The stock market, whether you look at the S&P 500, Dow, or Nasdaq, has been partying like its 1999.

(Source: Ploutos)

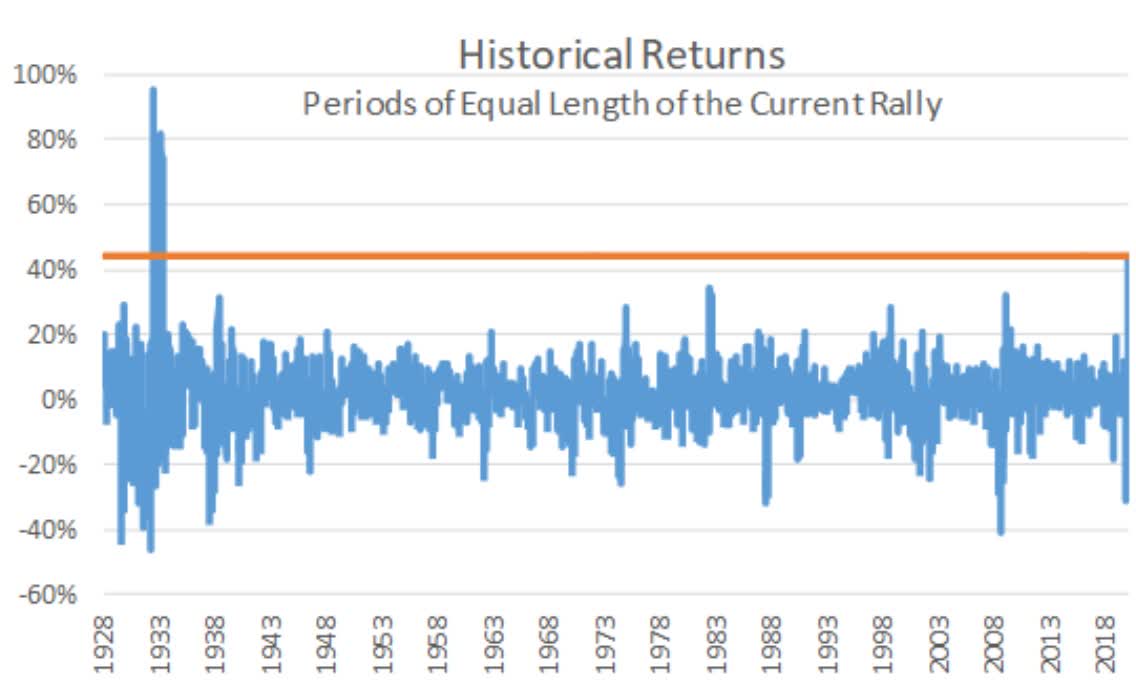

By June 6th the S&P 500 was up 45% in a 54-day rally that was the strongest sine 1933.

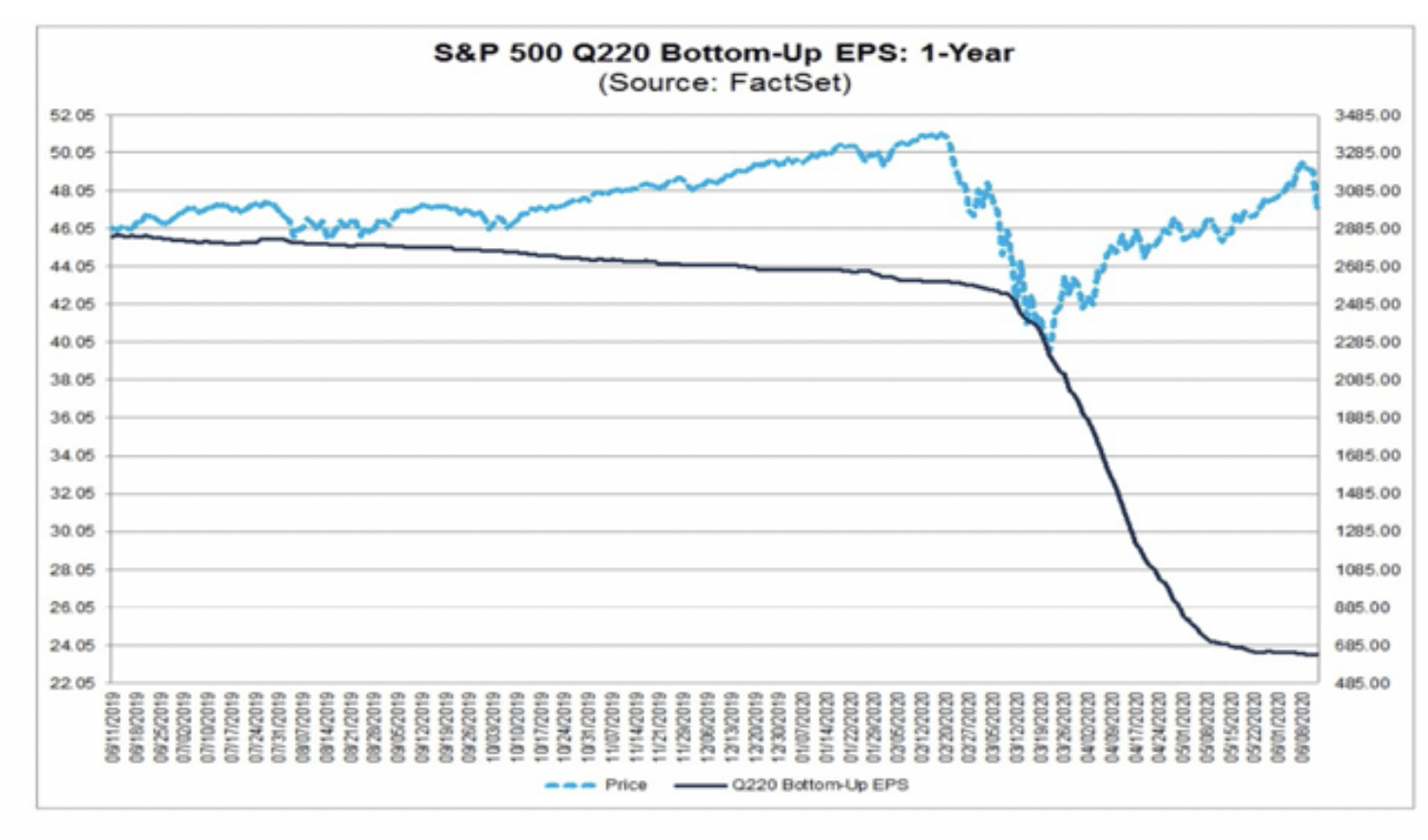

However, the market has absolutely gotten ahead of itself, becoming totally disconnected from a pandemic, economic or earnings fundamentals.

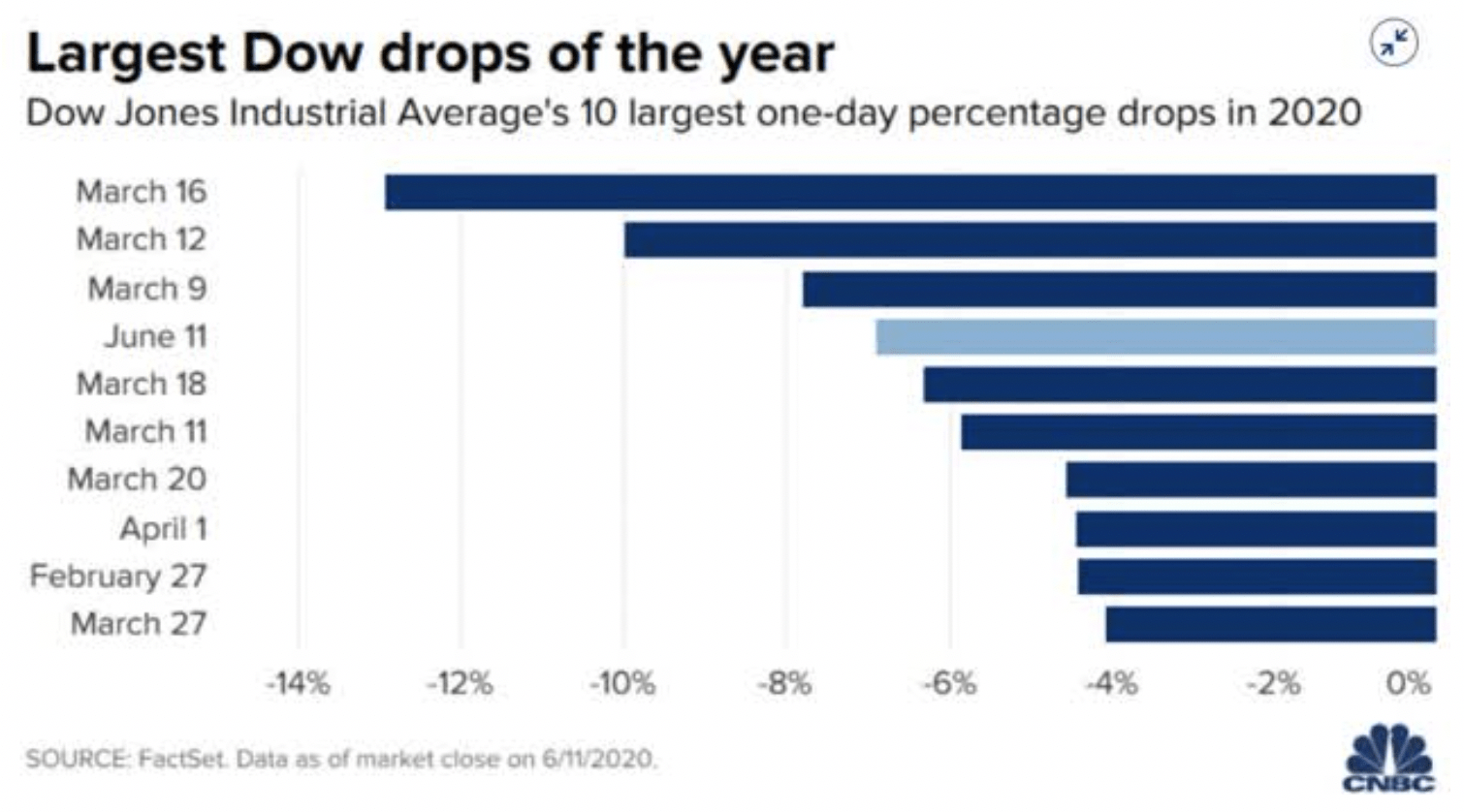

Last week the market suffered the worst day in three months, and the 46th worst of all time with the S&P 500 falling 5.9% and the Dow 6.9%.

I monitor the pandemic, economic and earnings situation closely each week for Dividend Kings, as part of our very thorough Weekly Recession Updates which cover

- credit/financial market health (to monitor for signs of a financial crisis)

- economy/small business updates (including the weekly Census Bureau’s survey of small businesses)

- earnings/market valuation updates (including long-term expected returns out to five years)

- pandemic update: second wave risk, transmission rates in each state, vaccine progress, and global viral transmission (because global infections eventually make their way here).

This week’s update included the first second-wave models from the IHME which has both good and bad news for the US economy, corporate earnings, and the stock market.

The Data Simply Doesn’t Support A V-Shaped Recovery

There are few economists I know of that still believe in a V-shaped recovery.

Morgan Stanley on Monday updated its base case for S&P 500 growth through June 2021, citing a swift economic recovery.

The bank raised its base case for the S&P 500 to 3,350 from 3,000 through June 2021, implying a 10% jump from Friday’s close, according to a Monday note from strategists led by Mike Wilson.

“A faster re-opening than expected along with a powerful combination of fiscal and monetary stimulus all support an economic and earnings recovery,” Wilson wrote.” – Business Insider

Morgan is applying a 20X forward PE to its recently revised 2021 EPS projections which are 22% above the 25-year average of 16.4.

In fairness to Morgan JPMorgan recently penned a very bullish note about how stocks might surge 47% off Thursday’s lows because it too is expecting a rapid economic recovery.

However, so far, the economic data absolutely doesn’t back up such bullishness.

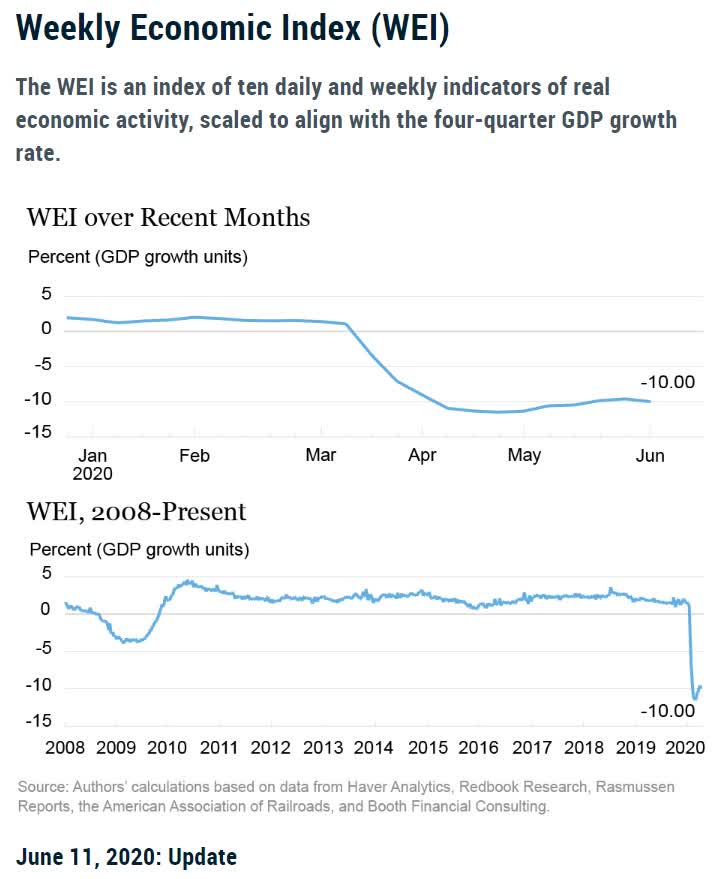

(Source: New York Fed, Dallas Fed, Harvard)

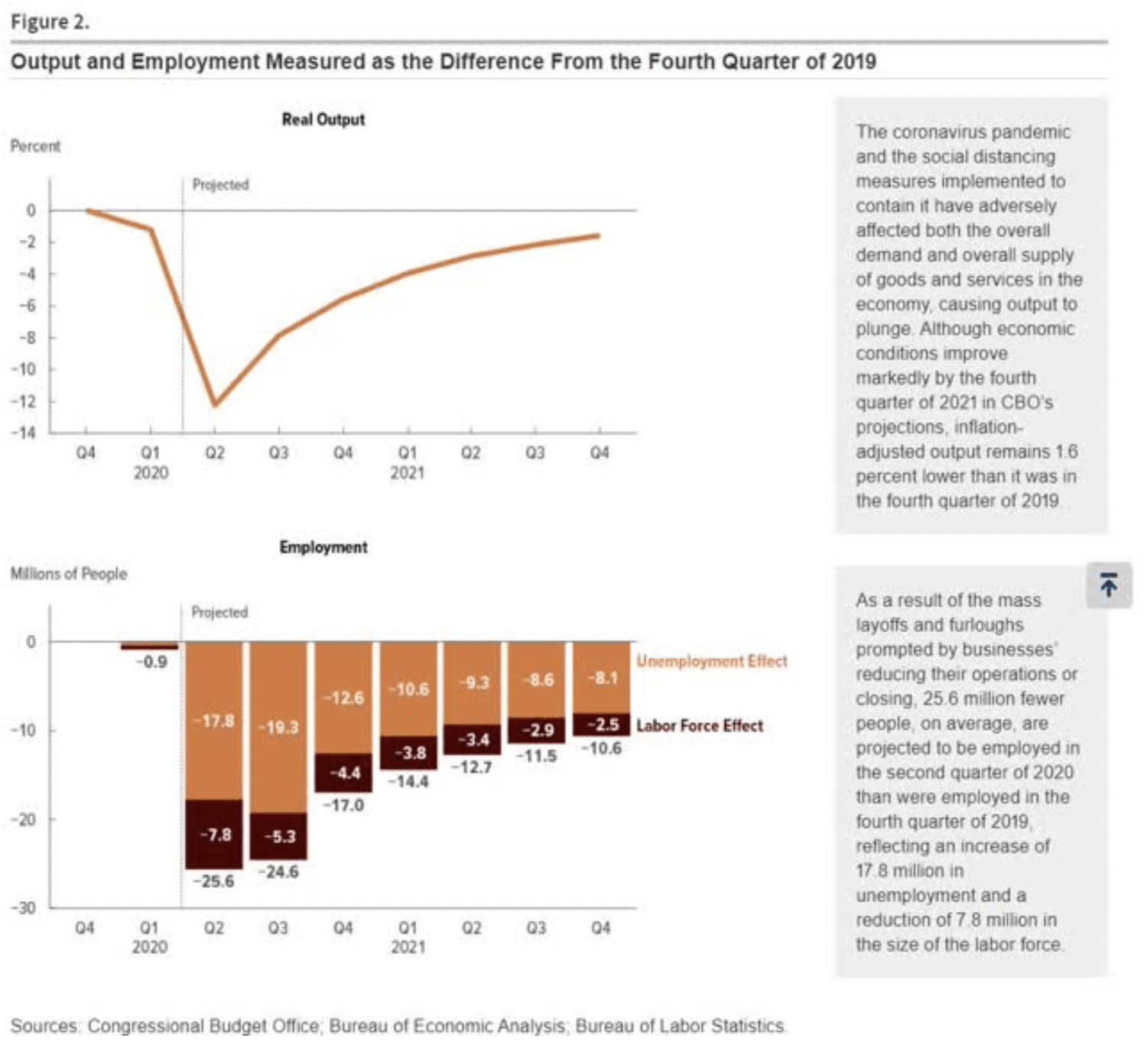

Using 10 weekly/daily reports, the high-frequency indicators, the NY Fed’s Weekly Economic Index shows that we appear to have bottomed but the shape the recovery looks far more like the Congressional Budget Office’s swoosh shaped recovery.

The Fed, not just Powell but all Fed Presidents, agrees that a long recovery in which unemployment rakes until 2023 or 2024 to get back to full employment (4%) is likely.

Morgan and JPMorgan, and all very bullish analysts, are not factoring in the second wave of the virus that not just 69% of Americans expect, but so do most medical experts.

And so here is what that potentially means for your portfolio.

First Second Wave Forecasts Are Here And They Bring Both Good And Bad News

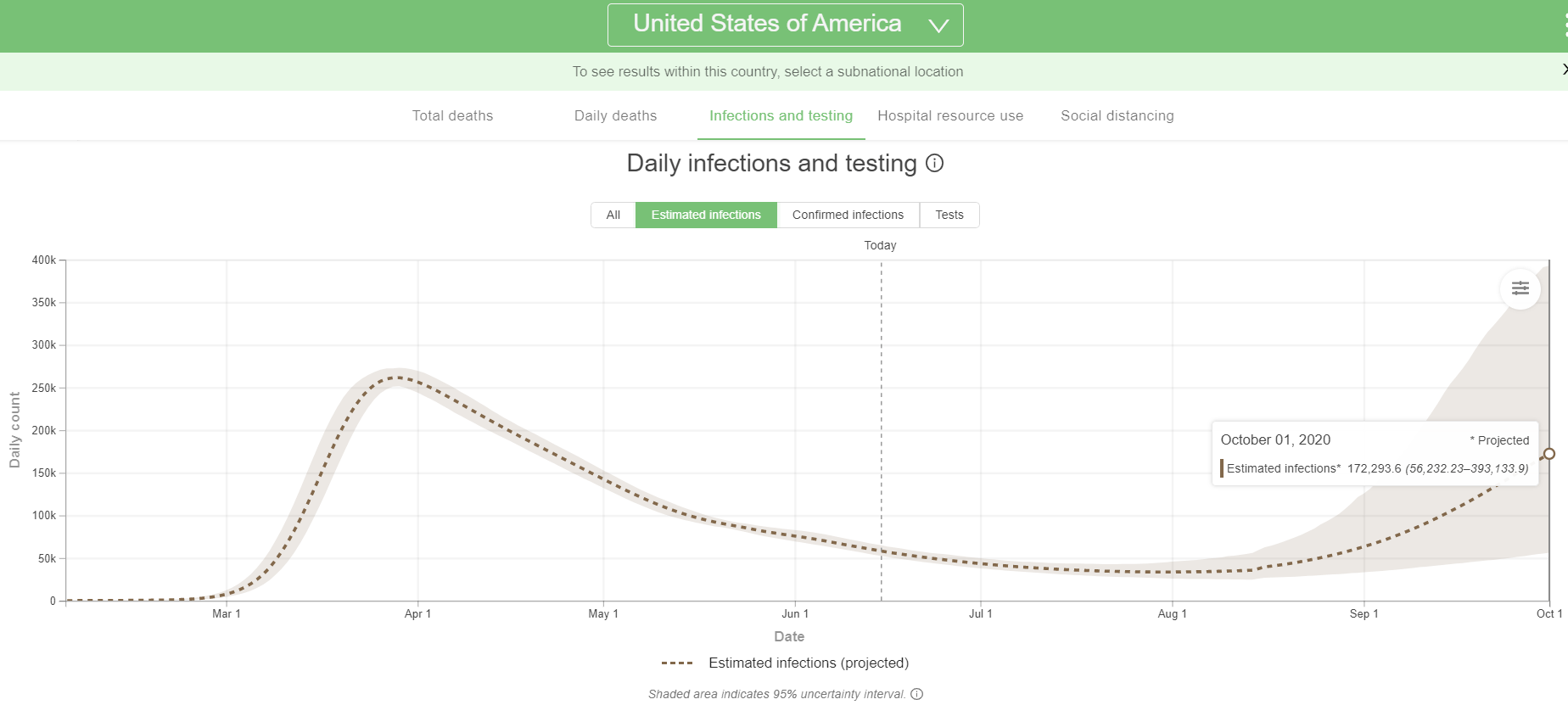

IHME estimates that US infections will keep steadily falling until about August 1st.

US Estimated Infections Expected to Surge In The Fall

(Source: IHME)

At which point the cases are expected to start rising and when schools reopen in September the second wave will begin in earnest.

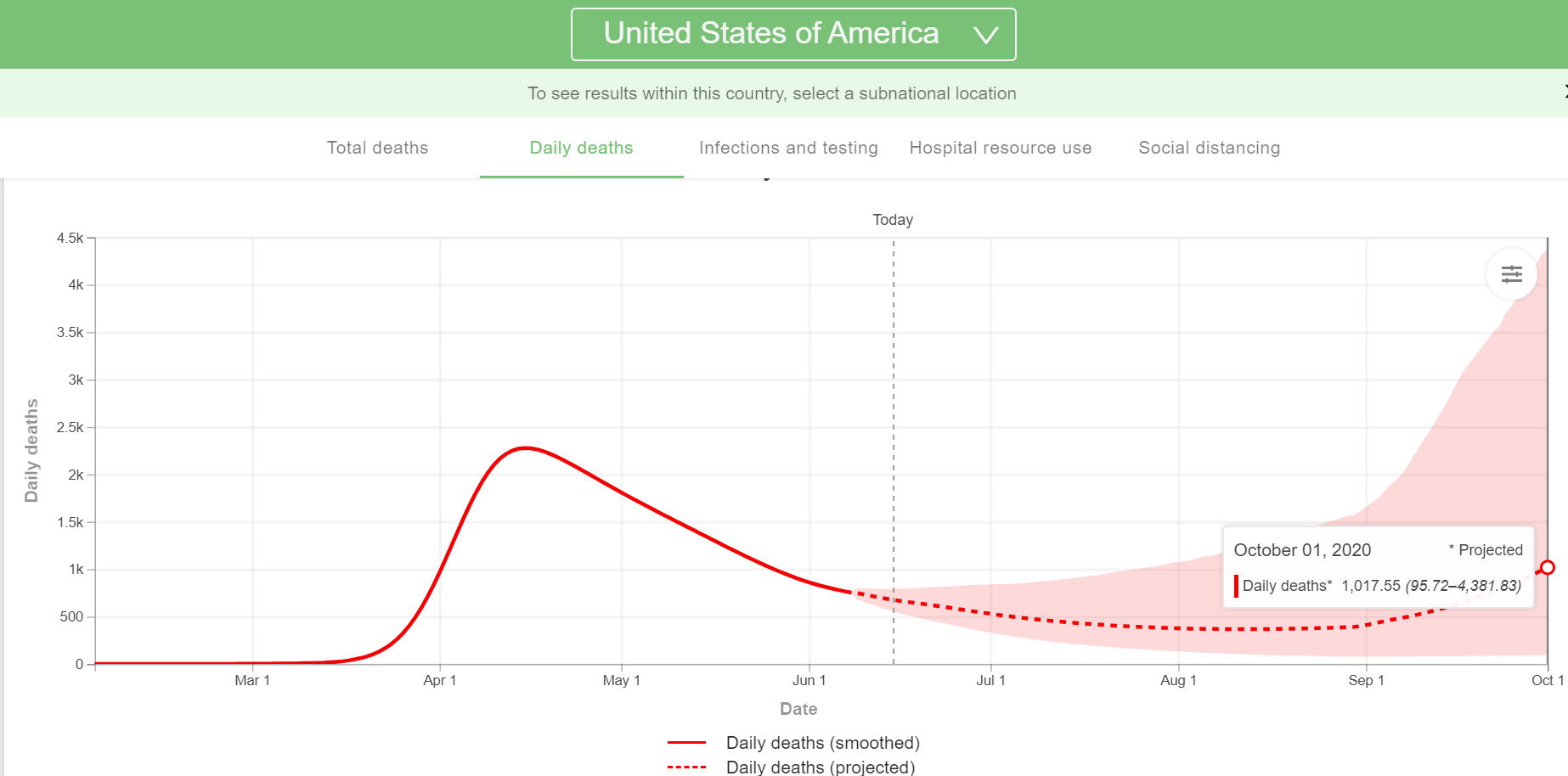

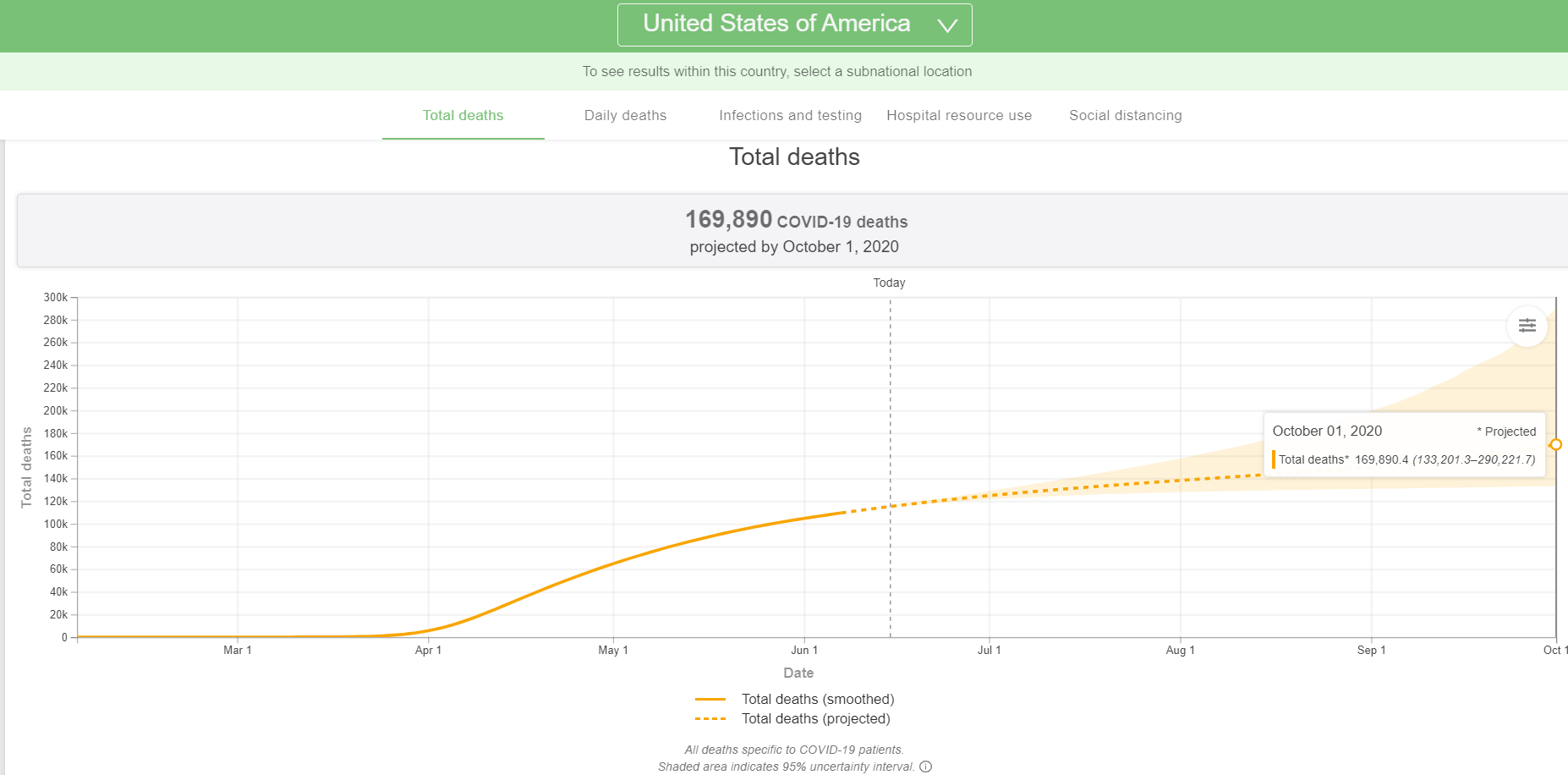

Mortality Estimates

(Source: IHME)

In terms of confirmed cases, the median consensus among experts is that there are about 8X more infections than confirmed cases. This implies

- August 1st daily confirmed cases (approximate Summer bottom): about 3200 to 5,700 (4,200 base case)

- October 1st daily confirmed cases (second wave): about 7,000 to 49,100 (21,500 base case)

The 2nd wave in September and October shows a base case forecast from IHME of about the same number of daily confirmed cases as we have now.

The upper bound on the estimate (with the 95th percent confidence interval) is for 49,100 cases which would be a new record if that turned out to be the actual figure.

- April 21st, 39,072 confirmed cases

So, the good news is that the second wave doesn’t appear to be set for the kind of 6 to 7X great cases wave that we saw in the 1918 pandemic and that experts warned was a worst-case scenario.

At least based on IHME’s model which only goes out to October 1st.

It’s possible that future updates, that extend the time horizon through Winter might indeed indicate far more cases than we saw in April.

Does this mean we’re going to lockdown again?

Most likely not.

- President Trump and Larry Kudlow (Senior Economic Advisor) have both said that’s not tenable.

- France and Canada’s leading experts have also said that even in second waves, neither country should lockdown again.

So, does that mean we can breathe easy? No, because it wasn’t government orders that caused most of the economic damage, it was people choosing/being forced to stay home (by schools closing) that the biggest cause of the economic devastation we’re now dealing with.

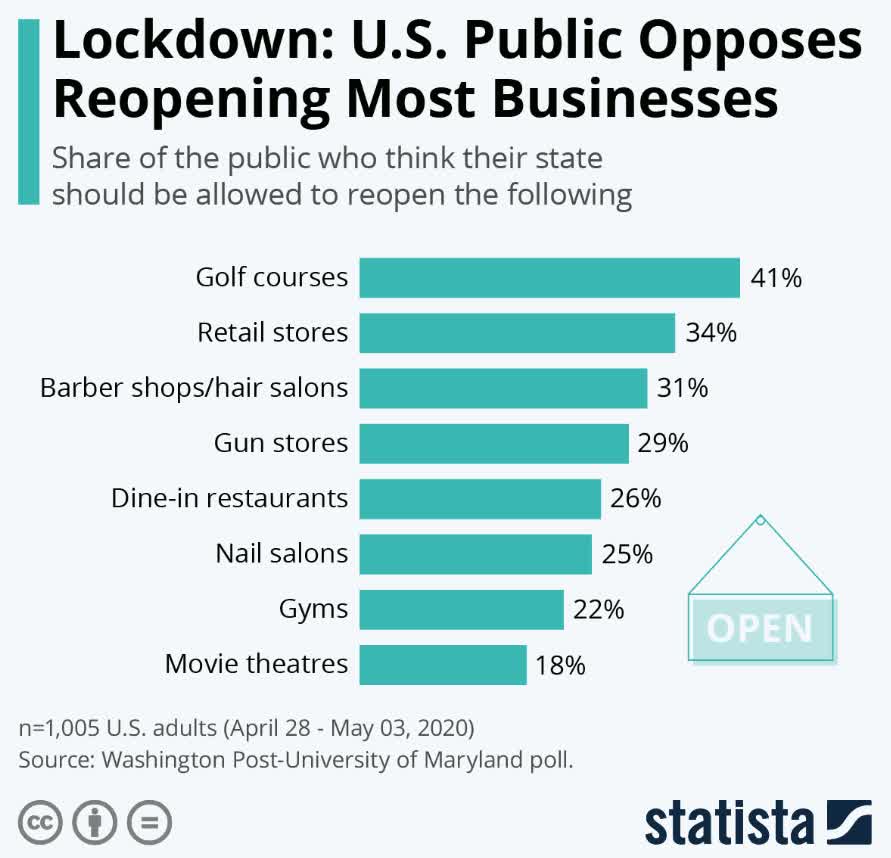

In early May, for example, the number of Americans who believed it was safe to go to the movie theater, gyms, and restaurants was under 26%.

Governors have the authority to declare lockdowns but even if none ever do again, if the second wave results in a record number of daily cases and deaths, guess who isn’t likely going shopping? Consumers.

Businesses can and likely will also restrict their operations if there are no customers and staying open requires running at a loss.

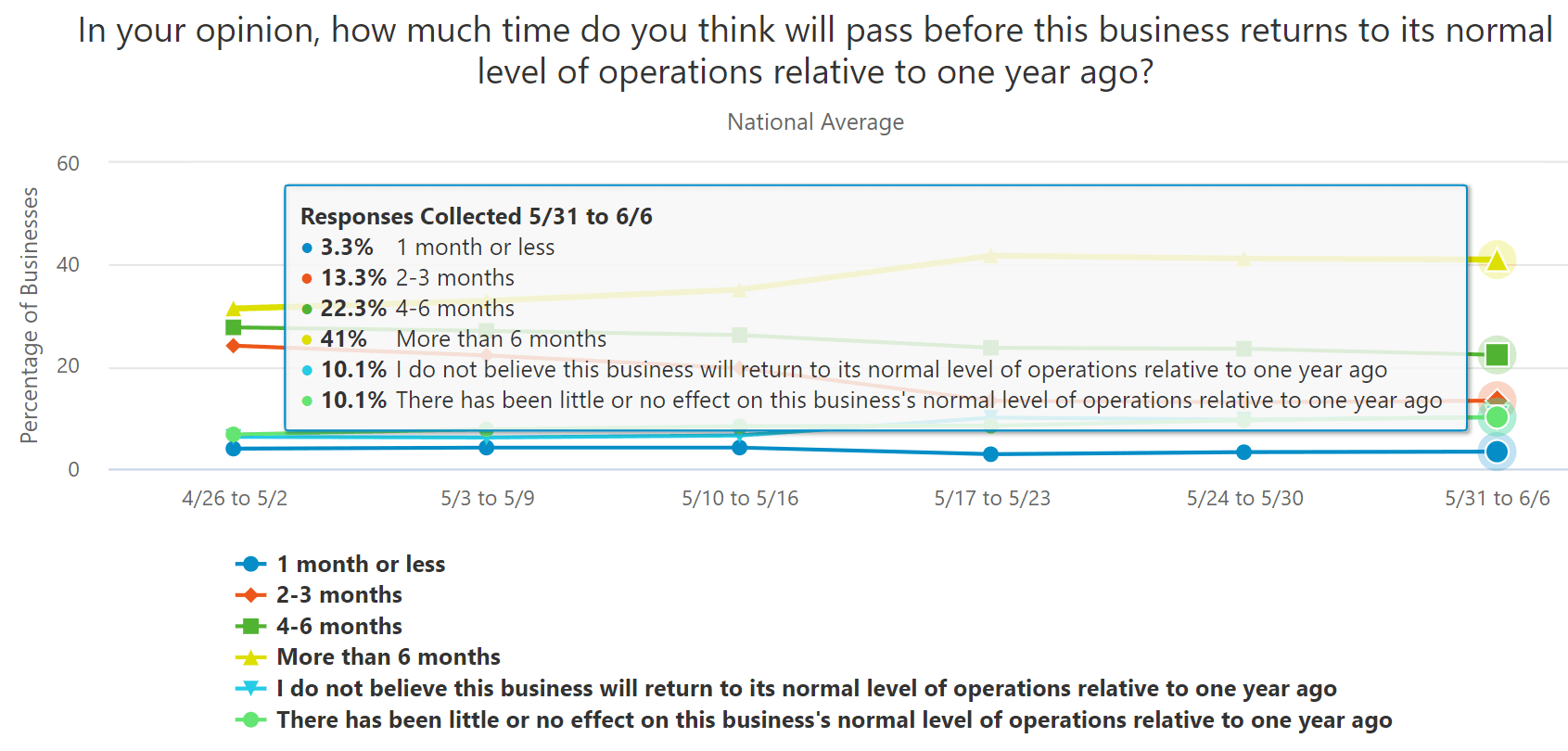

This is a demand shock recession unlike we’ve ever seen before and until the pandemic ends (likely in 2022 or 2023 according to experts) businesses won’t see revenues return to normal.

In the meantime, we have the economic realities to deal with that once the stimulus is over at the end of July unemployed workers will see a significant decrease in income ($600 per week).

Small businesses that took PPP loans will be kept afloat for a few months, but 31% of small businesses report having 30 days or less of cash on hand.

(Source: US Census Bureau)

20% of small businesses report not being able to pay the bills, meaning defaulting on rent, utilities, or loan payments.

Social distancing isn’t going to end fully until the pandemic does…in 18 to 24 months according to a study by the Center for Infectious Disease Research and Policy (CIDRAP).

The initial shock of the lockdowns is like an earthquake. We’re survived that and now all states have reopened to some extent.

However, as the saying goes, “it’s not the earthquake that can kill the most people, it’s the fires that come after.”

Our economy has been smashed into tinder and now there are tens of millions of potential fires in the form of a rising default and bankruptcy wave that might be approaching.

Don’t get me wrong, economists aren’t saying we’re headed for a Depression.

In fact, Ben Carlson has a wonderful article debunking the idea that we’re doomed to another Great Depression.

However, unless IHME is dead wrong about its model, and so are all the experts like Fauci and Dr. Thomas Friedan (former head of the CDC) about a second wave being likely, then most of the economic forecasts we see today are likely to be revised significantly lower.

Few economic forecasts factor in a second wave, because modeling such an event is so complex, and the error bars so wide, that it’s not very useful.

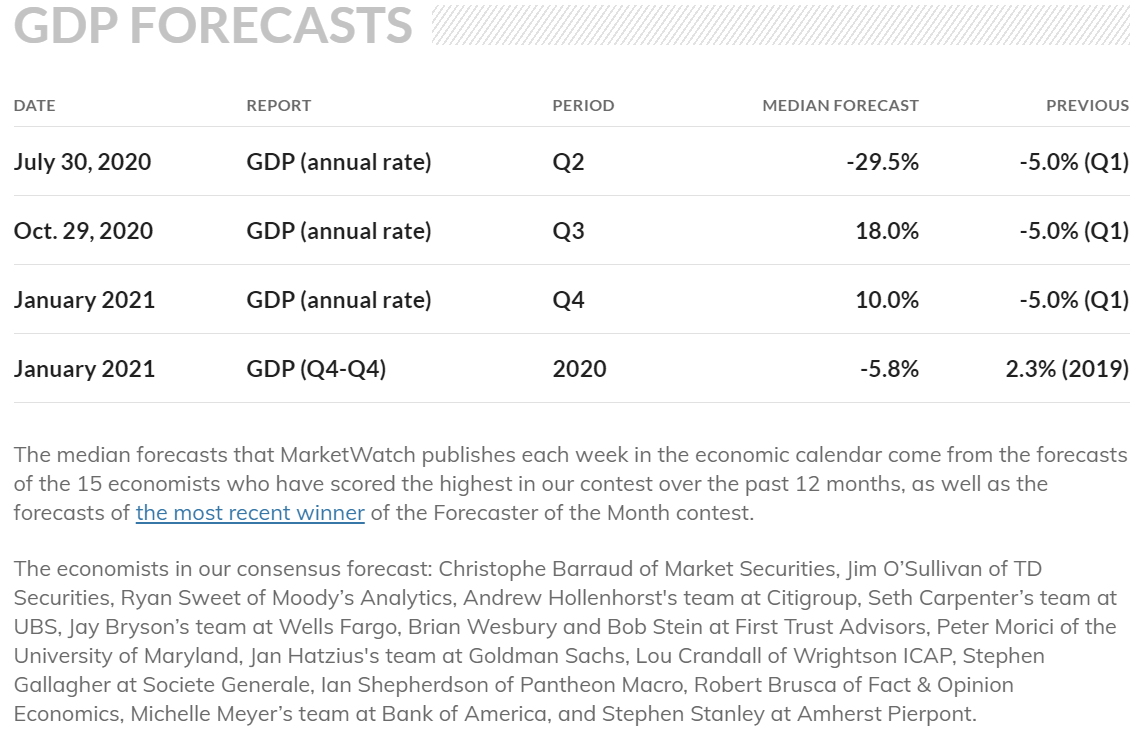

(Source: MarketWatch)

Thus, we get a blue-chip economist consensus that looks like this. A massive decline in Q2 followed by strong rebound growth in Q3 and Q4, though the full year’s growth would still be the 5th worst in recorded history.

Deutsche Bank is one of the few economist teams I know of that has modeled a second wave. What did they conclude?

- without a second wave, the US economy hits its pre-pandemic high in late 2021

- with a second wave, Deutsche estimates it would take two years longer for the economy (and unemployment) to return to previous levels (end of 2023).

Don’t get me wrong, for an economy that was smashed with a sledgehammer as ours was, even getting back to 4% unemployment by 2023 or 2024 (as the Fed median consensus estimates) would be a triumph.

But the stock market today isn’t priced for a likely second wave that the world-renown epidemiologists at the University of Washington’s Institute for Health Metrics and Evaluation are saying is coming…in just a few weeks.

The economic data we have now, which is incorporating every state now reopened, is showing that a swoosh shaped recovery is likely occurring.

The pending default/bankruptcy wave is the very reason that economists (including the ones at the Fed) expect a recovery to take years, not months or quarters.

And if the second wave causes consumers to retrench again?

If we get a second wave, it will be a depression,” the firm’s chief economist told CNBC’s “Trading Nation” on Friday. “We may not shut down again, but certainly it will scare people and spook people and weigh on the economy.”

Zandi defines a depression as 12 months or more of double-digit unemployment.” – CNBC

Then the swoosh shaped recovery could turn into a U-shaped one or a W “double-dip recession.”

America will recover from a second wave, or that there is no doubt.

However, hopes that a vaccine in early 2021, which Dr. Anthony Fauci says is still realistic is also not magic bullet investors can hang their hats on to levitate stocks from these historically high levels.

- surveys show that between 25% and 50% of Americans would not be willing to take a vaccine even if it were available.

A new vaccine has risks, including side-effects that parents might be especially wary of potentially inflicting on their children.

Some respondents to those surveys said they would require YEARS of post-approval safety data before taking a vaccine.

If 25% of Americans take that position, then we can still get to 75% herd immunity and 60% to 70% is the level experts believe is necessary to end the pandemic (in 2022).

New research indicates that if 70% of Americans wore masks (correctly) then we could also end the pandemic even without a vaccine.

However, if 50% of Americans refuse the vaccine when it becomes available? Then for all intents and purposes, the US epidemic will end when another 20% of the population gets the virus, a total of about 65 million people.

That doesn’t mean that we’d have 65 million confirmed cases since the median expert consensus is that there are eight actual cases for each reported one.

But that would mean that about 650K to 2 million Americans would die from this pandemic, given the 1% to 3% estimated total mortality rate.

Am I a pessimist? No, I’m a data-driven realist.

Am I selling all my stocks now ahead of a certain market crash?

Heavens know. My portfolio is 74% blue-chips and 24% cash/bonds.

Every day I am buying the same Dividend Kings’ daily blue-chip deal, for my portfolio, small amounts worth.

My daily buys are designed to match my savings rate. My bond/cash allocation is there so I can buy more aggressively on days like June 11th, when I and Dividend Kings bought two extra companies.

We have no intention of market timing and trying to guess where stocks are going in the short-term.

We merely have to be “approximately right” in the words of Warren Buffett.

(Source: imgflip)

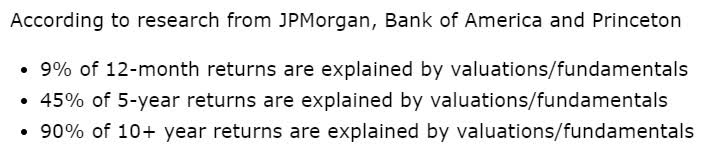

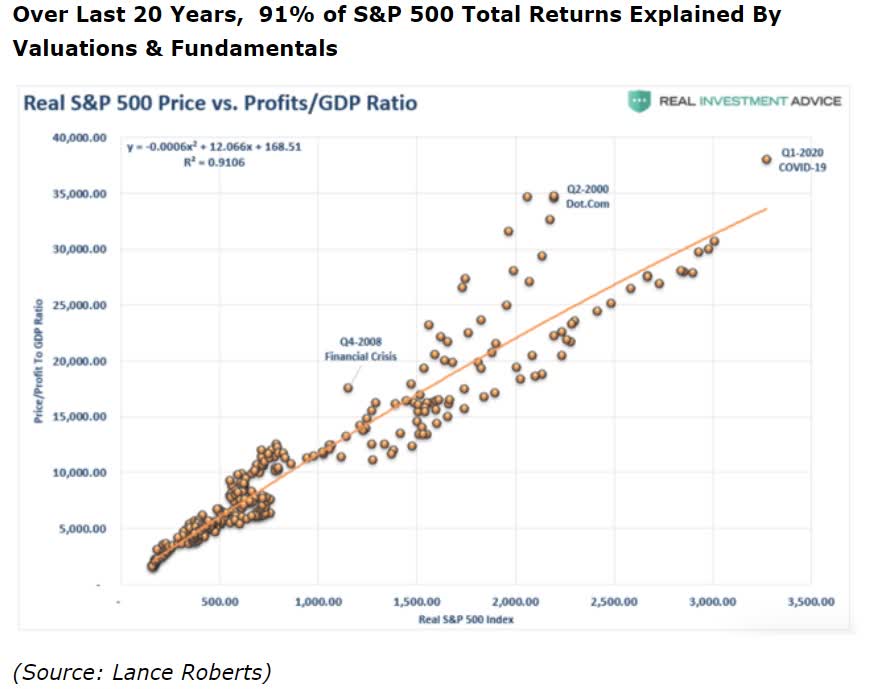

Because while stock returns are 91% driven in the short-term by sentiment and “animal spirits” over the long-term the reverse is true.

When you own shares of quality dividend-paying companies, bought at reasonable to attractive valuations, and held within a diversified and prudently risk-managed portfolio you don’t have to pray for luck with the market.

(Source: AZ quotes)

With a sound long-term approach based on sound time tested strategy and a motto of “quality first and prudent valuation & risk management always” you can make your own luck…and achieve your financial goals.

Want More Great Investing Ideas?

Do NOT Buy This Dip! Are you prepared for the bear market’s return?

7 “Safe-Haven” Dividend Stocks for Turbulent Times

9 “BUY THE DIP” Growth Stocks for 2020

SPY shares were trading at $313.01 per share on Wednesday morning, up $0.05 (+0.02%). Year-to-date, SPY has declined -2.18%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| Get Rating | Get Rating | Get Rating |