Energy Fuels Inc. (UUUU) in Lakewood, Colo., extracts, recovers, explores, and sells conventional and in situ uranium recovery in the United States. The company’s operations include the Nichols Ranch project, the Jane Dough property, and the Hank project in Wyoming; the Alta Mesa Project in Texas; and the White Mesa Mill in Utah. UUUU also holds interests in uranium and uranium/vanadium properties and projects in various stages of exploration, permitting, and evaluation located in Utah, Wyoming, Arizona, New Mexico, and Colorado.

Last month, the company announced that it had entered agreements for the acquisition of 17 mineral concessions between the towns of Prado and Caravelas in the State of Bahia, Brazil. Based on historical drilling, it is expected that the project holds significant quantities of heavy minerals, including monazite, which might bolster the company’s rare earth metals supply chain.

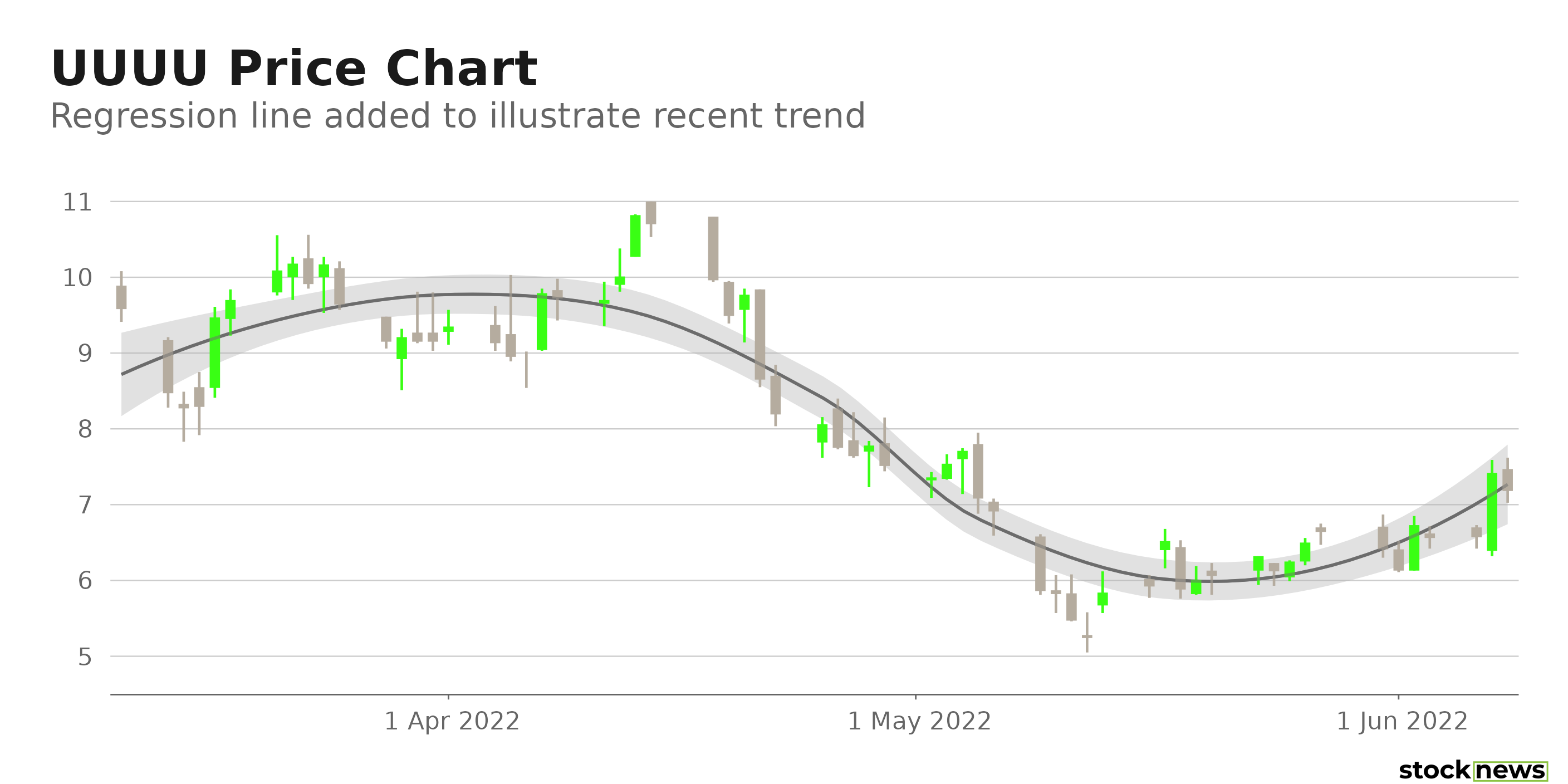

UUUU’s shares have declined 5.9% in price year-to-date and 20.9% over the past three months to close yesterday’s trading session at $7.18. However, it has gained 3.9% over the past month.

Here are the factors that could affect UUUU’s performance in the near term:

Bleak Bottom Line

For its fiscal first quarter, ended March 31, UUUU’s total revenues increased 732% year-over-year to $2.94 million. However, its net loss rose 35% from the prior-year quarter to $14.73 million. Its net loss per common share came in at $0.09, up 12.5% from the same period the prior year.

Stretched Valuations

In terms of its forward EV/Sales, UUUU is currently trading at 33.22x, which is 1,451.3% higher than the 2.14x industry average. The stock’s 3,487.70 EV/EBITDA multiple is 51,471% higher than the 6.76 industry average. And in terms of its forward Price/Sales, it is trading at 41.45x, which is 2,425.2% higher than the 1.64x industry average.

Negative Profit Margins

UUUU’s 18.41x trailing 12-month gross profit margin is 55% lower than the 40.93% industry average. Its negative 39.53% trailing 12-month net income margin is substantially lower than the 6.18% industry average.

The stock’s negative 1.00%, 9.85%, and 0.74% respective trailing 12-month ROE, ROTC, and ROA compare to their 10.98%, 5.26%, and 3.58% industry averages.

POWR Ratings Reflect Bleak Prospects

UUUU’s POWR Ratings reflect this bleak outlook. The stock has an overall F rating, which equates to a Strong Sell in our proprietary rating system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

UUUU has a Value grade of F, which is in sync with its high valuations. It has a Quality grade of D, which is justified by its bleak profitability margins.

In the 37-stock Industrial – Metals industry, it is ranked #34.

Click here to see the additional POWR Ratings for UUUU (Growth, Momentum, Stability, and Sentiment).

View all the top stocks in the Industrial – Metals industry here.

Click here to check out our Industrial Sector Report for 2022

Bottom Line

Although the Bahia Project acquisition should prove profitable, it might take some time before substantial gains from it can be realized. And considering its weak fundamental positioning, I think the stock might be best avoided now.

How Does Energy Fuels Inc. (UUUU) Stack Up Against its Peers?

While UUUU has an overall POWR Rating of F, one might consider looking at its industry peers, Ryerson Holding Corporation (RYI) and BHP Group Limited (BHP), which have an overall A (Strong Buy) rating, and Marubeni Corporation (MARUY) and Rio Tinto Group (RIO), which have an overall B (Buy) rating.

Want More Great Investing Ideas?

UUUU shares rose $0.08 (+1.11%) in premarket trading Thursday. Year-to-date, UUUU has declined -5.90%, versus a -13.15% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| UUUU | Get Rating | Get Rating | Get Rating |

| RYI | Get Rating | Get Rating | Get Rating |

| BHP | Get Rating | Get Rating | Get Rating |

| MARUY | Get Rating | Get Rating | Get Rating |

| RIO | Get Rating | Get Rating | Get Rating |