The Wuhan outbreak has seen the new coronavirus spread to 27 countries, in the fastest outbreak in modern history.

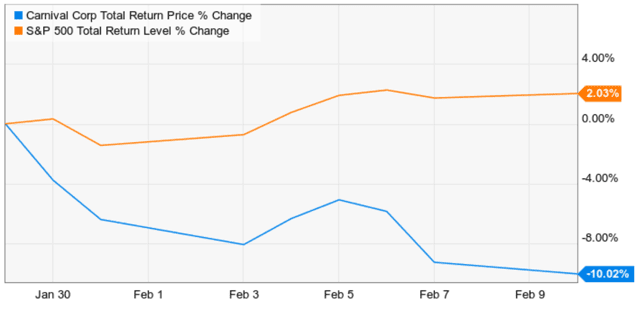

Already we’ve seen the market react with volatility to this threat, such as a two week, 3% decline that caused many tourism sensitive stocks like Carnival (CCL) to sell-off with a vengeance.

(Source: Ycharts)

Here are the most important facts investors need to know, about both the good and bad news coming out of China right now, that could have important ramifications for your portfolio’s short-term returns.

Fact 1: China’s Epidemic MIGHT Be Calming Down…Or About To Get Worse

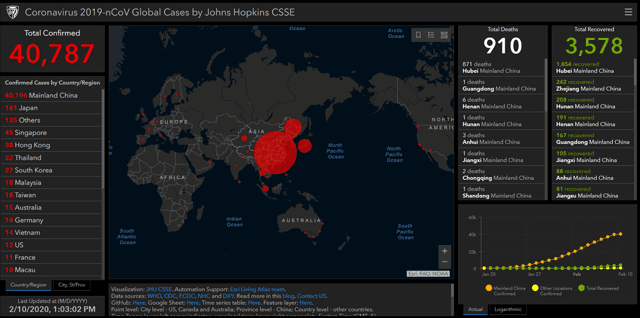

(Source: John’s Hopkins)

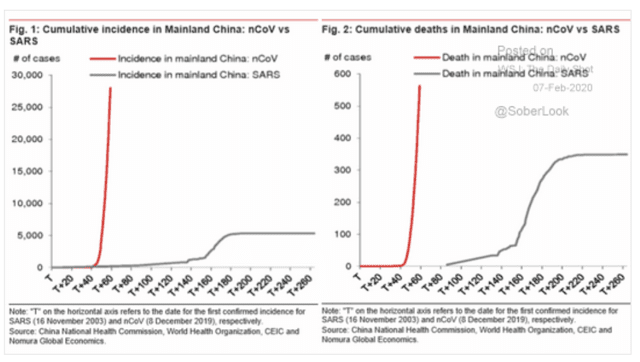

The media is more than happy to tell you that the Wuhan epidemic (a major regional outbreak, a pandemic is global) has killed more people than SARs or MERs.

However, less often pointed out is that the rate of new cases appears to have peaked, and the mortality rate is 2.2% (less than 25% that of SARs and 15 times less than MERs).

66% of all cases are in Wuhan itself, including 97% of deaths. In Wuhan, the mortality rate is about 5%, likely because that city is in lockdown and can’t get adequate medical supplies.

China’s mortality rate outside of Wuhan is 0.16%, and just two people outside China have died so far.

That’s the good news. The potentially bad news is that China is reopening most of its companies on Monday, February 10th, confident that the outbreak has been contained.

Some schools are closed through March 1st, and many companies are telling workers to work from home if they can. China wants to minimize the damage to its economy from this outbreak, but in the process might potentially spark a second wind in accelerating cases.

I’ll be watching the daily case count carefully this week for any signs of this.

But what of the economic ramifications to China?

Wisdom Tree has analyzed the various economic models from JPMorgan, the Economist, AllianceBernstein, and others and concluded that

- 5% to 1% slower growth in 2020 is likely (range of estimates 0.1% to 1.9%)

What does that mean for the US economy?

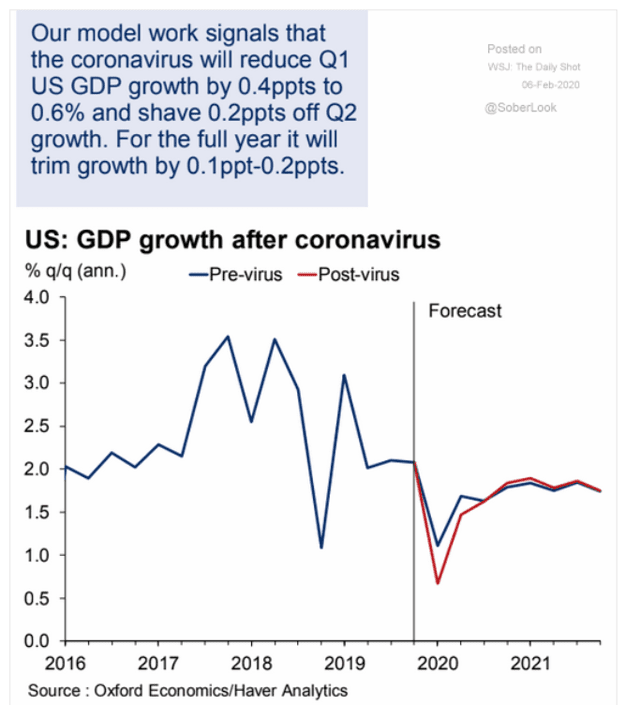

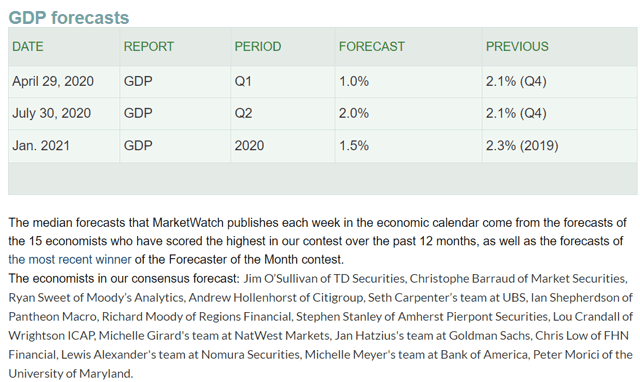

According to Oxford Economics and Haver Analytics (the same outfit that works with the Cleveland Fed on its recession model) US growth is likely to be impacted by 0.4% in Q1. But for the full year, the effect might be as small as 0.1% to 0.2%.

Oxford is now expecting 1.6% growth this year, which is higher than the blue chip consensus of 1.5% growth.

(Source: MarketWatch)

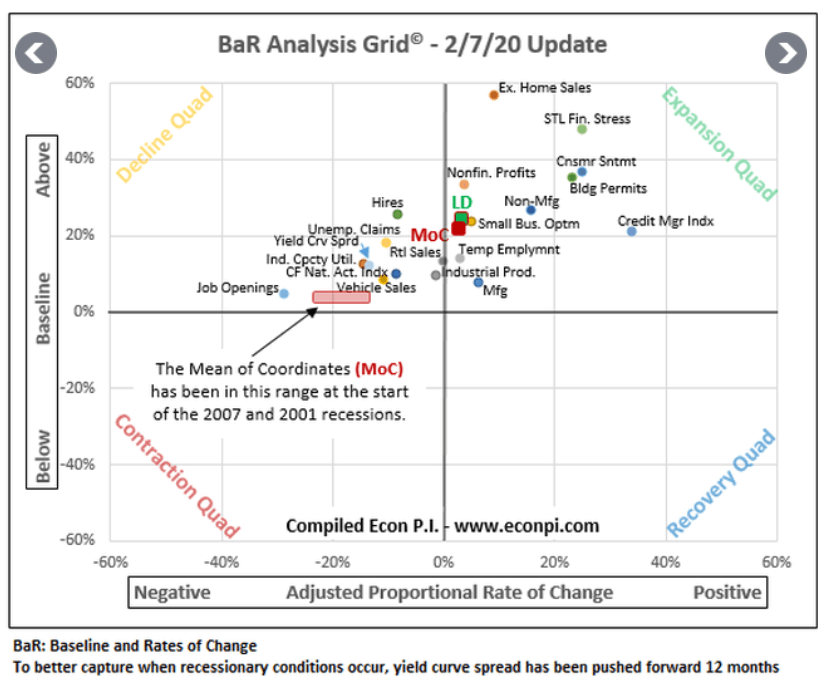

What about the overall US economic picture? For this, I turn to David Rice’s Baseline and Rate of Change or BaR economic grid.

(Source: David Rice)

BaR tracks 19 leading indicators, representing 127 economic reports, based on their location above historical recessionary baseline. It also tracks how fast each is changing from month to month. The red mean of coordinates or MoC dot is the average of all 19 indicators.

The green LD dot is the eight most sensitive indicators (like the yield curve, weekly unemployment claims, and the St. Louis Fed Financial Stress index) and indicates where the MoC is likely to go next as long as current economic conditions persist.

Unlike in previous weeks, both points are now indicating positive month to month growth, so the US economy appears to be improving. Wuhan effects have not yet shown up, and we’ll have to wait until February and March reports in March and April to see to what extent (if any) US growth has slowed due to that outbreak.

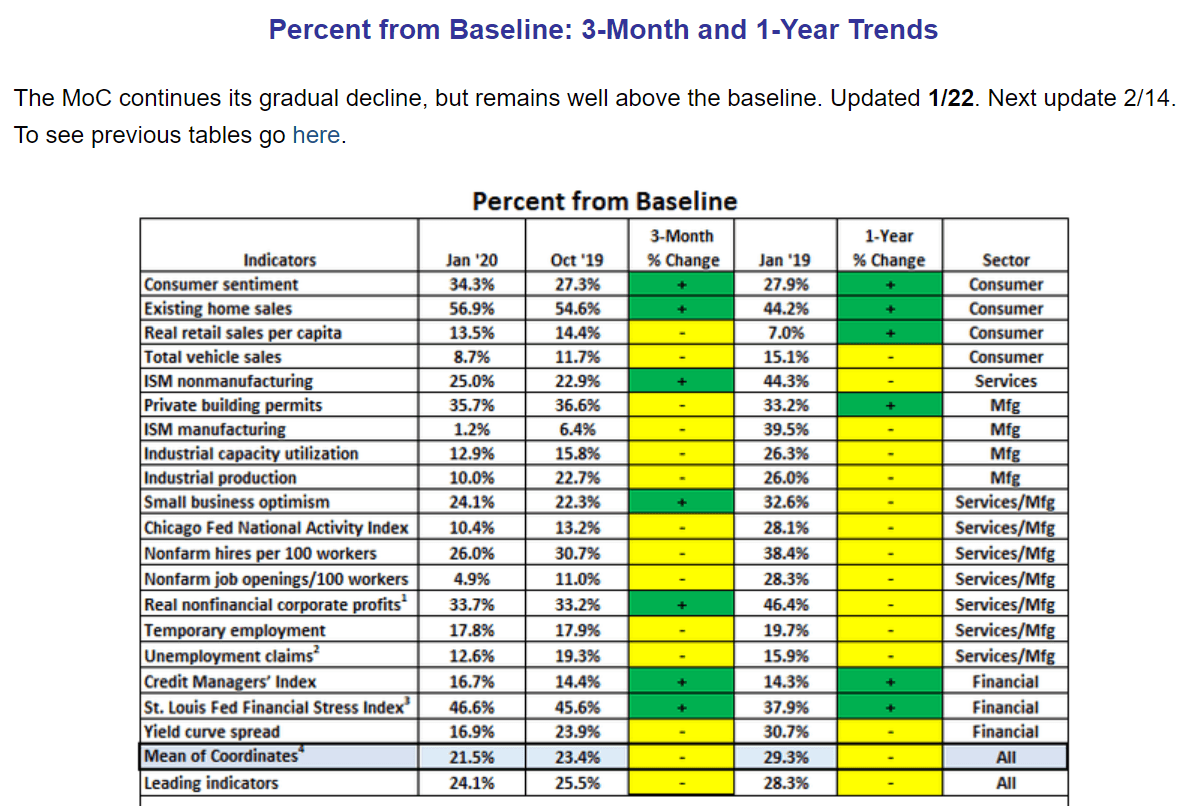

(Source: David Rice)

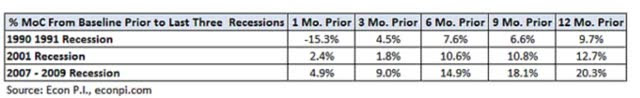

For now, we’re 21.5% above historical baseline which is above both key tipping points that David Rice has told both readers and me in direct communication.

- MoC below 20% = conditions are likely to keep weakening

- MoC below 15% = recession becomes the more likely outcome, within the next six to 18 months

Basically, the Wuhan outbreak and current economic data do not point to reasons to worry about stocks in the short-term. According to the Cleveland Fed recession model, the probability of a 2021 recession is just 30%, meaning a 70% chance we don’t get an economic contraction next year.

Fact 2: Every “Crisis” Is A Potentially Great Opportunity To Profit

Carnival is my favorite opportunistic buy to profit from the eventual end to the Wuhan epidemic. Consider these facts

- CCL trades at 9.3 times forward 2020 earnings = pricing in about 0.5% CAGR growth forever

- PEG is 1.06 or less than half the S&P 500’s 2.2

- Yield is 4.8%, the highest in 12 years

Right now Carnival’s earnings yield is 10.8%, fully 9.3% above the 1.5% yield of US treasuries. That means an earnings yield risk premium that’s 2.5 times the 3.7% average the S&P 500 has offered since 2000.

Or to put another way, CCL is offering a fantastic reward/risk ratio, especially given that it’s priced for virtually no growth at all.

According to the Graham/Dodd fair value formula (those are the legendary investors who invented the concept of value investing), a company with zero long-term growth potential is fairly valued at an 8.5 PE.

Carnival is priced as if it can’t grow at all, ever.

Here’s what FactSet is reporting as the consensus growth outlook from the 23 analysts that cover it on Wall Street.

- 2019 actual results: 3% EPS growth

- 2020 consensus: 3% EPS growth

- 2021 consensus results: 8% growth

- 2022 consensus: 7%

- 2023 consensus: 6%

CCL Growth Profile

- FactSet long-term growth consensus: 8.7% CAGR

- FactSet growth consensus through 2022: 6.0% CAGR

- Reuters’ 5-year CAGR growth consensus: 7.5% CAGR

- Ycharts long-term growth consensus: 10.4% CAGR

- long-term historical growth: 5.1% CAGR over the last 20 years

- realistic long-term growth range: 6% to 11% CAGR

- historical fair value (for use in total return modeling): 16 to 17 PE

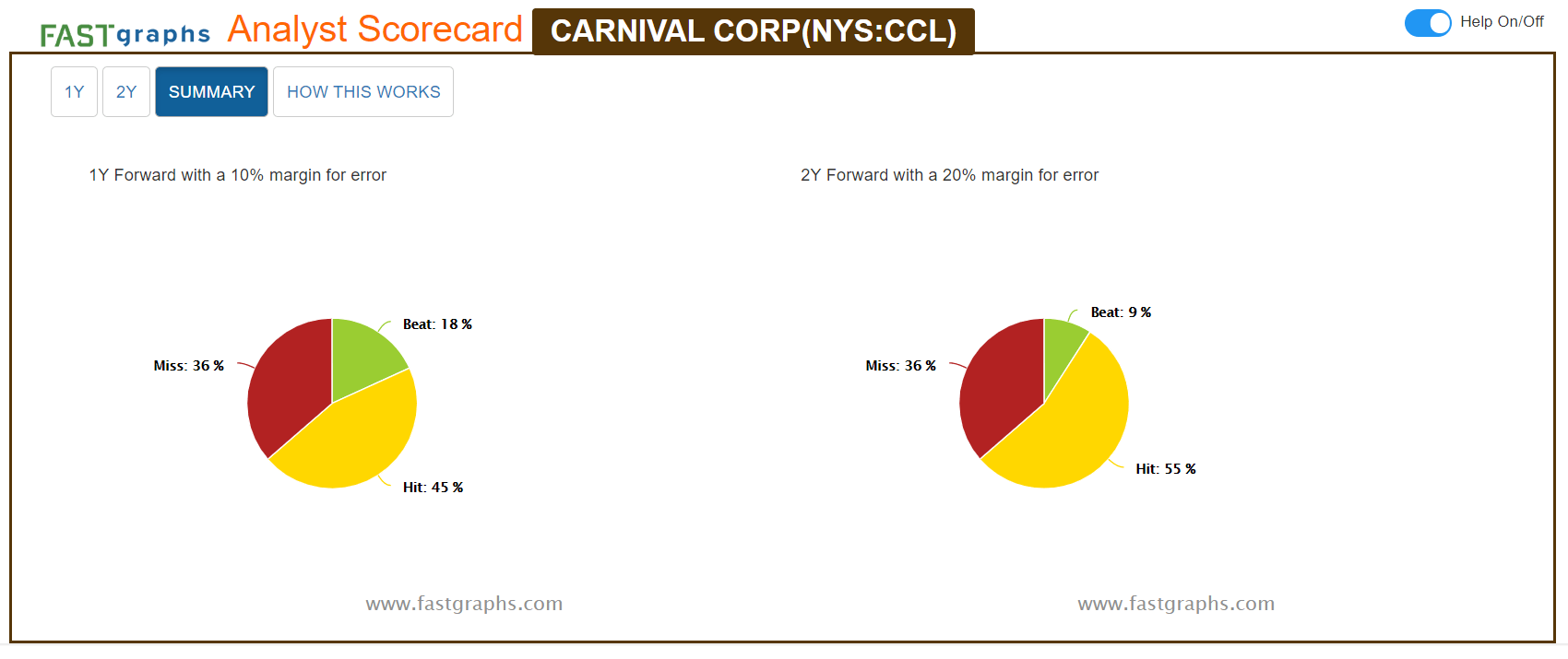

Due to Carnival’s mixed record on achieving 12 and 24-month forecasts, I use a wider range in the growth potential.

But the point is that right now there isn’t a question of whether or not CCL, which trades at just 9.3 times forward earnings, will grow, but how fast it will grow.

So let’s see what kind of total returns you can achieve on this 4.7% yielding stock over the next five years.

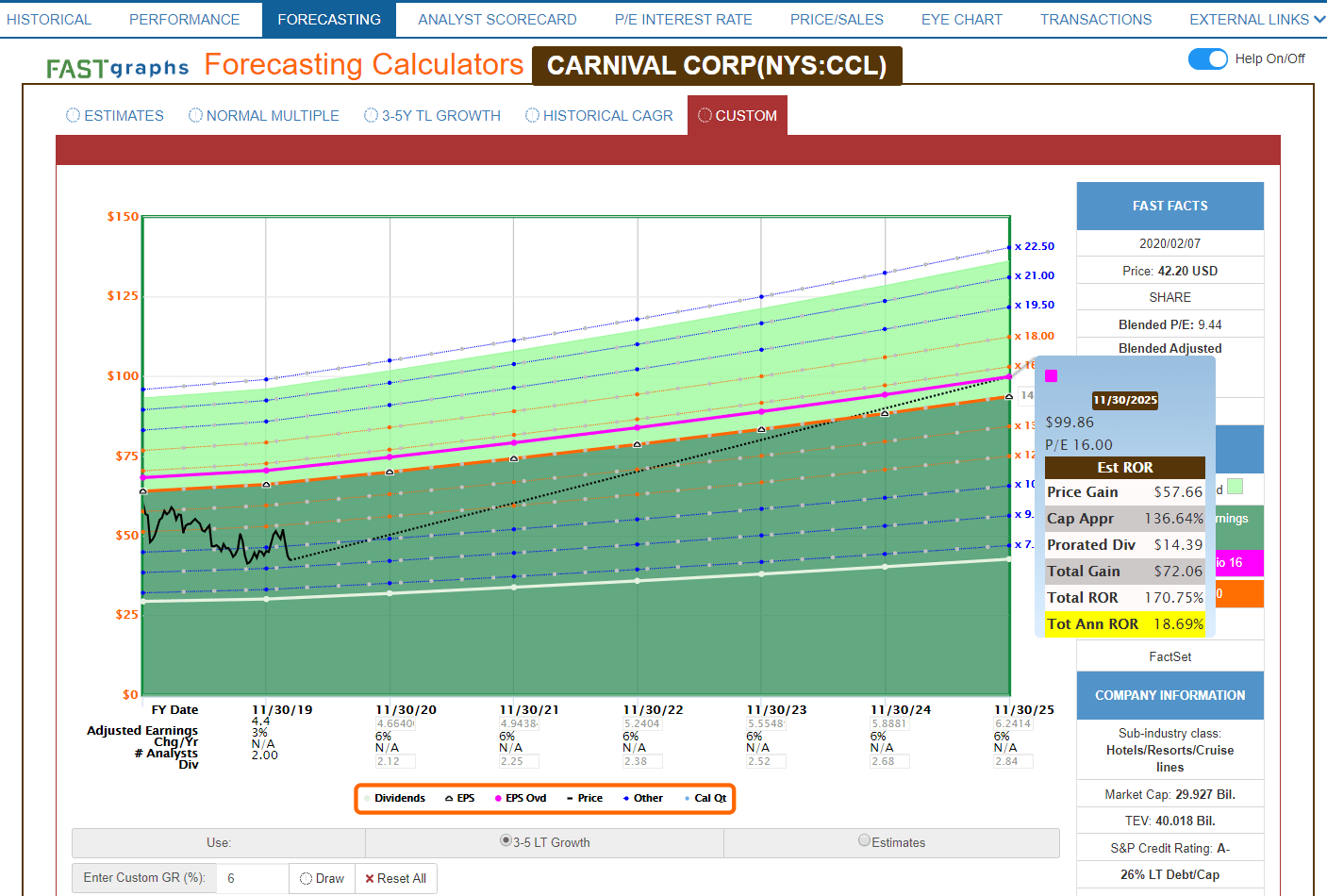

Conservative Total Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

If Carnivale grows slower than all analysts expect and returns to the low end of historical fair value, then you could potentially nearly triple your investment by 2025.

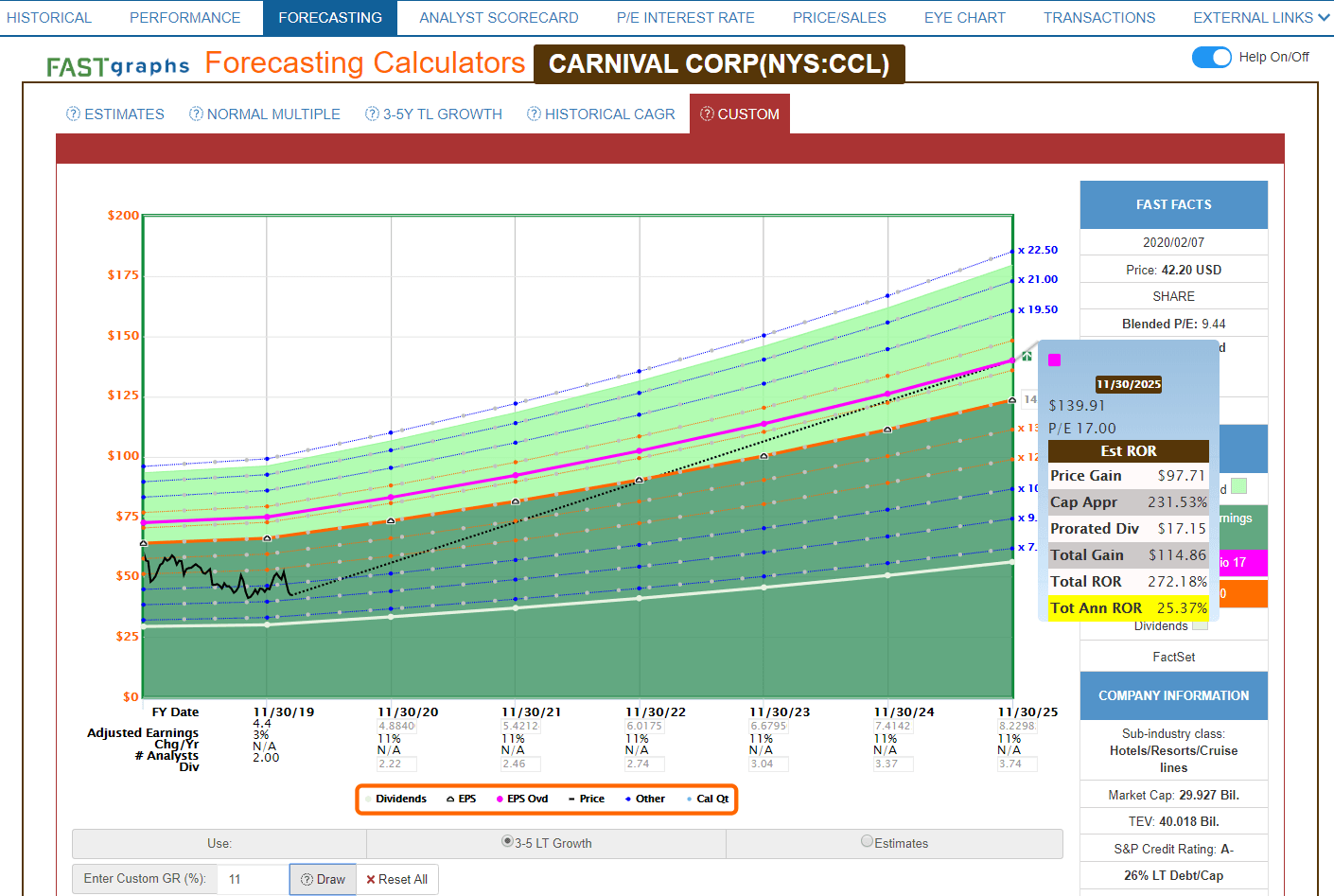

Upper End Of Total Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

If CCL grows slightly faster than analysts expect (as it does 9% to 18% of the time) and returns to the upper end of fair value, then it could nearly quadruple your investment over five years.

Medium-Term Analyst Consensus Return Potential

If CCL grows as expected over the next four years and returns to the low end of fair value, it could deliver about 25% CAGR total returns.

The point is that Carnival represents a classic deep value stock that’s being badly mispriced over concerns surrounding Wuhan.

Even if that outbreak results in weaker growth this year, unless it becomes a multi-year global pandemic that kills millions, Carnival’s long-term thesis is likely to be unaffected.

Thus the potential for smart long-term high-yield investors to profit from short-term market overreaction.

Bottom Line: “Luck Is What Happens When Preparation Meets Opportunity”

The market is never wrong in the long-term, but can be hilariously/profitably wrong in the short-term.

The Wuhan epidemic is NOT likely to become a global pandemic, though it is likely to slow Chinese growth a bit this year. That growth slowdown is almost certainly temporary and its effects on US growth are likely to be minor.

I consider any pullback/correction from Wuhan to be a great opportunity for smart long-term income investors to create their own luck.

Carnival is my favorite Wuhan high-yield investment to profit from the overblown fear. This is an above-average quality company pricing in 1/15th the long-term growth rate analysts actually expect. I’ve been buying Carnival for my portfolio and Dividend King portfolios with enthusiasm at these bargain-basement prices.

That means that anyone buying this nearly 5% yielding stock today, could be facing massive short and long-term upside that could make CCL one of the best investments of the next five years.

CCL shares were trading at $43.37 per share on Thursday afternoon, down $0.69 (-1.57%). Year-to-date, CCL has declined -14.68%, versus a 4.82% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CCL | Get Rating | Get Rating | Get Rating |

| SPY | Get Rating | Get Rating | Get Rating |