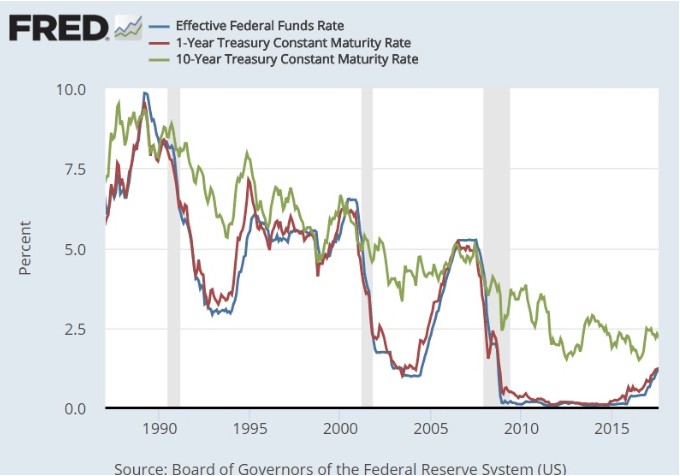

The Federal Funds Rate affects consumer borrowing costs (Bank Prime lending rates are indexed to it), and it also tends to be closely correlated with short-term treasury yields (like the 1 and 2-year bond yields).

But since long-term rates (like the 10-year yield) are not driven by the FFR, but long-term inflation expectations, this means that if the Fed hikes too quickly and too much, then short-term yields can rise higher than long-term ones. That’s called an inverted yield curve and since 1955 90% of the time, the 2/10 yield curve has inverted a recession has followed six to 24 months later (17-month average).

This makes the bond market in general, and the yield curve, in particular, the best recession predictor ever discovered. Why does an inverted curve predict recessions so well? Because according to the Fed’s most recent survey of banking loan officers:

“Banks would tighten standards or price terms across every major loan category if the yield curve were to invert, a scenario that they interpreted as a signal of a deterioration in economic conditions.”

Basically, the yield curve might be a self-fulfilling prophecy. If it inverts then banks fear a recession is coming, and thus start cutting off credit to the economy, and thus cause the very recession they feared was imminent.

The 2/10 yield curve is currently at 0.23%, near its August 2018 lows (0.18%). Analysts at Goldman Sachs and JPMorgan Chase expect the curve could invert by mid-2019 if the Fed makes good on its current plan to hike again in December, and then in March, June, and December of 2019 (Goldman thinks it will also hike in September).

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!