Every election season the media loves to plaster bold headlines about how stocks in general, or some companies in particular, will soar or plummet if one candidate or party wins or loses. Such articles and arguments usually make a great deal of sense, at least superficially. However, market history is littered with examples of investors losing big because they mixed their political beliefs with investing decisions.

In fact, no less than Warren Buffett, the greatest investor in history has said “if you mix your politics with investing decisions you’re making a big mistake”. Let’s see why the Oracle of Omaha is absolutely right, and why making large portfolio shifts based on expected election outcomes can end up costing you a fortune.

Politically Motivated Investing Decisions Can Cost You A Fortune

Perhaps the most famous prediction about election effects on the stock market came from Nobel Prize-winning economist Paul Krugman on election night 2016. Based on various polls in the run-up to the election, most political prediction models gave Trump no more than a 35% chance, at best, of winning the Presidential election. When actual results starting coming in that showed he would become the next president stock futures plunged, with the Dow futures hitting -1,000 at one point. That pointed to a 4% decline at the open the next day. Due to his earlier predictions that Trump’s policies would trigger a global recession Krugman told reporters:

“It really does look like ‘President Donald Trump’ and markets are plunging. If the question is when markets will recover, a first-pass answer is ‘never.”

In reality, the US and the global economy did NOT fall into recession, and the S&P 500 has gone on to deliver 33.5% total returns since Trump’s surprise election win. That’s despite 2018’s correction and the recent pullback in October (the worst month for stocks in seven years).

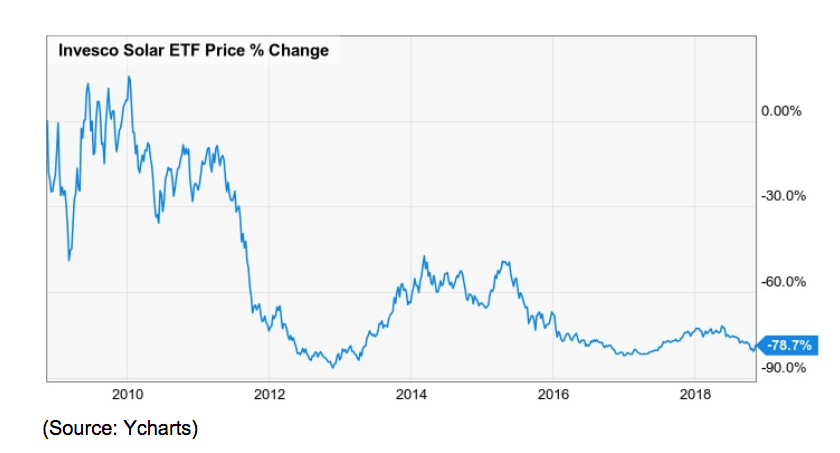

But that’s just one example of many. For example, when President Obama won in 2008 many predicted that renewable energy (solar and wind) companies would boom.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!