Headquartered in Calgary, Canada, Crescent Point Energy Corp. (CPG) explores, develops, and produces light and medium crude oil, natural gas liquids, and natural gas deposits in Western Canada and the United States. Its crude oil and natural gas properties and associated assets are situated in Saskatchewan, Alberta, British Columbia, Manitoba, North Dakota, and Montana.

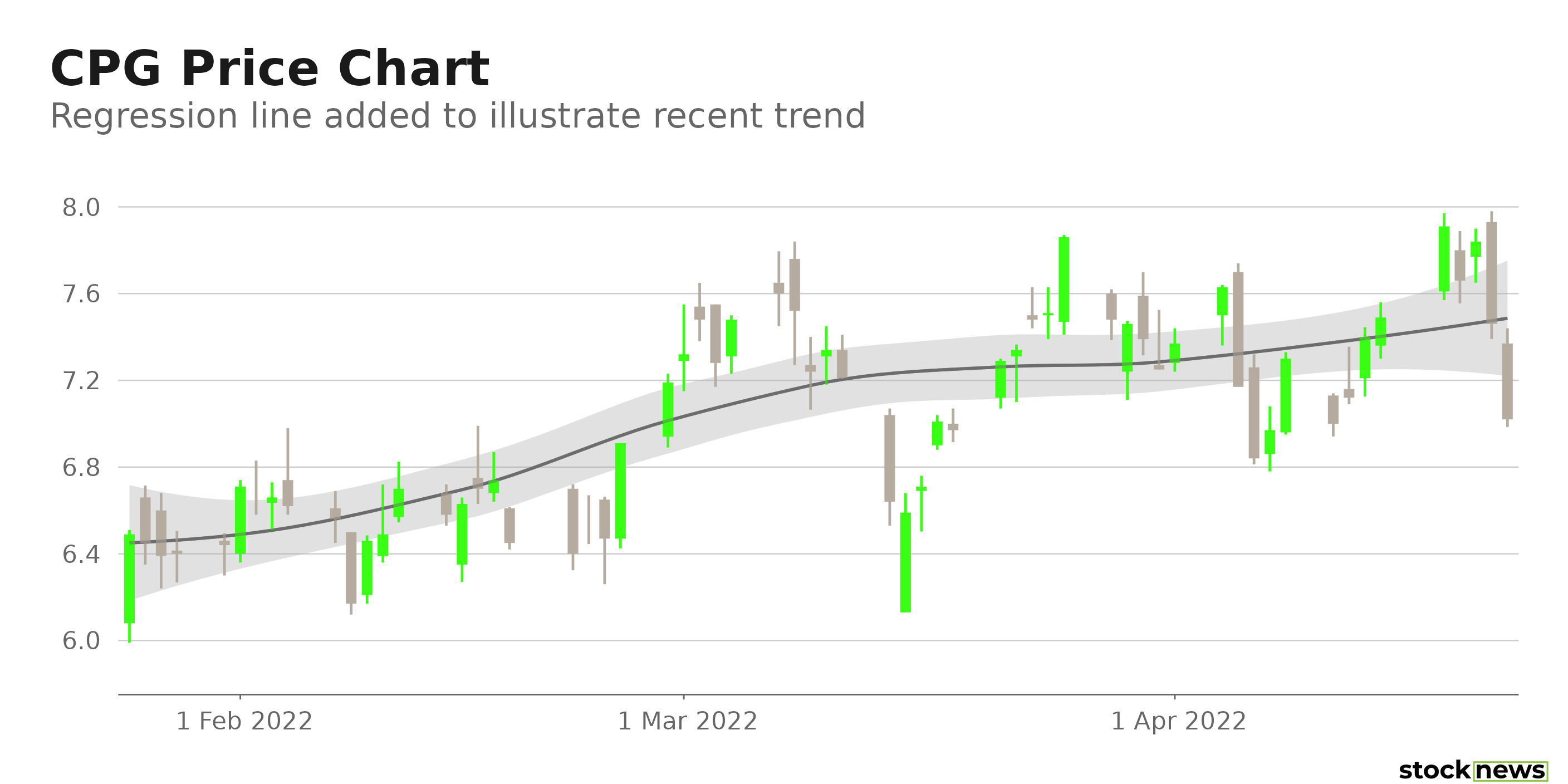

The stock has gained 91.3% in price over the past year and 107.7% over the past nine months to close Friday’s trading session at $7.02.

The Canadian oil producer has attracted investor attention on rising oil and natural gas prices and growing demand. In addition, analysts’ optimism surrounding the stock should further fuel its price performance.

Here is what could shape CPG’s performance in the near term:

Strong Profitability

CPG’s 72.6% trailing-12-months gross profit margin is 79.7% higher than the 40.4% industry average. Also, its ROC, net income margin and ROA are 576.5%, 1158.3%, and 775.9% higher than the respective industry averages. Furthermore, its $1.18 billion in cash from operations is 285.2% higher than the $307.11 million industry average.

Impressive Growth Prospects

The Street expects CPG’s revenues to rise 45.2% year-over-year to $2.84 million in its fiscal 2022. In addition, CPG’s EPS is expected to rise at a 177.2% CAGR over the next five years. And the company’s EPS is expected to rise 9.9% from its year-ago value to $1.33 in fiscal 2023.

Discounted Valuation

In terms of forward Non-GAAP P/E, the stock is currently trading at 5.37x, which is 44.7% lower than the 9.71x industry average. Also, its 1.78x forward EV/Sales is 9.7% lower than the 1.97x industry average. Furthermore, CPG’s 1.26x forward Price/Sales is 11.6% lower than the 1.43x industry average.

Consensus Rating and Price Target Indicate Potential Upside

Among the eight Wall Street analysts that rated CPG, seven rated it Buy, and one rated it Hold. The 12-month median price target of $10.8 indicates a 54.1% potential upside. The price targets range from a low of $9.03 to a high of $15.70.

POWR Ratings Reflect Solid Prospects

CPG has an overall B grade, which equates to a Buy rating in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. CPG has a B grade for Quality, Growth, and Value. CPG’s solid earnings and revenue growth potential are consistent with the Quality and Growth grades. In addition, the company’s lower-than-industry multiples are in sync with the Value grade.

Of the 42 stocks in the A-rated Foreign- Oil & Gas industry, CPG is ranked #16.

Beyond what I stated above, we have graded CPG for Sentiment, Stability, and Momentum. Get all CPG ratings here.

Bottom Line

Investors’ interest in the stock is evident from the CPG’s solid price gains over the past year. In addition, the company intends to offer stronger fundamental performance in the coming quarters. Therefore, given the company’s high-profit margins and favorable oil and gas pricing environment, we believe the stock might be a great bet now.

How Does Crescent Point Energy Corp. (CPG) Stack Up Against its Peers?

CPG has an overall POWR Rating of B, which equates to a Buy rating. Check out these other stocks within the same industry with A (Strong Buy) ratings: GeoPark Ltd. (GPRK), Parex Resources Inc. (PARXF), and TransGlobe Energy Corp. (TGA).

Want More Great Investing Ideas?

CPG shares fell $0.29 (-4.13%) in premarket trading Monday. Year-to-date, CPG has gained 32.10%, versus a -10.02% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CPG | Get Rating | Get Rating | Get Rating |

| GPRK | Get Rating | Get Rating | Get Rating |

| PARXF | Get Rating | Get Rating | Get Rating |

| TGA | Get Rating | Get Rating | Get Rating |