Digital Turbine, Inc. (APPS) in Austin, Tex., is the industry’s foremost independent mobile growth platform, leveling the competitive landscape for advertisers, publishers, carriers, and OEMs. It boosts advertising and revenue by combining a comprehensive ad stack with proprietary technologies embedded into devices by cellular carriers and OEMs.

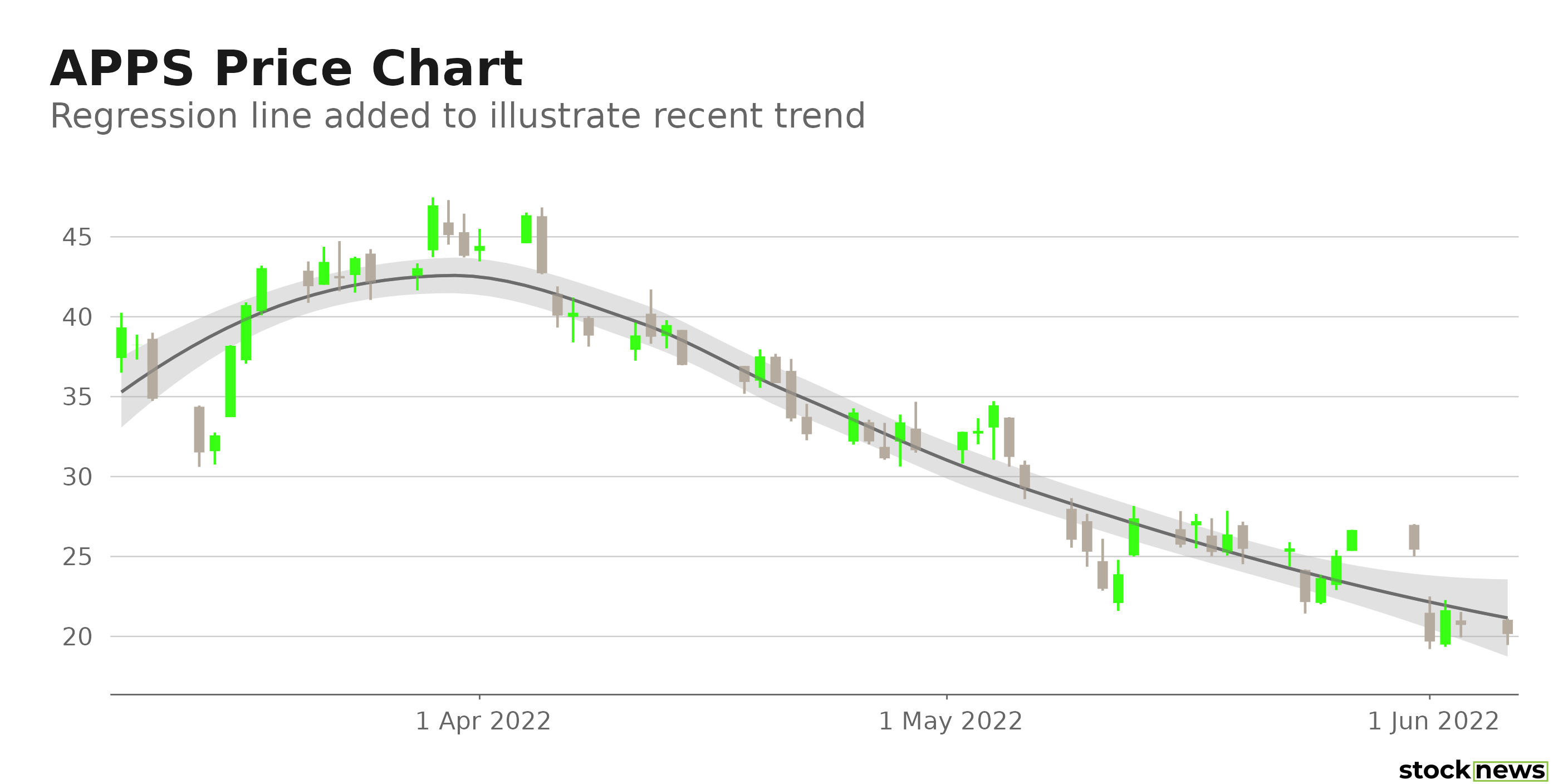

The company’s shares have declined 70.3% in price over the past year and 66.9% year-to-date to close yesterday’s trading session at $20.15. In addition, the stock is currently trading 78.6% below its 52-week high of $93.98, which it hit on Nov. 01, 2021.

Regarding its last earnings release, CEO Bill Stone stated that the company’s performance is being impacted by the adverse macroeconomic environment and deterioration in the digital ad industry.

Here is what could shape APPS’ performance in the near term:

Poor Bottom-line Performance

APPS’ net revenue increased 93.7% year-over-year to $184.13 million for its fiscal fourth quarter, ended March 31, 2022. Its income from operations grew 71.9% from its year-ago value to $27.43 million. The company’s net income declined 32.9% from the prior-year quarter to $20.10 million. Its EPS decreased 38.7% year-over-year to $0.19.

Weak Outlook and Reduced Price Target

APPS shares are sinking after it missed its fiscal fourth-quarter revenue projections. Furthermore, although its earnings met Wall Street’s forecasts, a poor current-quarter revenue projection is impacting the stock. Consequently, Oppenheimer has reduced its price estimate on APP to $40 from $117.

POWR Ratings Reflect Bleak Outlook

APPS has an overall D rating, which equates to Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. APPS has an F for Stability, which is justified given the stock’s 1.89 beta.

Among the 156 stocks in the F-rated Software – Application industry, APPS is ranked #110.

Beyond what I have stated above, you can view APPS ratings for Growth, Value, Quality, Momentum, and Sentiment here.

Click here to check out our Software Industry Report for 2022

Bottom Line

APPS’ declining bottom-line performance and poor growth outlook have weighed on investor sentiment. While the company is expected to gain on the back of content discovery and media platforms for mobile operators, current macroeconomic headwinds could mar its growth. In addition, analysts expect its EPS to decline 11.4% in the next quarter (ending Sept. 30, 2022). Moreover, the stock is currently trading below its 50-day and 200-day moving averages of $32.29 and $51.74, respectively, indicating bearish investor sentiment. So, we think the stock is best avoided now.

How Does Digital Turbine Inc. (APPS) Stack Up Against its Peers?

While APPS has an overall D rating, one might want to consider its industry peers, Commvault Systems Inc. (CVLT), Rimini Street Inc. (RMNI), and Progress Software Corporation (PRGS), which have an overall A (Strong Buy) rating.

Want More Great Investing Ideas?

APPS shares fell $0.55 (-2.73%) in premarket trading Tuesday. Year-to-date, APPS has declined -66.96%, versus a -13.03% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| APPS | Get Rating | Get Rating | Get Rating |

| CVLT | Get Rating | Get Rating | Get Rating |

| RMNI | Get Rating | Get Rating | Get Rating |

| PRGS | Get Rating | Get Rating | Get Rating |