Earnings season is upon us once again. But with the market now 14% historically overvalued, and at high pullback/correction risk, there are three crucial things investors need to know about the final earnings season for 2019.

That’s both to avoid costly mistakes and to potentially profit from the wild swings in stock prices that are likely to be coming in the next few weeks.

1. Earnings Expectations Are Very Low, So Most Companies Will Beat Expectations

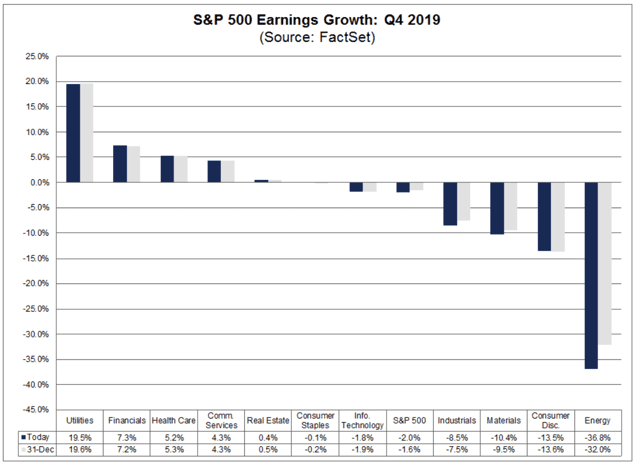

This is what FactSet is reporting is the consensus expectations for Q4 2019 earnings.

-2% YoY growth for the entire market hides massive losses for certain sectors, who have very low expectations to clear. 20 companies have actually reported already and 84% of them have beaten EPS expectations and 74% sales forecasts.

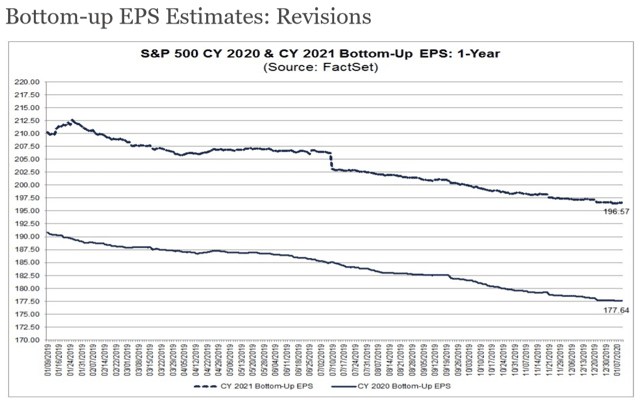

Analysts always cut expectations over time, which is why over the past 10 years 72% of companies have beaten earnings expectations. You can see that trend with the 2020 and 2021 analyst consensus forecasts which show strong EPS growth this year and next, but that steadily fall over time.

In 2020 the same sectors hit hardest by the trade conflict in 2019, particularly energy, industrials, and basic materials, are expected to post the strongest growth.

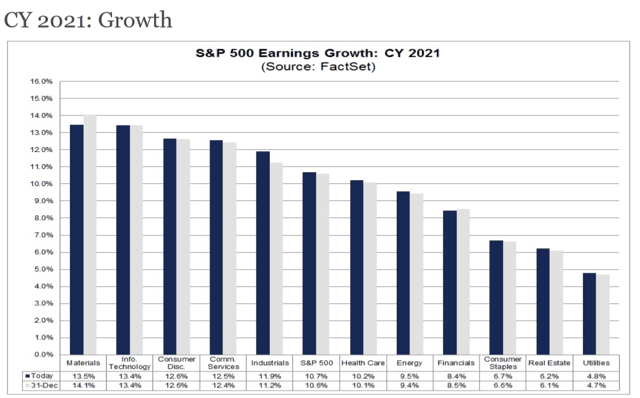

2021 is expected to be another strong growth year, likely due to expectations that the US/China trade conflict will end in late 2020 or early 2021. The defensive sectors, such as REITs, utilities, and consumer staples, are expected to once more lag faster growth sectors like technology and consumer discretionary in the coming two years.

What implications are there for stocks in the short-term if more companies than usual beat expectations?

2. Stocks Might Continue Rising In The Coming Weeks If We Avoid Bad Trade/Geopolitical News

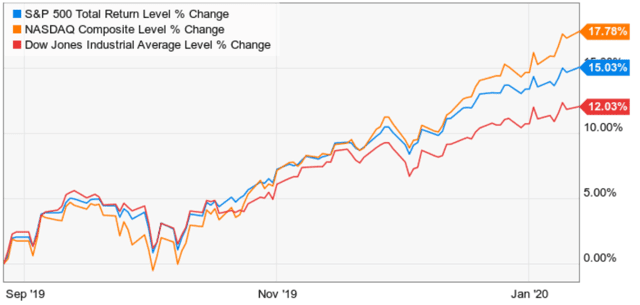

Stocks are currently melting up, with the S&P 500, Nasdaq, and Dow up 15%, 18% and 12% in just the past four months.

Stocks Since Last Trade Freakout Ended

(Source: Ycharts)

Stocks have barely had any dips since easing recession fears and phase one trade deal euphoria began a low volatility steady march higher.

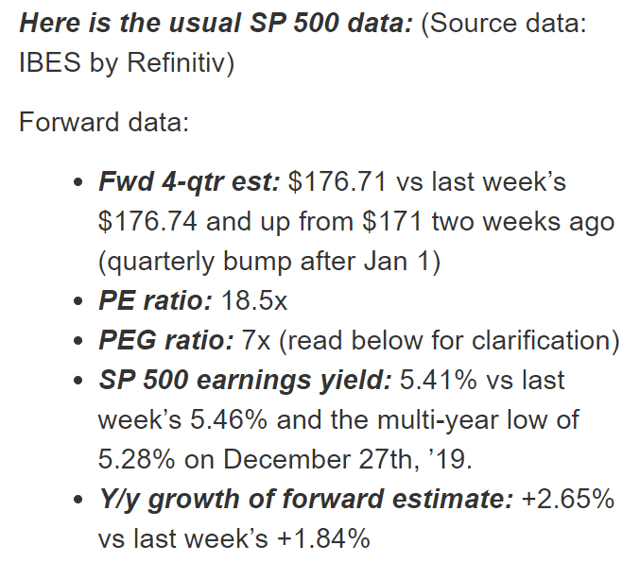

(Source: Brian Gilmartin)

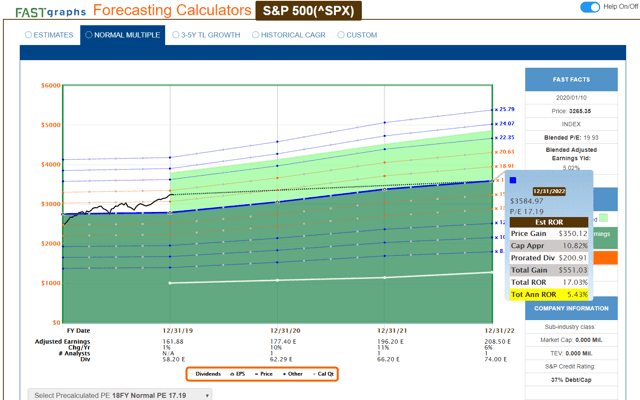

Unfortunately, that means that stocks are trading at 18.4 to 18.5 forward earnings, depending on whether you use FactSet’s optimistic 9.4% growth consensus or Refinitiv’s more modest 3% growth estimate.

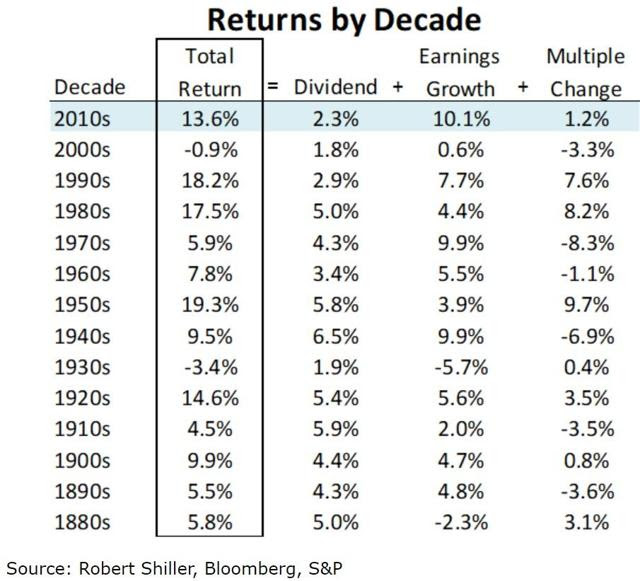

3% to 8% EPS growth in 2020 is the likely range, with Goldman and Wells Fargo estimating 5%. 5% to 7% CAGR is the historical EPS growth rate for the S&P 500. However, over the past 20 years, 8% has been achieved thanks to higher-margin and faster-growing tech stocks (and the market cap-weighted nature of the S&P 500).

16.5 to 18.0 is the historical fair value PE for the broader market, over the past 20 years. Those are the historical average market blended PEs during a period when EPS growth ranged from 4% to 11% CAGR.

(Source: F.A.S.T Graphs, FactSet Research)

If we use FactSet’s optimistic 10%, 11% and 6% growth estimates for 2020, 2021 and 2022, respectively, and apply the mid-range historical 17.2 blended PE we can estimate that 5% CAGR total returns are likely over the next three years.

That’s nearly three times less than the 13.6% CAGR returns over the past 10 years, which is likely to disappoint a lot of passive investors who have been spoiled by the first decade in US history without a recession.

(Source: Ploutos)

But there is good news for those who are willing to be “greedy when others are fearful” and understand that historically normal volatility is the best friend of the disciplined investor.

3. Normal Volatility In Individual Stocks/Broader Market Will Create Great Long-Term Profit Opportunities

(Source: imgflip)

(Source: imgflip)

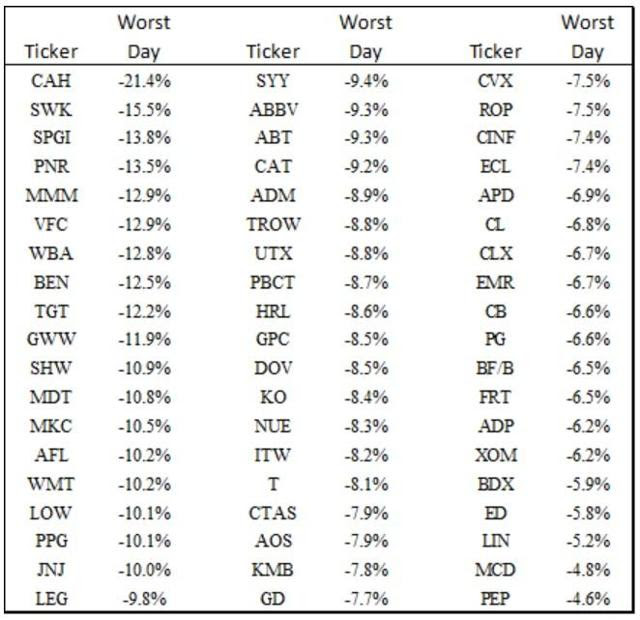

Earnings season is a time when even the bluest of blue chips can crash by double-digits.

Dividend Aristocrats Worst Single Day Losses (2009 to April 2019)

(Source: Ploutos)

Most of these peak declines in the legendary dividend aristocrats happen during earnings misses.

Dividend Aristocrats Forward 12-Month Total Returns Following Double-Digit Single Day Declines (2010 to April 2019)

| Ticker | Worst 1-Day Decline Since 2010 | Date Of Decline | 12-Month Forward Return |

| CAH | -21.4% | 5/3/2018 | -1.9% |

| ABBV | -16.3% | 6/25/19 | NA |

| SWK | -15.5% | 1/22/19 | NA |

| SPGI | -13.8% | 2/4/13 | 85.4% |

| PNR | -13.5% | 4/9/19 | NA |

| MMM | -12.9% | 4/25/19 | NA |

| VFC | -12.9% | 10/23/15 | -12.2% |

| WBA | -12.8% | 4/2/19 | NA |

| BEN | -12.5% | 9/22/11 | 33.4% |

| TGT | -12.2% | 2/28/17 | 33.6% |

| GWW | -11.9% | 10/16/18 | 12.1% |

| SHW | -10.9% | 10/25/16 | 60.3% |

| MDT | -10.8% | 8/24/10 | 12.4% |

| MKC | -10.5% | 1/24/19 | NA |

| AFL | -10.2% | 8/10/11 | 32.8% |

| WMT | -10.2% | 2/20/18 | 8.7% |

| LOW | -10.1% | 5/21/12 | 69.1% |

| PPG | -10.1% | 10/9/18 | 18.3% |

| JNJ | -10.0% | 12/14/18 | 9.3% |

| Average | 27.8% | ||

| Median | 18.3% |

(Sources: Ploutos, Ycharts)

The bluest of blue chips, including Johnson & Johnson, arguably the safest dividend stock in the world, is capable of falling 10% or more in a single day. And yet within a year, nearly all such single-day crashes turn out to be excellent buying opportunities.

This table is the basis of my “buy undervalued/fairly valued dividend aristocrats on 10+% single-day crashes” rule. That’s assuming the news doesn’t break the thesis of course. An aristocrat cutting its dividend would not be a good buying opportunity, at least not one I’d personally recommend or participate in.

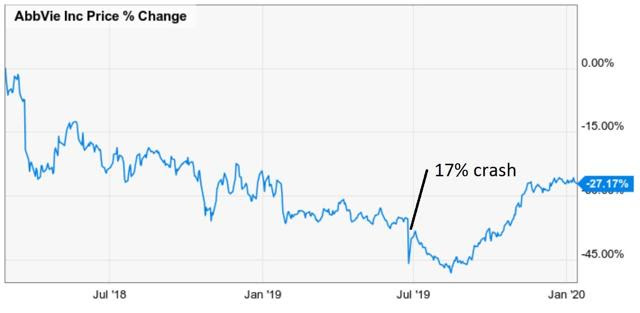

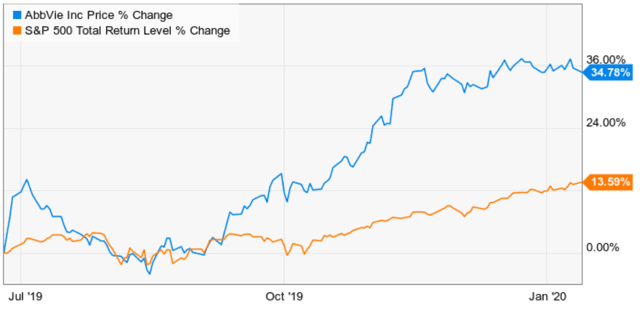

Earnings season is sure to bring plenty of volatility among quality dividend stocks, some of which will start out overvalued and become fairly/undervalued. Others will start out undervalued and become even better bargains, as was the case with AbbVie after it announced the Allergan merger.

(Source: Ycharts)

I bought AbbVie that day, and not surprisingly it’s up a lot for me, in the time since.

Since AbbVie’s Worst Single Day Crash Ever

(Source: Ycharts)

That 35% gain is over about six months, but the point is that opportunistically buying quality companies when the market overreacts is a classic example of Buffett’s “greedy when others are fearful”.

(Source: AZ quotes)

It’s also how you can make your own investing luck. A good watchlist can be worth its weight in gold.

I maintain a 351 company watchlist (on its way to 400 to 500) for Dividend King members that includes

- quality scores (average 9.1/11 vs aristocrats & kings 9.5)

- dividend safety scores (average 4.5/5 vs 4.7 average aristocrats & king)

- yield (average 3.0% vs 1.8% S&P 500 and 3% to 4% most “high-yield” funds)

- fair value in any given year

- good buy price

- potential sell/trim price

- long-term return potential range

- dividend growth streak

- 5-year CAGR dividend growth rate

- analyst long-term growth consensus (proxy for future dividend growth)

- forward PE

- PEG ratio

Thus I am not nervous about earnings season but eagerly awaiting the next irrational market freakout for quality dividend stocks. I’m not even necessarily waiting for 10% single-day crashes.

What I LOVE To See

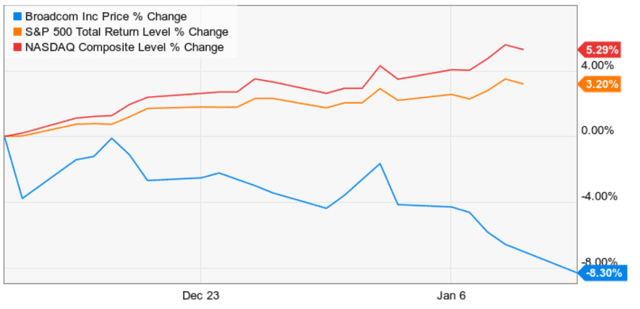

(Source: Ycharts)

Here’s Broadcom following great earnings. It’s down almost 10% for no good reason. This is why I’ve been steadily buying that high-yielding, fast-growing blue chip which is about 15% undervalued for 2020 based on its consensus results.

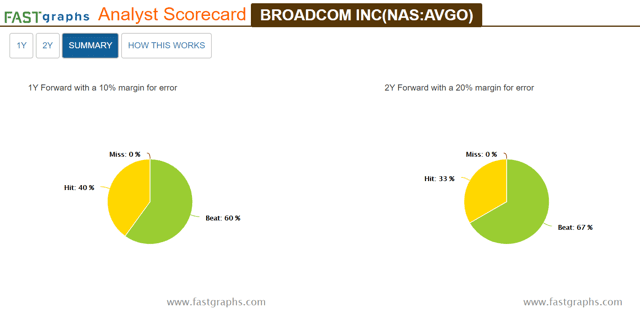

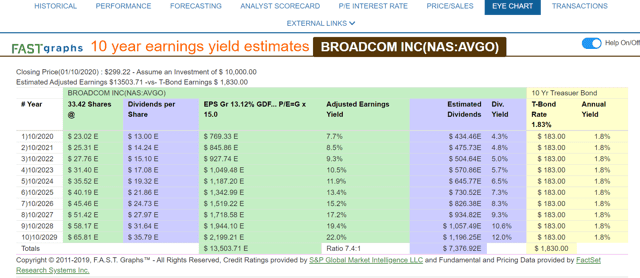

Broadcom is a company with an exceptional track record of meeting and usually beating expectations. Those expectations right now include 13.1% CAGR long-term earnings and dividend growth which means buying today could result in recouping 74% of your cost basis within a decade from safe and rapidly growing dividends.

On shares that could have a yield on cost of 12% in 2029 and make Broadcom one of the best high-yield dividend growth names in the tech sector.

These are just some of the examples of the market acting irrationally in the short-term, which we’re sure to see a lot of this earnings season.

(Source: imgflip)

SPY shares were trading at $327.62 per share on Tuesday morning, down $0.33 (-0.10%). Year-to-date, SPY has gained 1.79%, versus a 1.79% rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |