Stocks overall have put in quite a performance since the Fed decision on March 15. The S&P 500 has risen almost 9% while the NASDAQ 100 popped over 13%.

Those gains, though, pale in comparison to what the pot stocks have done. The marijuana ETF Alternative Harvest (MJ) is up over 30% since bottoming out on March 15.

Two acquisitions were the initial spark that got the marijuana stocks lit. Cresco Labs (CRLBF) bought Columbia Care (CCHWF) and Aurora Cannabis (ACB) purchased Thrive Cannabis.

This red-hot rally was further fueled on news that a House panel will vote next week to decriminalize marijuana. Doubtful the Senate will pass it, so it may once again be posturing on the part of the politicians.

The shorts have been squeezed hard as evidenced by the recent price action. The ETF MJ (yes it stands for Mary Jane) is by far the most overbought it has been in the past year.

The 9-day RSI just broke past 70. MACD is at the highest levels of the prior 12 months. Bollinger Percent B exploded over 100. The last time all these indicators even came close to these readings marked a significant top in Marijuana stocks.

Friday saw over 24,000 calls trade in MJ versus just 887 puts. This type of over-the-top call buying is usually a reliable contrarian indicator that the bullish euphoria has gotten way overdone.

Implied volatility (IV) is at an extreme as well. Current implied volatility stands at the 100th percentile. This means option prices are the most expensive they have been in the past year.

This favors option selling strategies when constructing trades. The best way to position for the euphoria to begin to wear off is by selling out-of-the money bearish call spreads. These defined risk trades provide ample upside cushion while potentially generating solid returns.

Here are three Sell rated Cannabis stocks to consider along with example call spreads.

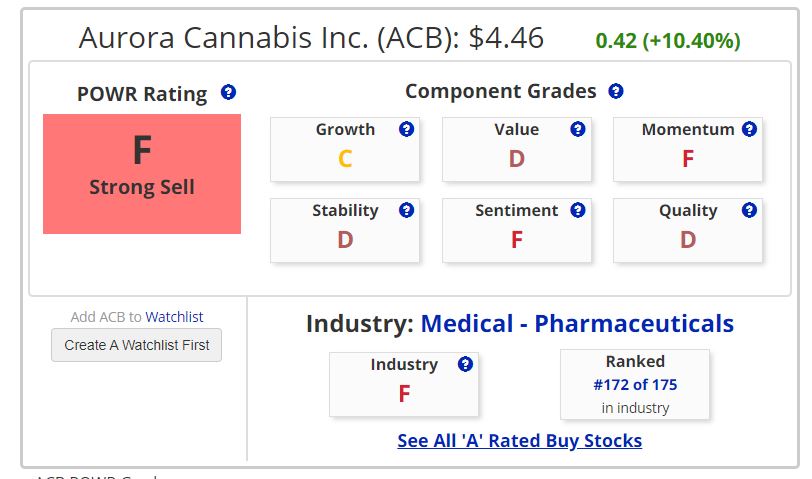

Example: Sell ACB September $6/$8 call spread for 25 cents net credit

Maximum gain is $25 per spread. Maximum risk is $175 per spread. Return on risk is 14.28%

The short $6 strike price provides a 34% upside cushion to the $4.46 closing price of ACB stock.

Example: Sell CGC July $10/$12.50 call spread for 50 cents net credit

Maximum gain is $50 per spread. Maximum risk is $200 per spread. Return on risk is 25%.

The short $10 strike provides a 15% upside cushion to the $8.69 closing price of CGC stock.

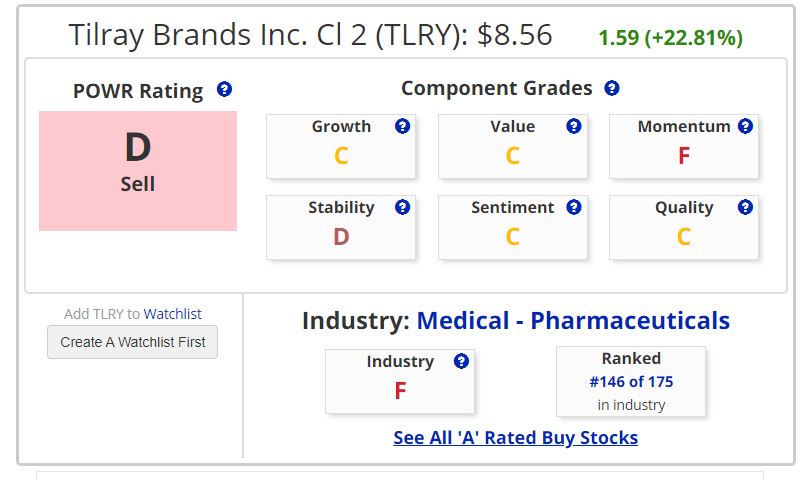

Example: Sell TLRY September $11/$13 call spread for 35 cents net credit

Maximum gain is $35 per spread. Maximum risk is $165 per spread. Return on risk is 21%.

The short $11 strike provides a 28% upside cushion to the $8.56 closing price of TLRY stock.

While marijuana mania may take the pot stocks somewhat higher, at some point the buzz inevitably wears off. Selling out-of-the-money call spreads allows traders to get paid now to be sellers later-all in a risk-defined fashion and with plenty of upside cushion. Using extremes of implied volatility to structure trades that take advantage of very expensive options makes probabilistic sense. At the end of the day, trading is all about probability and not certainty. Use options to put the odds in your favor.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

Want More Great Investing Ideas?

TLRY shares closed at $8.56 on Friday, up $1.59 (+22.81%). Year-to-date, TLRY has gained 21.76%, versus a -4.39% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| TLRY | Get Rating | Get Rating | Get Rating |

| MJ | Get Rating | Get Rating | Get Rating |

| CGC | Get Rating | Get Rating | Get Rating |

| ACB | Get Rating | Get Rating | Get Rating |