- A substantial recovery in traditional energy stocks hits a speed bump

- Crude oil is likely to find a higher low and resume its upward trajectory

- Chevron is the US leader with low debt and an attractive dividend

- XOM pays shareholders even more

- Buy the best on dips- Q1 earnings at the end of April

After underperforming the stock market and even the crude oil market since 2018, traditional energy-related shares made a comeback starting at the late October 2020 lows. The recovery started from a higher low in late October as the transition of power from the Trump to the Biden administration ushers in a new era for US energy output.

After reaching 13.1 million barrels of daily output last year, US crude oil production has dropped to the 11.1 million bpd level as of March 26. The 15.3% drop may only be the beginning as increased regulations cause even lower levels over the coming years.

The shift in US policy to decrease production and consumption of fossil fuels to address climate change is handing crude oil pricing power back to the oil ministers of OPEC and the Russians. OPEC+’s mission is to achieve the highest price possible for the energy commodity. After years of suffering from the rise of shale oil, the cartel could seize the opportunity to squeeze US consumers to pay higher prices.

When it comes to US-based multinational oil companies, Chevron (CVX) and Exxon Mobile (XOM) remain the leaders. Their stocks have made significant comebacks from the late October lows and could have more upside potential if crude oil prices stay above $60 per barrel over the coming months.

A substantial recovery in traditional energy stocks hits a speed bump

The benchmark for US traditional energy-related stocks is the Energy Select Sector SPDR Fund (XLE). The highly liquid ETF has approximately $22.8 billion in assets under management, trades an average of over 38.5 million shares each day, and charges a 0.12% management fee. After reaching a low of $22.88 in March 2020, when crude oil’s price was on its way to the lowest price since futures trading began in the early 1980s, the XLE made a higher low of $26.98 in late October.

Source: Barchart

Source: Barchart

As the chart highlights, the XLE has made higher lows and higher highs since March 2020. The latest peak came on March 11, 2021, when it reached $54.37 per share. Since then, it has pulled back with the crude oil price, hitting a low of $47.26 on March 26. The XLE was trading at the $50.31 level at the end of last week.

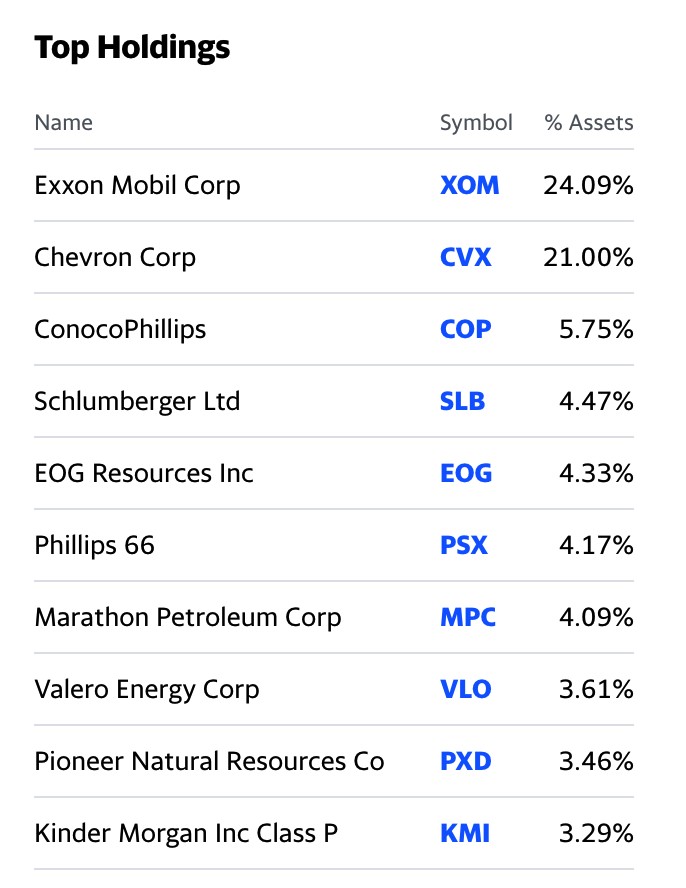

The XLE holds a portfolio of the leading US energy companies. The top holdings include:

Source: Yahoo Finance

Source: Yahoo Finance

As the chart shows, the XLE has an over 45% exposure to the two leading US integrated oil companies; XOM and CVX.

Crude oil is likely to find a higher low and resume its upward trajectory

The nearby NYMEX WTI crude oil price tanked on April 20, 2020, reaching under negative $40 per barrel. After recovering to over $43, the energy commodity fell to a higher low of $33.64 per barrel on November 2.

Source: CQG

Source: CQG

The chart shows that crude oil rallied steadily from November 2 through March 8, reaching a high of $67.98. After correcting to $57.25 on March 23, the energy commodity settled at the $61.45 level at the end of last week.

Three factors support the oil price as we head into 2021’s second quarter:

- Vaccines creating herd immunity to COVID-19 are likely to continue to increase energy demand as people return to work and travel over the coming months.

- Central bank liquidity and government stimulus programs are inflationary as they increase the money supply and deficits. Rising inflationary pressures support all commodity prices, and crude oil is no exception.

- US energy policy is undergoing a significant change under the Biden administration. Addressing climate change via increased regulations on extracting fossil fuels from the earth’s crust and moving towards alternative fuels is shifting the oil market’s pricing power back to OPEC+. US output is likely to decline at a time when demand is increasing, putting upward pressure on the energy commodity’s price.

Nearby NYMEX crude oil futures may fall below the recent $57.25 per barrel low, but they are unlikely to move anywhere near the $33.64 low from early November 2020 as supply and demand fundamentals remain bullish along with the technical trend since the April 2020 low. The XLE is likely to stay above its late October higher low.

Chevron is the US leader with an attractive dividend

CVX shares were trading at the $105.75 level at the end of last week. The company’s market cap was around the $203.7 billion level. The highly liquid stock trades an average of over 12.6 million shares each day. CVX pays its shareholders a $5.16 dividend, translating to a 4.88% yield on the stock.

Source: Barchart

Source: Barchart

The chart shows the pattern of higher lows and higher highs for CVX shares. Above the March 12 $112.70 high, the next upside target stands at the early January 2020 $122.72 peak.

At the end of last week, a survey of twenty-six analysts on Yahoo Finance has an average price target of $118.82 for the stock, with forecasts ranging from $91.50 to $152 per share.

XOM pays shareholders even more

XOM shares were trading at $57.39 at the end of last week. The company’s market cap was nearly the $243 billion level. Nearly 33.0 million shares change hands on average each day. XOM pays a $3.48 dividend. The 6.06% yield is higher than CVX’s.

Source: Barchart

Source: Barchart

XOM shares show the same pattern of higher lows and higher highs since last March. The most recent high at $62.55 on March 11 was the highest level since early February 2020. The next upside target for XOM is at the January 2020 $71.37 high.

A survey of twenty-four analysts on Yahoo Finance has an average price target of $60.47 for XOM shares, with forecasts ranging from $40 to $90.

Buy the best on dips- Q1 earnings at the end of April

The trend is always your best friend in markets as it tells us the path of least resistance for prices. Despite the recent pullbacks in crude oil, the XLE, CVX, and XOM, the trends remain higher.

Chevron and Exxon will report first-quarter earnings in late April and early May. Rising oil prices over the first three months of 2021 support increasing profits for the companies. The current consensus estimate is for XOM to report EPS of 56 cents in Q1, the highest level in over four quarters. The forecast for CVX is for EPS of 94 cents, the highest level since Q1 2020 when it reported $1.29 per share.

If XOM and CVX beat analyst estimates on revenues and earnings and the oil price remains above $60 per barrel, the shares are likely to head to higher highs. I am a buyer of XOM, and CVX on price weakness as the trends remain bullish. Sector rotation is likely to continue to support the leading US integrated oil companies as they offer value and attractive dividends in a stock market that remains at lofty levels.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the NEW Stock Bubble?

5 WINNING Stocks Chart Patterns

Unlock the POWR in Your Portfolio!

CVX shares were trading at $104.78 per share on Tuesday morning, up $0.27 (+0.26%). Year-to-date, CVX has gained 25.83%, versus a 8.94% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| CVX | Get Rating | Get Rating | Get Rating |

| XOM | Get Rating | Get Rating | Get Rating |

| XLE | Get Rating | Get Rating | Get Rating |