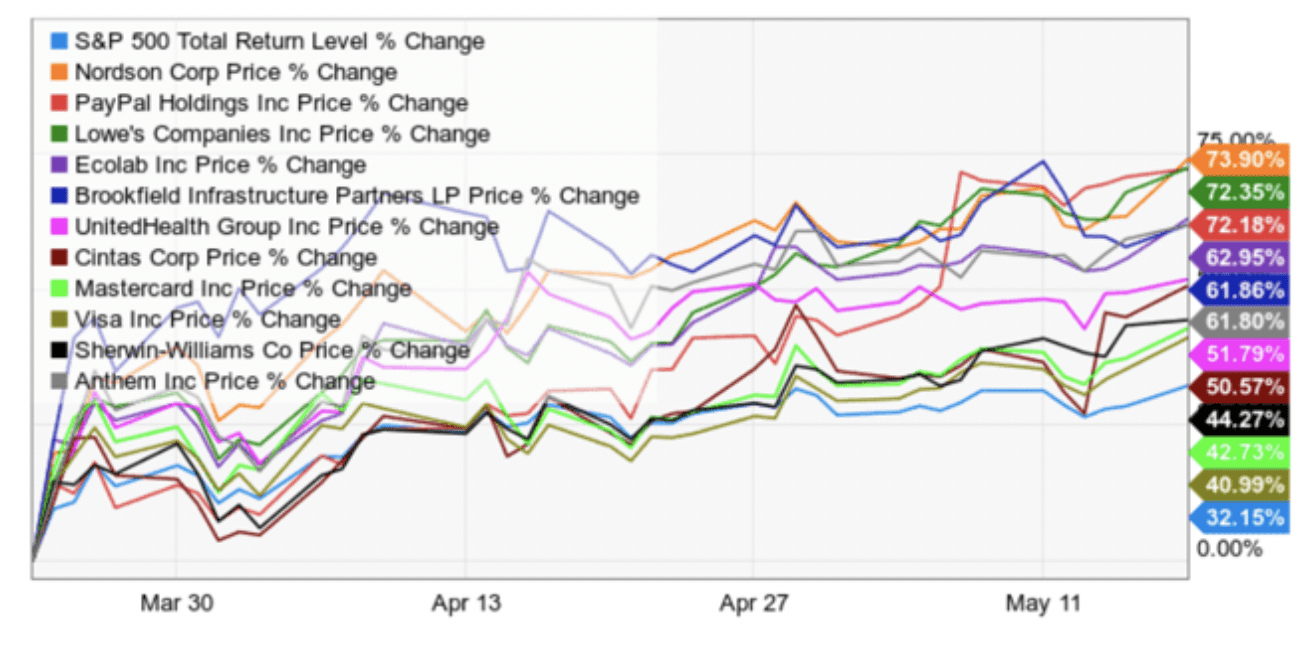

Optimism about restarting America’s economy and a faster than expected development of a vaccine have helped power the S&P 500 up and impressive 32% over the last six weeks.

S&P 500 and Dividend Kings Phoenix Portfolio Companies Since March 23rd

(Source: Ycharts)

Some blue-chip growth stocks, such as what Dividend Kings’ Phoenix portfolio bought in early March, have achieved far more impressive returns.

But of course, there is a big difference between optimism about how the economic restart could go, and how it turns out in reality. This has important implications for whether or not this red-hot rally can continue in the coming weeks and months.

So, let’s take a look at the initial data, to see whether or not the economic restart is going as well as the market hopes, and whether there are any indications of the dreaded and much-feared “second wave” of the virus.

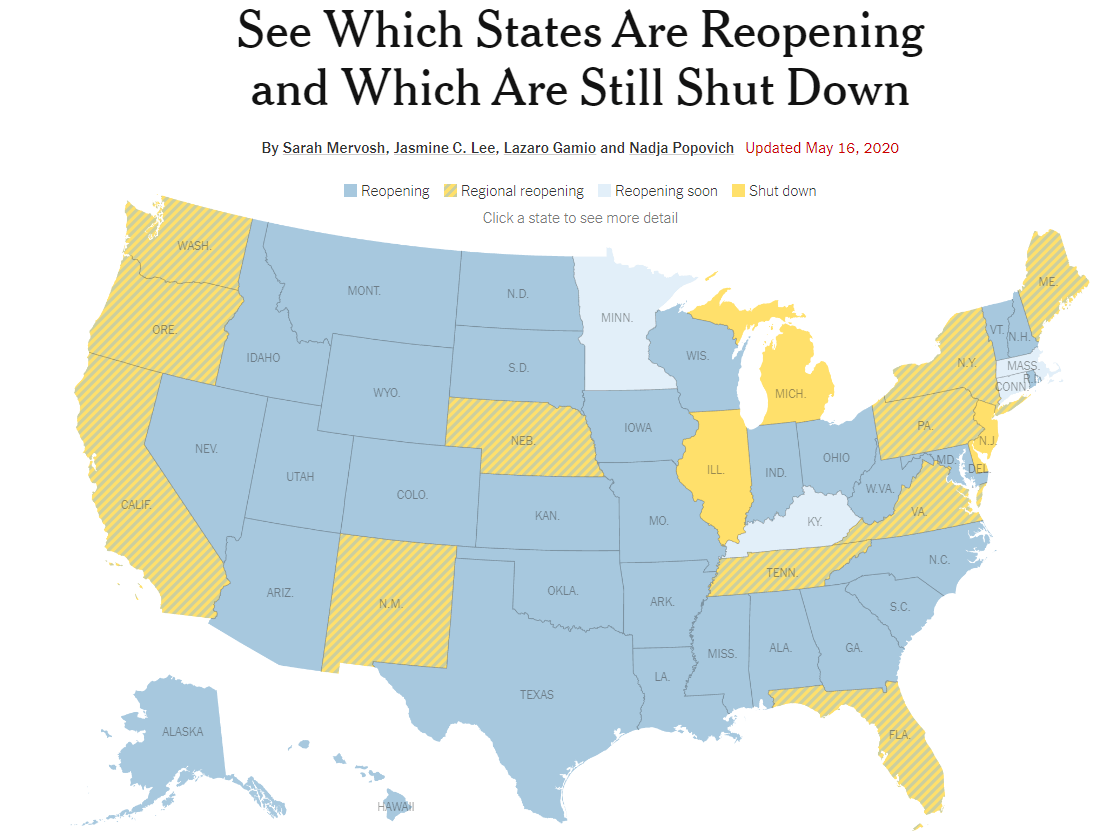

June 8th Is When All States Plan To Be In Phase 1

(Source: New York Times)

Already all states except for five have lifted their stay at home orders and at least partially restarted their economies.

- DE stay at home order expires May 31st

- DC lockdown order expires June 8th

- MI order expires May 28th

- NJ expires June 5th

- IL expires May 31st

- PR expires May 25th

The rest plan to enter phase one by June 8th or earlier.

Within three weeks the US will be on the road to recovery, or so the stock market rally implies.

The big question is, can we safely restart the economy without triggering a big spike in new cases and more lockdowns?

If some areas, cities, states or what-have-you, jump over those various checkpoints and prematurely open up without having the capability of being able to respond effectively and efficiently, my concern is that we will start to see little spikes that might turn into outbreaks,” said Fauci, director of the National Institutes of Allergy and Infectious Diseases.

“I have been very clear in my message — to try, to the best extent possible, to go by the guidelines, which have been very well thought-out and very well-delineated.” – Washington Post

The leading pandemic expert, Dr. Anthony Fauci, who Google Scholar reports as the 3rd most cited epidemiologist in history, says that states going too early is a major risk that could backfire economically (plus cost lives).

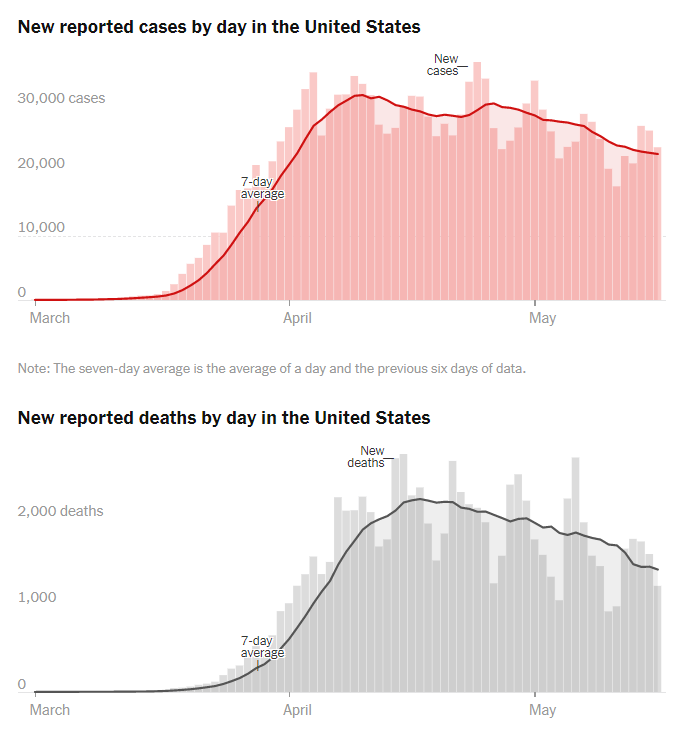

(Source: New York Times)

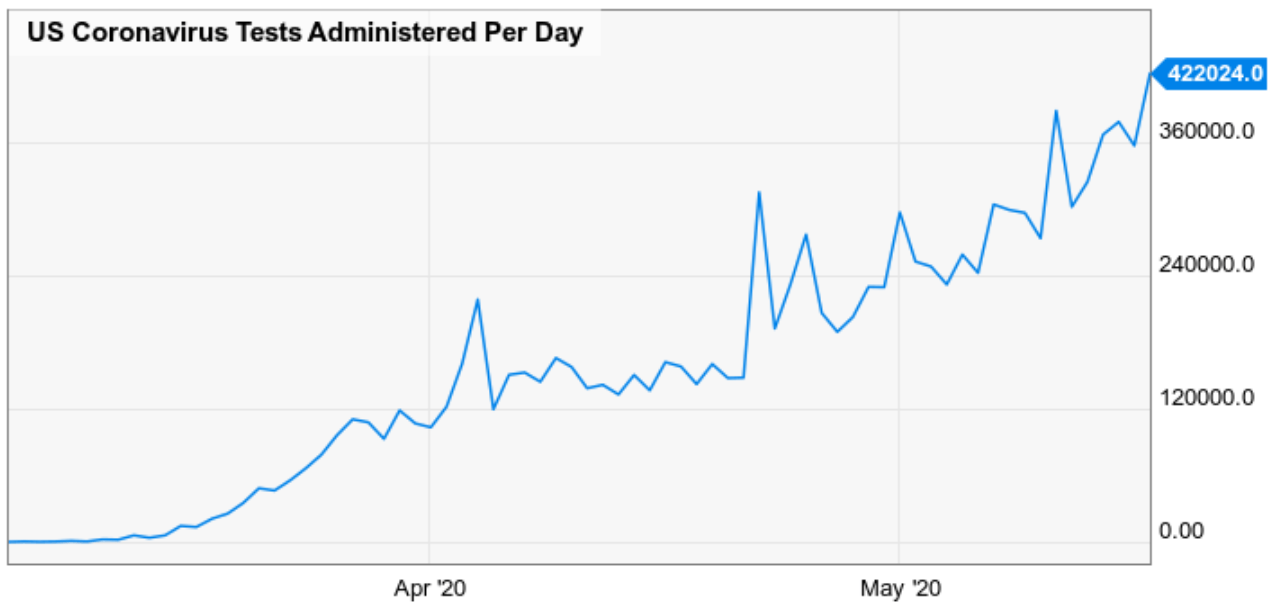

Thus far, we haven’t seen a big spike in cases at the national level, despite US testing ramping up aggressively in recent weeks.

(Source: Ycharts)

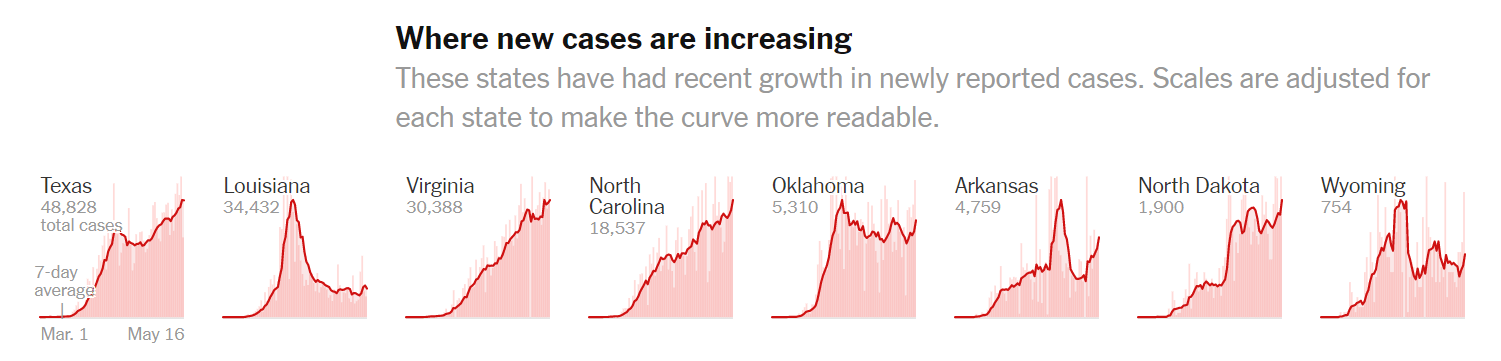

What about at the state level?

(Source: New York Times)

Eight states have seen a spike in daily new cases, and all of them restarted earlier than guidelines said was safe.

However, while that’s certainly worth watching, it’s important to note that 30 states have stable cases, and the rest have declining cases.

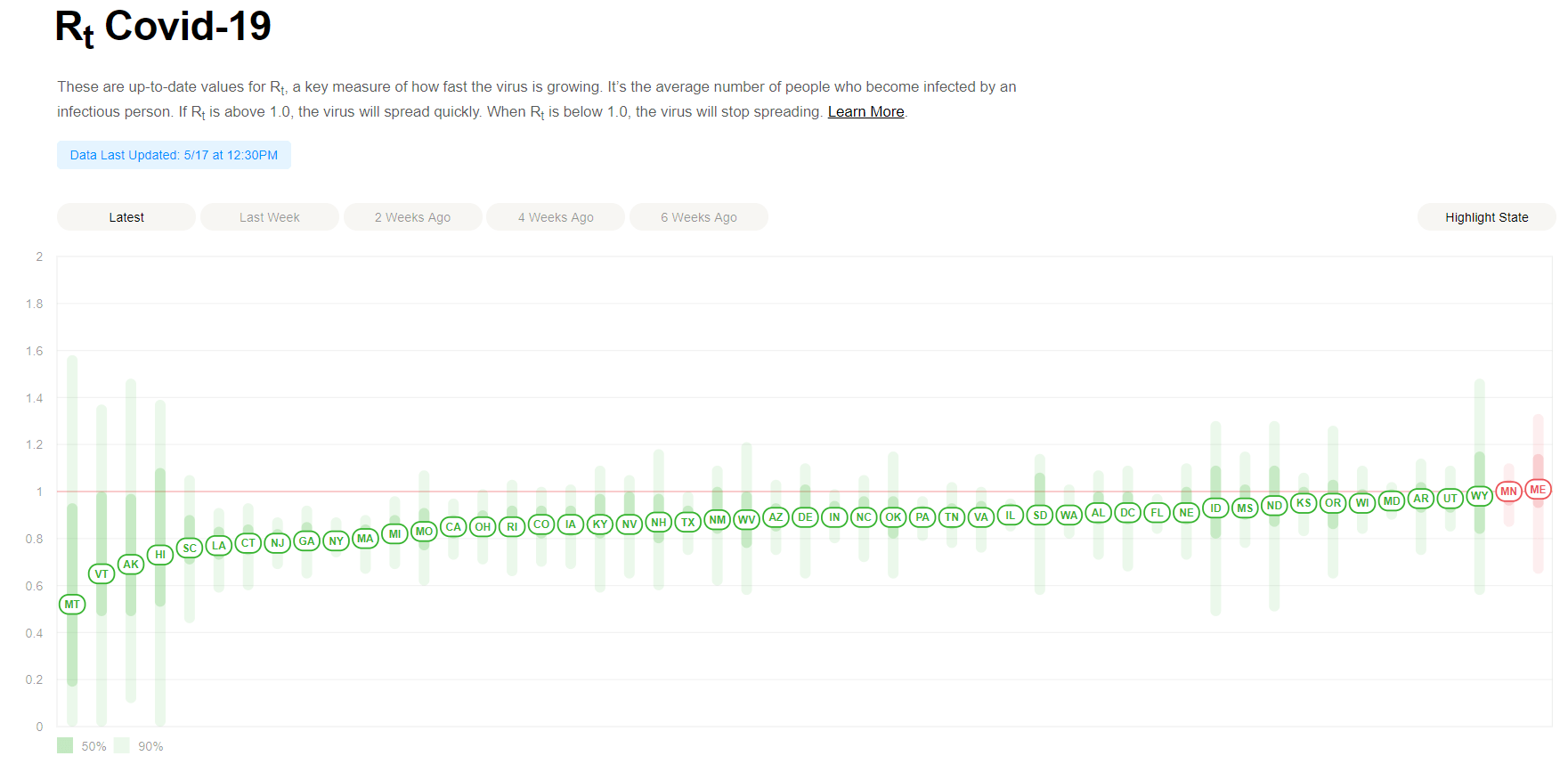

Effective Transmission Rate By State: May 17th

(Source: Rt.live)

In fact, despite opening earlier than many experts said was prudent, the effective transmission rate in all but two states is now below 1.0, meaning the virus is gradually burning itself out.

While it’s certainly true that lifting social distancing, restrictions have widened the error bars on those Rt estimates, so far, the daily case data is indicating no second wave has begun so far.

But just because the virus hasn’t started a resurgence doesn’t mean we’re out of the economic woods yet.

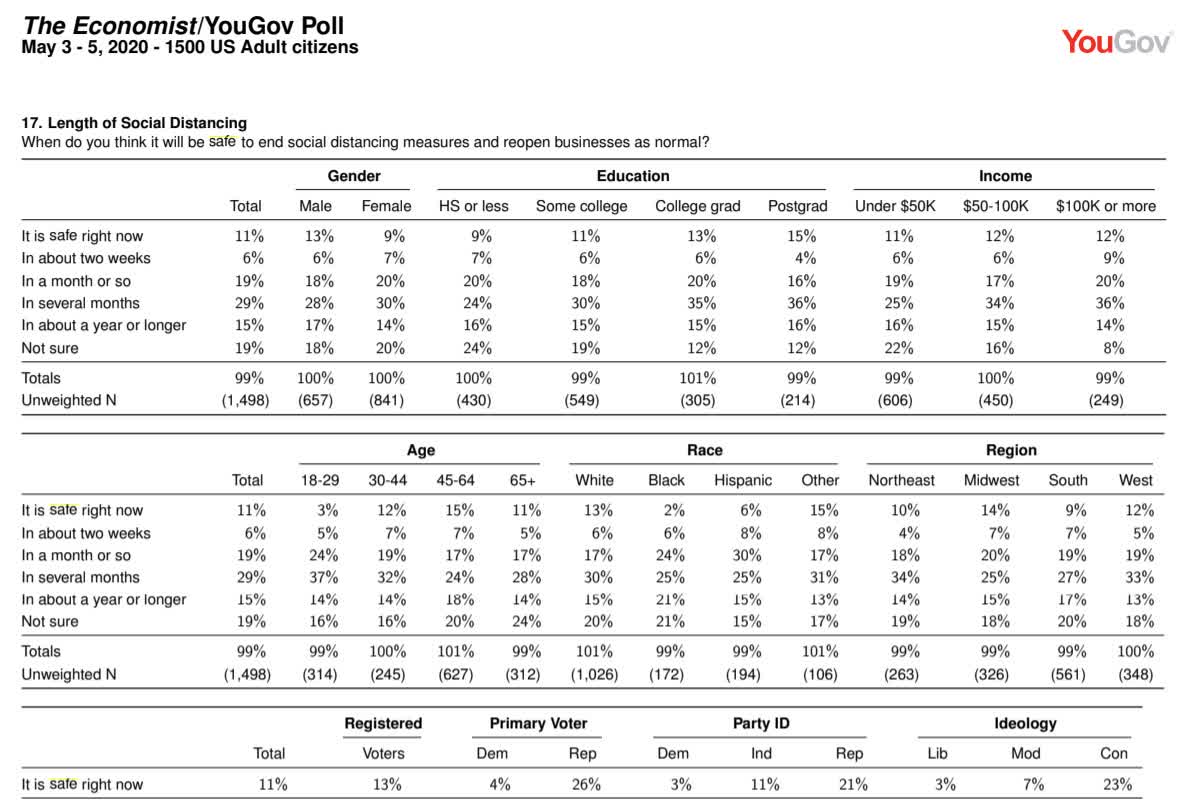

After all, most Americans say they don’t feel it’s safe to reopen yet.

(Source: Economist/Yougov)

In fact, about 65% of people say it won’t be safe to do so for several months.

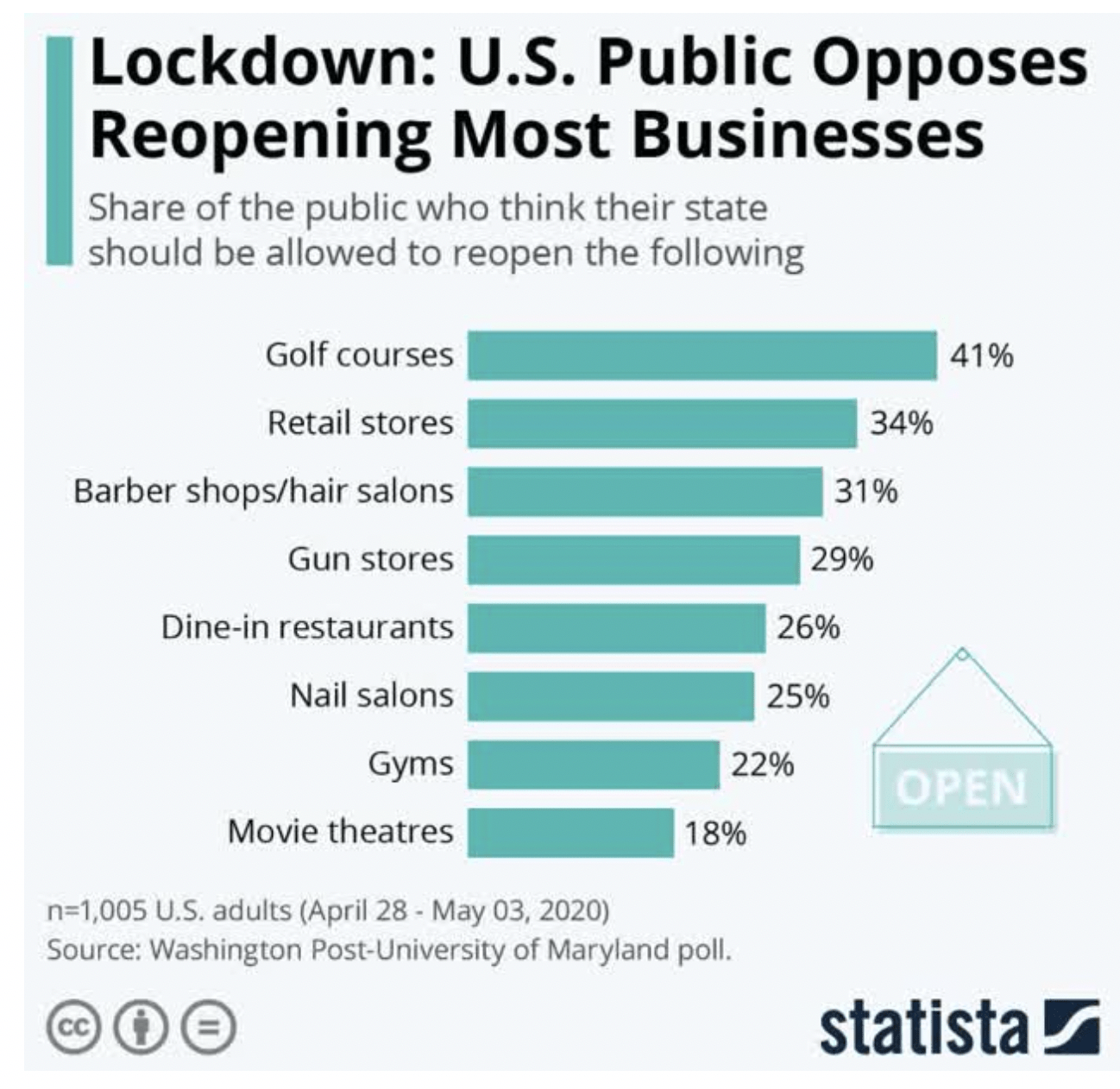

What’s more, Americans are telling posters that they don’t feel safe about going shopping. 44% feel uncomfortable grocery shopping, 67% don’t want to go to a clothing store, and up to 82% say that movie theater is a bad idea right now.

So perhaps the reason the virus hasn’t been surging post restarts is that Americans are just staying home, despite businesses being reopened and government lockdown orders being lifted?

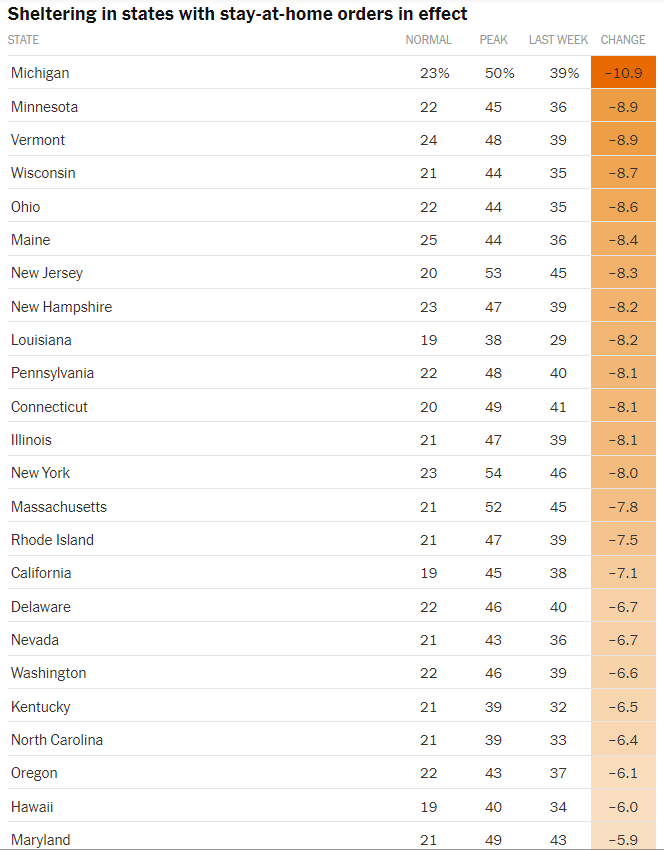

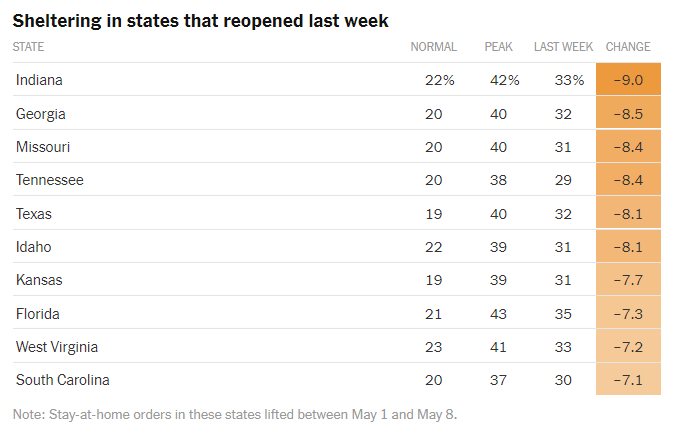

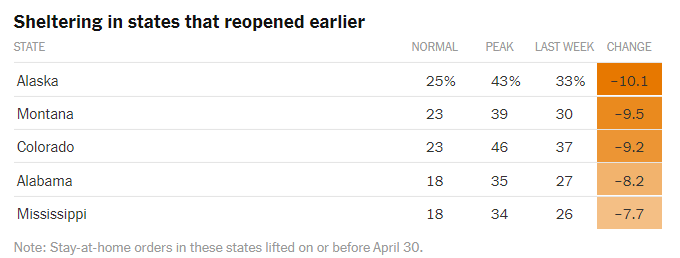

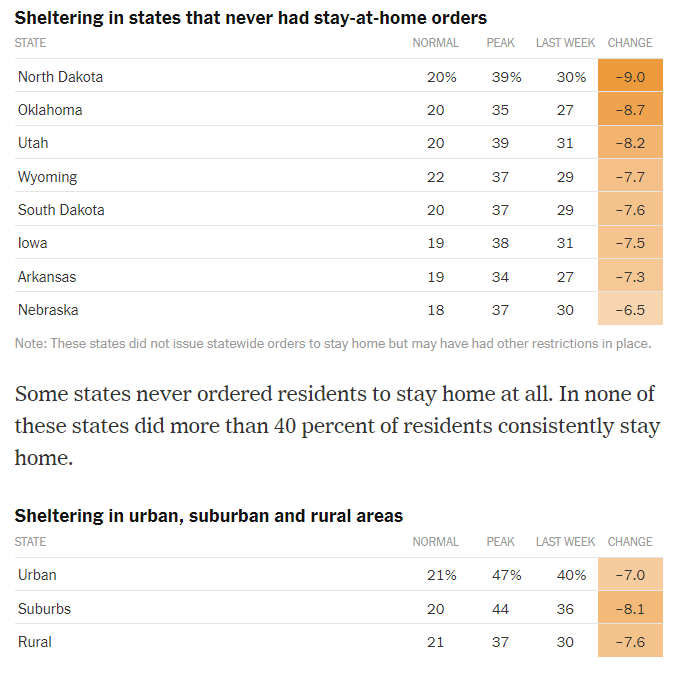

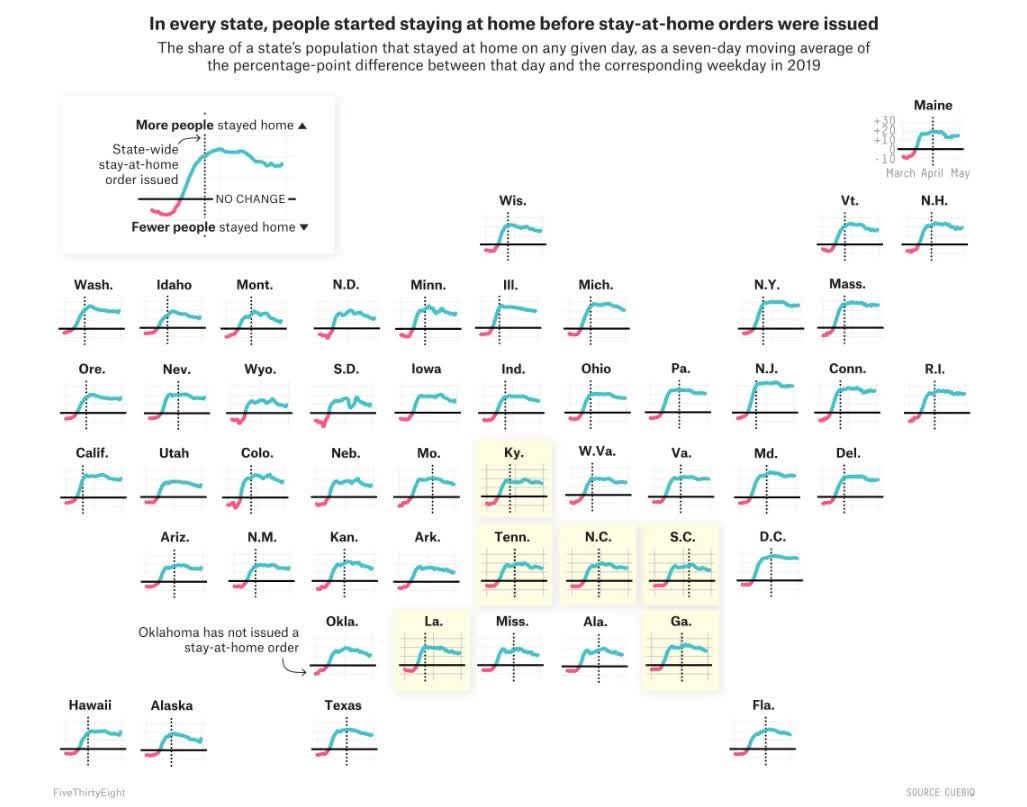

Despite Fears Of Second Wave Americans Are Starting To Leave Their Homes…And Apparently Go Shopping

(Source: New York Times, Cubiq)

The New York Times, using Cubiq smartphone tracking of 15 million people (who opted into being tracked with anonymized data) has confirmed that every single state has seen a significant decline in people staying home.

Red state or blue, rural or urban, locked down or never locked down, it doesn’t matter.

(Source: FiveThirtyEight)

On March 12th and 13th, every state saw the number of people staying home increase by 100% or more. But now Americans are journeying out again, or at least beginning to.

But are they actually going to newly reopened businesses? Perhaps they are just going to parks, going for walks, and hoarding money rather than spending it?

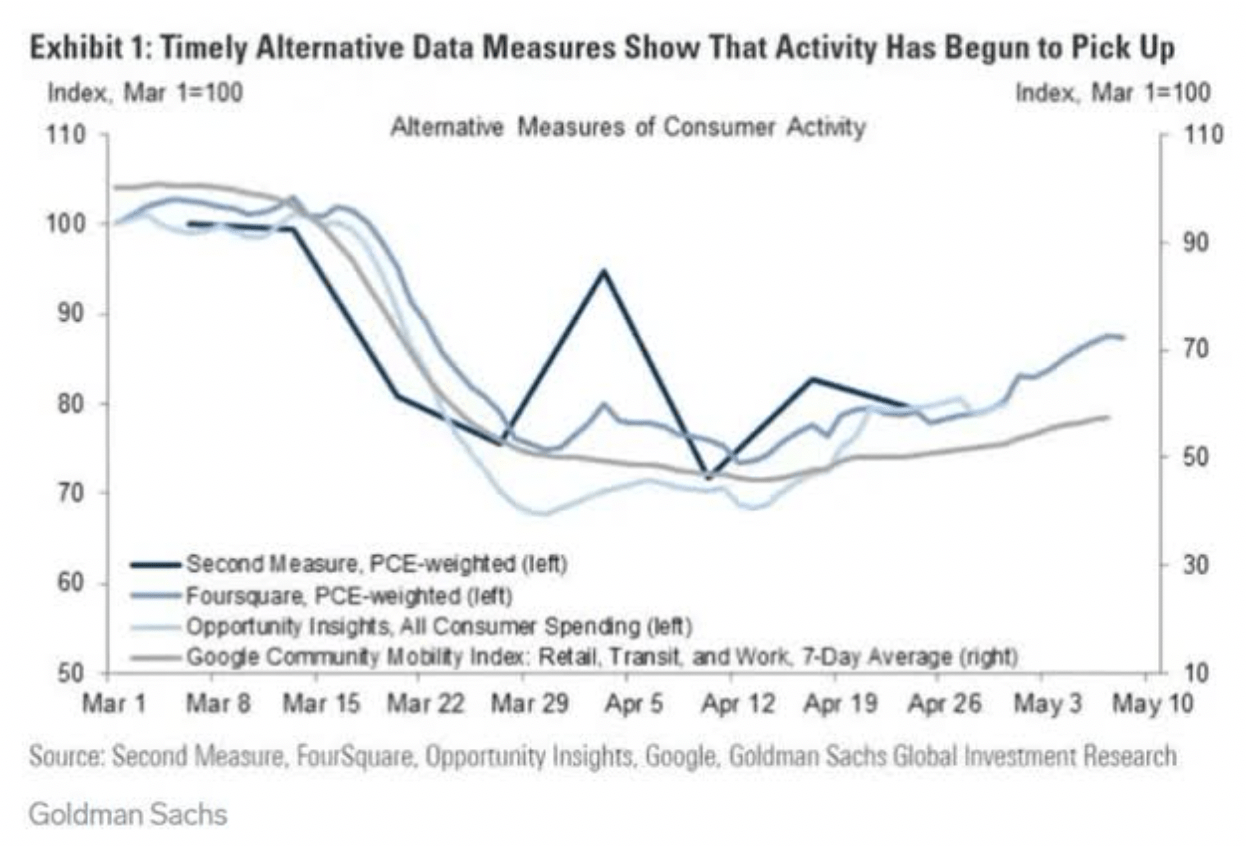

Goldman Sachs has used cell phone mobility data from four sources to confirm that it appears that consumers are going out more and shopping.

Mind you it’s not a torrid recovery by any means. But Goldman is saying that they think the US economy has bottomed, barring the second wave in the fall/winter.

The bank now forecasts a deeper quarter-on-quarter annualized hit to economic growth, with second-quarter GDP dropping 39% versus its prior 34% estimate. That will be followed by a faster recovery in the third quarter, with GDP jumping 29% versus its prior 19% estimate, Goldman said.

For year-over-year GDP growth estimates, the bank expects -12.6% in the second quarter, -7.3% in the third quarter, -5.4% in the fourth quarter, and -6.5% for 2020.

Goldman said it thinks the US economy is through the trough, essentially having bottomed in April. Alternative data from sources like Foursquare and the Google Community Mobility Index suggest consumer activity is starting to pick up.” – Business Insider (emphasis added)

A Good Start To The Recovery But Don’t Get Too Excited…Or Complacent

So, the initial data we have says that America’s restart appears to be going well.

There are no major surges in new cases, and national daily cases overall keep trending lower as the average transmission rate creeps down (about 0.01 per week).

However, while the economic data appears to have bottomed, it’s still too early to fully celebrate.

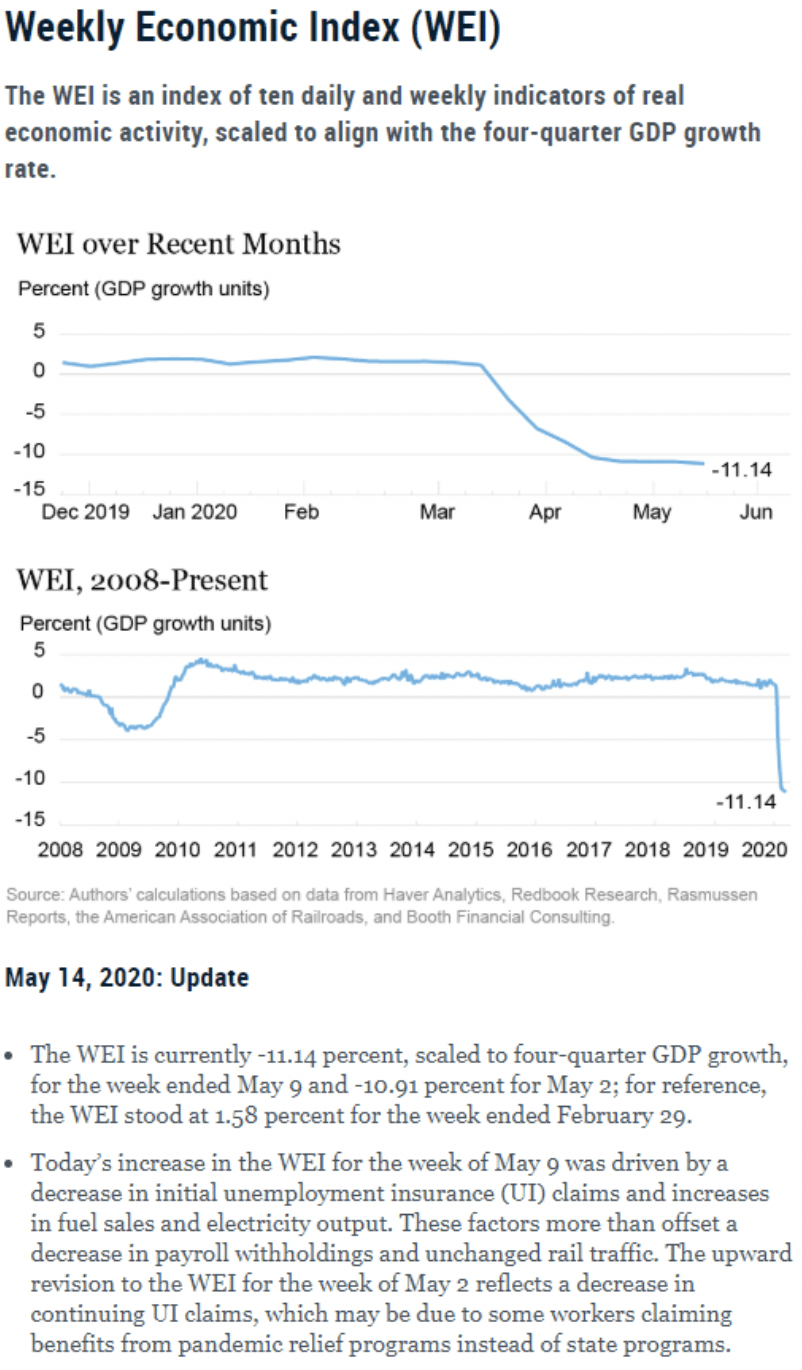

(Source: New York Fed)

The Weekly Economic Index tracks 10 daily/weekly reports to estimate how rapidly the economy is growing/contracting in close to real-time. On May 13th it hit -12% (-48% Q2 growth on an annualized basis).

It now reads -11.1% or about -44.5% Q2 growth.

Compared to the record low so far, that’s a 10% improvement, so a cause for cautious optimism.

But it’s still far from great as Jerome Powell just explained in his 60 minutes interview where he said he expects the economic recovery to take to the end of 2021 at least.

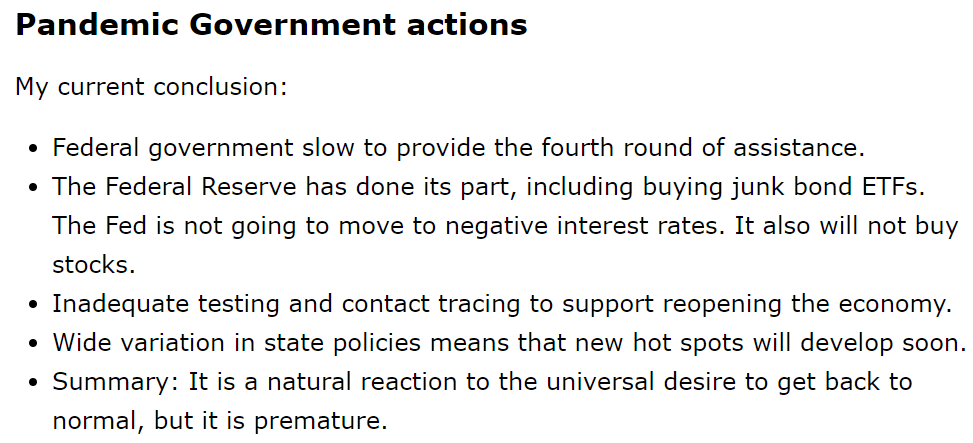

(Source: Jeff Miller)

Jeff Miller is a registered investment advisor, formerly President of NewArc Investments, and Seeking Alpha’s economic guru. Every week he combs through dozens of reputable economic sources to bring readers a summary of what the latest economic facts and data actually are.

As part of my own weekly pandemic/economic/earnings update for Dividend Kings, I use Jeff as one of my most trusted sources of economic news and analysis.

I also 100% agree with his conclusions about our current situation.

While it’s OK to celebrate good news, especially after the house of horrors we’ve seen over the last few months, we can’t get complacent.

Despite what the market rally of the last month might lead us to believe, we’re not out of the woods yet.

As Mr. Miller wrote this week “there are no short-cuts” a sentiment shared by both Chairman Jerome Powell and Dr. Anthony Fauci.

This pandemic is expected to last 24 to 30 months in total, and we’re in month five.

Not just could we get a second wave in fall/winter 2020, but unless we get enough supply of the vaccine in 2021, we might get a third wave as well.

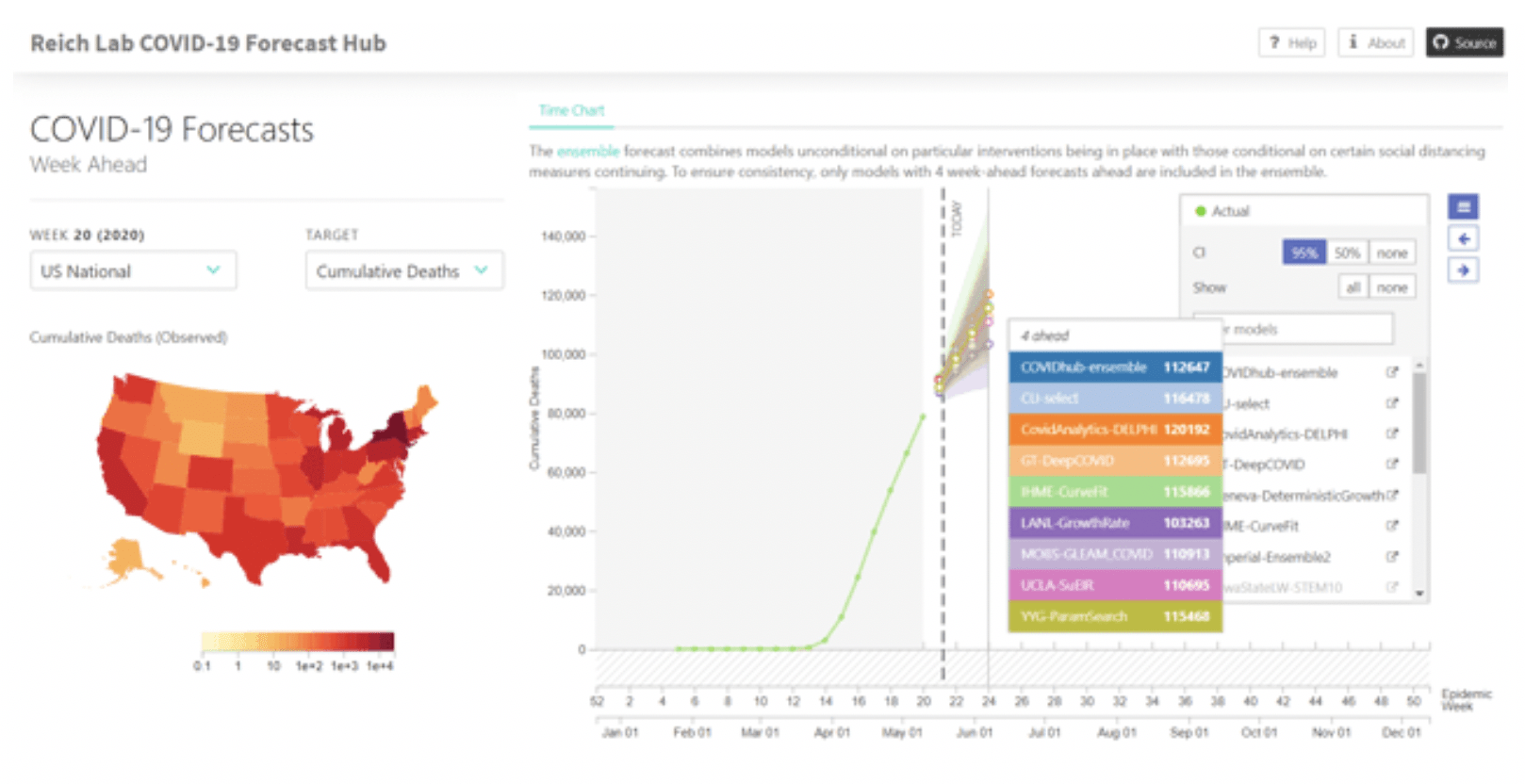

(Source: University of Massachusetts Amherst)

We also can’t forget the human toll of this pandemic. The consensus of all COVID-19 models estimates 112K deaths within four weeks.

The expert consensus (from the survey conducted by the U&M Amherst) is for about 250K US deaths by the end of 2020.

In my home state of Minnesota, our local model (from the University of Minnesota and world-famous Mayo Clinic) is forecasting 29K deaths by the end of 2020.

For context,

- 250K US deaths would be 0.75% of our population (and 125 9/11s)

- 29K MN deaths would be 0.5% of our population (and about 15 9/11s)

- These are estimates for the end of 2020, but the pandemic isn’t expected to end until early to mid-2022 (when 70% of the US has immunity)

The point is that there is a lot that can, and indeed, will go wrong before, what the former head of the CDC calls “World War C” is over.

The victory was never in doubt, nor the eventual economic recovery.

Only the road to victory and the duration of the economic recovery is the real question, which is what we all desperately want to know the answer to.

Unfortunately, the only thing we can know with high confidence is that the road to victory will likely be a long and winding one, involving a high cost in both blood and treasure.

The economic recovery that has hopefully started already, and will ramp up steadily in the coming months, will likely take years before many Americans can rebuild their shattered lives.

Sadly, some never will. I’m not trying to be a Debby downer and throw cold water on the valid reasons for cautious optimism.

But I do think that, as we approach memorial day weekend, we should take a moment to remember the already many casualties of this war. A war we’ve all been drafted into, and that is far from over.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

REVISED 2020 Stock Market Outlook– Discover why there is more downside ahead and the Top 10 picks for the bear market.

SPY shares were trading at $297.11 per share on Wednesday morning, up $5.14 (+1.76%). Year-to-date, SPY has declined -7.15%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |