The market has settled down to some extent after one of the most volatile months on record. However, the reprieve may be short-lived as we head into what is likely to be an interesting earnings period. We all know that most companies are suffering due to the pandemic; the question is, just how much damage has been done?

We don’t know when the economy will fully reopen and how long the pandemic will continue to impact our daily lives. It’s likely because of this that some companies are not releasing any guidance given the uncertain timeframe of the economic shutdown.

Still, there could be quite a bit of useful information gleaned from what various companies say on their earnings calls. It’s not the numbers that matter all that much this time around; rather, it’s anything investors may be able to determine about expectations across various industries.

This week, we get most of the major banks reporting earnings. Like most industries, banks are being hurt by a slowing economy. However, this damage may just be getting started. Banks are setting aside billions in anticipation of defaults and missed loan payments.

JP Morgan Chase (JPM)

For example, JP Morgan Chase (JPM) said in its earnings call this week that it has set aside $8.3 billion for bad loans… but it may not be enough. What’s more, JPM has revised its second quarter economic forecast to reflect a 40% reduction in GDP and a 20% unemployment rate. Those are substantial negative numbers.

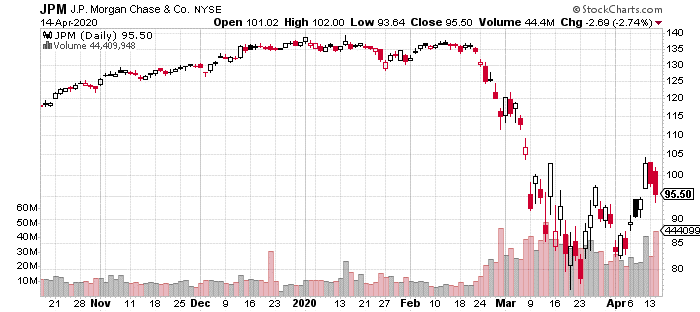

As a result, JPM shares were down 3% on a day when major stock indices were up 3%. Year-to-date, the stock price is down over 30%, despite being more than 20% off its lows.

At least one trader believes JPM has a ceiling of $115 through next January. The trader sold January 2021 calls at the 115 strike with the stock at $96. The block trade was for 1,200 calls for $4.95, which generated about $600,000 in cash from the premiums.

If the stock is below $115 at expiration next January, the trader keeps all the premium collected. Of course, there’s unlimited loss potential should the share price explode higher.

Betting on a $115 ceiling isn’t a bad plan, given all the negative factors hitting banks this year. However, there are much safer ways to make this trade. Few investors should ever sell naked calls. Instead, using a covered call makes more sense.

By purchasing shares of JPM and selling the 115 calls simultaneously, a trader can significantly reduce risk while still collecting the premium from the January options. Of course, buying shares opens up the trade to downside risk in JPM stocks. However, the bad news is mostly out in the open now, and there may be a limit to how much further the stock will fall.

While a covered call has its own set of risks, it is still much safer than selling naked calls. Being stuck with shares is typically not a problem in the long-term for a major company like JPM; however, having a stock blow through naked calls can be catastrophic to a portfolio.

Want more great investing ideas?

Download free the “10-Step Options Trading Checklist” you need before making a trade

JPM shares were trading at $87.47 per share on Thursday afternoon, down $3.32 (-3.66%). Year-to-date, JPM has declined -36.19%, versus a -13.12% rise in the benchmark S&P 500 index during the same period.

About the Author: Jay Soloff

Jay is a former professional market maker who cut his teeth trading on the floor of the CBOE. With more than 20 years of experience trading and investing, his focus is on making professional strategies accessible to everyone, which is exactly what does in his highly profitable POWR Income and POWR Stocks Under $10 investment advisory services. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| JPM | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating | |

| IYF | Get Rating | Get Rating | Get Rating |

| KRE | Get Rating | Get Rating | Get Rating |