GrubHub (GRUB) is a food delivery service that also operates under the Seamless and Eat24 platforms currently servicing over 80,000 restaurants.

Last week, the company delivered a triple play of an earnings report, beating both the top and bottom line, and boosting guidance. Revenue grew by 53% to a record $286 million in the quarter.

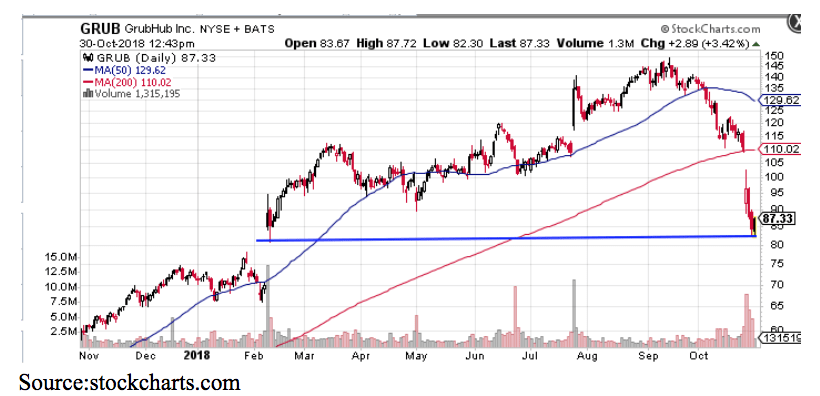

Despite this top-notch report, the stock slumped over 12% and continued lowering the following day. This decline comes even after the stock had fallen some 18% in preceding weeks.

Now down over 40% — from its 52-week high of $150 a share — it looks deeply oversold. The $85 level is old support and is a great entry point to long the shares.

GrubHub’s business model is a prime example of the network effect in which scale matters and becomes a defensive business moat.

The right location is said to be crucial for the success of a restaurant. This is especially true of independent and mid-priced casual, which might not have large marketing budgets and are not deemed “destination” spots that foodies are willing to travel to and discover.

Locations on a busy street or well-trafficked area usually command higher rents for a good reason; they drive business. Likewise, as consumers are increasingly ordering food online (or with mobile app) for delivery it becomes crucial for restaurants to locate or set up shop where they are most likely to be found and provides an easy transaction experience.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!