(Please enjoy this updated version of my weekly commentary from the POWR Growth newsletter).

On Monday, we conducted our monthly webinar, where we did a deeper look at the broader market, talked about what I love and hate about crypto, and discussed our positions and future trades.

Click here to view the replay.

Now back to the Commentary:

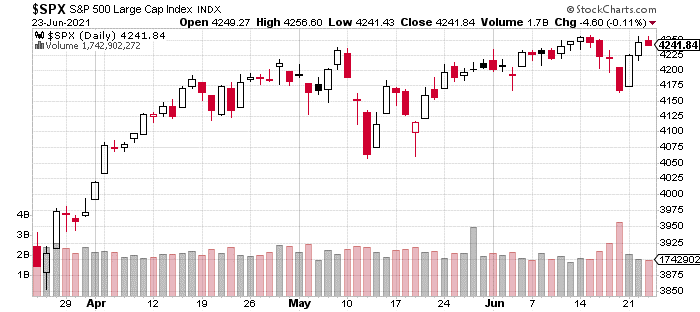

As we can see from the 3-month chart of the S&P 500, the market has done very little since mid-April. These choppy conditions are particularly perilous for growth strategies which tend to outperform once the market is trending.

The FOMC’s surprise hawkish pivot resulted in a rejection of the breakout last week. Now, we are back to these levels once again.

As noted in the webinar, I’m pessimistic about the market’s ability to pierce these levels and start trending higher.

Some of the major reasons are that retail and institutional positioning is at historically, bullish levels. This dynamic would also explain some of the market’s puzzling behavior over the last few weeks, specifically, how it would sell-off on good news whether it was economic data or earnings. If everyone is fully invested, then there is no marginal buyer.

This circumstance also explains why the Fed’s little hiccup turned into such a quick sell-off. It’s an indication that the market may be more fragile under the surface.

Thus, despite the market’s recent strength and proximity to its all-time highs, my confidence that the market will breakout and trend higher is at 40%. This is the lowest it’s been since we started our journey in mid-April.

The Other Side

Still, we have to be open to a bullish resolution of this range… it is a bull market after all. And, bull markets have certain characteristics: Buying on pullbacks or weakness in high-quality stocks will eventually be rewarded. Consolidations and patterns tend to resolve higher. And, overbought markets tend to get more overbought.

Strategy

And, this is precisely why we continue to have a long bias in our portfolios. Further, if the market strengthens, then technology is likely going to keep leading us higher.

This explains the logic behind today’s trades. We’ve increased our weight in technology by a significant margin. And, we are reducing our weighting of cyclical and industrial stocks.

The best time to be overweight in these groups is during periods of accelerating economic growth. This is no longer the case, and we have a decelerating economy.

Further, tech has been an underperformer for many months, so there is more upside for the group.

If as expected, the market does weaken, we are prepared for that outcome with our higher than average cash weightage which will allow us to take advantage of any enticing opportunities.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stock strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

Want More Great Investing Ideas?

SPY shares were trading at $425.29 per share on Thursday afternoon, up $2.69 (+0.64%). Year-to-date, SPY has gained 14.50%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |