- Brazil is a leading commodity producer

- The currency rises and falls with raw material prices

- The real is cheap at below $0.20 against the US dollar

- EWZ holds the leading Brazilian companies

- Bullish price action since March 2020 but inexpensive compared to the close at the end of 2019

Brazil is South America’s leading economy. Brazil is also the most populous nation on the continent, with nearly 214 million people. Brazil has a higher population than Bangladesh and is just below Nigeria as it occupies the seventh spot worldwide.

Brazil’s climate, soil, and geology bless the country with abundant mineral and energy reserves. Moreover, the nation is a substantial agricultural producer. Meanwhile, Brazil’s economy has been a mess for many years. Scandals have plagued Brazil and weighed on its economy for decades. In 2018, the nation elected Jair Bolsonaro as its thirty-eight President. He pledged to clean up corruption and appealed to voters with a populist message on the campaign trail.

Meanwhile, the President faces rising opposition as the global pandemic weighs on the nation. Brazil has the third number of COVID-19 infections behind the US and India. However, it is second to the US in fatalities as over 230,000 Brazilians have lost their lives because of the coronavirus.

Meanwhile, the Brazilian stock market has been moving higher since the March 2020 low. Moreover, rising commodity prices could lift the economy as they increase corporate profits, tax revenues and support Brazil’s currency, the real.

The iShares MSCI Brazil ETF (EWZ) holds shares in many of Brazil’s top companies. Rising commodity prices over the coming months and years could boost both share prices and the currency’s value. The EWZ is an ETF that holds companies that qualify as growth stocks for the coming years.

Brazil is a leading commodity producer

Brazil is the world’s leading producer and exporter of sugar, coffee, and oranges. The nation’s expanding grain belt makes it a substantial supplier of soybeans and soybean products, corn, and other grains. Meanwhile, animal feed production put Brazil in a position to have the world’s largest commercial cattle herd of around 200 million head, making it the leading exporter of beef as well as poultry.

Brazil ranks sixth among global cocoa-growing nations and produces substantial amounts of timber. The South American country is the fourth-leading cotton exporter, is the leading tobacco producer, and is the number one exporter of sugarcane-based ethanol.

Brazil is also a significant exporter of crude oil, iron ore, and many others. In 2011, many commodity prices rose to multiyear highs. During the boom period for Brazil, its currency reached a high a decade ago.

The currency rises and falls with raw material prices

Tax revenues and corporate profits in Brazil lifted the currency relationship between the Brazilian real and the US dollar to a high in 2011.

Source: CQG

Source: CQG

As the chart highlights, the exchange rate between the real and US dollar hit a peak in 2011 at $0.65095. A combination of falling commodity prices and political and economic scandals pushed the exchange rate to a low of $0.1673 in May 2020, just after commodity prices hit lows during the height of the global pandemic’s impact on markets.

Meanwhile, the low level of the Brazilian currency is a mixed blessing for the nation as local employment and other domestic costs are a function of the real. The low level of the currency allows Brazil to sell and export commodities at lower prices because of low production costs. Between the 2011 high and 2020 low in the currency, the Brazilian real fell 73.4%.

Over the same period, the sugar price in dollars on the ICE futures exchange declined from 36.08 to a low of 9.05 cents or 74.9%. Ironically, the sugar price in Brazil’s currency was higher at 9.05 in 2020 in US cents than it was in 2011 at 36.08 US cents.

Meanwhile, rising commodity prices are likely to increase the real versus the dollar as rising earnings will lead to higher tax revenues.

The real is cheap at below $0.20 against the US dollar

The currency relationship between the real and the dollar has been consolidating since mid-May 2020.

Source: CQG

Source: CQG

The chart shows that over the past nine months, the exchange rate between the real and the dollar has traded in a range between $0.17 and $0.20. At the $0.1853 level on February 11, it was near the middle of the trading band.

From a technical perspective, the first level of resistance is at the June 2020 $0.2073 high. Above there, $0.2521 and $0.26865 are the next technical targets. Rising commodity prices should put upward pressure on the Brazilian currency. Moreover, as the real moves higher against the US dollar, so will local production costs, which could push commodity prices even higher over the coming months.

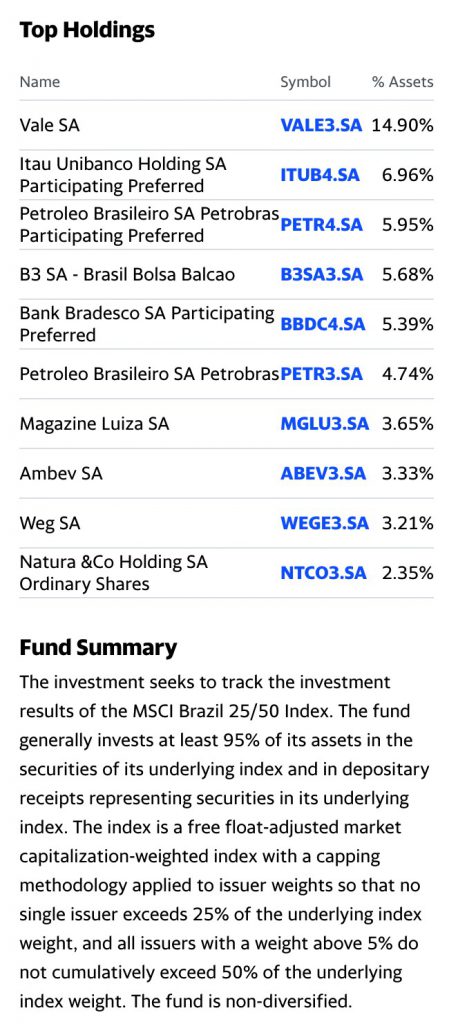

EWZ holds the leading Brazilian companies

A bull market in commodities is bullish for Brazil’s leading companies, which would also support higher levels of the real versus the US dollar. EWZ holds a portfolio of diversified Brazilian multinational companies. The top holding and fund summary include:

Source: Yahoo Finance

Source: Yahoo Finance

Vale SA (VALE) is a leading global commodity-producing company. EWZ holds 14.90% of its $6.55 billion in net assets in VALE shares. EWZ trades an average of over 27 million shares each day and charges a 0.59% expense ratio. The ETF provides shareholders with a blended dividend yield of 1.71%, which covers the expense ratio in a little over four months.

Rising commodity prices and a stronger real against the dollar is likely to support gains in EWZ over the coming months and years.

Bullish price action since March 2020 but inexpensive compared to the close at the end of 2019

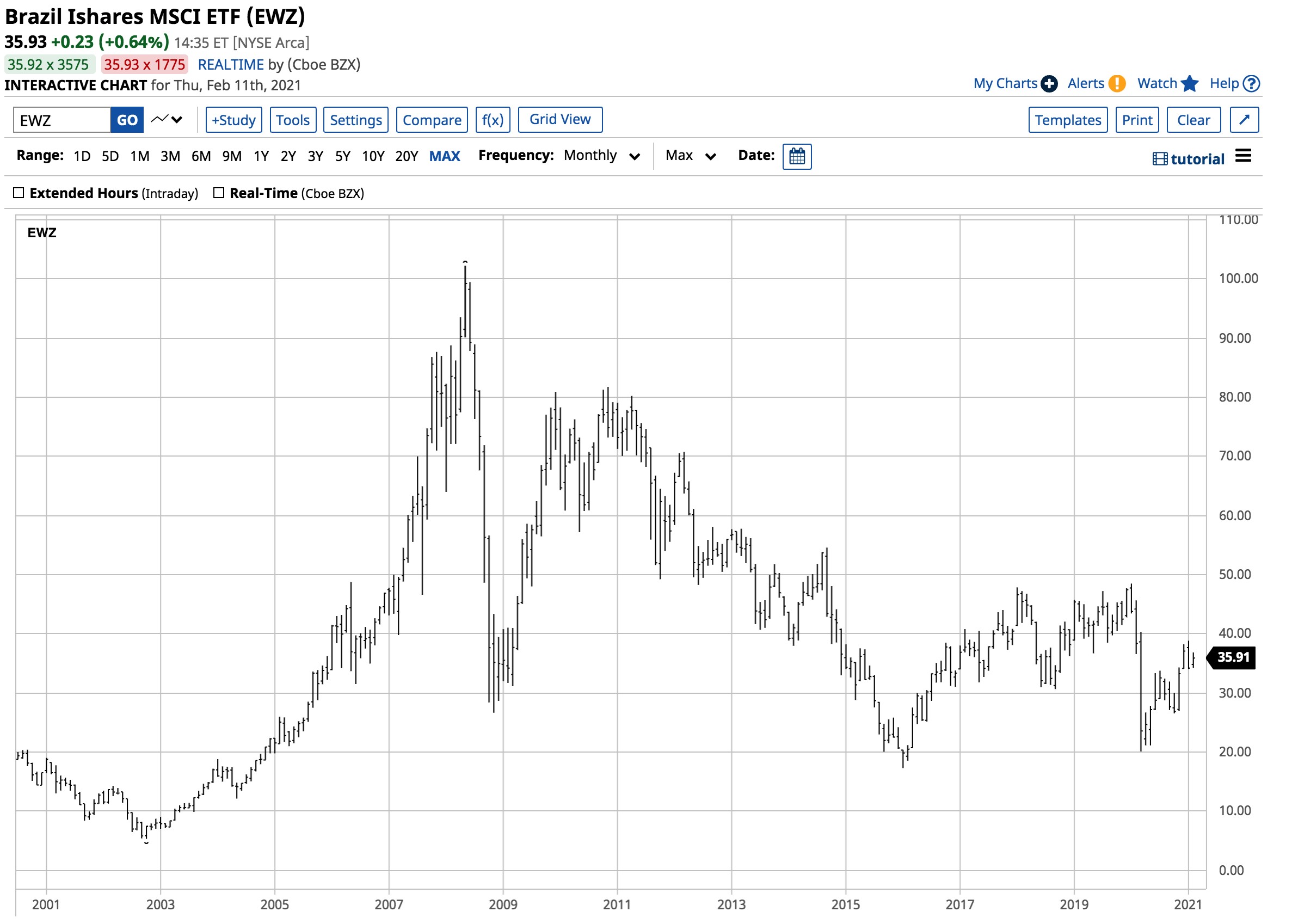

The EWZ ETF product has made higher lows and higher highs since March 2020, when it fell to a low of $20.14 per share.

Source: Barchart

Source: Barchart

The chart shows that EWZ rose from the March 2020 low to the $35.90 level at the end of last week, a rally of over 78%. Meanwhile, EWZ closed 2019 at $47.45 per share and was at $37.07 on December 31, 2020. While US indices all posted gains in 2020, the Brazilian ETF declined.

Commodity prices and the Brazilian real hit highs in 2008 before the global financial crisis and 2011 through 2012, in its aftermath.

Source: Barchart

Source: Barchart

The chart shows that the high level in commodity prices and the Brazilian real led to a high of $102.21 in May 2008 and a lower peak at over $80 per share in 2010 through 2011.

I view Brazil as a growth area for the coming years as rising commodity prices will support its companies and currency. The EWZ ETF product holds shares in many companies with substantial growth potential in early 2021.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

EWZ shares were trading at $35.96 per share on Thursday afternoon, up $0.26 (+0.73%). Year-to-date, EWZ has declined -2.99%, versus a 4.50% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| EWZ | Get Rating | Get Rating | Get Rating |

| VALE | Get Rating | Get Rating | Get Rating |