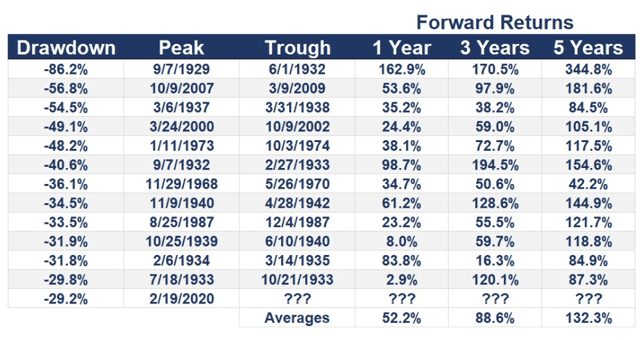

It’s been a hellish month for most investors, with the S&P 500 falling into the fastest bear market in history thanks to the coronavirus pandemic grinding the global economy to a halt.

(Source: Ycharts)

It’s hard to believe that just over a month ago, no one was majorly concerned about this virus and stocks were at all-time highs.

Today the market is trapped in its fastest bear market ever and many investors just want to know when the pain will stop.

There is bad news and good news to report on that front, which has important implications for all of our portfolios in the coming years.

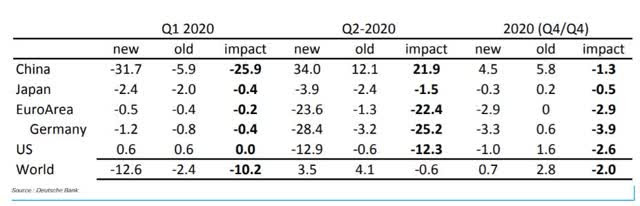

Economists Are Racing to Revise Economic Forecasts…In The Wrong Direction

In recent days, as 23% of the US population locks down to combat the pandemic, economists have been racing to lower economic expectations for Q2.

Deutsche Bank has cut its US Q2 forecast to a mind-blowing -12.9% growth. For context, the record for the single worst quarterly YoY growth is 1958’s -10%.

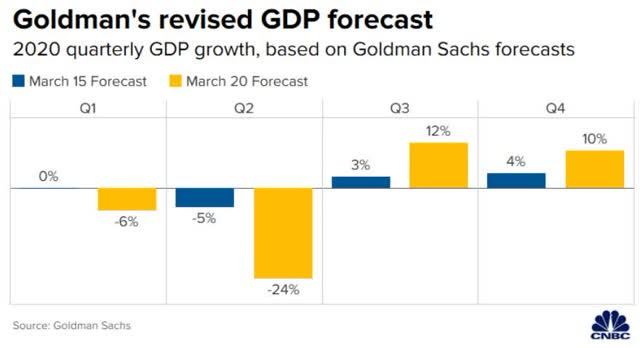

Goldman Sachs’ forecast is even more bearish, falling from an already bad -5% last week to -24%. For context, the peak GDP decline during the Great Recession was -5.1%.

But Morgan Stanley has even worse news for Americans.

As the coronavirus pandemic worsens and keeps people across the country at home, Morgan Stanley expects personal consumption expenditures to decline 31% as consumers cut back on travel, dining out, and other services. The extreme contraction will push the unemployment rate from current historic lows to an average 12.8%, one of the highest on record since the 1940s, according to the note.” – Business Insider (emphasis added)

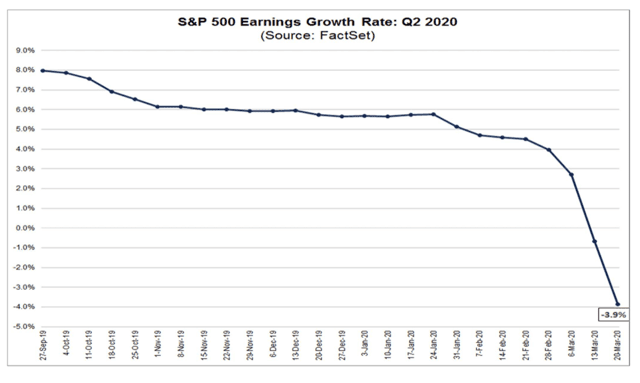

For context, the previous range for unemployment, just last week, was 6.3% to 10.6%, and it’s now as high as 12.8%. It’s no surprise that corporate earnings growth forecasts have been falling at an accelerating rate.

For the full year, Merril Lynch now forecasts -16% EPS growth for the S&P 500 but admits that this is an educated guesstimate given we don’t yet know how long the pandemic will last.

So it’s not surprising that stocks have swan dived off a cliff.

But in the name of preparing readers for the worst realistic short-term possibilities, to immunize you from potential panic in the coming weeks, I feel I should warn you that even these pessimistic forecasts might be overly conservative.

The US Is Potentially Headed for -50% GDP Growth And 30% Unemployment

Fed’s Bullard: Coronavirus shutdown is not a recession but an investment in survival

In normal times massive unemployment and a collapse in economic output would be tragic.

This time, as the coronavirus cloisters millions of Americans and shuts down the U.S. economy, it should instead be saluted as an investment in public health that lays the groundwork for a rapid rebound.

That is the view of St. Louis Federal Reserve President James Bullard, who argues that a potential $2.5 trillion hit coming to the economy is both necessary and manageable if officials move fast and keep it simple. It may seem an unconventional view in a moment of global anxiety, but Bullard argues the shutdown measures now being rolled out are essential to shortening the course of the pandemic.

They must also be coupled with massive federal government support to sustain the population through its coming isolation and prime the economy to pick up where it left off…

No arguments about bailouts or “moral hazard” – the sticky issue of publicly funded rescues of bad actors.

And, above all, when the losses are tallied, don’t call it a recession.

Recessions are the ordinary – even predictable – contractions in activity that mark the end of normal business cycles. Bullard, who has earned a reputation inside the Fed for a penchant to rethink problems and reframe debates, said this is anything but.

“Frame this as a massive investment in U.S. public health,” Bullard said in a Friday telephone interview.” – CNBC (emphasis added)

The president of the St. Louis Fed thinks that GDP growth might hit -50% in Q2, with unemployment peaking at 30%.

Bullard’s ballpark estimate is that unemployment could hit 30%, higher than in the Great Depression and three times more than the 2007-2009 recession.

Output in the second quarter could be half the norm, a hit of about $2.5 trillion.

That is unavoidable if the virus is to be contained through “social distancing” or government orders to stay at home…

Bullard said the “core aim” can be kept simple: “keep everyone, households and businesses whole through the second quarter.” Do it with a quick expansion of unemployment insurance to cover lost wages, and through grants and loans to business to cover losses from “unemployed” capital.

From a macroeconomic standpoint, he argues, it is a tractable problem. Again using back of the envelope math and a 30,000-foot view, he said perhaps half a trillion dollars of lost output will be accounted for by necessarily lost consumption – all the movie tickets and clothes no one buys and trips people will not take.

As to the other $2 trillion, Bullard said the federal government should borrow and distribute it to people and business.

“That is completely feasible,” in service of limiting economic damage, he said. “This is a planned, organized partial shut down of the U.S. economy. We are throttling back output on purpose to meet health guidelines… Transfer income to affected households.”

“Call it pandemic relief,” Bullard said. “Get transfers to businesses that are affected heavily, and come out on the other side. Identical economy. Produce the same goods as before.”

The good news is that the Federal Government is prepared to combat this unprecedented slowdown through $2 trillion in stimulus as well as infinite QE from the Fed (one of seven emergency plans the Fed is enacting).

Never in history have countries voluntarily shut down to combat a pandemic.

Is the St. Louis Fed president possibly right about 30% unemployment that would require a staggering 50 million Americans to lose their jobs over just a few months?

Recent data says Bullard may be right in his estimates.

- SurveyUSA Polls shows 9% of Americans unemployed already, vs 1% last week (potentially about 13 million job losses in a week)

- Goldman Sachs estimates 2.4 million job losses last week (before CA, NY, CT and IL lockdowns went into effect)

- Bank of America estimates job losses last week might have been 3 million

- April job losses estimates range from 500K to 5 million

- 14 million travel/leisure jobs are at risk, 80 million total US jobs at risk according to Moody’s (50% of all jobs)

- Moody’s is currently estimating 10 million total job losses (vs 8.8 million in Great Recession) by the time this is over

- In May, Morgan Stanley estimates 17 million job losses, more than double the Great Recession’s total losses in a single month

But while these forecasts are truly horrifying, it’s important to realize there is good news as well.

The Light at the End of the Tunnel

As Bullard pointed out about $500 billion in US GDP will likely be lost forever due to the shutting down of so much of the US economy.

However, the Fed has just confirmed infinite bond buying to keep credit markets liquid and the $2 trillion stimulus bill is designed to replace 80% of the lost output.

That stimulus is basically designed to allow the US to beat the virus in four months (China’s lockdown took just two) and then allow for record-setting recovery.

As the coronavirus outbreak eventually subsides, Morgan Stanley expects that consumption will resume at its pre-virus levels and that the economy will bounce back, growing 29.2% in the third quarter. That will stabilize to a 3.3% annual growth rate in 2021, a faster pace of recovery than was seen in 2008, according to the note.” – Business Insider

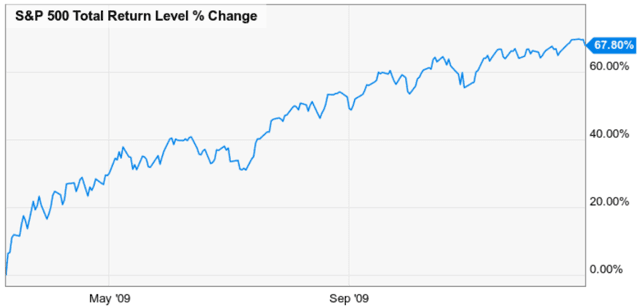

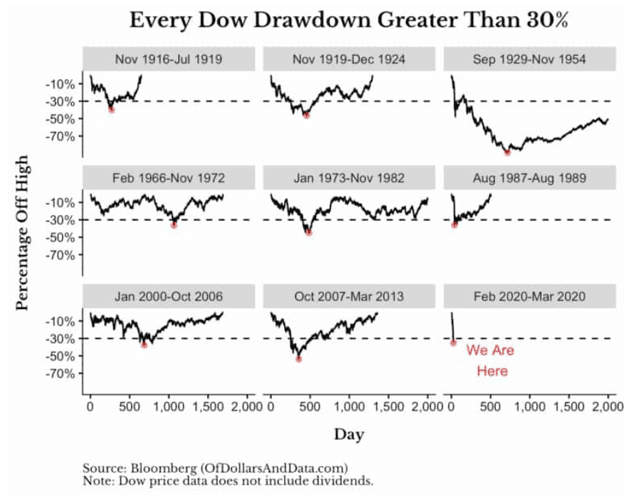

Ritholtz Wealth Management’s CEO Joshua Brown has been warning his clients about “record-setting growth down and then back up.”

His colleague Ben Carlson, recently said in the “Animal Spirits” podcast that once the market finally bottoms, we’re likely to see a “historic, face-ripping” rally.

What a “Face Ripping” Rally Looks Like

(Source: YCharts)

What about all the doomsday preppers gleefully jeering that the collapse of civilization they’ve been stockpiling for is now at hand? That a Great Depression is now upon us and America is finished?

- In the Great Depression, the Fed was RAISING Interest Rates

- In the Great Depression, Congress was cutting spending to balance the budget

- In the Great Depression, FDIC insurance didn’t exist, so when banks failed millions lost their life savings

Today’s economic world looks nothing like 1929’s, and thus the probability of this becoming a protracted depression is relatively remote.

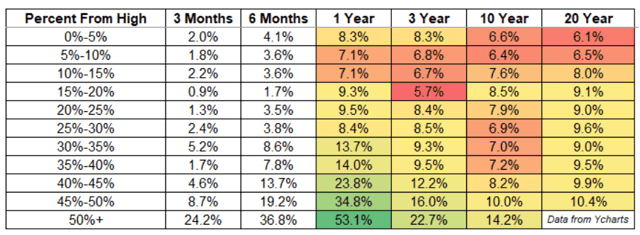

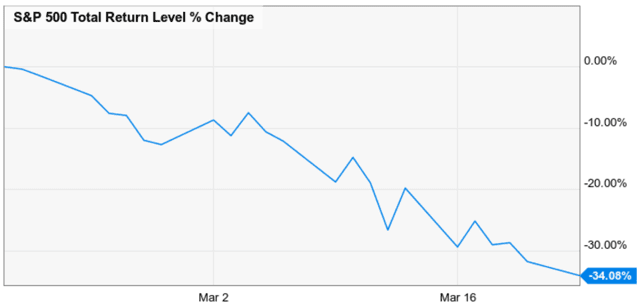

What’s far more likely is stock returns like this.

The Bigger the Decline the Higher the Future Returns

(Source: Michael Batnick)

Forward Returns From Bear Market Bottoms

(Source: Ben Carlson)

Ok, but that’s if you bought at the bottom, what if your portfolio has been pummelled by this bear market and you’re sitting on a mountain of losses?

Here’s Ritholtz Wealth Management’s chief data scientist, Nick Maggiulli explaining the good news for shell shocked investors.

So, if you think the market recovery will take:

- 1 year, then your expected annual return = 50%

- 2 years, then your expected annual return = 22%

- 3 years, then your expected annual return = 14%

- 4 years, then your expected annual return = 11%

- 5 years, then your expected annual return = 8%”

The average bear market, measured from peak to new record highs takes three years. The longest bear markets, created by shocks like the Financial Crisis, which hamper recoveries, take five years.

If you are buying stocks today, then even if it takes five years for the market to hit record highs you’ll achieve the market’s historical returns over that time.

And if the same economists forecasting mind-blowing GDP declines in Q2 (like Goldman and Morgan Stanley) are right about the speed of the recovery?

- Goldman’s 2020 year-end S&P 500 forecast: 3200 (41% rally off today’s price)

- Merril Lynch 2020 year-end S&P 500 forecast: 3100 (36% rally of today’s price)

Is it possible that these analysts are wrong? You bet. But given that China beat the virus in two months of lockdown, and that Italy’s lockdown is starting to show signs of stabilizing that country’s daily case growth, I’m cautiously optimistic.

Just as the stock market rebounds faster the deeper the plunge, so too is the expectation for this economic recovery as long as we can restart the US economy within a few months.

- Goldman -24% Q2 growth, +12% and +10% growth in Q3 and Q4

- Morgan Stanley -31% Q2 growth, +29% growth in Q3

What if Bullard is right and we end up growing at a shocking and likely never to be seen again -50%? Well if the Q3 recovery is proportional to what Goldman and Morgan Stanley are forecasting then 25% to 45% Q3 growth might be coming.

Do you think that might be enough to set off a “historic and face-ripping” rally? I certainly do.

Does that mean that stocks have bottomed? Nope. We could easily fall another 10% to 30% more, as the tsunami of horrible news hits us in the next few months.

But that’s why I don’t advocate market timing, such as going “all in” at some supposed bottom.

Rather steady, staged buying of top quality companies, at today’s reasonable to attractive levels, while owning enough cash equivalents/bonds to ride out however long this bear market lasts, is the prudent course of action.

(Source: Imgflip)

Want more great investing ideas?

Buy the Bounce? Or Sell the Bounce?

Reitmeister Total Return portfolio – Discover the portfolio strategy that Steve Reitmeister used to produce a +5.13% gain while the S&P 500 fell by -14.97%.

Free Access Pass to 4/20 Wealth365 Online Summit– join many of the world’s top investors to learn strategies to not just survive, but actually thrive in the midst of this bear market.

SPY shares were trading at $237.77 per share on Tuesday morning, up $14.82 (+6.65%). Year-to-date, SPY has declined -26.13%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |