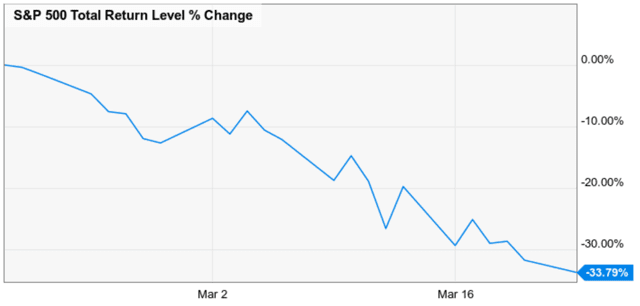

It’s hard to believe that on February 19th, the S&P 500 closed at 3,393, an all-time high.

In just over a month the market dived 34%, the fastest bear market in history.

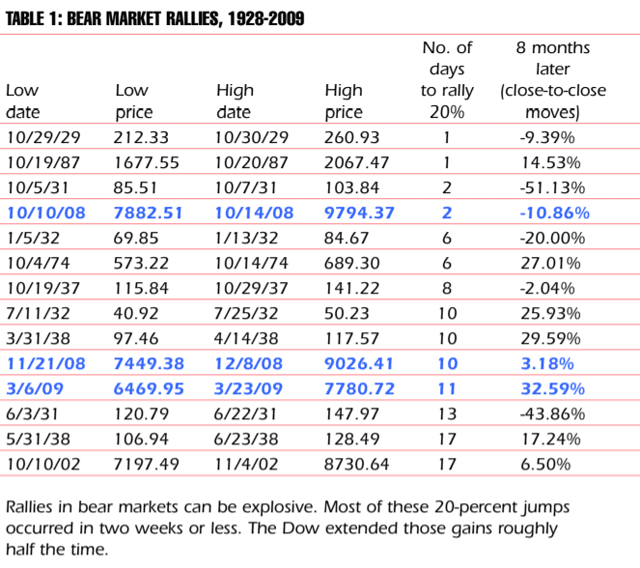

Since then stocks have seen a nice 20% rally that many don’t trust, believing it to be a bear market rally.

(Source: Market Pulse)

Indeed we’ve seen bear market rallies as strong as 62% in the past before stocks rolled over and crashed to new lows. In October 2008 stocks soared 27% in two days, and then bottomed in March 11% lower.

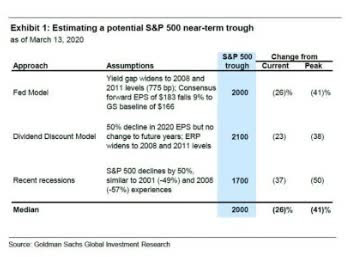

There is no end of high stakes risks facing us right now, so naturally, a reasonable argument can be made either way. That stocks have bottomed (as JPMorgan just wrote in a note) or may have further to fall (as Goldman Sachs expects).

I can’t tell you whether stocks are now bound for a face-ripping rally or are going to retest new lows in the coming weeks.

I’ve planned for both scenarios, as well as the market merely trading sideways within a 25% to 35% range.

But in a month when we’re facing the worst economic data in history, here are three bits of good news to let you sleep better at night because another Great Depression is likely not upon us.

Reasons for Hope 1: This Virus Is Beatable

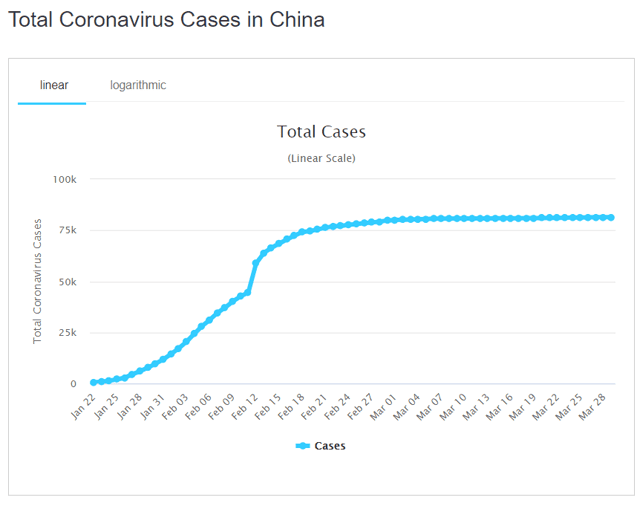

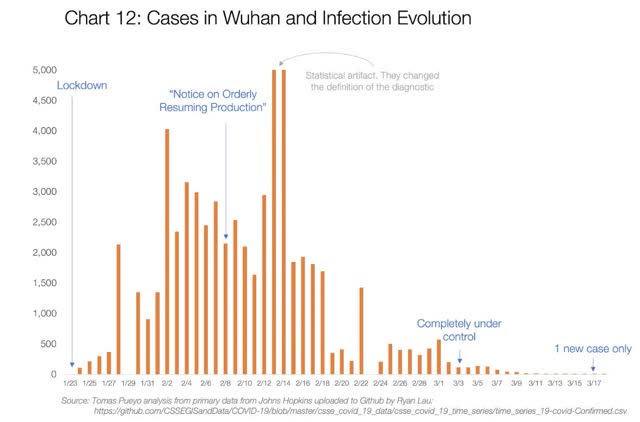

China was where this started and they made many of the same mistakes the rest of the world did. They initially didn’t want to admit it was a problem, didn’t test enough early on, and thus had to pay a terrible economic price when they locked down their economy for six weeks (possibly -40% GDP growth in Q1).

(Source: World of Meters)

However, China rapidly switched gears and began testing people like mad, tracing contacts of the infected, and even quarantining entire apartment buildings if a single occupant tested positive.

Some of those were false positives, but China didn’t take any chances. The result has been a significant decrease in new cases. How significant?

In Wuhan, the city where this began, they went five straight days without a new case. Some foreign travelers are bringing in about 50 cases per day, but China’s healthcare system is easily able to accommodate this.

Which brings us to the second reason for hope, which is about the economy.

Reasons For Hope 2: A Rapid Economic Recovery Is Expected

The past few weeks have been a horror show of bad economic news and terrifying headlines.

Bill Ackmann got a lot of flack for going on CNBC in early March and proclaiming that “hell is coming!”.

Well, hell was coming and it’s now here.

- 3.3 million new jobless claims last week

- 4 million is the median consensus for this week

- some economists expect up to 5 million

- Goldman Sachs estimates -24% GDP growth in Q2

- JPMorgan estimates -25% growth

- Morgan Stanley -31%

- Capital Economics -40%

- St. Louis Fed as bad as -50% (and up to 30% unemployment)

For context, the single worst quarter for growth was in 1958 at -10%.

(Source: MarketWatch)

The consensus among the 16 most accurate economists is we’re set for at least -12% growth in Q2 and this consensus estimate is falling each week.

Moody’s had previously estimated 10 million job losses when this was all over. In just two weeks we are potentially looking at eight million and Morgan Stanley estimates 17 million job losses in May alone.

If the St. Louis Fed is right, then 47 million Americans could lose their jobs.

BUT the good news is that most of these layoffs are furloughs and not permanent cuts.

Companies are being subsidized by the $2.2 trillion stimulus bill to the tune of $500 billion to minimize permanent layoffs.

- companies with under 500 workers can get zero-interest loans to cover 2.5 months of operating expenses and payroll

- any company that doesn’t layoff workers is forgiven the loans which become cash grants

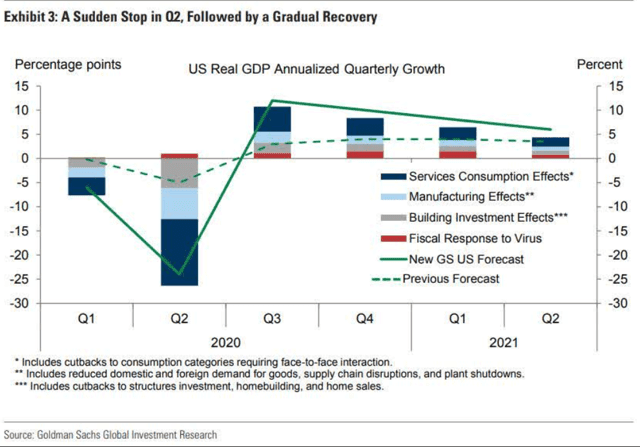

What’s more, the same analysts forecasting the worst economic growth in US history are also expecting a relatively rapid recovery.

Goldman Sachs expects +12% and +10% growth in Q3 and Q4, the highest in over 50 years.

Morgan Stanley, the one expecting -31% growth in Q2, expects +29% growth in Q3. They expect 2021’s growth to be 3.3%, the fastest in 16 years.

JPMorgan is one of the least bullish economists, expecting JUST +6% GDP growth in the second half of the year. That’s nearly three times the average we saw since 2009.

These models are all based on the assumption that the US economy will restart in July.

But of course, I’m sure you’re thinking that models are fine, but what evidence do we have that a country that shuts down for months can restart its economy quickly?

Reasons for Hope 3: Rapid Economic Restarts Are Possible

China was the first country stricken by the virus, the first to institute draconian lockdowns and the first to attempt the fastest economic recovery in history.

Within 12 days of locking down, China’s cases peaked. Other countries haven’t been so fortunate, likely because China’s government is able to institute harsher measures than democratic societies are willing to endure.

On February 10th, China began easing its restrictions and restarting its economy.

Bloomberg Economics estimates that as of March 20th, 85% of China’s economy has come back online.

And that’s not just based on government data either.

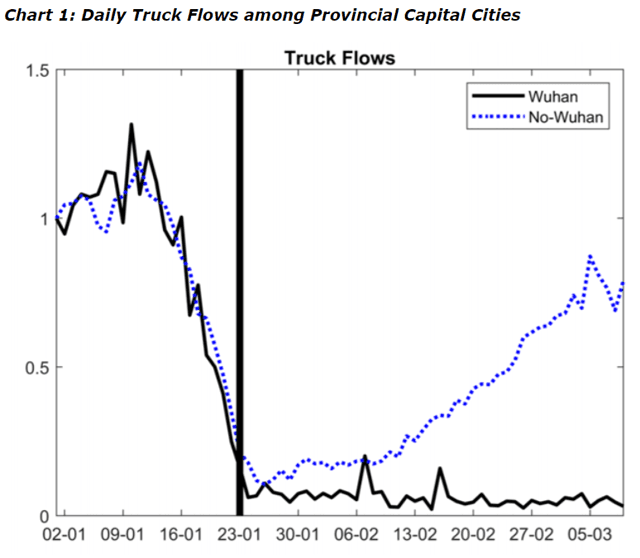

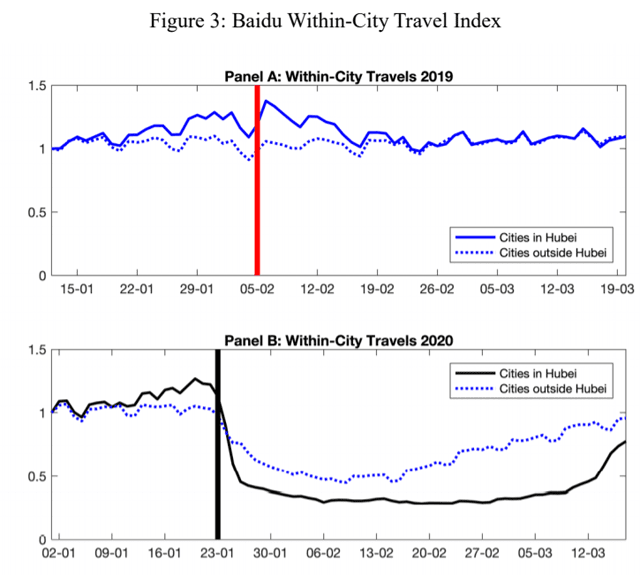

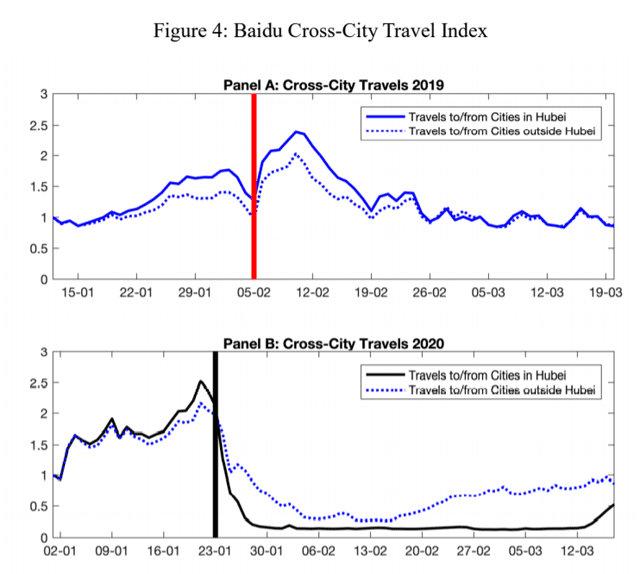

(Source: University of Hong Kong, G7)

Using G7 data, derived from private trucking companies, Hong Kong university estimates that outside of Wuhan itself, trucking volumes have nearly returned to January levels.

(Source: University of Hong Kong)

Travel between cities has bounced back outside of Hubei province (where Wuhan is located) and is basically back to pre-crisis levels.

(Source: University of Hong Kong)

Even in Hubei province, the epicenter of the global crisis, travel between cities have bounced back to 50% of pre-crisis levels. And that’s with travel restrictions just now being lifted.

Wuhan has just recently begun to lift its lockdown. And yet travel between it and other provincial cities is skyrocketing.

Other independent sources of data, such as rail car shipments, power consumption, and oil demand similarly show a nation of 1.3 billion rapidly getting back on its feet.

China is a single data point. And there is no denying that the economic shock facing most of the world is historic and unprecedented.

Without sufficient monetary and fiscal stimulus, it’s likely this pandemic would have smashed the global economy and plunged the US into a deep depression, that could have taken decades to recover from.

- $11 trillion in total global stimulus and counting

- $6 trillion in global spending

- $5 trillion in pledged central bank QE support

- US Congress is discussing a potential 4th stimulus bill to plug the gaps of the first three (including more state aid)

Is unemployment going to hit record highs, worse than the Depression? It very well might, as the St. Louis Fed has warned.

But the global response to this virus, as imperfect as it’s been thus far, has been swift, massive and coordinated.

Yes, there is a lot more that needs to be done. The medical logistics alone needed to treat hundreds of thousands of people requires a near wartime effort.

But as I expected, the American people, and indeed the citizens of the entire world, as divided as they were before, are coming together to beat this virus and preserve our way of life.

I can’t tell you when the pandemic will end for certain. I can tell you it will eventually end.

I can’t tell you how bad the economic damage will get, but we’ll likely recover from far worse than the Financial Crisis in far less time.

And as for the stock market? Well, whether or not the market has already bottomed and is set for an impressive year-long rally, I can’t say.

Goldman’s base case bottom forecast is -41%, 23% below where stocks sit now.

Merril Lynch and Goldman think that the market might end up cut in half before stocks begin a roughly 60% 6-month rally.

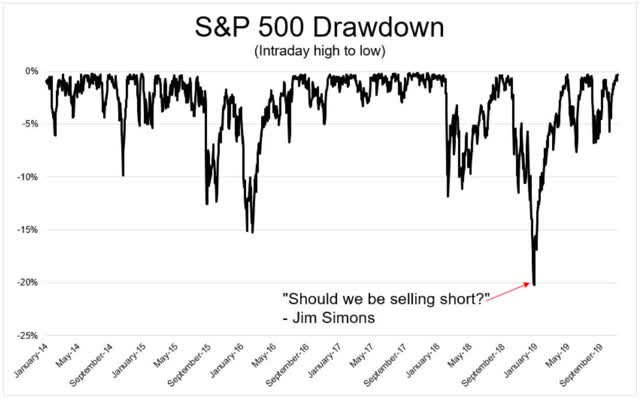

Jim Simmons, Greatest Trader In History (66% CAGR returns from 2002 to 2018) Can’t Time The Market

(Source: Michael Batnick)

So rather than make an “all in” bet, and try to time the market, which no one can do, I’m taking a long-term prudent strategy of buying great companies at reasonable to attractive prices.

I’m steadily buying the best blue chips in the world, every day, while also able to opportunistically buy 10 companies on days if the market hits -40%, -45%, -50%, ect.

Funding this are sales of t-bills and long-duration US treasuries that serve as a store of value or hedge against this recession.

For now, the bond market is signaling it thinks things will get a lot worse before they get better. Fundamentally speaking, that’s a near certainty.

Whether or not the stock market reacts by rolling over and plunging to new lows, doesn’t matter.

I have a 5+ year time horizon, and a plan that works well if stocks go up, down or sideways.

Want more great investing ideas?

Why Shutting Down the Stock Market Is a Very Bad Idea

Reitmeister Total Return portfolio – Discover the portfolio strategy that Steve Reitmeister used to produce a +5.13% gain while the S&P 500 fell by -14.97%.

Free Access Pass to Wealth365 Online Summit– join many of the world’s top investors to learn strategies to not just survive, but actually thrive in the midst of this bear market.

SPY shares were trading at $247.93 per share on Wednesday afternoon, down $9.82 (-3.81%). Year-to-date, SPY has declined -22.52%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |