Over the past sixth months, the average rate on a 20-year mortgage rose from 3.5% to 4.45% which equates to an increase in monthly payments of approximately $240 on a $400,000 home.

Homebuilders have been under pressure all year, squeezed by higher rates, higher material costs, and the removal of the SALT deduction, which will have the greatest impact on high-end homes in coastal regions; the prime locations of Toll’s newer developments over the past few years.

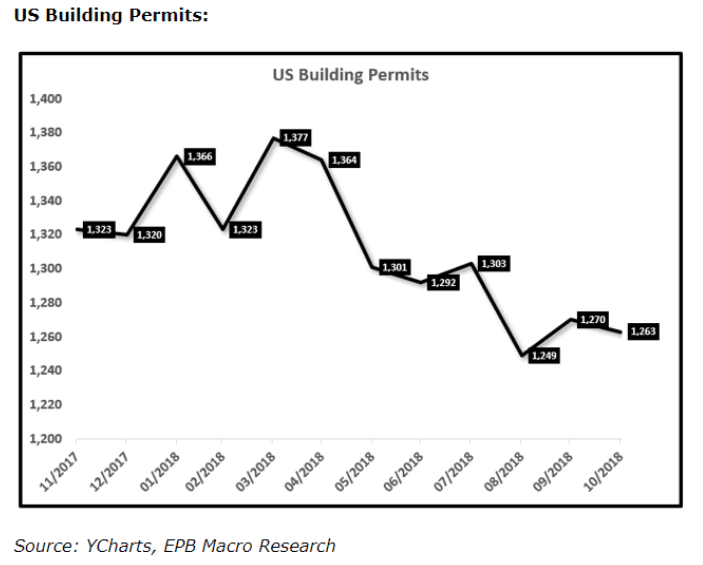

One can see the precipitous decline in building permits through the last 12 months.

But the news is improving, at least on rates. Fed Chair Jerome Powell recently indicated the pace and number of rate hikes is likely to slow or even be ending. And on Tuesday, the long end of the bond market staged its largest one-day rally of the year sending yields back to their lowest levels in three months.

One of the concerns from the prior quarter was that gross margins had slipped raising concerns about higher material and labor costs. Management said that it was temporary and it was widening its footprint with new communities and an expanded building capacity.

It appears this was is now paying off as gross margins ticked back up to 21.1% this past quarter to go with its 27% increase in revenue. That revenue increase came from the one-two punch of higher unit sales, up 18% to 2,246, and higher average selling prices, up 7.6% to $851,900.

Speaking on the conference call Toll chairman Bob Toll, highlighted some of the longer-term structural trends favoring the housing market as well as some of the market opportunities specific to the luxury and higher-priced homes. Toll Brothers spoke on the issue, saying the following:

“We believe there is room for continued growth in the new home market in the coming years. Household formations have been increasing, and in many regions, the aging housing stock may not satisfy the lifestyles of today’s buyers.”

“In addition, existing-home values have increased, providing potential move-up and empty-nester customers with more equity that they can put toward a new home purchase. We believe these two groups, along with the growing number of millennials starting to buy homes, are all sources of potential new demand.”

Toll Brothers has a leading share of the luxury market which should continue to do relatively more resilient than the industry as a whole. By focusing on luxury apartment sales and rentals in denser urban areas Toll Brothers can obtain decent margins despite the much higher costs for materials and customization.

I think the stock has most of the bad news priced into current levels. I expect shares to build a base and resume a healthy uptrend over the next 12 months.

I’ll be using the purchase of LEAP call options to minimize my risk while providing good upside potential. One can buy the January 2020 35 strike calls for around $3 per contract.

About the Author: Steve Smith

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!