In part 1 of this series, I explained the most important facts you need to know about the new super strain of the coronavirus, which is 70% more infectious.

In this conclusion, I wanted to highlight the best way to potentially profit from any short-term market freakout that may be coming in the weeks ahead.

The Important Difference Between Gambling & Investing

If you pray for luck in the stock market, it’s because you’re gambling, not investing.

I’ll give you a very simple example, of how to make your own luck in the stock market, which is what I did the day the market fell 2.4% on news of the new super strain of the coronavirus, before recovering 2% that very same day.

Risk Management: The Cornerstone of a Sleep Well At Night Portfolio

If you can’t stay disciplined when the market suffers one of its normal, healthy, and utterly expected short-term declines, you shouldn’t be invested in stocks period.

These are the risk-management guidelines that

- I’ve been perfecting over seven years

- with input from colleagues with nearly 100 years of asset management experience

- that have been stress-tested about 300 times

- using historical market data

- and JPMorgan’s future risk assessment scenarios

- and 30 and 75 year Monte Carlo simulations

- all Dividend Kings portfolios use these risk-management guidelines

- 100% of my life savings is entrusted to these guidelines

- whatever risk-management rules are best for your specific needs stick with them

Once you have a bunker portfolio that can withstand virtually anything the economy or stock market can, and will, eventually throw at you, then it’s time to get rich.

The Simplest Way To A Rich Retirement On Wall Street

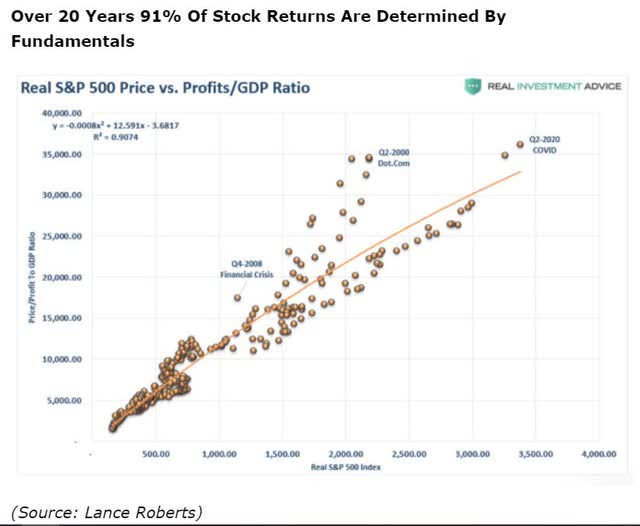

Once you have a sleep-well-at-night bunker portfolio, you can focus on the three fundamentals that drive 91% of long-term stock returns.

I use a combination of daily small dollar-cost averaging to target four kinds of companies.

- highest safe yield

- lowest PEG (Peter Lynch’s growth at a reasonable price)

- highest ROC/PEG (BM Cash Flow Detective’s super metric combining Joel Greenblatt’s ROC with Peter Lynch’s PEG to create a single metric combining quality + valuation + growth)

- highest discount to fair value

Then I set high priority limits on companies in these same categories, that combine as many of the proven alpha factors as I can.

When the market sells off, the same high conviction blue-chip bargains that I’ve been buying steadily in small amounts, become even better bargains.

How I Cashed In When The Market Freaked Out Over The Corona Super Strain

For example, on December 21st, when the market freaked out over the new super strain of the coronavirus, I opportunistically bought Alibaba (BABA) during the pre-market crash, when BABA was down 2%.

A 2% decline by itself is not that special. But it most definitely is special if BABA is already 39% undervalued, and suddenly you can grab it at a 40% discount.

(Source: imgflip)

BABA on December 11th was a wonderful company that was beaten down due to months of worries about increasing Chinese regulations.

Here’s what the 58 analysts who cover BABA and collectively know it better than anyone other than management thought of those regulatory threats to its business.

Alibaba Consensus Growth Estimates

So far the news of increased regulations hasn’t blunted the bullishness of analysts for BABA’s long-term future growth prospects.

(Source: FactSet Research Terminal)

In other words, BABA’s 2% freakout over the pandemic, which hadn’t hurt its business in early 2020, and was unlikely to do so even if the pandemic dragged on long into 2021, was an opportunity to lock in amazing long-term return potential.

BABA 2022 Consensus Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

If BABA grows as analysts expect through March 2023 (the end of its fiscal year 2023), and returns to historical fair value, then analysts expect

- 93% total returns

- 33% CAGR returns

- vs -3.4% CAGR S&P 500

BABA 2025 Consensus Return Potential

(Source: F.A.S.T Graphs, FactSet Research)

If BABA grows as analysts expect through March 2026 (the end of its fiscal year 2026), and returns to historical fair value, then analysts expect

- 250% total returns

- 27% CAGR returns

- vs 3.2% CAGR S&P 500

Buffett like returns, from one of the highest quality hyper-growth Super SWANs in the world. The essence of low risk/high-probability investing. I don’t need to know exactly when the market is going to freak out next.

All I have to know is

- what companies are worth owning (thus the Dividend Kings Master List)

- what the companies are worth

- what limit prices to set (DK strong buys, very strong buys, ultra-value buys)

- that at some point the market will fall rapidly, and usually for overblown reasons

If you follow a disciplined strategy focused on quality first, and prudent valuation and sound risk management always, retiring rich doesn’t require luck, it only requires time.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

5 WINNING Stocks Chart Patterns

7 Best ETFs for the NEXT Bull Market

SPY shares were trading at $372.87 per share on Wednesday morning, up $1.41 (+0.38%). Year-to-date, SPY has gained 18.01%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |