No Dividend Is Ever Truly “Safe,” Just Low Risk

After a disastrous third quarter, GE’s new CEO (second since 2017) announced the company was slashing its dividend, for the second time in a year. A staggering 92% cut follows the 50% earlier one, meaning that compared to a year ago, GE will be paying a 96% smaller dividend (just $0.01 per quarter). The quarterly payout is now 97% below its all-time high of $0.31 per quarter in 2007. Literally, the remaining token payout is purely to allow some mutual funds that only invest in dividend stocks to continue owning the rapidly shrinking industrial conglomerate.

This is an important lesson that no dividend is every truly “safe”, not even from blue chips or dividend aristocrats. All dividends are set by the Board of Directors and while dividends tend to be stable and reliable, that’s only on the aggregate level.

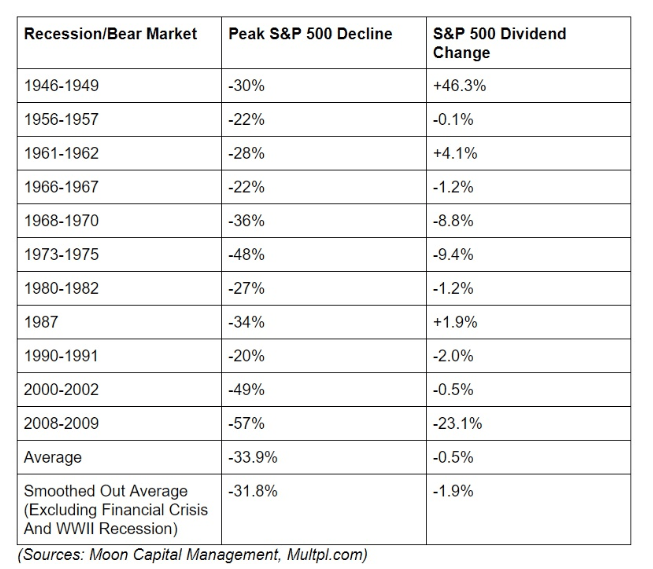

For example, since WWII the S&P 500’s dividends have actually held up very well, even during recessions and some nasty bear markets. In some economic downturns, the market’s total dividends even went up. This is because American companies know that income investors treat every dividend as perpetual and so companies that reduce payments are severely punished.

But at the individual company level, it’s important to remember two things. First, dividends are only “safe” if three things hold true:

- A company’s sales, earnings, and cash flow are relatively stable or growing over time

- The dividend is covered by earnings or cash flow

- The balance sheet is in good shape

What caused GE to slash its dividend 97% over the past 11 years? Well, that would be the rapidly shrinking nature of its cash flow and the terrible balance sheet. GE’s cash flow, even in 2018, will likely have been enough to cover the payout.

The trouble for GE is the terrible capital allocation decisions made by former CEOs Jack Welch (who turned GE into a massive financial company) but especially Jeffrey Immelt. Immelt is the only CEO in US history to buy and sell over $100 billion in 16 years as CEO. That included such disastrous ideas as buying WMC in 2004, a subprime mortgage company. That was sold for a major loss in 2007. But, GE’s subprime assets continue to haunt it — even to this day. Immelt also overpaid for no less than nine oil & gas companies between 2010 and 2014, when oil prices averaged about $100 per barrel.

Immelt dismantled GE piece by piece, including selling off the safest and most profitable parts of GE finance. Then he either blew the proceeds on terrible acquisitions or bought back tens of billions in shares. All while ignoring the terrible state of the balance sheet. That includes a pension plan covering 691,000 former employees and dependents that, before this year’s $6 billion top off, was $31 billion underfunded (the most underfunded pension in Corporate America).

The takeaway for investors is to never ignore terrible management. Sure all executives will occasionally make mistakes, especially in M&A. But for most corporations look at a company’s returns on invested capital or ROIC. This is a good proxy for quality management that includes all previous capital allocation decisions, including R&D spending, acquisitions, and overall growth CapEx investments.

If a company’s ROIC is steadily falling over time, it might be a good idea to take a hard look at what’s going wrong and potentially sell a company that isn’t investing shareholder capital well. For example, when Immelt took over as CEO of GE the ROIC was 29.6%. That means that for every dollar of shareholder capital (debt and equity, including retained earnings), the company was generating excellent annual returns of 29.6%. Today, GE’s ROIC is just 2%, showing that the much smaller company is 94% less profitable than it was 17 years ago.

A few bad years does not break an investment thesis. But steady erosions in ROIC signals that a company’s captain might be drunk at the helm, and investors might want to abandon ship.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!