When things are going well, it’s natural to worry about what could cause the good times to stop. In, fact when facing unsustainable rallies in the stock market, it’s not just smart, it’s sound risk management.

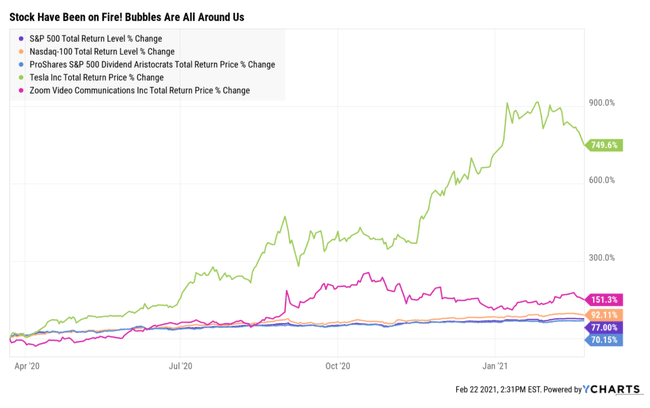

From the March 2020 lows, the S&P 500 is up 77%, the Nasdaq 92%, and red hot Wall Street darlings such as Tesla hit a peak gain of 900% before recently correcting.

- returns of 77% to 900% in less than a year!

Not surprisingly many investors have correctly concluded that much of these gains are unsustainable and the result of speculative manias.

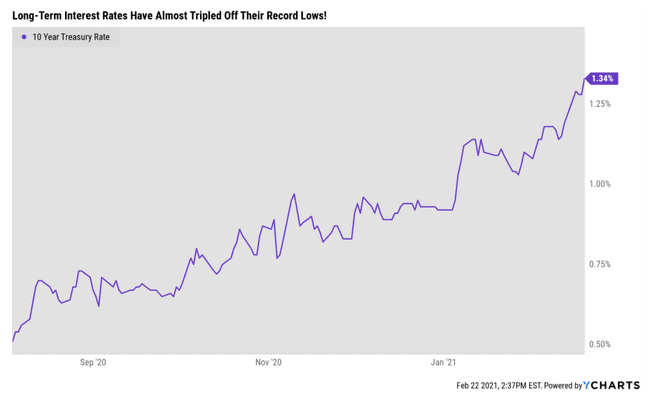

Record low-interest rates are one of the many reasons given for justifying today’s extremely high valuations. Well, guess what? Interest rates have almost tripled in the past six months.

Some bubble stocks have already begun to feel the effects of rising rates, and some investors are worried that a market crash could happen if the economy gets too good.

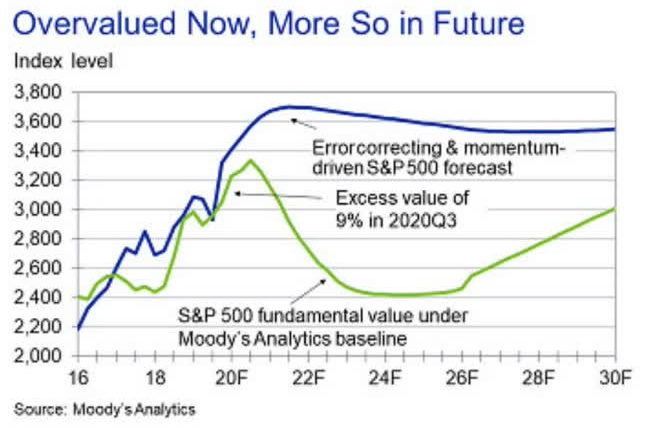

Moody’s even predicts that a booming economy could trigger a multi-year bear market that leaves the S&P 500 with negative returns for a decade.

These are some frightening predictions, so to help you make a more informed investment decision, here are four facts you kneed to know about rising interest rates and what effects are likely on your portfolio.

Fact 1: There Are Many Reasons Inflation Could Rise In The Short-Term

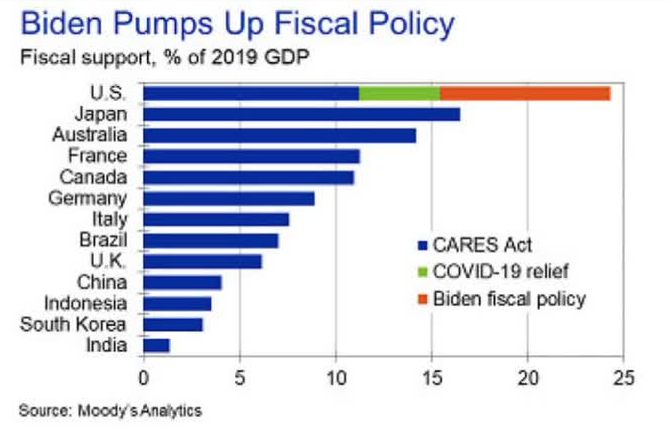

The $1.9 trillion Biden stimulus proposal has now passed the House budget committee and is expected to be approved by the end of February.

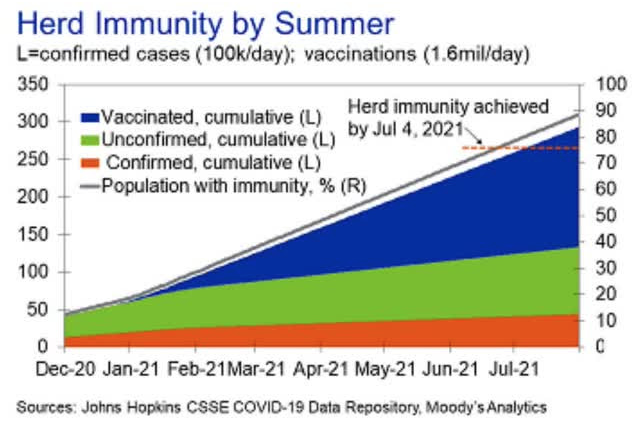

This would bring total US stimulus thus far to almost 25% of pre-pandemic GDP. That’s the largest of any country, and given the $30 trillion in stimulus so far, that’s saying something. If these trends in confirmed infections and vaccinations continue, the U.S. will achieve herd immunity—with three-fourths of the population having been vaccinated or infected and thus presumably with some immunity to the virus—around July 4.

This is our baseline expectation, although there is plenty of both upside and downside risk to the baseline; vaccinations are quickly trending higher, but new strains of the virus—more resistant to the vaccine—are becoming more prevalent.” – Mark Zandi, Chief Economist Moody’s, emphasis added

Meanwhile, economists are increasingly confident that the pandemic will end in the US in the next few months.

Morgan Stanley, Bank of America, JPMorgan, Moody’s, and Goldman all expect herd immunity in the US by mid-year.

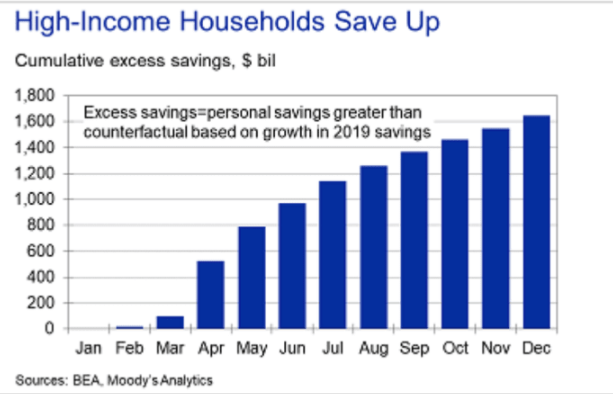

US savings has surpassed $11 trillion by some counts, and Moody’s estimates that there are more than $1.6 trillion in additional savings ready for spending once the economy reopens.

We can’t forget that America, and most of the world, will have spent almost 18 months cooped up, most at home, unable to do all the things we love.

Once the threat of the virus has passed, and millions of people, flush with cash, and with infrastructure setting the economy up for another four years of strong growth, we could see amazing growth.

The case for a much stronger, even booming economy, is so good that some have already begun to worry it will ignite undesirably high inflation. That concern is much too premature…

The economy is a long way from full employment, particularly for the hardest-pressed lower-income households. Besides, the Federal Reserve and other central banks have struggled for well more than a decade to get inflation out of the doldrums.

A more serious immediate threat is surging asset values, which have risen to the point that markets appear overvalued and at risk of turning speculative. Asset prices are thus vulnerable to sharp declines, which under certain circumstances could be a problem for the economy.” – Mark Zandi, Chief Economist for Moody’s

Moody’s, like most blue-chip economists, is not denying that more inflation is coming, in fact, that’s the entire point.

Real GDP growth this year would come in well over 6%, up from the near 5% growth we are projecting, and the economy would return to full employment by early 2022…

To be sure, inflation will accelerate, and if the economy sticks roughly to our script, inflation will rise meaningfully above the Fed’s 2% target. However, this is by design. It is precisely what the Fed is aiming for in its new monetary policy framework after more than a decade of unsuccessfully battling undesirably low inflation.” – Moody’s

Fact 2: Bubbles, Not Inflation Are The Biggest Risk Right Now

For now, fears of the type of accelerating price inflation experienced during the 1970s appear overdone.

The simple aging of the populations and workforces of advanced economies will make it difficult for consumer spending to grow rapidly enough to sustain a rising rate of price inflation.

Moreover, U.S. businesses and labor faced considerably less global competition during the 1970s. For example, giant emerging market economies possessing highly skilled workforces and advanced technologies (such as India and China) were largely absent from cross-border business activity.” – Moody’s

Moody’s isn’t worried about a sustained surge in inflation, and they are joined by the chief economists of Goldman, JPMorgan, the Fed, and Secretary of the Treasury Janet Yellen.

Meanwhile, handwringing over what could go wrong if the economy takes off feels a bit like putting the cart before the horse. It is important to consider the unintended consequences of the monetary and fiscal policy decisions being made today in an effort to mitigate them. But, given what we’ve been through this past year, most everyone is likely willing to take their chances with a booming economy.” – Moody’s

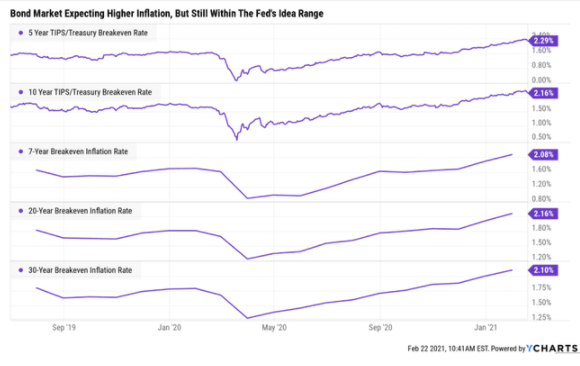

The bond market is also signally greater economic optimism but just 2.1% annual inflation expectations over the next 30 years. That’s just barely above the Fed’s 2% asymmetric target.

There is even a meaningful possibility that at some point in the next two or three years inflation will accelerate beyond what the Fed is comfortable with, say closer to 3%.

But the Fed has a clear guidebook for fixing this problem, namely higher interest rates. It has been a long time since interest rates have fully normalized.

A more serious immediate threat is surging asset values, which have risen to the point that markets appear overvalued and at risk of turning speculative. Asset prices are thus vulnerable to sharp declines, which under certain circumstances could be a problem for the economy.” – Moody’s

However, even a modest increase in inflation expectations could trigger the bursting of speculative mania and bubbles.

Under the low-interest rate TINA (there is no alternative) theory of investing, low enough interest rates can justify any multiple at all, since the value of all future cash flows discount to the present is based on interest rate sensitive discount rates.

When you have red hot tech darlings trading at 100, 200, even 7,000 times earings recently, then the slightest increase in rates can trigger catastrophic declines.

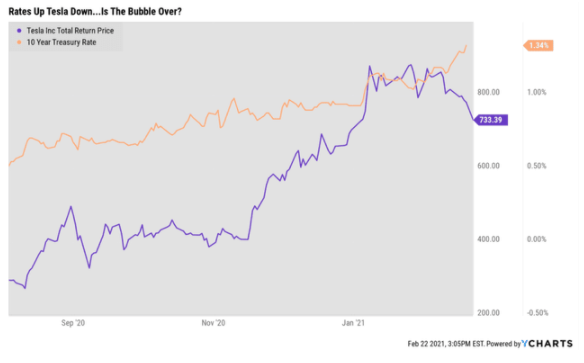

Tesla was headed straight up until 10-year yields hit 1.3% and now it appears to be headed straight down.

Of course, an increase from 0.5% to 1.3% on the 10-year yield shouldn’t actually cause Tesla to fall. After all, its company analysts expected to grow 33.4% CAGR over time.

It would illogical to consider Tesla a good buy when interest rates are 0.5% but a bad one at 1.3%.

- unless it was obscenely overvalued and pricing in over 10 years of growth already.

That’s what might be happening with Tesla now.

In part two of this series, I’ll explain the two most important facts about stocks and interest rates. The ones that can make or break your retirement dreams, and determine whether rising rates crush you, or set your portfolio soaring to the heavens.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

7 Best ETFs for the NEXT Bull Market

5 WINNING Stocks Chart Patterns

SPY shares were trading at $388.81 per share on Thursday morning, down $2.96 (-0.76%). Year-to-date, SPY has gained 3.99%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |