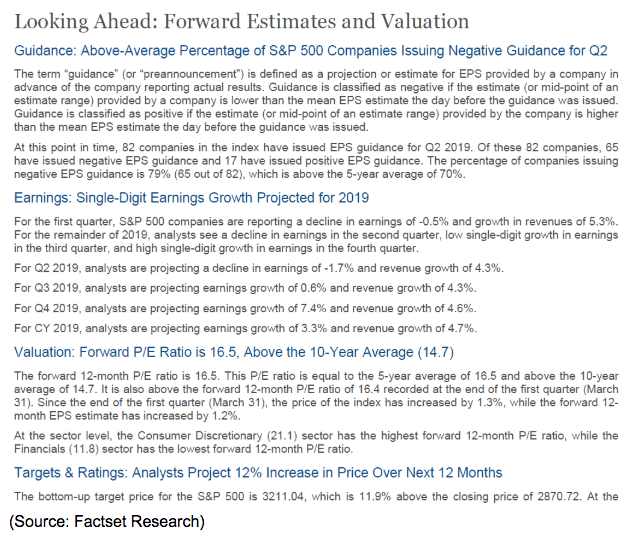

The first thing to understand is that corporate earnings growth in 2019 might come in far weaker than analysts expected on May 10th (3.3% this year). 2020’s growth forecast has also started slowing (down from 11.6% peak to 11.3% on May 10th).

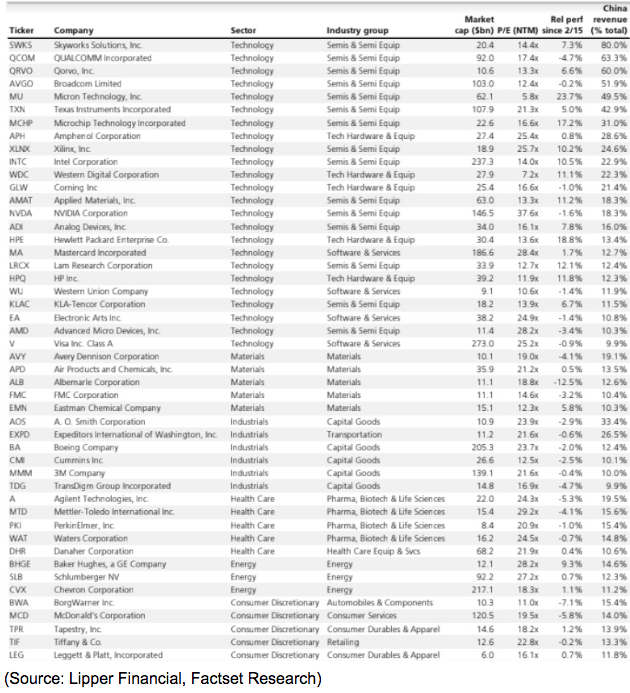

That’s because the increased tariffs that just went into effect will compress margins and the final round would be an even bigger growth headwind. What’s more plenty of large US companies derive 10% to 80% of sales from China, meaning retaliatory 25% tariffs could significantly impact their top and bottom lines.

Most Trade Sensitive US Corporations (Sales From China)

2019’s already weak 3.3% growth consensus was counting on a trade deal to be struck soon that would allow Q4 earnings to grow at nearly 8%. That now seems unlikely which means that the 16.5 forward PE on the S&P 500 is likely unjustified (25-year average, according to JPMorgan Asset management, is 16.2).

Which brings us to what the escalating trade war likely means for the stock market and your portfolio.

What It Could Mean for the Stock Market

Given that a big reason for the 18% rally in 2019 was expectations of a trade deal, it’s not hard to guess which direction the market is going to go now that hopes for a quick trade resolution have been dashed.

Lipper Financial (who I consider one of the most trustworthy analyst firms) estimates that a 5% pullback is likely even if a trade deal is reached within a month. Should that not happen, a correction becomes likely.

Ed Yardeni, another trusted analyst I follow, similarly thinks a 10% to 15% correction is likely should a deal not be reached soon.

Now it should be pointed out that 5% to 9.9% pullbacks have occurred, on average, every 6 months since WWII. Corrections of 10% to 19.9% have occurred 37 times since 1950, or, on average, every 1.9 years. 2018’s two corrections in a single year, is a rarity, having occurred just three times in the past 40 years.

Should the trade war freakout turn into a correction, it would mean three corrections in 18 months, something that hasn’t occurred since the Great Depression. I point this out to illustrate that while historical analysis can provide a rough guide to what’s likely to happen, it’s by no means a guarantee of what will happen. On Wall Street, the supposedly impossible (like US housing prices nationwide plunging 30%) occurs with frightening regularity.

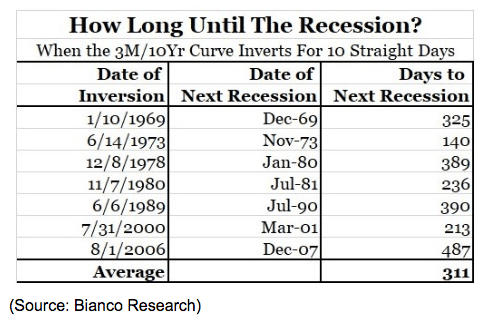

The same is true for recessionary models such as the famous 10y-3m yield curve (the best recession forecaster ever discovered according to the San Francisco, Cleveland, and Dallas Federal Reserves). The 10y-3M yield curve has once more inverted (due to flight to safety into long bonds). That technically means that the 10 day confirmation period is now ticking, however, it’s important to remember that seven data points is not statistically significant.

What’s more David Rice (who runs the BaR economic grid) points out that before the last three recessions the curve had to remain inverted a full month before it became an effective recession signal. Byron Wien, the chief strategist for Blackstone, one of the world’s largest private equity managers, says his firm’s economists don’t start expecting a recession until the curve is inverted by 15 basis points for 10 consecutive weeks.

This basically means that the economy (and stock market) is complicated and even experts can disagree about what the same fundamental data is saying at any given time.

While a market pullback is now highly likely and a correction might occur within the next week or two, that doesn’t mean that it’s time to panic sell. Remember that market timing is a fool’s errand and the reason the typical retail investor has done so poorly over the past 20 years.

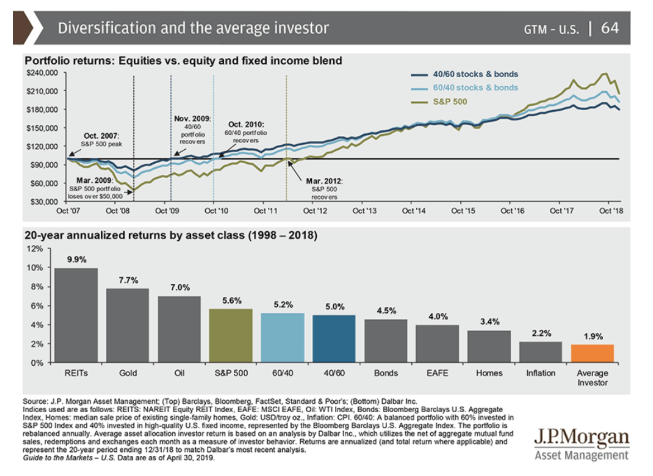

As JPMorgan Asset Management points out, terrible market timing, driven by a combination of fear and greed, has resulted in the typical investor obtaining just 1.9% CAGR total returns over the past 20 years. That’s both below inflation as well as underperformed literally every asset class.

However, note that a 60/40 stock/bond portfolio almost matched the 5.2% CAGR total return of the market as did a 40/60 stock/bond portfolio, that consisted of ETFs and was bought and held the entire time.

I point this out to illustrate that proper asset allocation and portfolio construction/diversification, not market timing, is your best way to protect your wealth during the market’s inevitable freakouts/downturns.

I am personally not losing a wink of sleep over the current trade war fears, or nearly 5% pullback in the market (as I write this). My personal retirement portfolio is 100% blue-chip dividends stocks (my personal situation allows for such a volatile asset allocation) and my primary goal is generous, safe and rising income. My portfolio’s yield on cost is 5.3%, and my dividends (which rose slightly even during the Great Recession) grew at 10% annually over the past decade and, according to analyst growth estimates, will keep growing at 7.5% or so over the next five years.

Even if this and next year’s payout growth is slower due to the trade war, as long as it ends eventually, any correction or even a recessionary bear market will prove merely a great long-term buying opportunity for me, that allows me to lock in ever larger share counts at steadily higher yields.

Bottom Line: The Escalating Trade War Isn’t Likely to End in Disaster but Likely Means A Painful Month or Two Lie Ahead for Stocks

I’m not trying to minimize the negative fundamental effects the trade war could have on the US economy, corporate earnings or the stock market in the short to medium-term. If things keep getting worse and culminate in full Chinese tariffs of 25% (or higher) than we’re likely in a lot of trouble as far as short-term economics and the stock market is concerned.

However, it’s important to remember that long tail risk (worst case scenarios), while worth considering as part of your risk management protocol, are rare. Should the trade war prove as destructive as economists/analysts expect, that will also limit its duration, and any recession it might ultimately cause.

That might not spare millions from pain, in terms of job losses and a bear market that hammers retirement portfolios and pension funds, but we’re not likely facing a repeat of 2008-2009’s economic/market meltdown.

Most likely what we’re facing now is a market pullback/correction, that while scary, doesn’t threaten your long-term financial goals, assuming you can avoid the temptation to market time and sell at a loss.

Personally, I’ve set up my retirement portfolio to profit from the trade war, on the assumption that any Chinese tariffs won’t be permanent. I’ve also helped my family and friends navigate the scary and turbulent market waters we’re facing, with a focus on good risk management/asset allocation and a diversified collection of blue-chip dividend stocks (my personal focus and that of my father is currently 3M, which is trading at one of its highest yields in 24 years).

If you don’t have the buying power to pick up quality companies at highly attractive valuations, then stay calm, sit tight, and trust that your portfolio’s construction will protect your from permanent capital losses and eventually recover and allow you to achieve your long-term financial goals.

Remember the immortal words of Peter Lynch (second best investor in history behind Buffett)

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!