In December the S&P 500 crashed into its worst correction in 10 years, largely due to fears that a recession was coming in 2019. The Dow and Nasdaq didn’t hold up any better, though all three indexes have rallied hard and strong so far in 2019.

However, the recession risks so many were worried about in December are starting to show up in the data and risks of an economic downturn starting in 2020 are now rising. Let’s take a look at why now is probably a good time to start getting defensive, including three ways you can “recession-proof” your portfolio to protect your hard earned wealth from a possible bear market.

Recession Risks Are Rising

While pinpointing when recessions will start is impossible there are time tested methods we can use to judge the current health and trend of the US economy, which ultimately drives corporate profits and thus share prices.

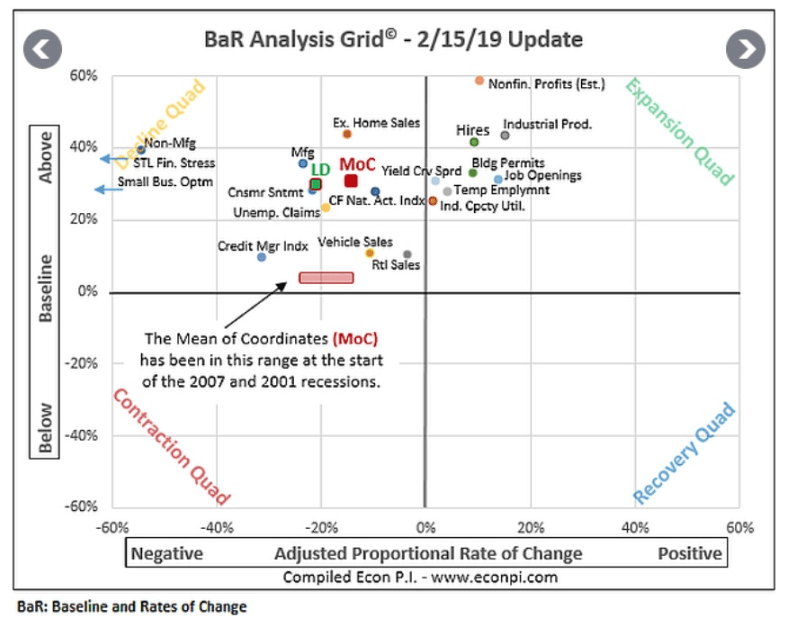

(Source: David Rice)

Specifically, there are 19 leading indicators (that have predicted the last four recession) that measure critical economic fundamentals such as industrial production, financial stress, small business optimism, and hiring. David Rice, ie “Economic PI” tracks all 19 leading indicators on his baseline and rate of change or BaR grid.

Since December the number of indicators pointing to slowing growth (decline quadrant) has jumped from three to 11. More importantly, the Mean of Coordinates or MOC has also shifted to the decline quadrant.

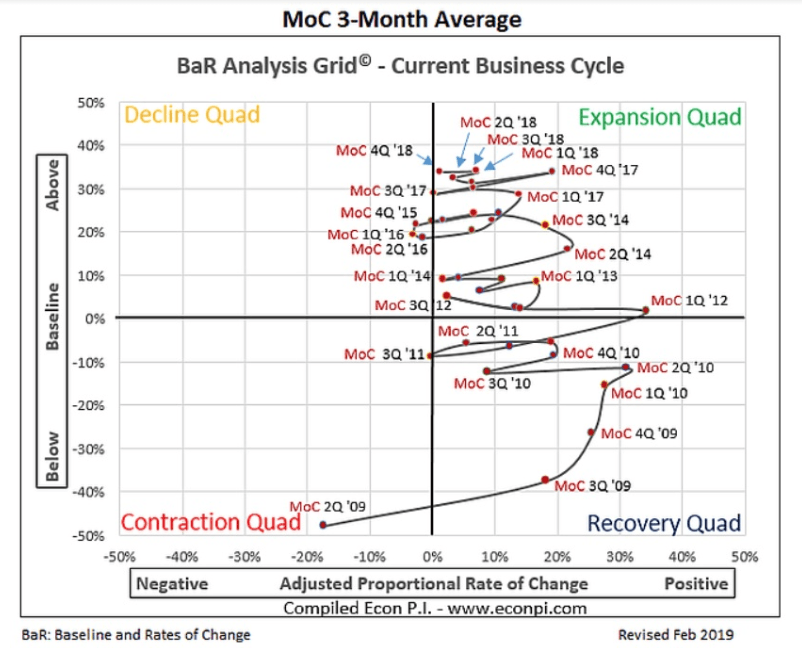

(Source: David Rice)

The leading indicator average has now shifted so far to the left (indicating contraction) that the MoC is likely to continue moving in the wrong direction (and the most leftward it’s been since the Great Recession ended).

Now it’s important to remember that the economy is a complex and slow-moving thing, like an oil tanker. Growth isn’t going to suddenly plunge negative, but these leading indicator trends are troubling and point to economic growth coming in far below the 2.3% to 2.7% most analysts expected in 2019.

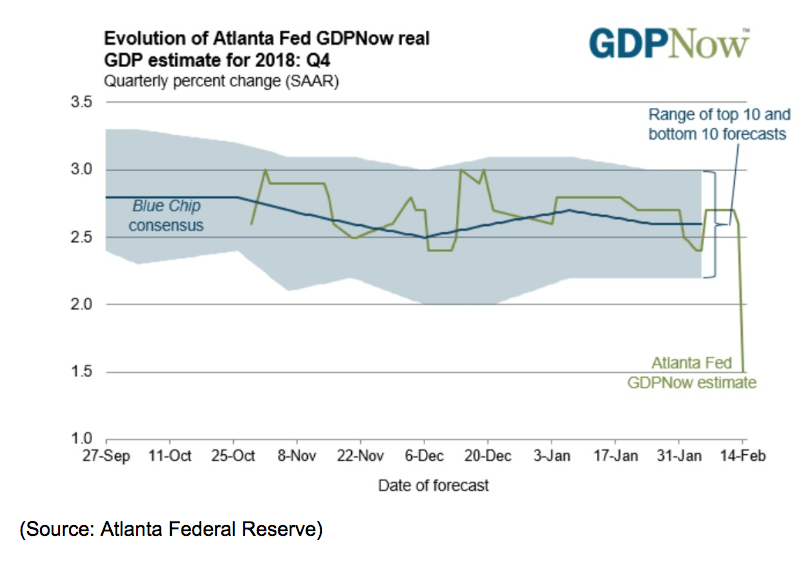

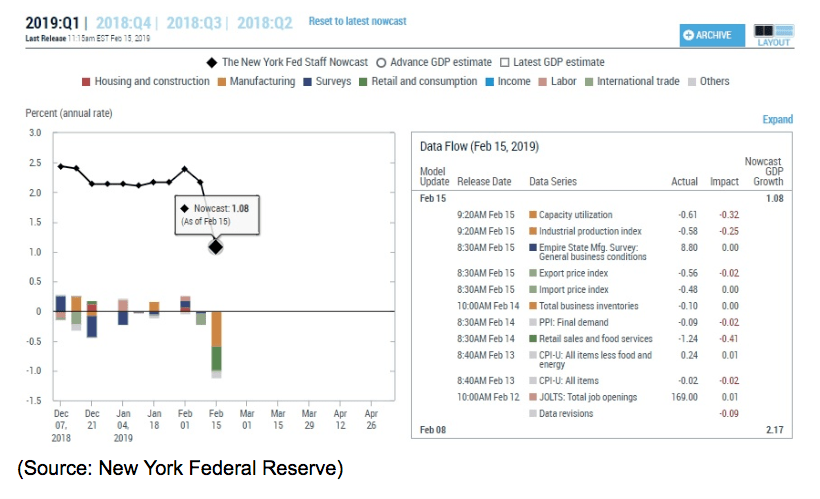

That’s what the Atlanta Fed’s real-time GDP growth model is saying with Q4’s growth rate (first Q4 estimate is coming out Feb 25th thanks to shutdown), now falling to 1.5%. While no one model should ever be taken as gospel the New York Fed’s real-time model is showing a similar rapid deceleration in Q1 (over three reports including the weakest retail sales since 2009 and weak industrial utilization).

The NY Fed’s forecast for Q1 growth has been cut in half to just 1.1%. If that proves accurate, then US growth in 2019 will be dangerously close to stall speed and the Fed should start cutting short-term rates quickly and end its balance sheet roll-off (quantitive tightening).

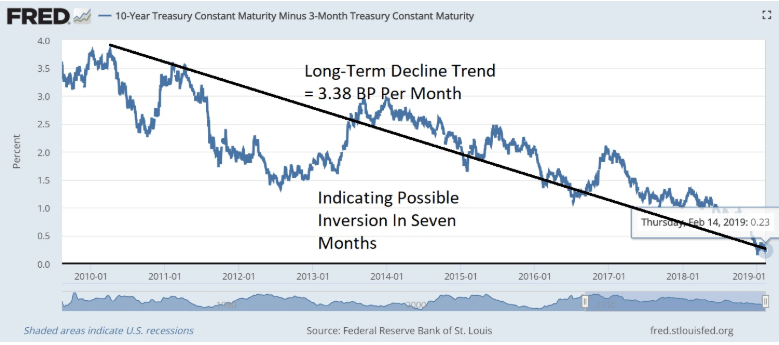

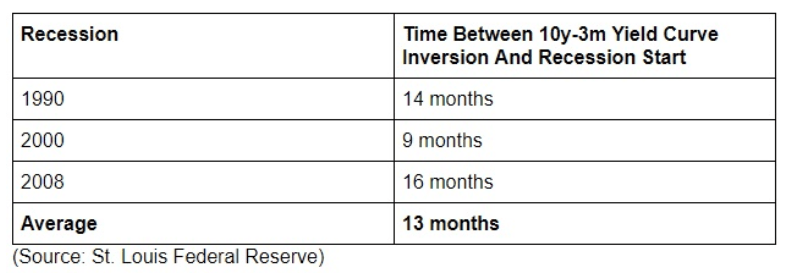

What about the best recession predictor of all, the 10y-3m yield curve, which has is the official model that most banks use to predict recessions (and tighten lending policies that actually cause them)?

The good news is that the “banker’s yield curve” is still positive. The bad news is that it’s continuing to track its long-term trend line lower. If that trend holds (which weakening economic fundamentals would indeed cause) then it could invert (turn negative) within about seven months.

If that happens in August (assuming current trends hold) then a recession becomes likely 16 to 23 months from now.

That means a recession isn’t likely this year but might be coming next year.

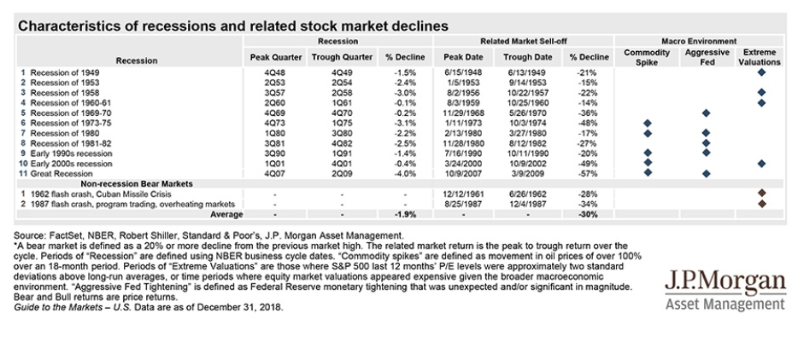

And while not all bear markets lead to recession, all recessions lead to bear markets. Fortunately, there are ways you can recession-proof your wealth and turn your portfolio into a bunker to ride out any coming market storm.

How to Protect Your Portfolio

I recently had a thesis break on one of my dividend stocks (Clearway Energy) and was able to sell it the day before it cut its dividend 40%. That same day I reviewed all my holdings and decided to sell all the high-risk ones (two companies, both at a steep profit). One of those would within days plunge 40% on thesis breaking news (so I got very lucky last week).

My point is that all investors need to periodically review what stocks they own to make sure their investment thesis (the reason you bought them) remain intact, but more importantly that they still meet your risk profile.

How much risk you want to take on with your portfolio is always evolving, as you age, and your life circumstances and long-term financial needs change. What’s more, what stocks you may wish to own in a growing economy might be very different than what you are comfortable holding during a recession.

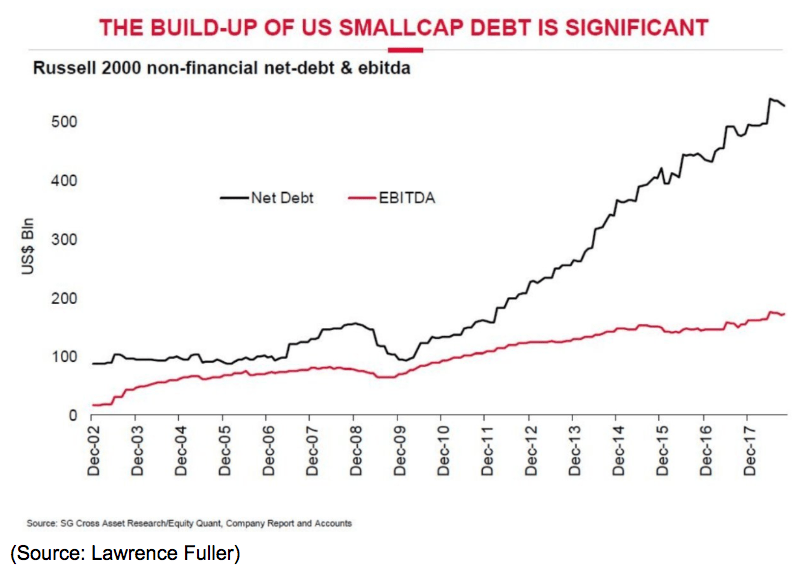

One of the most important, yet overlooked, things investors need to know is how strong their companies’ balance sheets are. As you can see, small-cap companies have taken on a lot of debt over the past decade, taking advantage of the lowest interest rates in history.

Now it should be noted that higher leverage doesn’t necessarily mean a company is dangerous. It depends on the industry, the business model, and how well cash flow covers interest costs. During normal economic conditions companies are able to refinance debt by selling new bonds to pay off maturing ones, and as long as interest rates don’t rise (they are currently not) then companies can be ok for a long time.

However, it’s important to remember smaller companies are naturally riskier (due to less diversified cash flow streams and access to smaller financial cushions) as well as more volatile in terms of share price.

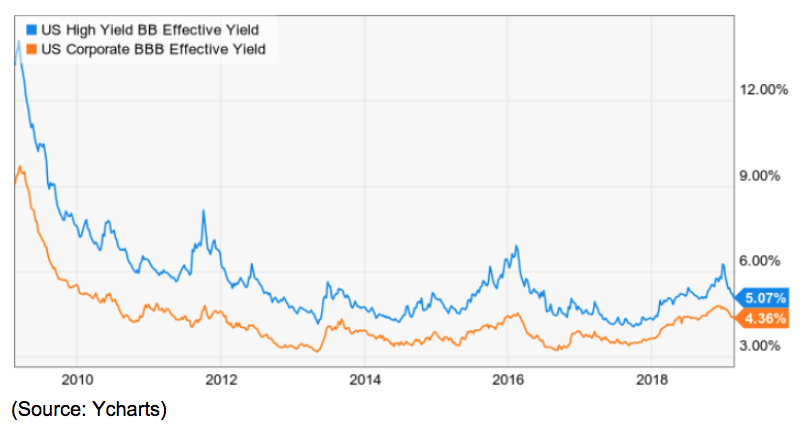

So you’ll want to check the debt levels on what you own, and not just small caps either. Total corporate debt is at record levels and as you can see above, during times of credit market fear (which usually correlate with corrections and bear markets) bond yields spike much higher. That’s even for investment grade BBB rated debt, and for junk bonds (below BBB-) the yields investors demand can rise even higher.

During the Financial Crisis credit markets got so tight that junk bond investors were demanding close to 14% yields in order to lend to companies, and even investment grade corporations had to refinance at over 9%.

Never forget that debt is effectively leverage, just like broker margin. I recently explained how to safely and profitably use leverage in your portfolio, but the same rules apply to companies you own in your portfolio.

If we are headed for a recession in 2020 then credit markets are likely to tighten up and you’ll want to make sure that most of your companies have at least BBB credit ratings. That’s two notches above junk status and allows for the company’s cash flows to take a hit (due to the weak economy) and still avoid losing investment grade status.

Many bond funds (as well as other institutions) have rules against owning junk bonds and so a downgrade to junk status can cause a potentially disastrous spike in borrowing costs at a time when a company might have billions on debt maturing and bond yields are in the stratosphere.

As Ernest Hemingway said, there are two ways you (and companies) go bankrupt. “Gradually, then suddenly.” By that he means that you steadily take on too much debt in the good times, but then the good times end and suddenly the interest costs are no longer manageable. For companies the biggest risk is also that bond yields can spike so high that refinancing debt becomes impossible, forcing Ch 11 bankruptcy (in which case equity investors get wiped out).

In December 2018 the correction caused bond yields to soar so quickly that not a single US Corporation sold new bonds. That was the first such month since 2011 when the US losing its AAA credit rating (over the debt ceiling fight that caused a major correction) sent yields also rocketing higher.

Fortunately, the correction ended quickly and bond yields have come way down again. But during a recession, and a bear market, in which stocks generally take 13 months to fall 30%, too much debt could sink a lot of companies, both big and small. So make sure you know what you own, and are comfortable with the strength of those companies’ balance sheets, and the stability of their cash flow during a recession.

Blue Chip Dividend Stocks Can Make For A Great Bunker Portfolio

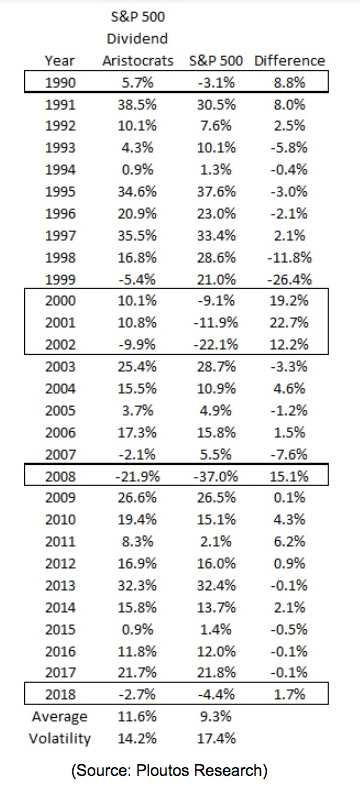

A great way to become more defensive is with quality dividend paying blue-chips like the famous dividend aristocrats (S&P 500 companies that have raised their dividends for 25+ straight years). While no company is ever truly “risk-free” these are the bluest of the blue-chips and have proven they can not just maintain dividends during recessions, but keep growing them. And as you can see, the aristocrats have not just beaten the market over time (by 25% annually since 1990) but done so with far less volatility. During the short 1990 bear market aristocrats actually went up, as they did in 2000 and 2001. In 2008 they did fall, but not nearly as bad as the overall S&P 500.

Basically, the reason aristocrats (and most dividend growth stocks) beat the market over time isn’t because they outperform during the bull market (they merely keep up). It’s because their safety and growing dividends keep long-term investors from panic selling, thus allowing them to hold up well during downturns. In other words, offense wins ball games, but defense wins championships.

My new model Deep Value Dividend Growth Portfolio or DVDGP (beating the market by 11% since Dec 12th) is specifically designed around this strategy of high-quality, applied to a diversified portfolio of low-risk (recession-resistant cash flow) dividend growth stocks.

- December 2018: +0.6% vs -3.5% for S&P 500

- January: +10.2% vs 8.0% for S&P 500

- February: +4.5% vs 3.0% for S&P 500

While 9 weeks isn’t much time it’s still a promising start given that the portfolio has been through both the strongest correction in 10 years and the strongest January rally in 32 years (plus now a low-volatility steady grind higher in February).

The point is that this portfolio’s success isn’t based on a few rockstar winners, but the overall investing strategy. The portfolio has 74 holdings with the largest one representing 2.8% of the portfolio. I’m looking for lots of small wins that total modest outperformance over time (we’re beating the market by a little nearly every day no matter the direction).

That low-risk strategy might not sound exciting but beating the S&P 500 by just 0.1% per week over time equates to about 6% annual outperformance (15% total returns which is what my total return model says it can deliver). That level of alpha would put this portfolio in the top 1% of all funds (it’s basically a smart beta ETF).

But you don’t have to own 50+ companies to have a safe, recession proof portfolio. Just 20 or so companies will do IF you select them wisely.

But there is one final and important way to build a bunker portfolio ahead of a recession, and it’s one of the most important, but overlooked, strategies of all.

Make Sure Your Asset Allocation Is Still Optimal for Your Risk Profile

I’m a passionate stock picker at heart (the best performing asset class in history) and most of my readers are looking for advice regarding the equity portion of their portfolio. But you can’t forget that the most important thing about your portfolio is its overall asset allocation, or mix of stocks/bonds/cash equivalents (money market accounts, high-yield savings or T-bills).

I recently explained my own asset allocation plan for the next recession, and it involves putting all my NEW money into bonds. That’s because I don’t plan to sell any of the dividend stocks I own (as long as their investment thesi hold up) and they keep paying me generous, safe and exponentially growing income. I bought them to do a job and as long as they keep performing well, I’ll ride out any downturn while sleeping very well at night.

But for new savings (which I have coming in weekly) if a recession is looming (not yet but getting closer) then I’ll put all my new money into VGLT, the Vanguard long-term Treasury ETF.

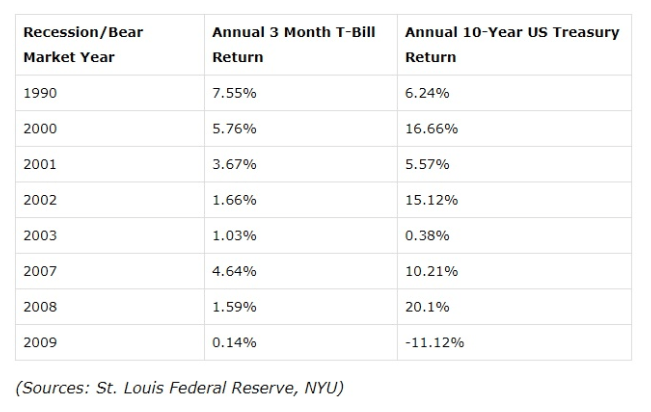

That’s because during recessions bonds rise (falling interest rates + flight to risk-free assets) and so I want my weekly savings to act as a hedge against falling stocks, but also represent an appreciating asset that I can sell when stocks have fallen at least 20% (the definition of a bear market).

You’ll note that T-bills (a cash equivalent) also tend to do well in recessions, though not nearly as well as long-term bonds. That’s because long-term Treasuries (10 and 30 year) have a longer duration so naturally rise more. VGLT has a duration of 17 years meaning that that ETF would have done even better than the 10-year Treasury returns in the above table.

What should you specifically do in terms of adjusting your asset allocation? Plan ahead. Make sure that any expenses you’ll have to pay soon are covered by your emergency fund first (3 to 6 months of expenses) and that if you’re retired you can pay three years of expenses with the cash part of your portfolio (I recommend the ETF MINT, which has a 5 star rating from Morningstar).

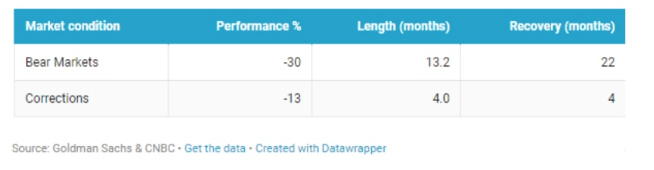

Why three years? Because that’s how long the average bear market lasts peak to peak (13-month decline plus 22 months to recover new all-time highs)

If it takes longer (up to six years back in 1973) then the bond portion of your portfolio (like VGLT) will be an asset that not just generates guaranteed income (backed by the full faith and credit of the US government) but will be an asset you can sell at a profit.

Essentially good risk management (recession-proofing your portfolio) isn’t just about what stocks you own, but making sure your asset allocation is right for your individual risk profile. Make sure you have assets you can sell that will be counter-cyclical to falling stocks so you can avoid selling quality companies at rock bottom prices, locking in paper losses that will be reversed in the next bull market.

What if you haven’t thought about asset allocation at all until now? Well, there’s good news.

While the bond market is signaling worry about the economy (via falling yields and a flattening yield curve) the stock market appears blind to these rising risks, and drunk on a cocktail of trade deal and dovish Fed hope. We’re now experiencing a similar situation to 2017’s steady, ultra-low volatility grind higher while facing a weakening economy and rapidly falling corporate earnings growth expectations.

That means that if you are currently invested too heavily in stocks (use how you felt in December as a guide to how much equity exposure is right for you) then now is the perfect time to lock in some stock gains and shift into whatever amount of bonds and cash equivalents is right for you.

Remember the time to start planning for an economic/market storm is when the sun is shining and stocks are rising, not when panic is tearing through Wall Street and stocks are crashing.

By making sure you have the right asset allocation, and the right companies in the stock portion of your diversified portfolio, you will be able to ride out whatever the future brings in a bunker portfolio while sleeping well at night. Ultimately, peace of mind is a priceless luxury you’ll be glad you earned with proper planning right now.

Bottom Line: A Recession-Proof Bunker Portfolio Can Help You Sleep Well at Night No Matter What the Economy Or Market Does

Please don’t misunderstand me, I’m NOT trying to frighten anyone or saying it’s time to go all to cash. What I am saying is that the fundamentals that ultimately underpin corporate profits and a rising stock market are weakening and that trend appears to be accelerating (for now).

Thus the current rally is a good opportunity to look at what you own, and make sure that you’re not overly exposed to riskier stocks, including companies with highly leveraged balance sheets, weak credit (or even junk bond) ratings, or overallocated in stocks in general.

Remember that asset allocation, not market timing, has been proven to be the most effective way for investors to protect their wealth during recessions. However, if the longest bull market in US history (and the strongest January rally in 32 years) has left you top heavy in stocks, then rebalancing your portfolio into more cash and bonds is probably a good idea. With the bond and stock market currently disagreeing on the economic outlook for 2019 (the bond market is usually right), now might be a good time to take a contrarian approach and recession-proof your portfolio, while prices are still high and rising.

That way you’ll be better prepared emotionally and financially to ride out any coming downturn and bear market, with less risk of costly mistakes like panic selling after stocks have fallen too deeply undervalued levels.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!