On November 16th the Fed’s Vice Chairman Richard Clarida told CNBC “As you move into the range of policy that, by some estimates is close to neutral…it is appropriate to sort of shift the emphasis towards being more data-dependent. I think Chair Powell the other day made the analogy … if you’re in a dark room, especially without your shoes on, you want to go slow so you don’t stub your toe. So I think data dependence makes sense right here.”

Basically, the Fed’s top two officials are saying that once the neutral rate is reached (what short-term yields have already priced in) then the Fed won’t hike unless the economic data says it should (because inflation is above target or the economy is growing faster than expected and threatening to overheat).

Given the current macroeconomic situation (which I track closely in my weekly economic updates) the chances are good that the Fed will prove the bond market right, and halt its rate hikes in June of 2019. What that would signal for the US economy is:

- Slower but steady growth

- Stable and low inflation

- Continued historically low interest rates

- Possibly no yield curve inversion in 2019 (or even 2020)

- No recession likely to begin until 2021 (or even 2022 or 2023)

- No bear market beginning before mid-2020 at the earliest (but likely 2021 or later)

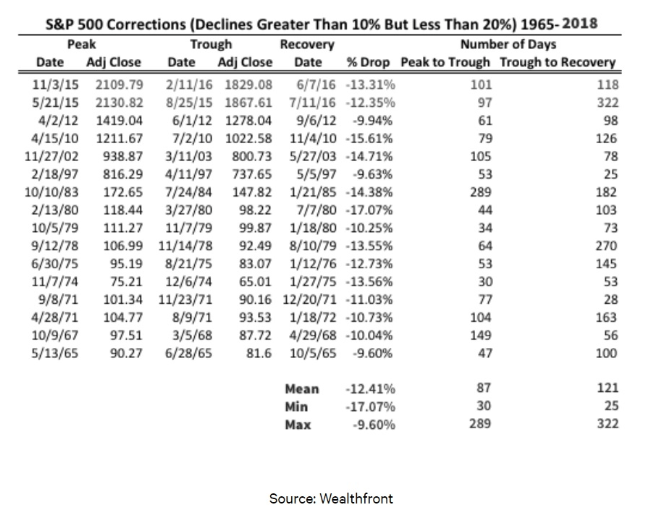

All of which means that this latest correction is likely not the start of a bear market (82% of which occur during recessions) but the natural 10% to 19.9% declines the market undergoes on average every 2.9 years since 1965.

Including 2018’s two corrections, the average correction sees stocks bottom after three months, at 12.3% from their all-time highs, and then take four months to hit record highs again. The last correction ended in a 10.2% peak drawdown and so far this one has seen an identical 10.2% peak decline.

That means we’re likely near the bottom of the market, which makes it the perfect time to go bargain hunting for deeply undervalued, fast-growing dividend blue-chips.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!