NCS Multistage Holdings, Inc. (NCSM) provides products and services to the global oil and natural gas sector for well completions and field development strategies. The company’s highly-trained direct sales force serves exploration and production companies onshore.

Consegic Business Intelligence reported that the global oilfield services market is expected to expand at a CAGR of 5.9% and hit $468.58 billion by 2030.

Considering this potential growth, let’s look at NCSM’s key financial metrics to understand why the stock could be a solid investment now.

Tracking NCSM’s Revenue, Gross Margin, and Asset Turnover Growth

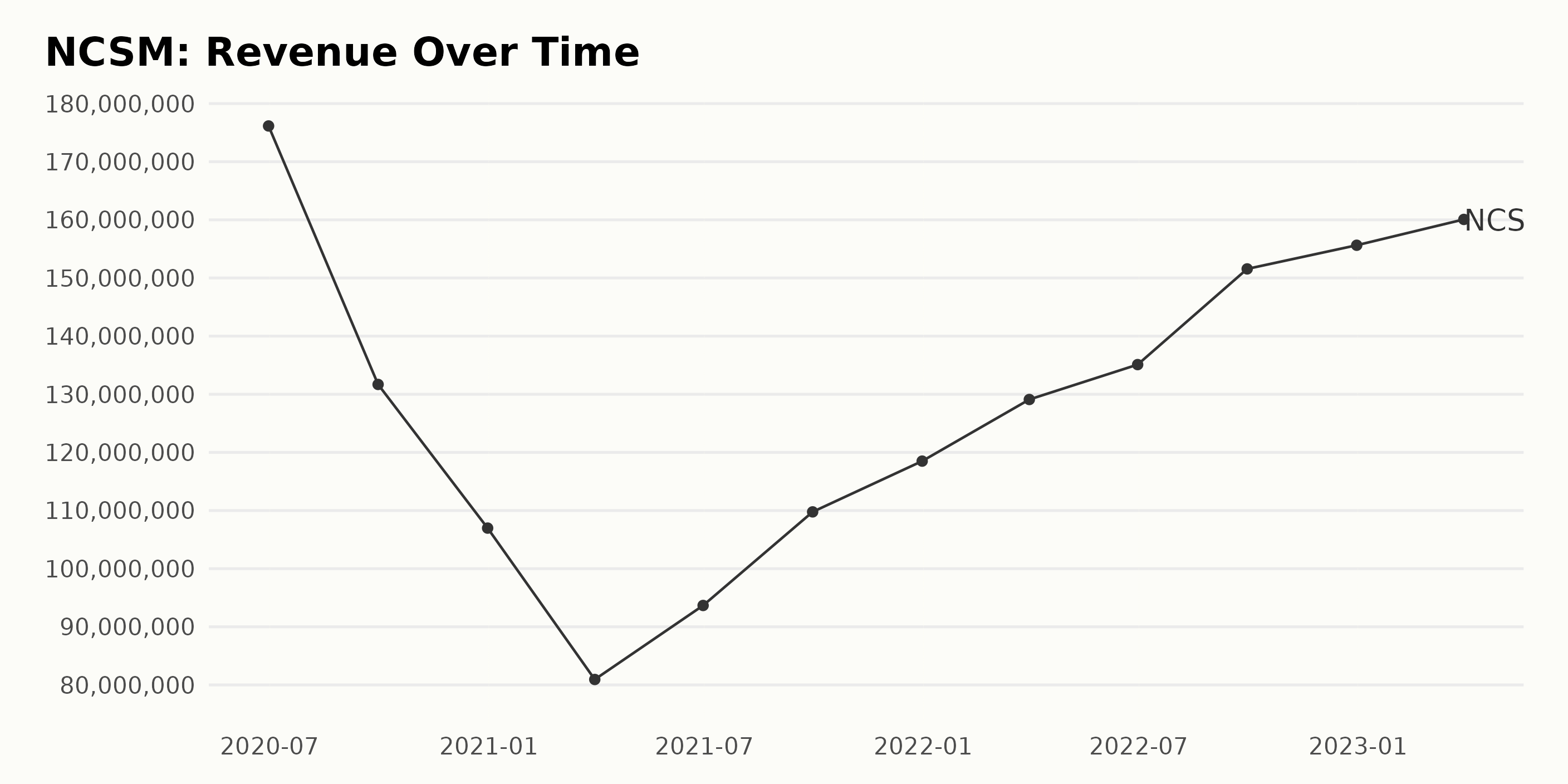

NCSM’s revenue has grown since June 2020, despite fluctuations. The revenue went from $17.61 million in June 2020 to $15.56 million in December 2022, reaching its peak by March 2023 with $16.01 million. The growth rate for this period is 13.3%.

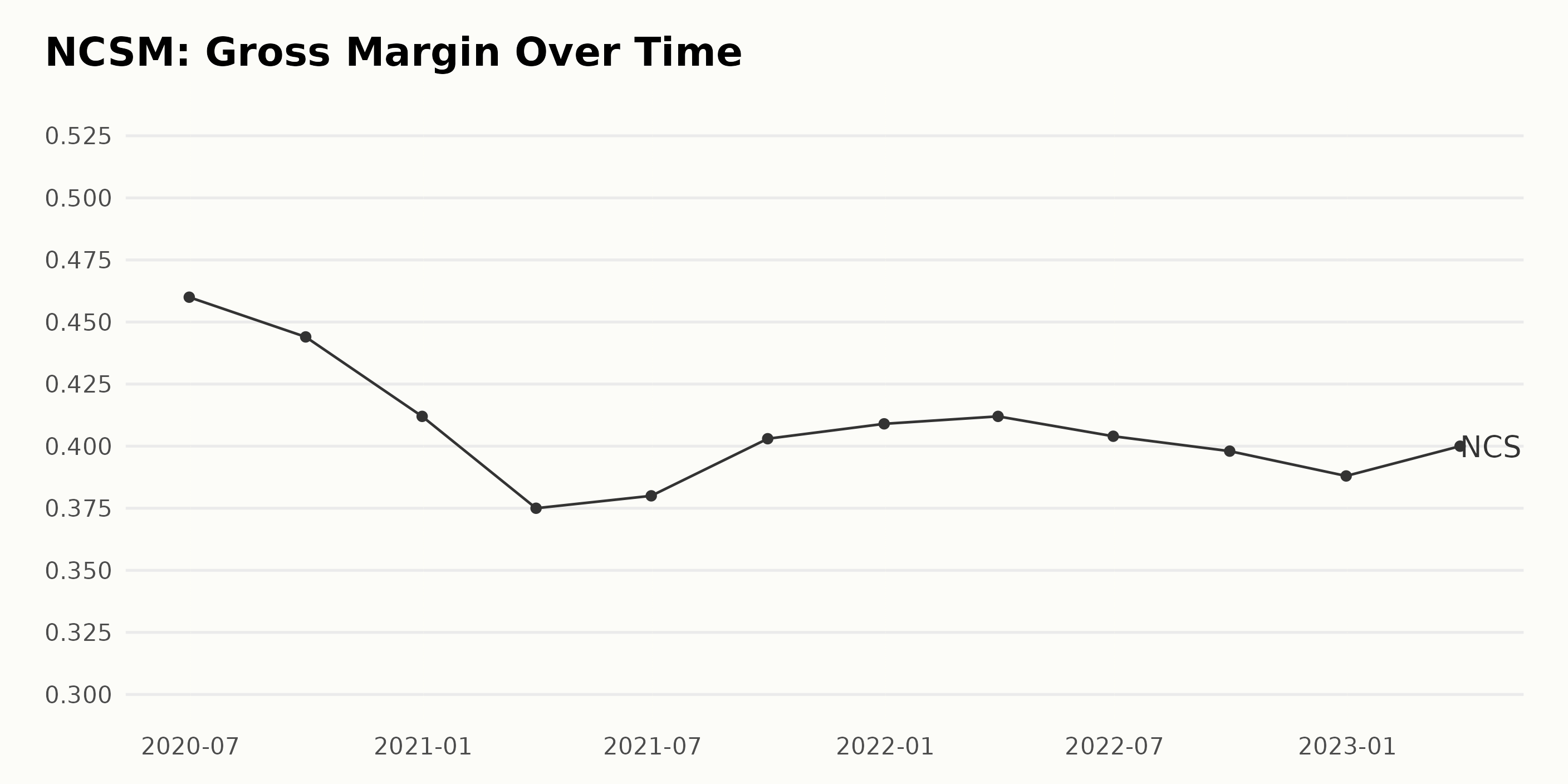

The gross margin of NCSM has generally been decreasing, with a slight increase in June 2021. The rate of decrease has been slowing since 2022, with the gross margin decreasing from 46.00% in June 2020 to 38.80% in March 2023.

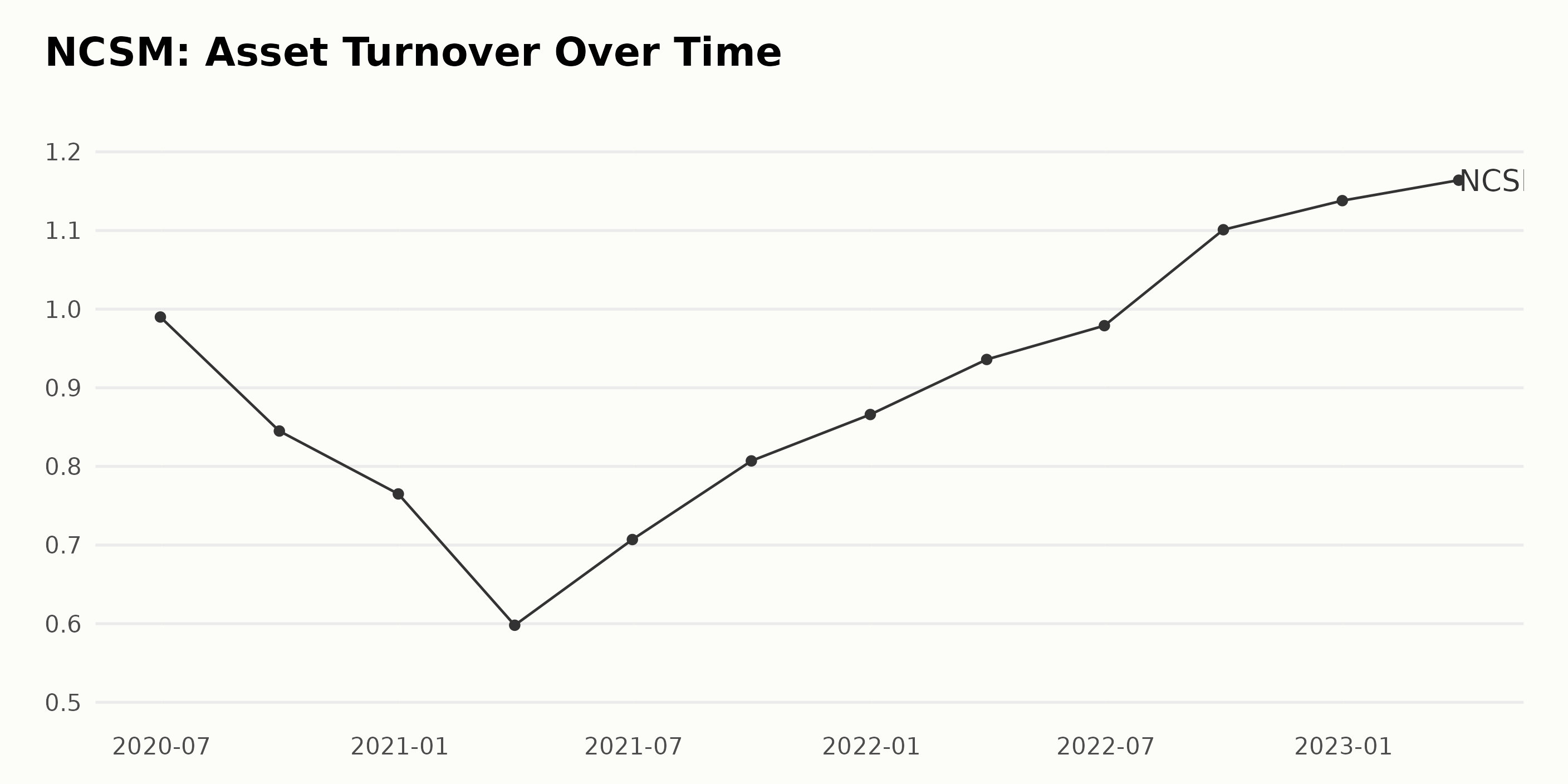

NCSM’s asset turnover has fluctuated throughout the past several years. Since June 2020, it has decreased from 0.99 to as low as 0.598 in March 2021 before increasing to 1.164 in March 2023. This is a growth rate of 17.3% from the start to the end of the series. Recent data and values show an overall upward trend with steady asset turnover increases.

NCSM’s Share Price: 180-Day Overview

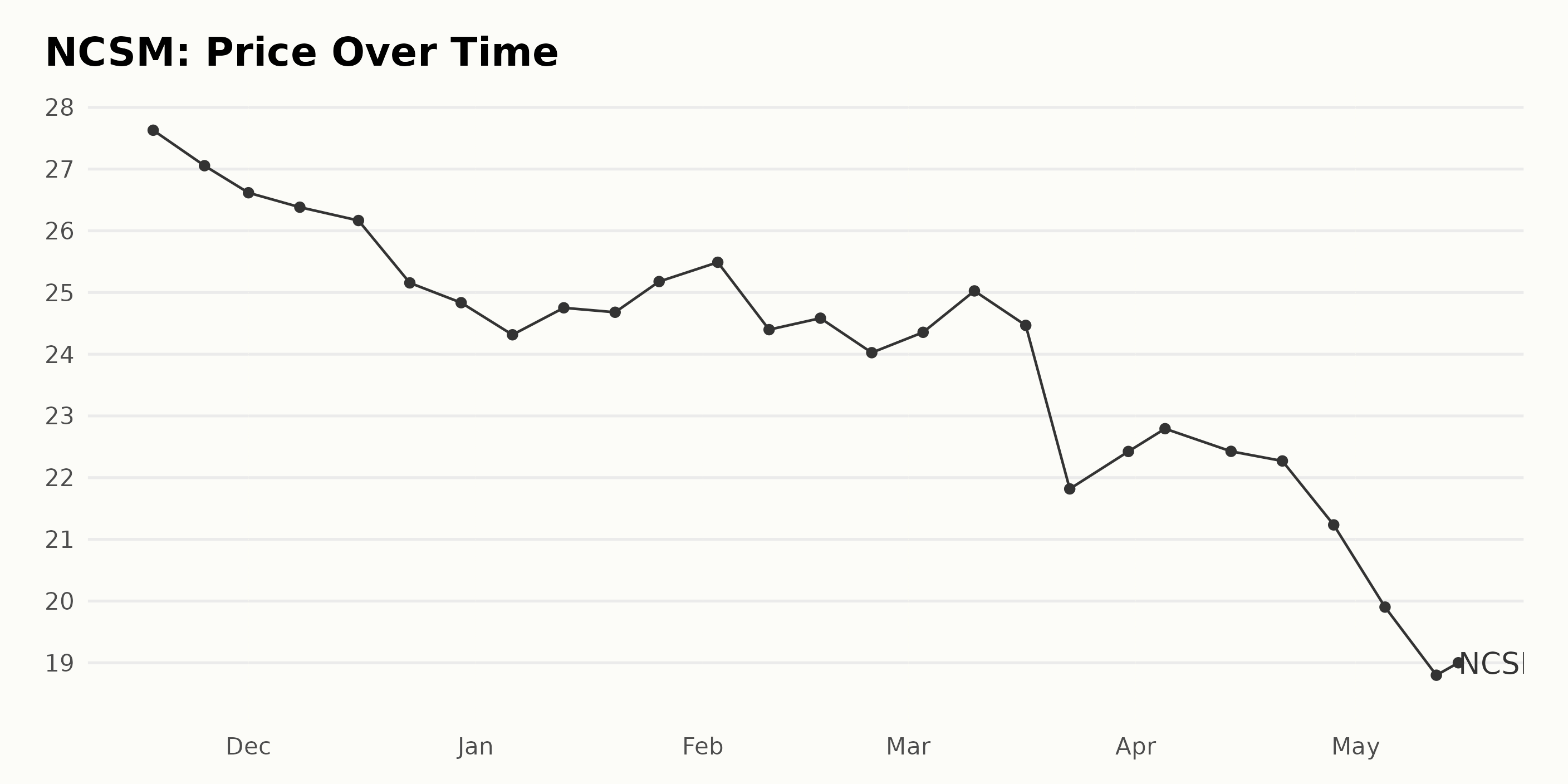

NCSM’s share price has steadily decreased, starting at $27.63 on November 18, 2022, and recently bottoming out at $18.80 on May 12, 2023. The initial drop was $0.58 over November 25, 2022, linearly over the following few months until December 30, 2022, when it dropped by $2.21.

After reaching a low point of $24.32 on January 6, 2023, there were several minor upswings before it began decreasing again, dropping $4.47 from March 23, 2023, to April 21, 2023. The rate of decrease has accelerated since then, with NCSM’s share price plummeting by $3.62 from May 5, 2023, to May 12, 2023. Here is a chart of NCSM’s price over the past 180 days.

NCSM POWR Ratings: Strong Momentum and Quality, Decreasing Stability

NCSM’s latest POWR Ratings grade is a B, which translates to Buy, and its rank in the Energy – Services industry is #5 out of 45. This grade was recorded on April 12, 2023.

The POWR Ratings for NCSM on April 7, 2023, and April 8, 2023, are noteworthy as they show that Momentum, Quality, and Sentiment had the highest ratings of 98, 81, and 84, respectively.

Furthermore, there is an upward trend in Momentum from April 7, 2023, to April 12, 2023, where its rating increased from 98 to 99. On the other hand, Stability has a decreasing trend during the same period, with its rating dropping from 50 to 48.

How does NCS Multistage Holdings, Inc. (NCSM) Stack Up Against Its Peers?

Other stocks in the Energy – Services sector that may be worth considering are North American Construction Group Ltd. (NOA), Ranger Energy Services, Inc. (RNGR), and Graham Corporation (GHM) — they have better POWR Ratings.

The Bear Market is NOT Over…

That is why you need to discover this timely presentation with a trading plan and top picks from 40 year investment veteran Steve Reitmeister:

REVISED: 2023 Stock Market Outlook >

Want More Great Investing Ideas?

NCSM shares were trading at $18.71 per share on Monday afternoon, up $0.53 (+2.92%). Year-to-date, NCSM has declined -25.16%, versus a 8.40% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| NCSM | Get Rating | Get Rating | Get Rating |

| NOA | Get Rating | Get Rating | Get Rating |

| RNGR | Get Rating | Get Rating | Get Rating |

| GHM | Get Rating | Get Rating | Get Rating |