(Please enjoy this updated version of my weekly commentary published January 10, 2022 from the POWR Growth newsletter).

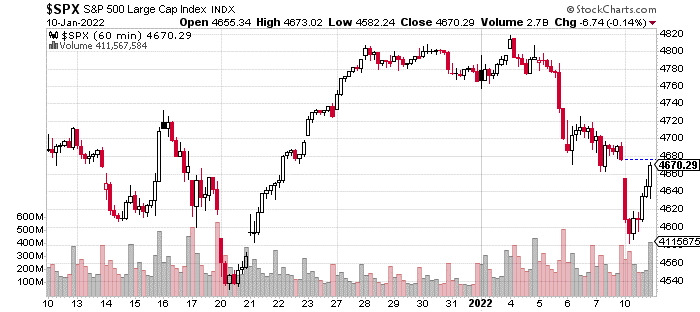

First, let’s check out last week’s price action:

As we can see, we ended last Monday with the S&P 500 at 4,795. On Tuesday, the market gapped up to a new, all-time high before topping out just under 4,820.

Of course, the notion that the market would keep waltzing higher in 2022 was brutally interrupted by a steady stream of Fed speakers and economic data that made it clear that higher rates are coming and faster than many had been expecting.

Maybe the most stunning development was the December ADP jobs report which showed more than 800,000 jobs were added by the private sector. Equally impactful were leaks through the WSJ that the Fed was considering adding another tool to its tightening arsenal with quantitative tightening (QT).

This would be an inverse of quantiative easing (QE) which the Fed deployed numerous times over the last 14 years to stimulate the economy when rates were at zero. With QE, in essence, the Fed was buying securities on the open market to flood the financial system with liquidity.

It was quite contentious during its implementation and many skeptics believed that it would lead to hyperinflation. While, this didn’t exactly happen, it was very effective in its goal to increase confidence in the financial sytem, stave off deflation, and ignite risk appetites.

With QT, the Fed’s intention is to reduce inflationary pressures without disrupting the economic recovery. I am unsure this will happen, in the same way that QE didn’t materially impact inflation, but just like QE certainly boosted risk-taking, I believe that QT will have a dampening effect on risk appetites.

What does this mean for investors and the POWR Growth portfolio?

Simply that we will have to pay more attention to the fundamentals and that I believe this type of choppy action will continue to dominate, although there will be brief spurts of a “blue sky” trading environment in which we can let our winners run.

Near-Term Setup

Now that we’ve covered the bigger picture, let’s talk about how it ties into the short-term trading setup.

For one, it’s clear that this is more of a market rotation rather than a correction or the start of a bear market – for about 80% of the market. However, 20% of the market is clearly mired in a bear market.

Not surprisingly, the market’s laggards are the speculative, high-multiple, growth stocks.

Between 2009 and 2021, these were market darlings who could do no wrong. We are finding out that Fed policy and the constant downtrend in interest rates was a big factor. Maybe the most important factor.

As rates move highers, this trade unwinds. The remarkable thing is that we have no idea where the floor is. Let’s take a look at a stock like Teladoc (TDOC) as an example.

TDOC is down 73% from its high in February. Yet, it still carries a price to sales ratio of 7 and continues to focus on growth rather than profitability. It also faces a slew of well-funded competitors.

This model of funding growth at the expense of profits for years can be justified in a low growth, zero rate, low inflation world where investors have no other place to put their money. It stops being cute in a high inflation, increasing rate, high growth world, where investors can find plenty of companies with double-digit earnings growth this year to invest in.

So, what is the floor? I don’t know. The only bull case I can see right now is that these stocks are extremely oversold. This is enough for a nice bounce but nothing that indicates a true bottom.

So, I think it will continue to get ugly especially as the Fed inches rates higher and unwinds its balance sheet via QT.

The short-term implication is that we will continue avoiding this sector for anything more than a quick bounce but we will monitor the situation as this will surely result in plenty of attractive opportunities once the selling finally subsides, and we reach the other extreme when investors get too pessimistic about these stocks’ fortunes.

For the other 80% of the market, I think its business as usual. Earnings should continue coming in strong based on all recent economic data. Earnings season will kick off in earnest later this week, and I’ve noticed the tendency for stocks to rise as higher profits dispell macroeconomic concerns about the pandemic or the Fed.

Therefore, in terms of the market, we had a big reversal today. It could certainly mark a bottom, but I think it’s possible that we see one more vicious move lower espeically as short-term rates continue creeping higher.

Plus, I’ve noticed that these types of sell-offs can have a couple of false starts before it decisively bottoms.

Market Commentary Summary

To recap, 80% of the market is in the midst of a garden-variety dip, while 20% of the market is mired in a brutal beark market that I don’t expect to end soon.

The Fed’s hawkish pivot means that earnings growth matters even more. It also means more a challenging environment that will require more aggressive risk management and modest profit targets.

Earnings season could be the catalyst that takes the market higher as earnings growth continues to come in at double-digits.

What To Do Next?

The POWR Growth portfolio was launched in April last year and significantly outperformed the S&P 500 in 2021.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $467.70 per share on Tuesday afternoon, up $2.19 (+0.47%). Year-to-date, SPY has declined -1.53%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |