There’s a reason that shows about rich people are so popular. Most of us would love to live in penthouses, drive fancy cars, and live in opulent mansions waited on by a cadre of servants.

At the very least we all want to be financially independent and not have to worry about making ends meet, especially if the economy falls into a recession and the stock market tanks (retirees especially).

But there’s a big difference between dreaming of such things and having a smart long-term plan for achieving them. Fortunately, Warren Buffett’s (the world’s second richest man and the greatest investor of all time) spending habits and lifestyle serve as a great example for how regular people to achieve financial independence and thus richer, fuller, and happier lives.

So let’s take a look at what I call “the Buffett Budget Rule” to see how it can help you maximize the chances of achieving your financial dreams.

Being Rich Has Little to Do With How Much You Earn

One of my best friends (and a business partner) recently told me about some of the financial mistakes he’d made in his life. One of those was falling into the “lifestyle creep” trap in which as he achieved greater professional success and income, he let his wife talk him into spending on extravagances they didn’t really need. A great example was leasing not one, but two Audis (for $1,000 per month in total). Such luxuries felt good in the short-term (nice cars are fun to drive) BUT ultimately led him to near financial ruin (he nearly filed for bankruptcy during the Great Recession).

Similarly, another friend I have lives in New York City where he and his wife bring home about $200K per year in income. That’s roughly three times the US median income. But thanks to that city’s high cost of living (and tax rate), plus supporting his parents and a new baby, their savings rate is zero (as is their net worth).

I’ve personally lived through several years of poverty, including a year that was so rough I literally went a month without eating (thankfully I was fat enough to survive the equivalent of a long water fast).

The point I’m making is that while everyone wants to live richly (or at least comfortably and securely) that actually has less to do with your income than your spending habits. According to Forbes, Michael Jackson made over $1 billion in his career and yet died $400 million in debt. Johnny Depp managed to blow $650 million from the Pirates of the Carribean Movies and was effectively broke by 2018.

Many people look at people like that and imagine it must be great to be rich. But the truth is that “rich” isn’t about how much you earn or what you spend, but what income producing assets you have.

For example, Warren Buffett is the world’s second richest man (accounting for Bezos’ divorce) and yet lives a more frugal lifestyle than many Americans including

- Never spending more than $3.17 on breakfast

- Living in the same house he bought in 1958 (for $260,000 in today’s money).

- Up until 2014 he only bought used cars (including those that were hail damaged and thus available at steep discounts)

- His first new car was a 2014 Cadillac XTS that cost $70,000 and still drives today (five years later)

Buffett is just one of numerous billionaires that cling to what some might consider freakishly frugal behavior (Marc Cuban likes to buy two years worth of discount toothpaste in-bulk when he can find it on sale).

Why do I bring up Buffett’s surprising frugality? Because the key to why the “rich” are actually rich is that they know how to prioritize what matters and most importantly the luxuries they do enjoy are all “free” in that they are effectively paid for by other people.

Which brings me to the Buffett Budget Rule, which is designed to allow you to also enjoy life’s luxuries, but the right way.

The Buffett Budget Rule: Making Sure Other People Always Pay for Your Luxuries

A recent survey by TD Ameritrade found that the average American spends $697 per month on non-discretionary luxuries (the average Millenial $838). Now I get spending on life’s essentials like housing, food, healthcare, etc. While there are always smarter ways to obtain those essentials (like buying non-perishables in bulk at Costco for 20% less than regular grocery stores) you can only economize so much on such things.

What this survey was talking about were things like eating out, vacations, going to the movies, etc. Are these things that you should feel bad about spending money on? Yes and no.

The secret to how the rich live richly AND stay rich is that their luxury spending is paid for by other people, via their passive income, and thus they can enjoy an exponentially rising standard of living.

Active income is what you have to work for, and passive income is your money working for you. Rich people (those with actually high net worth, not lavish spenders drowning in debt like Jackson or Depp) make sure that their luxuries are paid for out of a fraction of their passive income, such as profits and dividends from their investments.

In other words, part of the cash flow their assets produce is what pays for their lifestyle, while the remainder is always compounding their assets to keep producing exponentially more cash flow.

For example, someone with a $100 million dividend portfolio yielding 4% is getting $4 million per year in dividends. As long as they spend less than that on their lifestyle, then the reinvested dividends will ensure their portfolio is always growing and their passive income (and lifestyle) rising over time.

What are those dividends paid from? Their share of a company’s free cash flow, or the money left over after running the business and investing in future growth. That money itself comes from a business’ customers, which ultimately leads back to millions or billions of people around the world buying various products from companies (like Coca-Cola).

In other words, the billions of people buying Coke each year is what’s paying for that rich person’s Audi and penthouse.

So that’s the theory behind the Buffett budget rule, but what is the rule exactly and how can you apply it? Simply put the rule says that you should only spend 50% of your portfolio’s post-tax dividends on luxuries and reinvest the other half, to ensure that your portfolio is growing over time (via dividend reinvestment). Since quality dividend growth stocks increase their dividends over time (usually faster than inflation) you’ll benefit from two forms of compounding and thus enjoy exponentially growing income to fund a steadily better lifestyle over time, and never have to worry about going broke.

As a simpler rule of thumb, you can calculate it like this. Take your portfolio’s annual dividends, multiply by 0.4 (50% assuming 20% average dividend tax for qualified dividends) and that’s how much you can spend on non-discretionary items.

You don’t actually have to take money out of your portfolio (money is fungible) just spend that much of your active income on luxuries (things that are nice to have but not essential). This will ensure your diversified dividend portfolio is getting larger over time and growing your passive (ie “free money”) income.

But the best thing about the Buffett budget rule isn’t just that it can ensure you an exponentially better standard of living over time (no matter how long you live) but that it can also ensure you avoid poverty should tragedy strike.

How The Buffett Budge Rule Can Save You During Times of Crisis

There is a reason I set the rule at 50% of post-tax dividends. It’s not just so your portfolio is set to grow naturally over time via dividend reinvestment, but also so you have a backup in case tragedy (like a recession causing a job loss, or medical emergency not covered by insurance) strikes.

The best reason to have money isn’t necessarily to buy material luxuries (and services) but the security it provides. If you make sure that your non-discretionary spending is just half of your net dividends, then the other half can be tapped as a backup emergency fund (once your regular emergency fund is gone).

But unlike your emergency fund (three to six months of living expenses) this source of income is self-perpetuating and grows faster than inflation over time. Best of all, most US blue-chips don’t cut their dividends during recessions.

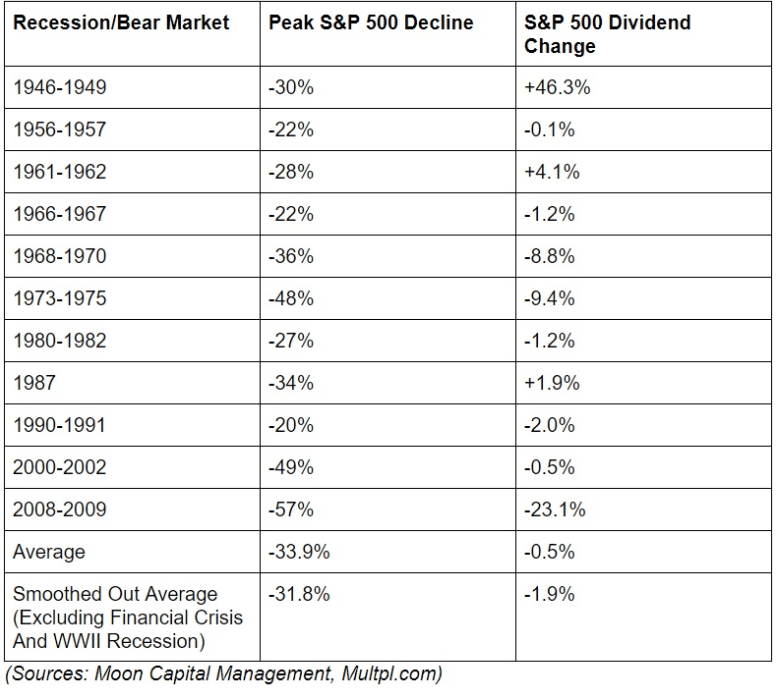

While a lot of financial companies (and REITs) had to slash dividends during the Financial Crisis that was an anomaly. Because as you can see, during most recessions dividends fall, on average just 2%, 16 times less than the regular peak market decline.

In other words, a diversified portfolio of quality dividend stocks will generate far more stable income than your job (which you can lose in a recession). Thus by always maintaining that 50% (or more) in backup dividend income, you can cover some or even all of your living essential living expenses with passive income. This also helps avoid you having to sell your stocks at the worst possible time (like during a bear market).

Then even once unemployment runs out, you don’t have to scramble to take the first job offer you get, one that might be for far less (and outside your actual profession) and force you to slash your lifestyle.

In essence, the Buffett budget rule can both help you grow your dividend portfolio over time, while simultaneously providing you with steadily, but sustainably more enjoyment in material goods and services, AND help you sleep well at night knowing that with each passing day your risk of falling into poverty from some black swan emergency shrinks.

Material peace of mind is the ultimate luxury. I say that from experience, having spent many years living a lifestyle that was materially rich, but asset poor (my ex-wife and I lived far beyond our means). Living on the knife’s edge of poverty, where you’re sure to go over the moment something bad happens (and it eventually will) is not a happy life. Trust me when I tell you that it will suck all the enjoyment out of expensive restaurant meals, a large home, and fancy luxury cars.

On the other hand, sustainable material luxuries paid for by other people (via a portion of your dividends) is something you can enjoy guilt and fear free, which is ultimately the real trick to “living richly”.

Bottom Line: Luxuries Are Ok…Just Make Sure Other People Are Paying for Them

Don’t get me wrong, I’m not saying you need to, or should, live like a monk forever. Money is a tool, and should be spent, but wisely. Remember that interpersonal relationship with family and friends are what ultimately produce lasting long-term happiness.

Material goods, while necessary, are just the base of the pyramid of a happy, rich and full life. The Buffett Budget Rule is my own take on how to balance frugality with enjoying an exponentially growing standard of living. It’s based on the principle that luxuries are OK to enjoy, BUT you need to prioritize what matters to you and make sure that other people are paying for them.

By budgeting no more than 50% of post-tax dividends to all your non-discretionary purchases you can not just enjoy steadily nicer things as your passive income grows exponentially over time, but more importantly, you’ll have a backup plan in case a recession causes you to lose your job. The other half of your dividend income can be temporarily used to cover your expenses, and as long as you follow the rule to keep your lifestyle expenses in check, then you won’t have to fear what tomorrow’s economy or market may bring.

Never forget that the real reason most people crave a lot of money is for the security it brings. The Buffett Budget Rule can help you focus on that, and keep you from living too richly today, only to find yourself catastrophically poor tomorrow.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!