In part 1 of this series, I explained why the stock market took the news of the Fed’s $2.3 trillion in direct stimulus so well.

(Source: Ploutos)

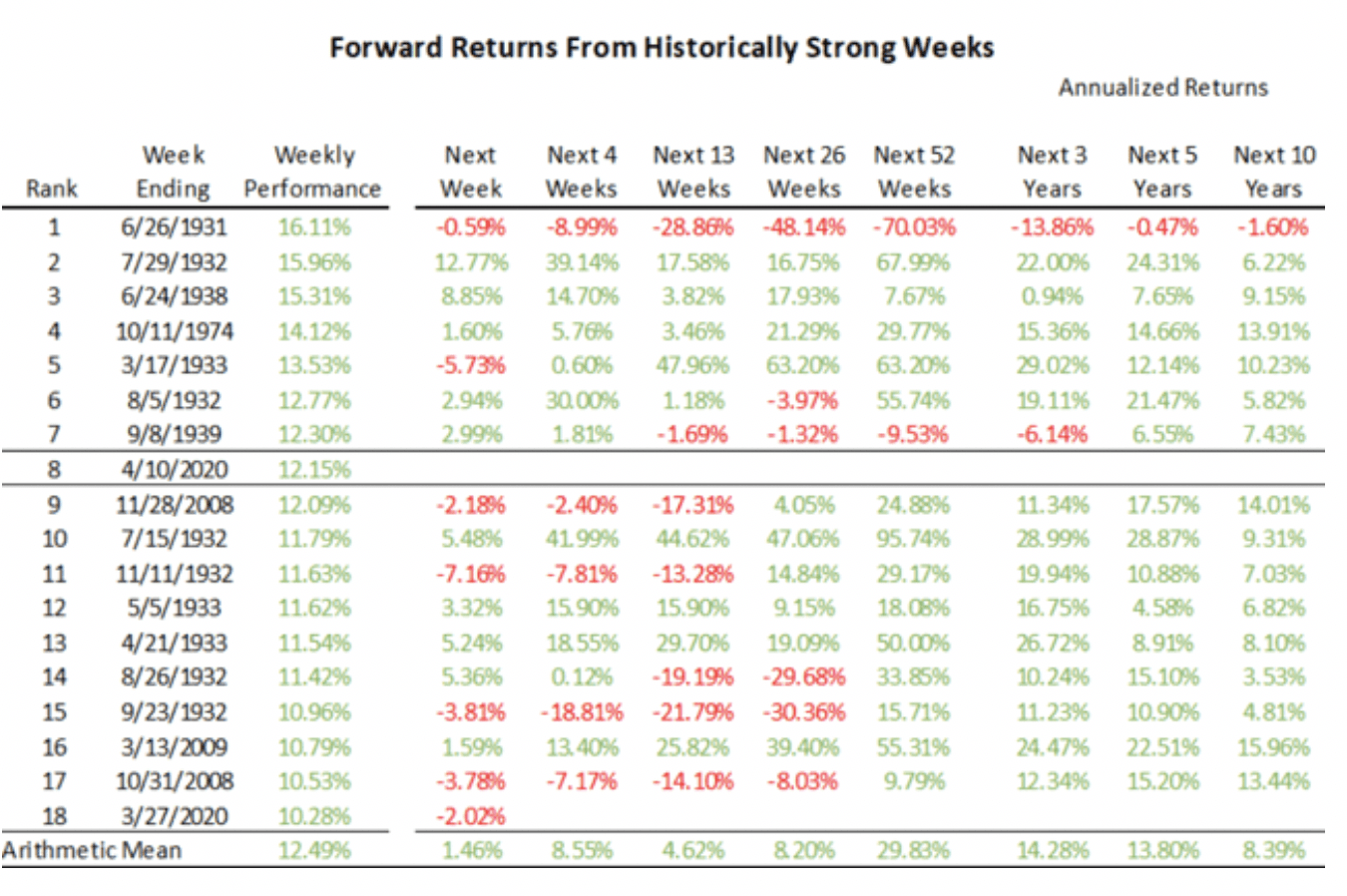

In fact, it was the primary driver of a 12% rally in the S&P 500, which was the 8th best week for stocks in US history.

The market’s epic four-day rally, as well as Goldman Sachs coming out and saying that “These policy actions mean our previous near-term [S&P 500] downside of 2,000 is no longer likely.” might leave you feeling confident you know stocks are going up. After all, you don’t “fight the Fed right.”?

However, there are important reasons that, while stocks might no longer be at high risk of a major meltdown, investors need to be prepared for further corrections and volatility in the months ahead.

The Fed Is Mighty, But the Worst Recession in 75 Years Isn’t Something to Be Ignored

Despite the trillions of dollars in aid, the second wave of virus infections could break the market floor and push prices to fresh lows, the bank added. The government’s “do whatever it takes” attitude helped quickly stem further losses, but a resilient bull run depends on economic data improving in April, the team said.” – Business Insider

Even Goldman, which has now joined JPMorgan in calling a bottom in the market correctly points out that should the coronavirus resurface, stocks might be in for a painful crash to fresh lows.

Even if the virus doesn’t surge in the fall, as some epidemiologists warn it might, we still have to contend with the worst recession in 75 years.

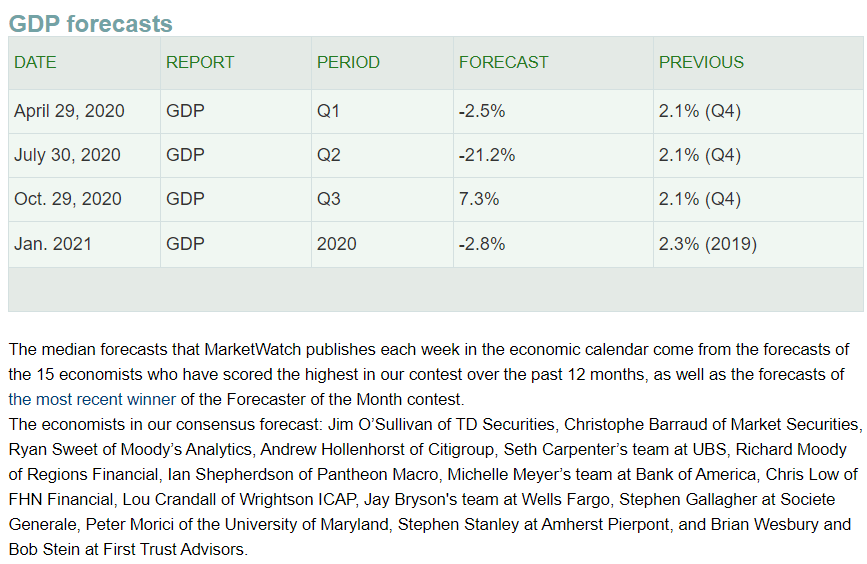

(Source: Market Watch)

And that Q2 estimate is the blue-chip consensus, that has been steadily converging with less rosy forecasts, such as this one from the New York Fed and Harvard.

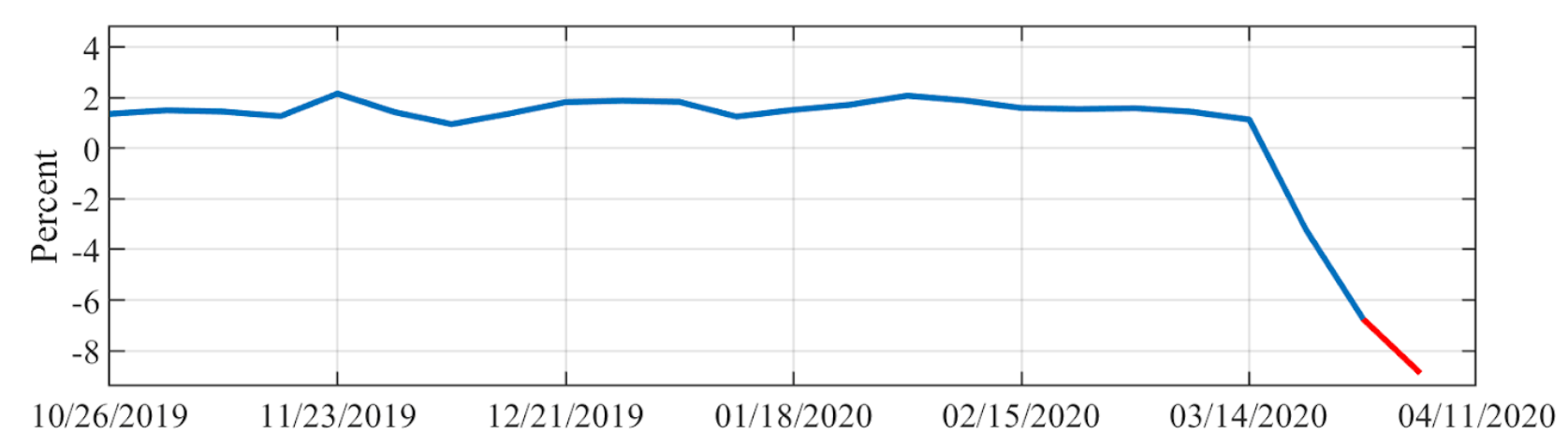

GDP Growth Based on 10 High-Frequency Indicators

(Source: NY Fed)

The New York Fed is estimating that, as of last week, the US economy was contracting at 31% on an annualized basis.

The St. Louis Fed estimates that GDP might contract by 50% in Q2, compared to 10% which was the previous record for a single quarter contraction back in 1958.

And even though most economists expect a July economic restart to induce the strongest growth in history in Q3 (and continued growth in Q4) the blue-chip consensus is still for -3% growth in 2020, and that’s likely to keep falling in the coming weeks.

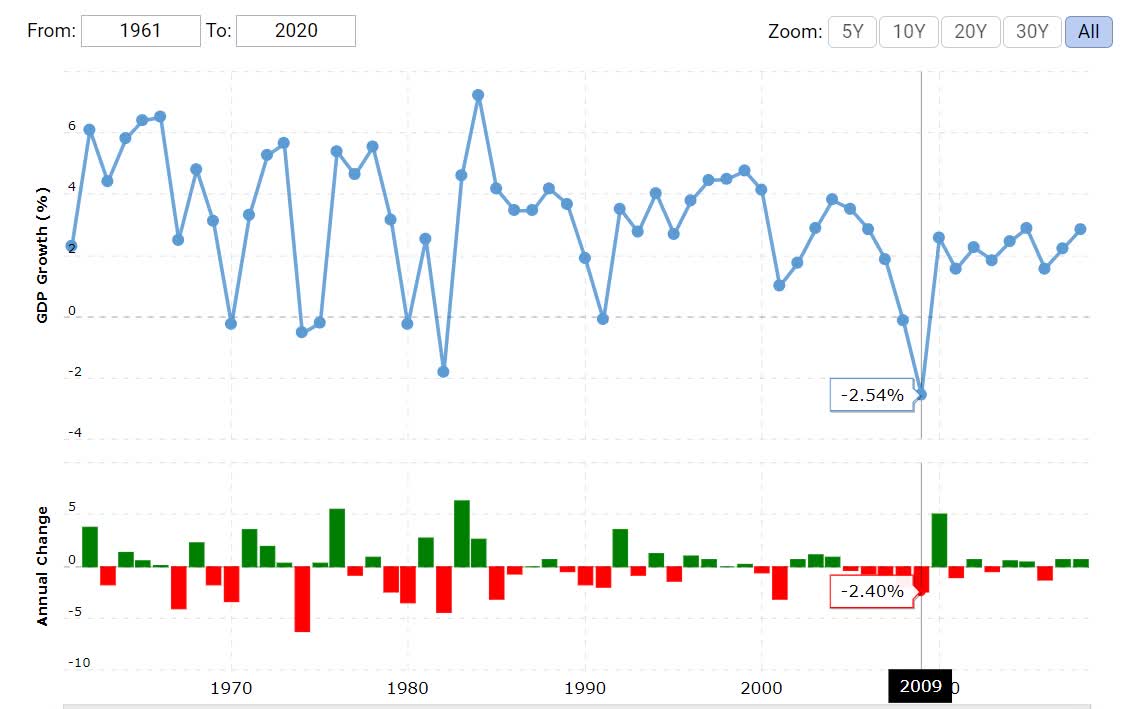

US GDP Growth by Year

(Source: Macro Trends)

In 2009, we suffered the worst year of growth since 1945, during the Financial Crisis when the peak GDP decline was 5.3% (in a single quarter).

Do I think there is much chance that the US won’t be able to restart much of its economy by July? No, that’s restart timeline seems extremely likely.

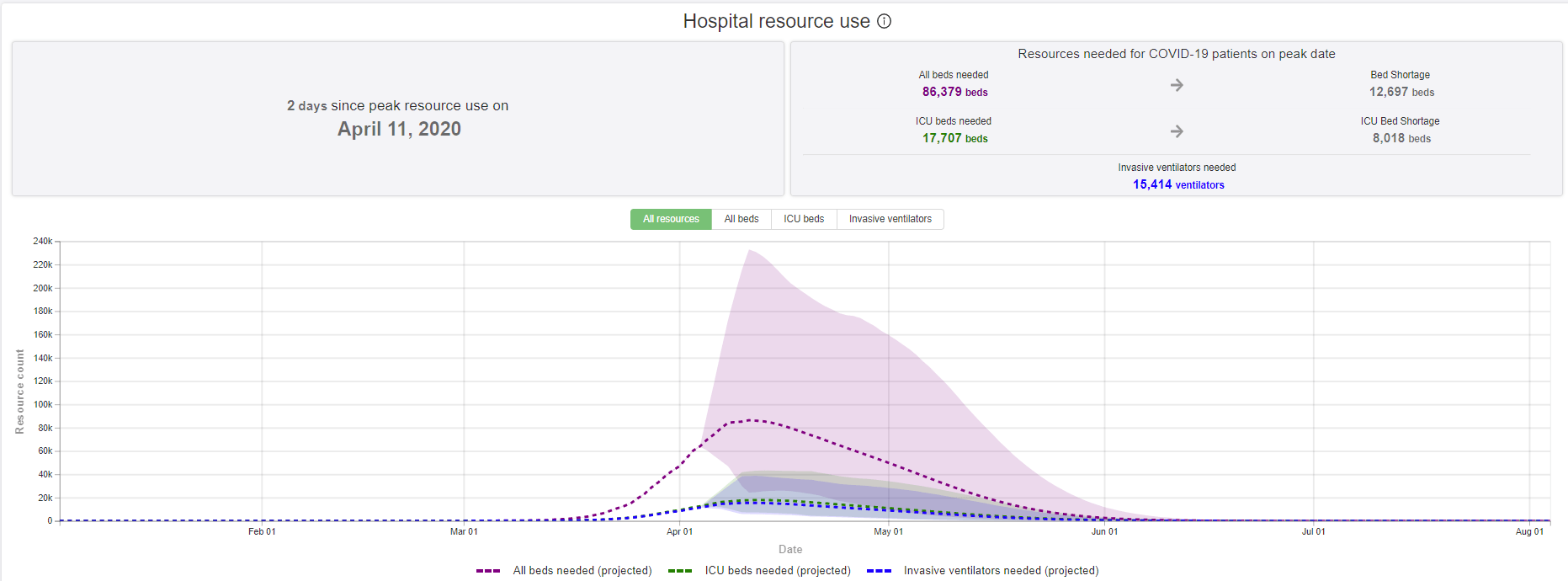

(Source: Institute For Health Metrics & Evaluation)

The University of Washington’s Institute for Health Metrics and Evaluation or IHME model has been highly accurate up until now and appears to have correctly forecast the peaking of both US new daily cases and deaths on April 11th and 10th, respectively.

That same model assumes social distancing through the end of May but also zero new cases by July 5th.

We don’t need zero new cases in order to begin reopening the economy, just three things according to Dr. Anthony Fauci, which the academic world calls (via citations in other research papers) the 3rd smartest epidemiologist and 13th smartest overall scientist in history.

- Declining new daily cases

- Falling active cases (in order to decrease stress on the healthcare system and minimize deaths)

- A plan for widespread testing and containment protocols in case the virus flairs up later (such as contact tracing and more focused quarantines, such as what South Korea did to avoid locking down its economy)

However, there are two reasons that anyone who thinks stocks are likely to just keep rallying, driven higher by the Fed’s aggressive stimulus, might be disappointed.

The Recovery From This Recession Likely Won’t Be Fast, Easy or Smooth

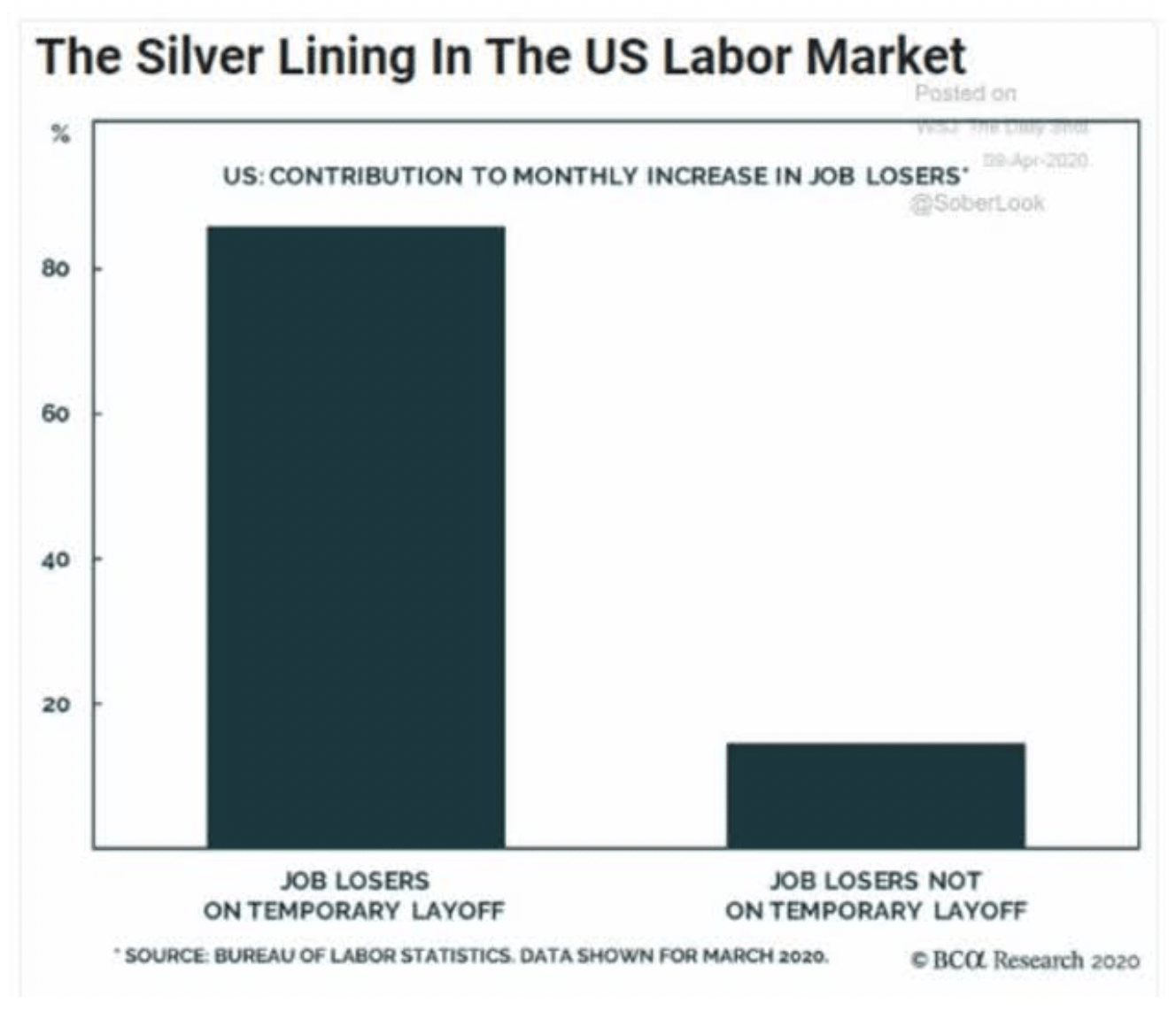

The terrifying number of new jobless claims we’re seeing now is NOT actually real, or at least the vast majority of them.

According to the Bureau of Labor Statistics, 85% of them are temporary furloughs, at least so far.

However, JPMorgan estimates that by the time America is able to reopen, about 30% of the job losses could be permanent, totaling about 17 million.

Or to put another way, in four months we could see double the job losses the Great Recession took 23 months to inflict.

- Peak unemployment: 32% to 40% (from St. Louis Fed)

- Unemployment at the end of 2020: 14% (from JPMorgan)

- Unemployment at the end of 2021: 9% (Congressional Budget Office)

By the end of the year, JPMorgan estimates unemployment will be 14% and the Congressional Budget Office estimates it will still be 9% by the end of next year.

The free-fall in confidence would have been worse were it not for the expectation that the infection and death rates from COVID-19 would soon peak and allow the economy to restart…

Anticipating a quick and sustained economic expansion is likely to be a failed expectation, resulting in a renewed and deeper slump in confidence…

Going forward, consumers should be prepared for a longer and deeper recession rather than the now-discredited message that pent-up demand will spark a quick, robust, and sustained economic recovery…

“Sharp additional declines may occur when consumers adjust their views to a slower expected pace of economic recovery.” – Richard Curtin

As the chief economist of the University of Michigan’s consumer confidence survey explains, high unemployment is going to result in a multi-year recovery, and possibly far worst consumer confidence in the coming months.

Compared to Q2’s worst quarter of growth in history, any positive growth will seem “v-shaped”.

But anyone who expects unemployment to return to 50-year lows within a few months, or even a few years, is likely being overly optimistic.

Yes, economists believe we’ll recovery faster than after the Great Recession, which included a financial system that was nearly smashed.

This time it’s intact and the Fed and Congress are throwing nearly $5 trillion of direct stimulus at not just big companies, but also directly to consumers and small businesses.

This time Main Street is getting trillions in bailouts as well. However, the scale of this economic disaster can’t be underestimated.

Stimulus Likely Can’t Fully Stop What’s Coming Next

There are 30.5 million small businesses in America and 32.5 million total businesses.

The University of Washington estimates that 2.5 months of payroll for companies with 500 or fewer employees would cost $2.8 trillion and including the fixed expenses floating them for 2.5 months, as the Payroll Protection Program of the CARES act is meant to, would cost $3.7 trillion.

So far Congress has either authorized or plans to authorize $600 billion to that purpose and the Fed is willing to add another $600 billion towards that goal.

That means that so far about 1/3 of what’s needed to prevent a lot of small business closures (which provide 48% of all US jobs) has been pledged.

Now it’s true that the Fed and Congress are likely to keep lending as much as it takes BUT there are major logistical hurdles to sending trillions of dollars to every small business in America.

Through April 8th, $100 billion in PPP loans were approved, but it can take a week for the money to arrive in a small business owner’s account.

Before the pandemic began, JPMorgan estimated that the average small business had 27 days of cash reserves, and the average restaurant just 16 days.

By the time the PPP began taking loan applications on April 3rd, most small businesses were nearly out of money, and by the time the money begins arriving, millions will be at risk of permanently closing.

And we can’t forget that restarting America’s economy is likely to be a long and chaotic process, assuming the virus doesn’t come back as many epidemiologists warn it might.

For one thing, the Congressional Budget Office estimates that 25% of social distancing measures will have to remain in effect through the end of the year. Life will not “return to normal” until we have a vaccine, according to Anthony Fauci and other leading experts.

That’s not likely until 12 to 18 months from now, and that’s just to test a vaccine for safety/efficacy. Mass producing and distributing nearly 8 billion vaccine doses could take another 6 to 12 months, meaning that the world might not truly be safe from COVID-19 until mid-2022.

Despite what some headlines might say about President Trump potentially reopening the economy in May, that’s also not likely to happen.

First and foremost, states currently retain the power to decide who stays home and for how long,” according to an analysis for Lawfare. “Among the powers generally reserved to the states is the authority to quarantine individuals and otherwise protect public health.” – USA Today

It will be up to 40 individual governors of states currently in lockdown when they reopen. And it won’t be like flipping a switch either.

Austria, Norway, Denmark, the Czech Republic, and Germany have announced plans to reopen…”little by little” over 6 to 8-week periods.

The US will likely follow a similar model, with a multi-month approach that leaves a ton of uncertainty in corporate supply chains.

No matter how grand and intricate the plan to reopen almost 33 million businesses, the complexity of such a task is literally beyond the comprehension of any person.

No plan survives contact with the enemy, and this war is far from over.

The peaking of new cases in the US and globally, is merely the end of Phase 1, of a 4-phase road to victory in what some doctors are calling “World War C”.

- Phase 1: lockdowns to flatten the curve and beat the virus as fast as possible (the easiest phase)

- Phase 2: planning for unlocking economies, over time, in staged rollouts

- Phase 3: executing on that plan, while being vigilant and dealing with viral flair-ups that might occur

- Phase 4: develop a vaccine, mass-produce it, and distribute it to nearly 8 billion people around the globe (a herculean task in its own right)

Phase 2 and 3 are the most dangerous that we’ll face before we can declare this war over.

In phase 1 fear caused many people to set aside political differences, including Congress passing an 850-page, $2.2 trillion stimulus bill in a week.

Now that fear is abating, the political daggers will likely come out, and finger-pointing and attempts to score political points could cause mistakes to be made in the timing of reopening of various economies.

Even if we have perfect timing on when to begin reopening our economies, and even if it goes far smoother than expected, the disruption to company supply chains from bankrupt small businesses could last for months (at least) and possibly for years.

But even if we get very lucky and American businesses bounce back at hyper speed, there is no question that it will take several years for unemployment to fall to anywhere close to February 2020 levels.

Americans who have lost their jobs are going to be gun shy about spending money, and corporations that just survived the worst recession in 75 years are not likely to invest heavily in CAPEX either.

Basically, the road to recovery will be long, winding, and could be riddled with many landmines. Landmines such as viral flair-ups (which could cause stock market corrections), double-dip recession fears (which could also cause stock market corrections), and any other number of scary headlines, all of which could cause market corrections.

Am I predicting stocks will crash soon? Nope. We may have indeed bottomed.

But even if -35% from record highs is as bad as stocks fall during this recession, that doesn’t mean stocks will rise in a straight line.

They could fall 10% from here, then recovery 10%, then fall again, and basically trade flat for several months, whipsawed by the various scary headlines that are likely coming in the next few months.

Am I advocating market timing? Heck no! I’m advocating sticking to your long-term plan, built around a strong core of prudent risk-management.

These are the risk management guidelines I use for my retirement portfolio. They are what let me sleep well at night no matter what happens over the coming months.

I’m personally putting my savings to work 2 to 3 stocks at a time, each Friday, through about mid-August.

Why August? It’s not because I have a crystal ball and know the market is going to roll over, dive to new lows, and no bottom until August.

Rather it’s because buying 2 to 3 stocks per week through that time would put 100% of my discretionary savings to work, and then allow me to invest in 1 to 2 stocks per week pretty much forever. My plan isn’t to “call the bottom” and go “all in” at the best possible prices. Prices that you can’t know until the bear market is long over and the opportunities are gone forever.

(Source: Imgflip)

Do you know who’s a fan of buying great quality companies at reasonable to attractive prices based on a reasonable plan that works for you? Warren Buffett.

In mid-October 2008 Buffett wrote an op-ed for the Wall Street Journal says.

The financial world is a mess, both in the United States and abroad. Its problems, moreover, have been leaking into the general economy, and the leaks are now turning into a gusher. In the near term, unemployment will rise, business activity will falter, and headlines will continue to be scary. So … I’ve been buying American stocks.” – Warren Buffett

Stocks would go on to fall 30% more before bottoming and beginning an 11-year bull market. Buffett had no more idea when the bottom was coming than anyone.

He didn’t care. His focus is not on perfection, but on a sound long-term strategy, approached in a disciplined fashion, devoid of emotions that get so many investors into trouble.

(Source: Imgflip)

My approach is the same as Buffett’s, just on a much smaller scale.

When I buy some of the highest quality companies on earth, such as Amazon (AMZN), Realty Income (O), or Nike(NKE), I don’t care whether I nail the exact bottom.

In 5, 10, 20 years from now, I trust that much stronger future cash flows and exponentially greater dividends will allow me to live on passive income alone. The strong capital gains? Those will be a nice cherry on top of my dividend pie.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

7 “Safe-Haven” Dividend Stocks for Turbulent Times

Investors Beware: It’s Still Really Bad Out There!

SPY shares were trading at $276.18 per share on Wednesday morning, down $7.61 (-2.68%). Year-to-date, SPY has declined -13.69%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |