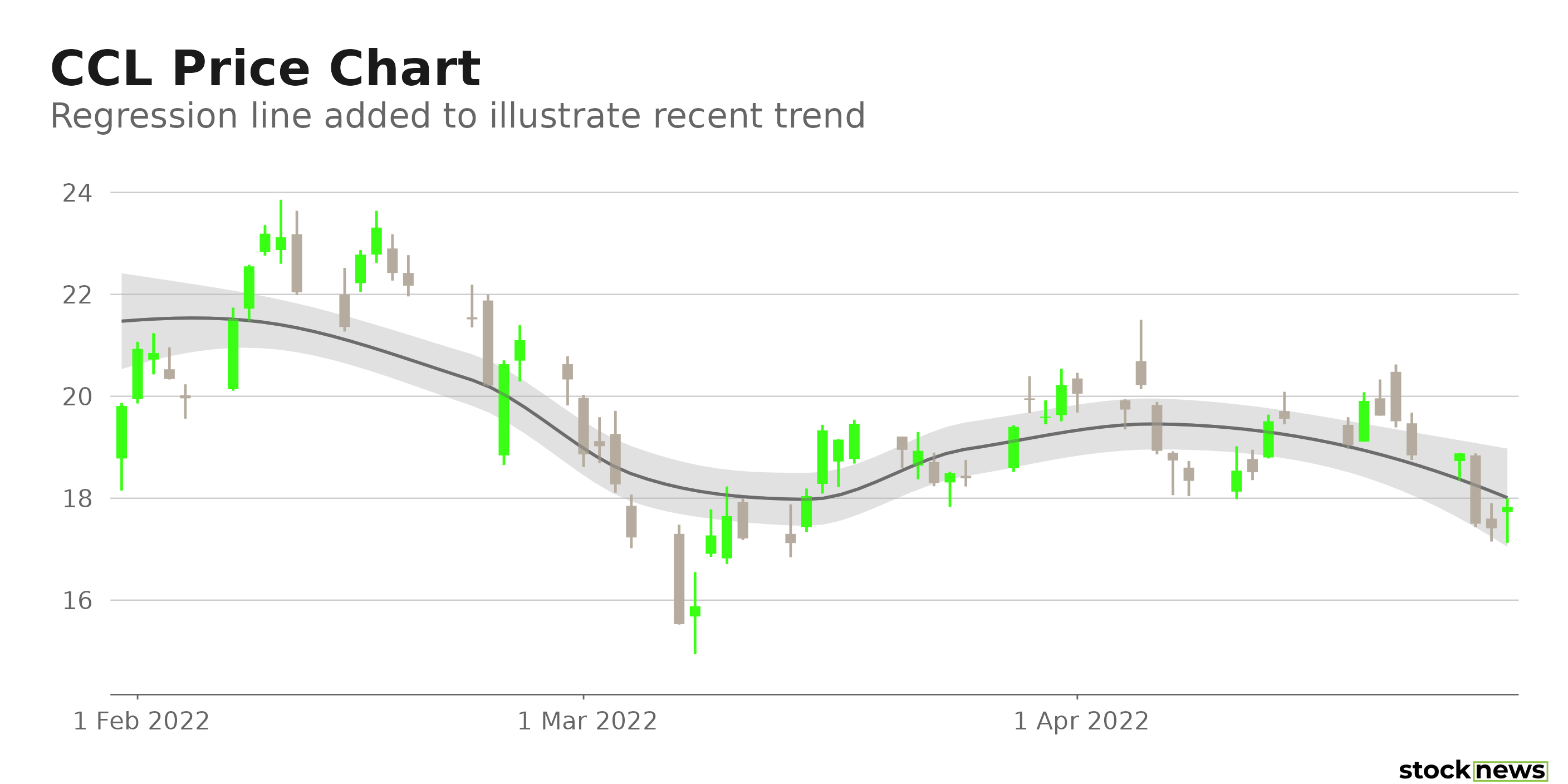

Carnival Corporation & plc (CCL) in Miami, Fla., is a leisure travel company that operates across North America, Australia, Europe, and Asia. Its portfolio consists of Carnival Cruise Line, Princess Cruises, Holland America Line, Seabourn, P&O Cruises, Costa Cruises, AIDA Cruises, P&O Cruises, and Cunard. Shares of CCL have declined 21.8% in price over the past nine months and 35.8% over the past year to close the last trading session at $17.83. In addition, it is currently trading 43.4% below its 52-week high of $31.52, which it hit on June 8, 2021.

On Dec. 20, 2021, CCL announced its partnership with Jabil, Inc. (JBL) to launch the first Experience Internet of Things consumer wearables manufacturing and fulfillment location in the Florida/Caribbean region. The partnership will likely enable the company to fulfill the increased demand for IoT wearables.

The travel industry is witnessing a rebound with pent-up demand in the absence of COVID-19 restrictions. Summer has traditionally been the busiest and most profitable season for the travel industry. CCL announced that it witnessed the busiest booking week in its history. After being in the doldrums over the past two years, rising travel demand is expected to boost the performance of travel companies like CCL.

Here is what could influence CCL’s performance in the upcoming months:

Disappointing Financials

CCL’s operating costs and expenses increased 101% year-over-year to $3.11 billion for the first quarter, ended Feb. 28, 2022. The company’s net loss narrowed 4.1% year-over-year to $1.89 billion. Also, its loss per share came in at $1.66, versus a $1.80 loss per share in the year-ago period. In addition, its total current assets at the end of the first quarter ended Feb. 28, 2022, declined 20.4% to $8.05 billion, compared to the $10.13 billion at the end of its fiscal year ended Nov. 30, 2021.

Low Profitability

CCL’s trailing-12-month gross profit margin is negative versus the 36.23% industry average. Also, its trailing-12-month ROCE, ROC, and ROA are negative compared to the 17.44%, 7.72%, and 6.12% respective industry averages.

Stretched Valuation

In terms of forward EV/S and P/S, CCL’s respective 3.34x and 1.39x are higher than the 1.13x and 0.96x industry average. Also, its 37.29x forward EV/EBITDA is 338% higher than the 8.51x industry average.

POWR Ratings Reflect Bleak Prospects

CCL has an overall F rating, which equates to a Strong Sell in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. CCL has a D grade for Value, which is in sync with its 33.04x forward P/CF, which is 218.8% higher than the 10.36x industry average. In addition, it has an F grade for Stability, which is consistent with its 2.08 beta.

Furthermore, the stock has an F grade for Quality, which is in sync with its negative trailing-12-month EBITDA margin compared to the 12.63% industry average.

CCL is ranked #3 out of 4 stocks in the F-rated Travel – Cruises industry. Click here to access CCL’s Growth, Momentum, and Sentiment ratings.

Bottom Line

CCL does not look well-positioned to capitalize on the rebounding demand for travel due to its weak fundamentals, lower-than-industry profitability, and stretched valuation. So, we think the stock is best avoided now.

Want More Great Investing Ideas?

CCL shares fell $0.07 (-0.39%) in premarket trading Friday. Year-to-date, CCL has declined -11.73%, versus a -10.54% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CCL | Get Rating | Get Rating | Get Rating |