(Please enjoy this updated version of my weekly commentary from the Reitmeister Total Return newsletter).

Just as stocks were flexing their muscle with a breakout above 4,000 we find ourselves in a curious place. That being a switch to defensive stocks as the market leaders.

Reity, that doesn’t sound very bullish, does it?

No…its definitely not bullish. But it not necessarily a permanent state of affairs either. So we will concentrate today’s commentary on this intriguing turn of events.

Market Commentary

Investors are on the defense. This is kind of a mind bender when the bull market is up nearly 100% year over year. All the while the economy is improving. Not to mention the Fed and Treasury could not be MORE accommodative.

So what gives?

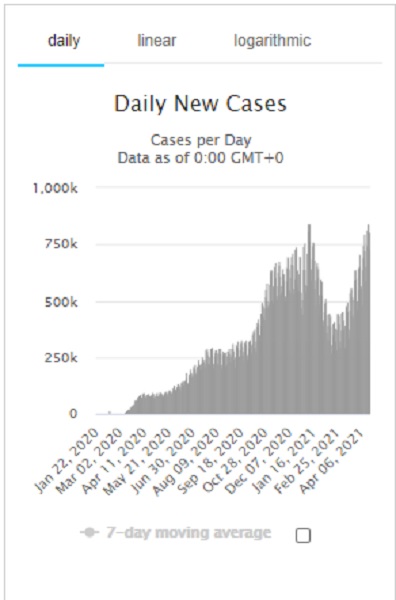

The Coronavirus is spiking around the globe and yes, on the rise in the US once again. Let’s take a look at the worldwide picture with the graphic below:

Yes, we are right back to the highs set at the end of 2020 after a meaningful decline. New variants is part of the problem. Plus we finally see the spike in India that was always feared for the world’s second largest population. And yes, even in Europe and other places they are enduring a new wave of cases.

Back in the states we are 80% lower than the peaks set a few months ago…but if you look closely they are starting to rise a bit from bottom. Yes, this flies in the face of the logic that we are rolling out vaccines at an aggressive pace. However, some of that is causing lax behavior in some parts of the population and we see higher cases as a result.

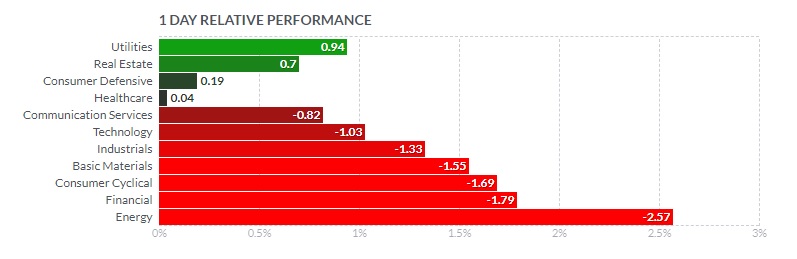

So the trading on Tuesday was very much a reversal of the “Back to Normal” action leading the way the past several months. Airlines, hotels, cruises, restaurants and the like all got beaten like a red headed step child (my apologies to all the red headed step children reading this commentary 😉

On the other hand defensive plays in utilities and consumer staples actually ended the day in positive territory. Here is a chart from FinViz which tells the defensive investment story which is in many ways the EXACT OPPOSITE of what was taking place year to date:

We talked about needing to keep an eye on the Coronavirus #s in recent commentaries. Like this clip from the 3/16/21 RTR weekly commentary:

“Unfortunately there are new flickering flames coming from the Coronavirus that could burn us if they start to rage higher.

I am referring to the new Coronavirus lockdowns in Italy given more contagious variants is a trend worth watching. On top of that you have concerns about Spring Break happening in March and April that could lead to surge in cases. Meaning that a unwelcome new wave of cases could indeed lead to more economic shutdowns and correlated stock sell off.”

Note that one day does not a trend make. So quite possibly this is just a fleeting move, like most inside a sector rotation type market. This would mean that we stay put expecting the positions that fell the most this past session will come back roaring higher.

Then again, if the Coronavirus stats around the world, and especially in the US, don’t start heading lower fairly soon, then this new wave of defensive trades could have greater legs.

Putting it altogether, we are in wait and see mode with where the Coronavirus stats go from here. Until proven otherwise I lean towards this being a fairly temporary situation with no change to our approach being necessary. However, I am willing to bend on that notion if there is convincing evidence to the contrary. Stay tuned…

What To Do Next?

The Reitmeister Total Return portfolio has outperformed the market by a wide margin this year.

+20.31% for Reitmeister Total Return

+10.09% for S&P 500

Why such a strong outperformance? Because we know that 2021 stock market is playing by very different rules than last year. And thus a different breed of stocks will lead the way higher.

If you would like to see the current portfolio of 11 stocks and 3 ETFs, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About Reitmeister Total Return newsletter & 30 Day Trial

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

Want More Great Investing Ideas?

SPY shares were trading at $414.80 per share on Wednesday afternoon, up $2.63 (+0.64%). Year-to-date, SPY has gained 11.31%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| .INX | Get Rating | Get Rating | Get Rating |

| DIA | Get Rating | Get Rating | Get Rating |

| IWM | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |