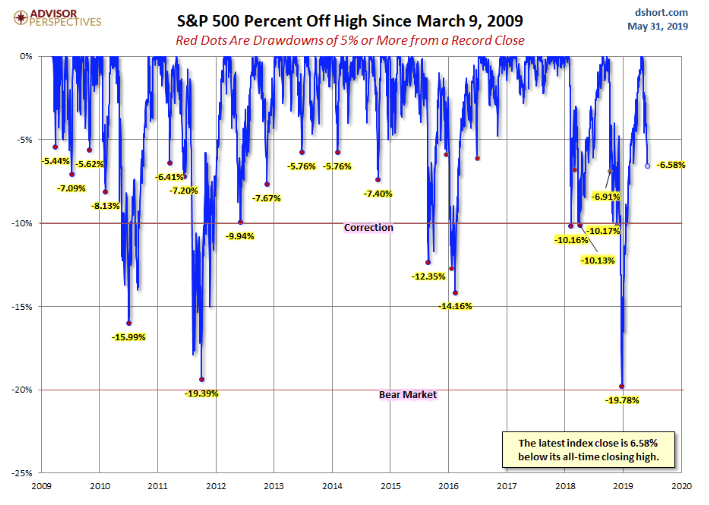

I think we can all agree May was a pretty poor month for stocks. Thanks to rising trade war/recession fears, the S&P 500 fell nearly 7% in May, the trade-sensitive Nasdaq 8% (the worst May in nine years), and small-cap stocks are already in a correction.

With China releasing a white paper on Sunday, June 2nd, that officials blamed the US 100% for the collapse of trade talks and promised to “not back down” hopes for a June 29th G20 trade deal appear pretty bleak.

During such scary and headline dominated times, the media is out in force, trying to gin up ad dollars by highlighting claims from various investment firms and analysts that even larger declines are likely coming. This includes one especially egregious example of a Guggenheim prediction about an “agonizing market crash” the asset management firm now considers likely.

So to help you learn how to separate fact from fiction, and hopefully avoid making costly portfolio mistakes, let’s take a look at what Guggenheim thinks is coming, whether or not that’s likely to actually occur, and how smart investors can prepare for it.

Media Hype About “Market Crashes” is Almost Always Greatly Exaggerated

In addition to working 10 to 12 hours per day as an analyst/investment writer, I read about two hours each night to keep abreast of what’s going on in the world of finance. So I came across an article highlighting a scary sounding prediction from Scott Minerd, the Global Chief Investment Officer and co-founder of Guggenheim Partners.

“The trade tensions are likely to get a lot worse because we have never in modern times had a trade war like this…Our models signal markets will make new lows in the summer. A break below December lows would mark the end of the bull market that began in 2009, Something we expect.”

CCN, where I found this article went on to explain that Minerd was expecting a worse decline this summer than December’s horrifying crash (17% in 3 weeks) and warns readers to prepare for an “agonizing market crash.”

However, I want to use this prediction/article as a case study of how to avoid getting suckered into making a potentially harmful portfolio decision that could cost you a fortune.

That’s because what CCN calls “an agonizing market crash” is actually a guess by Guggenheim that stocks will fall a…wait for it…16% from Friday’s levels (22% total decline before bottoming).

Yes, that would be the biggest decline since 2009 and an official bear market. However, it’s important to note that the longest bull market in history (in which stocks more than quadrupled) was marked by plenty of scares, including two corrections that came within a hair’s breadth of triggering a bear market.

It should also be noted that one asset manager’s model is hardly the gospel truth. Goldman Sachs estimates that we’re likely to only fall another 7% and that’s if the final round of $300 billion in China tariffs occurs (13% peak decline).

Byron Wien, the Vice Chairman of Blackstone, one of the world’s largest private equity groups, recently told CNBC “The Chinese conflict on the trade issues is serious, and I think it’s going to be prolonged…But I don’t think it’s going to create a recession or a bear market.” Wien even reiterated his belief, based on his company’s own market models that the S&P 500 will end the year 4% higher than it did on Friday, June 1st.

The point is that Wall Street is full of smart people, including plenty of spreadsheet jockeys, with models that have very different interpretations about the same facts that we’re all seeing.

So it’s important to keep in mind three important truths about market downturns.

3 Important Truth About Market Downturns

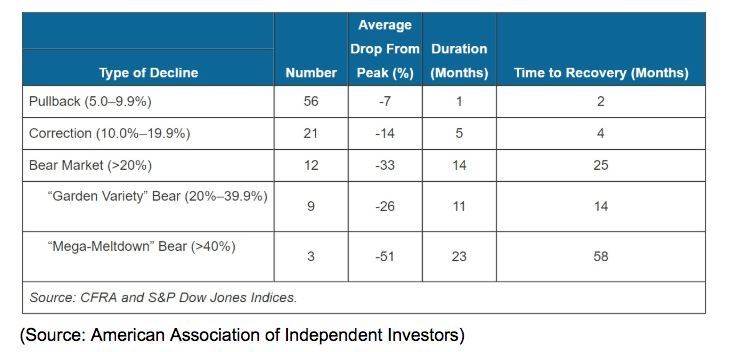

Market declines happen frequently, including almost 60 pullbacks of 5% to 9.9% that have occurred since WWII (about one per year) and 23 corrections (one every two years on average). Thus far this decline is merely a pullback, though it could easily become a correction given the poor state of trade negotiations between the US/China and America with Mexico (25% tariffs on Mexican imports could easily happen given the reasons the US gave for threatening those isn’t something Mexico can actually stop).

However, note that most such downturns are short-lived with stocks recovering to new highs within a few months. Even recessions, which cause garden variety bear markets only tend to see stocks fall for about a year, and then take another year to recover to new all-time highs.

And it’s still far too early to declare that a recession is imminent. Remember that all investing is probabilistic and the stock market, during periods of “risk-off” mentality always overreacts by pricing stocks as if the worst case scenario has already occurred.

In Q1 S&P 500 EPS, according to FactSet Research, declined just 0.4%, far less than the 3.2% decline analysts had expected going into earnings season. For Q2 analysts expect -2.1% EPS growth, which would officially mean an earnings recession. However, 77% of the time companies exceed earnings expectations, usually by 3% to 4%.

This means that the 3.2% EPS growth consensus for this year (which has since stabilized despite ever-worsening trade news) could come in at 4% to 5% and support the market which is now trading at a forward PE of 15.8 (vs 16.2 25-year average).

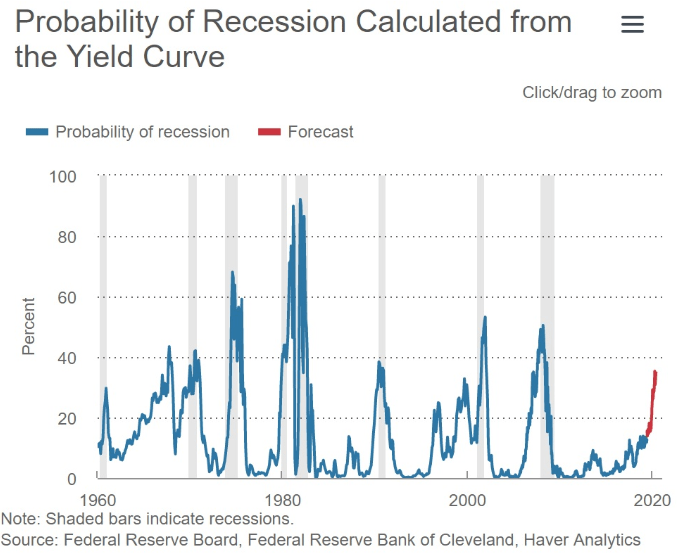

But what about the rising risk of a recession? Well, it’s true that recession risk is now at a 10 year high, according to models from both the New York and Cleveland Federal Reserves.

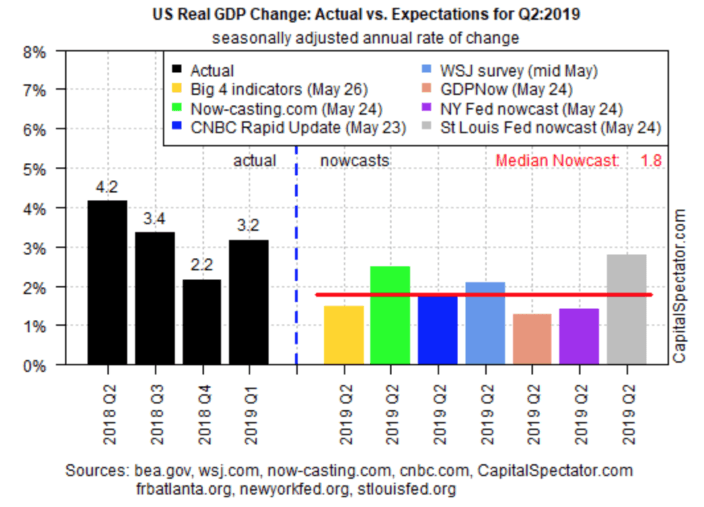

However, we’re still nowhere close to growth that risks turning negative, at least based on the actual macroeconomic data coming in.

Slower growth in 2019 isn’t the same as negative growth, just as 3% to 5% EPS growth in 2019, while far below 20% seen in 2018 (due to tax cuts) isn’t a reason for the market to sell off to the extent that bears are predicting.

Remember the difference between fears and facts. Risks are what investors fear might go wrong with facts, ie economic and company fundamentals. But ultimately worst-case scenarios are very rare, which is why times like December 24th, when the forward PE on the S&P 500 hit 13.7 (roughly the historical recessionary bear market low) are such great buying opportunities.

Back then recession risk was far lower than it was today, and if the US ends its trade wars this year, then we could very well avoid negative growth entirely (don’t forget the Fed can cut up to nine times and Powell has said he’ll do whatever it takes to avoid a recession).

Which brings me to the third essential truth about market downturns, and the most important for protecting your wealth.

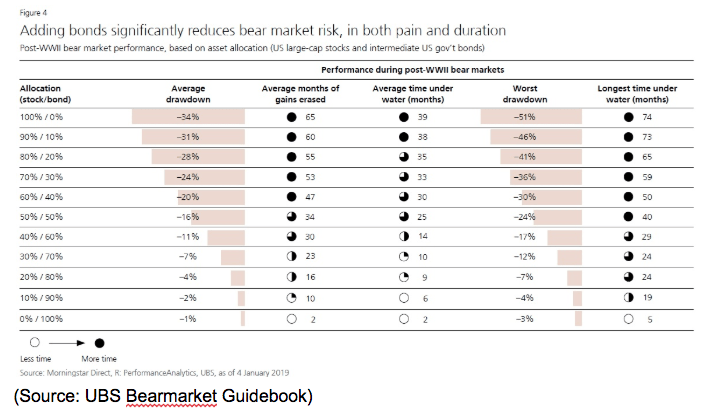

Asset allocation, not market timing, is the right way to protect yourself from inevitable periods of market volatility like we’re seeing today. Stocks are the best performing, but also most volatile asset class, while bonds are owned to smooth out volatility because they tend to appreciate during market downturns.

How much stocks/bonds you should own depends on your risk tolerance, time horizon, and individual needs. 60% stocks/40% bonds are the standard default asset allocation that most financial advisors recommend because that’s been the most tested using historical data (it’s what the 4% rule is built on).

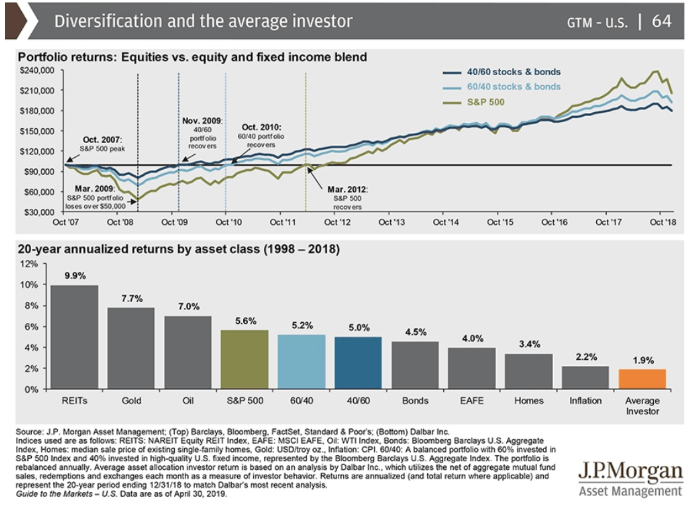

But as you can see, over the last 20 years, even an ultra-conservative 40% stock/60% bond portfolio would still have nearly matched a pure S&P 500 portfolio, but with about 50% less volatility. And the average marketing timing investor, who panic sells during downturns hoping to avoid even larger losses and buy back in near the bottom? Well, those people didn’t even keep up with inflation, over 20 years, or half an investing lifetime.

Or to put another way, over the past 20 years market timing has killed more retirement dreams than any bear market. Which backs up Peter Lynch’s famous quote “far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

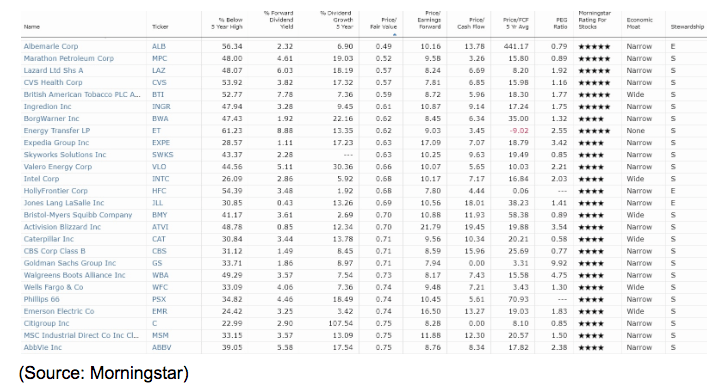

And let’s not forget that while most investors are appropriately using low-cost index funds to invest in stocks, stock pickers like myself can use periods of even modest market fear (we’re merely in a pullback) to find incredible bargains. For example, here are the valuation stats on the $79,000 worth of stocks I’ve bought over the past few months (including when the market was nearing its May 3rd all-time high).

- weighted average price/operating cash flow: 8.9 (vs Chuck Carnevale’s 15.0 rule of thumb)

- 28% discount to Morningstar fair value

- 10.6 average forward PE (S&P 500’s forward PE in 2009 bottomed at 10.3)

- 4.3% average yield

I was able to literally put my money to work into 100% blue-chip dividend stocks, and at March 2009 like valuations. The fact that so many great bargains can be found even when the market is barely off its record highs highlights explains why I’m actually excited by the prospects of a potential correction.

My last retirement portfolio buy was Energy Transfer (Friday, June 1st) which I paid $13.77 that day which equates to

- A safe 8.9% yield (market’s historical return is 9.1% CAGR, which I’m basically getting on income alone)

- 6.0 times distributable cash flow (what funds the payout)

- 3.5 times operating cash flow (what many of the greatest investors (and private equity firms) value businesses on)

Buying a quality firm, whose cash flow is booming, and whose growth runway is clear for decades of steady growth, at under four times cash flow is a fantastic bargain that is only possible because the market is worried that a recession could cause oil prices to crash. In which case Energy Transfer’s 87.5% of cash flow from long-term, fixed-rate and volume committed contracts (and 2.07 times coverage ratio) would still keep the payout safe and rolling in each quarter.

Might ET fall even lower? Sure. In December it hit a low of $11.8, meaning 10.3% yield and 2.9 times operating cash flow. But ultimately I am not a market timer, who foolishly overlooks the chance to buy a great company at a great price, on the hopes of getting it at even more ludicrously cheap levels.

And that’s just one example of a deeply undervalued blue-chip I bought for my retirement portfolio. There are actually dozens of quality dividend blue-chips trading at table pounding levels.

As of Friday, June 1st no less than 26 of the blue-chips in my 182 company watchlist were 25% or more undervalued, per Morningstar’s conservative discounted cash flow estimates. Albemarle, a fast-growing dividend aristocrat (as of 2020) even hit a 51% discount to fair value making it arguably the most undervalued blue-chip in America.

While there are lots of ways to value companies, the point I’m making is that even during a run of the mill pullback, there are truly exceptional opportunities for long-term investors to lock in potentially enormous, private equity style profits (15% to 20% CAGR or more over the next five to 10 years) but in low-risk dividend blue-chips.

This is why it’s so important to make sure that your risk management, including your asset allocation, is locked down before any market downturn begins. That will allow you to ignore the short-term pain and either ride out the market storm (retirees with no spare savings) or profit from even better bargains than I’ve highlighted here.

Bottom Line: Investing Genius Means Keeping Your Head When Others Are Losing Theirs

Pullbacks and corrections naturally mean lots of media hype about “market crashes” that, while great for attracting eyeballs and ad dollars, are horrible sources of investing advice. Even if Guggenheim is right that a 16% decline is coming by the end of Summer, that would merely be a 22% bear market, and not an “agonizing market crash.”

Mind you it wouldn’t feel good, and the months-long stock slide might indeed feel agonizing to some investors who have the misguided notion that stocks are supposed to steadily climb higher with minimal volatility (as they did in 2017).

The truth is that the market has always been volatile and always will be. That’s because the stock market is dominated by increasingly passive dominated fund flows that mean wild overreactions to the upside and downside are to be expected.

Don’t get me wrong, I’m not saying that the mounting trade wars are a good thing. The economist consensus is that they will 100% slow growth, and if they get bad enough, might even trigger a mild recession.

But ultimately, while tariffs will slow growth, we just can’t know by how much, until the economic data comes in. For now, rising tariffs are merely a risk about what might hurt fundamentals in the future, but the actual fundamentals appear to be holding up well.

That could mean that this correction might not become a bear market, as Blackstone’s Byron Wien predicts, which could potentially make the next few weeks and months an excellent time to put new money to work.

Good long-term investing is about recognizing that the market will always overreact to heightened risk and thus prepare to not just protect your wealth during corrections, but take advantage of the market’s famous short-term irrationality.

Or to put another way, don’t necessarily believe all the scary headlines you see right now. When it comes to my own retirement portfolio I’m still buying because the stock market might be lying.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!