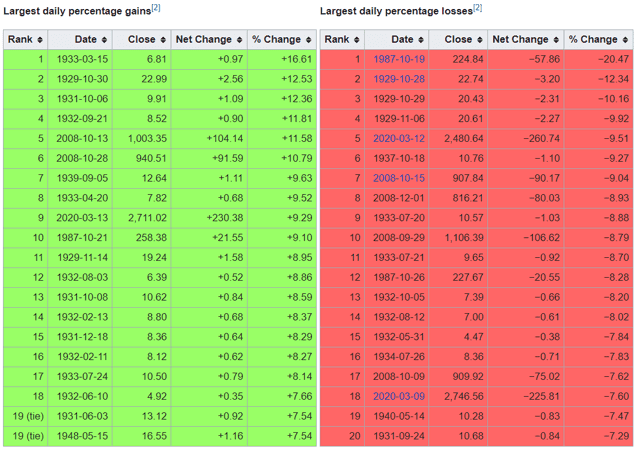

Rather than respond with a continued rally, following March 13th’s 9.5% surge (the 9th best day for stocks in history) stocks reacted with a furious sell-off, at one point the S&P 500 (SPY) hitting -11% on March 16th.

An 11% crash would have been the 3rd worst day for stocks in history.

(Source: Wikipedia)

While the market managed to recover much of its losses that day, investors may be confused and angry at the Fed for “not saving the stock market”.

In this two-part series, I’ll explain what the Fed is actually trying to do, and why the market’s crash was a major overreaction, one that smart long-term investors can profit from.

The Fed Doesn’t Care About the Stock Market, Just the Credit Market

It’s commonly believed that the Fed wants the stock market to rise due to the “wealth effect”. Or to put another way, the Fed believes that when investors feel richer, they spend more money and thus translate a strong market into a stronger economy.

There is SOME truth to that but the actual reason the Fed cut rates 1.75% in two weeks is because of financial stress.

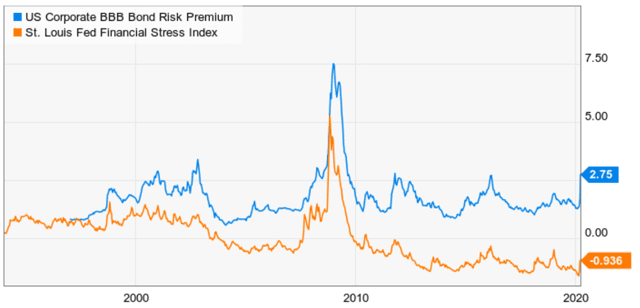

(Source: Ycharts)

In the three weeks since the COVID-19 pandemic really got going, credit markets have shown significant stress.

You can see that in both the St. Louis Fed’s Financial Stress Index, (18 weekly economic reports), and the doubling of the BBB-risk premium spread.

According to S&P and Moody’s BBB corporate bonds make up about 50% of the $9.3 trillion worth of corporate bonds. 72% of those bonds are investment grade.

Companies rely on a smoothly functioning bond market to allow them to not just borrow for new growth efforts but to refinance existing debt as it comes due.

During a recession the risk premium, or amount over the 10-year Treasury yield (a “risk-free” asset), that bond investors demand generally rises to 3% or so.

That’s close to the 2.75% it hit on March 13th.

Even more concerning for the Fed was the liquidity crunch that occurred on March 12th, when stocks suffered a 9.5% decline, the 5th worst day in history.

Normally when stocks crash, risk-free, non-correlated assets such as Treasury bonds go up, as investors flee to safe-haven assets. That’s what was happening for most of the first three weeks during the bear market.

10-year bond yields plunged from about 1.5% to 0.32% in the fastest bond rally in history. However, then on March 12th and 13th, bond yields began soaring, hitting 1.0% on Friday.

Gold, bonds, and pretty much every asset fell in concern on Thursday, March 12th, and for one main reason.

Companies around America, and indeed the world, are preparing for a likely COVID-19 recession by drawing down on their corporate credit facilities.

If everyone draws on revolving credit lines all at once, the credit system might become stressed. (A revolving credit facility is the corporate equivalent of a home-equity line.) S&P 500 companies have about $1 trillion in credit lines. That is a big potential cash call for lenders.” – Barron’s

US companies have $1 trillion in credit facility liquidity, created by a consortium of banks.

Everyone from Boeing (BA) to small businesses owned by private equity firms, has been drawing down their credit facilities, “just in case.”

As a result, banks (and private equity funds) have been rushing to sell anything to raise cash, even risk-free US treasuries.

When you combine rising long-term rates, with a rising investment-grade bond risk-premium, as well as lots of bond sales by the US treasury, you also get significant stress in the overnight lending or repo market.

The Fed has previously promised “at least” $1.5 trillion in repo bond buying. And as James Hyerczyk explains, it had nothing to do with propping up stocks.

The Fed did not flood the market with cash to save the benchmark S&P 500 Index from crashing or widely-held Amazon shares from wiping out small-investor 401K accounts. Its aggressive move was not meant to save the few, but to save the many from a major collapse of the vital Treasury market. This move was designed to prevent another financial crisis.

Every day, small banks, big banks, brokerage firms, hedge funds, money markets, and the Federal Reserve participate in the repurchase agreement or repo market. The world’s financial institutions use this type of transaction to fund themselves using government debt as collateral. Due to the excessive demand for Treasurys, liquidity has become a major issue. Essentially, if the repo market seizes up for some reason, much of the financial system will cease to function. This occurred during the 2008 financial crisis which is often described as a “run on the repo market.”

So the Fed didn’t bailout the market last week, it provided liquidity to a major market that became less liquid as financial firms gobbled up safe-haven Treasurys as protection during the coronavirus crisis that turned our bull markets into bear markets in a matter of weeks.

With the major investors taking cash out of the markets by buying Treasurys, the Fed made a move to address this shortage by putting cash back into the market.” -James Hyerczyk (emphasis added)

So what did the Fed do on Sunday, March 15th that so rocked financial markets around the globe (European stocks fell 12% at one point as well)?

What The Fed Actually Did And Why the Market Freaked Out

- Fed funds rate cut to zero (expected)

- $700 billion QE program (up to $40 billion per day)

- up to $5 trillion repo (overnight lending) support over the next month- $500 billion Monday and $1 trillion per week available for the next month

- coordinating with all major central banks globally to ensure sufficient US dollar 1-3 month lending capacity

- entire Fed toolbox is now available to minimize economic damage

The Fed didn’t just act alone, promising close to $6 trillion in bond-buying in coming weeks if necessary.

In addition to rate cuts, the Fed also said it would purchase another $700 billion worth of Treasury bonds and mortgage-backed securities. It also struck a deal with five other foreign central banks, the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, to lower their rates on currency swaps to keep the financial markets functioning normally.” – CNN (emphasis added)

It is coordinating with five major central banks around the world to ensure virtually free 1 to 3-month dollar-denominated loans to anyone who needs it.

This is the greatest coordinated monetary stimulus since the Financial Crisis and indeed might prove to be far larger than 2008-2009. So why didn’t the stock market rocket higher on news of the return of QE?

This, coupled with an important fiscal package, should help cushion the economic downside from the virus’ effect on economic activity,” said Quincy Krosby, chief market strategist at Prudential Financial. “It’s going to be positive, but the market is at the mercy of the virus and at the mercy of whether the containment policies work.” – CNBC (Emphasis added)

Because monetary stimulus, even when combined with aggressive fiscal stimulus now coming from major governments around the world, still can’t fix the core problem of this bear market.

The COVID-19 virus is a black Swan event that has to be addressed first before stimulus can have any effect.

This is the “pushing on a string” argument that Fed critics rolled out when they criticized the first 50 bp emergency rate cut.

What good are infinite low-cost loans and even governments spending money when consumers can’t go out to shop, eat, or do the normal things that drive 70% of the service dominated US economy?

Why the Market Was Both Wrong…And Right to Freak Out Over The Fed Rate Cut

The Fed isn’t run by idiots, who think that merely cutting rates and potentially pumping trillions into the financial system is going to avert a global recession.

The OECD estimated that global GDP will be 2.4% this year, a 0.5% percentage point cut from a forecast done in November. Moody’s revised down its GDP expectations for the global economy Friday to 2.1%, from 2.4%.” – CNBC

There is no greater priority than stopping this virus and saving lives. In order to do those countries around the world are following South Korea and China’s leads and testing like crazy and increasingly locking down their economies.

- travel is being banned

- non-essential businesses forced to close

- large public gatherings (greater than 50 people) are being banned

This is massively disruptive to not just global supply chains but service sectors that account for 60% to 80% of developed national economies.

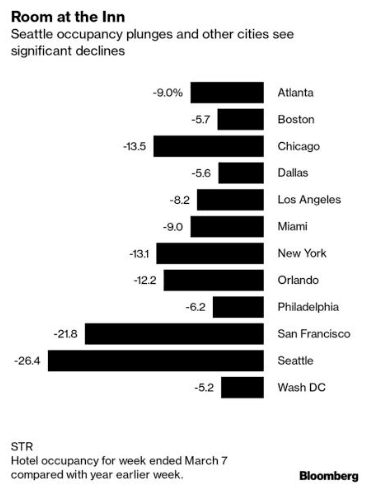

In hard-hit Seattle, which is now locking down its restaurants and bars, hotel occupancy has fallen 26% YoY. For context, US hotel occupancy fell about 50% after 9/11. If Seattle completes locks itself down, hotel occupancy might fall even more this time.

The US Commerce Department estimates that about 0.8% of the entire US economy is from hotels, and thus a 50% national decline in occupancy could reduce US growth by 0.4% all on its own.

The reason the Fed cut rates at all is that the Fed Funds Rate is used to index many kinds of loans, including LIBOR, which is the basis for most credit lines.

The Fed wants businesses both large and small to be able to borrow at very low costs, in order to minimize the economic damage created by short but drastic actions like locking down large parts of the global economy.

The goal isn’t to avert negative growth entirely, but make any global recession (2.5% or less growth) mild, short and kick off a strong recovery as soon as the pandemic is over.

In Part 2 of this series, I’ll look at the latest data about the coronavirus pandemic to hopefully give you an idea of just how long this global health crisis might last, and what’s potentially coming next for the stock market in the rest of the year.

SPY shares were trading at $245.58 per share on Tuesday morning, up $5.73 (+2.39%). Year-to-date, SPY has declined -23.70%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |