- More than robust energy demand- US energy policy could have an opposite to the desired impact over the coming years

- The XLE is a diversified traditional multinational energy ETF product

- A significant comeback, but lots of room on the upside

- XLE pays while you wait for capital appreciation

- Three reasons crude oil could head for $100- Bullish for XLE

Prices are rising as raw material inputs are moving to multi-year or all-time highs. After making significant price bottoms in March and April 2020 during the height of “risk-off” selling during the global pandemic’s spread, prices have taken off on the upside.

In April 2020, nearby NYMEX crude oil futures fell to a record low at negative $40.32 per barrel. NYMEX crude oil’s delivery point is a pipeline in Cushing, Oklahoma, making it landlocked petroleum. As storage facilities reached capacity, there was nowhere to store the energy commodity. Those holding long positions as the nearby futures contract entered the delivery period had to sell at any price as WTI crude oil became a bearish hot potato.

Brent crude oil futures fell to a century low at $16 in April 2020. Brent is a seaborne crude oil. The potential to store oil in tankers prevented it from falling below zero.

As crude oil tanked last April, shares of the leading US traditional oil and gas companies plunged. The Energy Select SPDR Fund (XLE) holds a portfolio of the top US oil companies’ shares. The XLE has made a substantial comeback since the 2020 lows, but it has room on the upside as the energy commodity is trending higher and more gains are on the horizon. Higher crude oil prices translate to rising profits for companies in the XLE.

More than robust energy demand- US energy policy could have an opposite to the desired impact over the coming years

It is no secret that the energy demand picture in 2021 is a complete about-face from this time in 2020. Vaccines creating herd immunity to COVID-19 are sending people back to the workplace, allowing for more unrestrained movement. They are increasing the number of people taking long-overdue vacations over the coming weeks and months.

Moreover, the sharp rise in commodity prices from metals to agricultural products increases production, lifting energy requirements for mining, smelting, refining, and farming worldwide. The bottom line is that energy demand is not only robust; it is booming.

Meanwhile, US energy policy under the Biden administration is shifting to a greener path. According to Baker Hughes, the number of operating oil and gas rigs on May 14 was 352 and 100, respectively. Since last year at the same time, there are 94 more oil and 21 more natural gas rigs extracting the energy commodities from the earth’s crust in the US.

Meanwhile, according to the Energy Information Administration, US crude oil production stood at 11 million barrels per day as of May 7, down 7.6% from May 1, 2020, and natural gas inventories were 15.7% lower than last year. The tightening regulatory environment under the Biden administration is likely weighing on oil and gas output as demand is rising.

OPEC+’s pricing power is rising after years of suffering under US shale production. The cartel’s mission is to manage production policy to achieve the highest possible price for its members.

While the shift to green energy production and consumption will take years, the US and other consumers worldwide continue to depend on fossil fuels for power. US energy policy could wind up costing consumers a lot as energy prices rise.

The XLE is a diversified traditional multinational energy ETF product

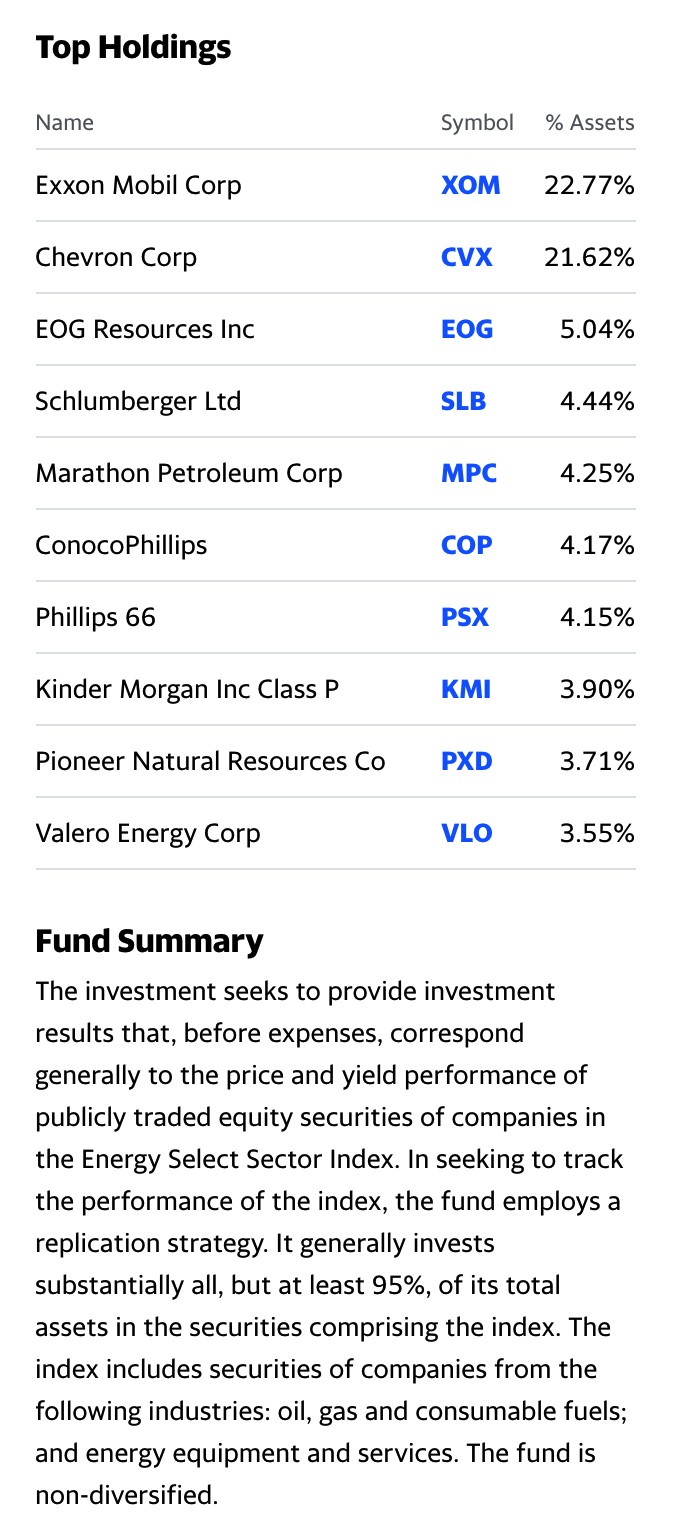

XLE is the leading diversified ETF holding a portfolio of multinational US oil and gas-related companies. XLE’s top holdings and fund summary include:

Source: Yahoo Finance

Source: Yahoo Finance

The holdings include an over 44% exposure to Exxon Mobile (XOM) and Chevron (CVX), the two top US integrated oil and gas companies. XLE also holds oil services and refining companies in its portfolio. At $53.49 per share at the end of last week, the XLE had approximately $23.84 billion in assets under management. The ETF trades an average of over 29.8 million shares each day and charges a 0.12% management fee.

Rising oil and gas prices pushed earnings higher for the companies in the XLE’s portfolio.

Source: CQG

Source: CQG

During the second week of May 2020, nearby NYMEX crude oil was below the $30 per barrel level. The price was over double that level at the end of last week, with nearby June futures settling at $65.37 per barrel.

Source: CQG

Source: CQG

At this time last year, nearby natural gas futures traded to a high of $1.89 per MMBtu, at over the $2.90 level on May 14, the price is over $1 per MMBtu higher.

Source: Barchart

Source: Barchart

On May 14, 2020, the XLE closed at $36.13 per share. At $53.49, the ETF was 48% higher. Crude oil, natural gas, and the XLE all experienced significant price recoveries from mid-May 2020 to mid-May 2021. The trends in all three remain bullish.

A significant comeback, but lots of room on the upside

The XLE maybe 48.5% higher than last year at this time, but the long-term chart shows that it could have room to run over the coming months.

Source: Barchart

Source: Barchart

The long-term chart shows that technical resistance stands at the April 2019 $68.81 high, the May 2018 $79.42 peak, and the all-time high from 2014 at $101.52 per share.

The trend is always your best friend in markets. In the XLE, it remains higher as of May 14, 2021.

XLE pays while you wait for capital appreciation

The leading US multinational traditional energy companies continue to pay above-market dividends to their shareholders. As of April 30, the average dividend yield on the S&P 500 was at the 1.38% level. The DJIA average was at the 1.60% level, and the NASDAQ 100 yield was at 1.19%.

The XLE pays its shareholders an annualized dividend of $2.09, translating to a 3.9% yield at $53.49 per share. The XLE pays an attractive dividend while shareholders wait for capital appreciations.

Three reasons crude oil could head for $100- Bullish for XLE

Crude oil is trending higher, and the prospects for a continuation of the rally are increasing. Three factors support higher crude oil prices in the current environment:

- The tidal wave of central bank stimulus and tsunami of government stimulus is highly inflationary as they erode money’s purchasing power. Rising inflation supports higher oil and gas prices. Other commodity prices have moved to multi-year or all-time highs over the past weeks and months. The last time crude oil traded at over $100 per barrel was in 2014. Copper, palladium, and lumber prices have risen to new record peaks in May 2021. Grains moved to the highest prices since 2012-2013.

- The shift in US energy policy allows OPEC+ to squeeze US consumers after years of suffering under the weight of lower prices because of US shale output. The Biden administration is tightening regulations, increasing taxes, and limiting output to address climate change. The pricing power in the oil market has moved back into the hands of the cartel and Russia. Balancing the Saudi budget requires an $80 per barrel crude oil price. US relations with Riyadh and Moscow have deteriorated, increasing the desire to push oil prices much higher.

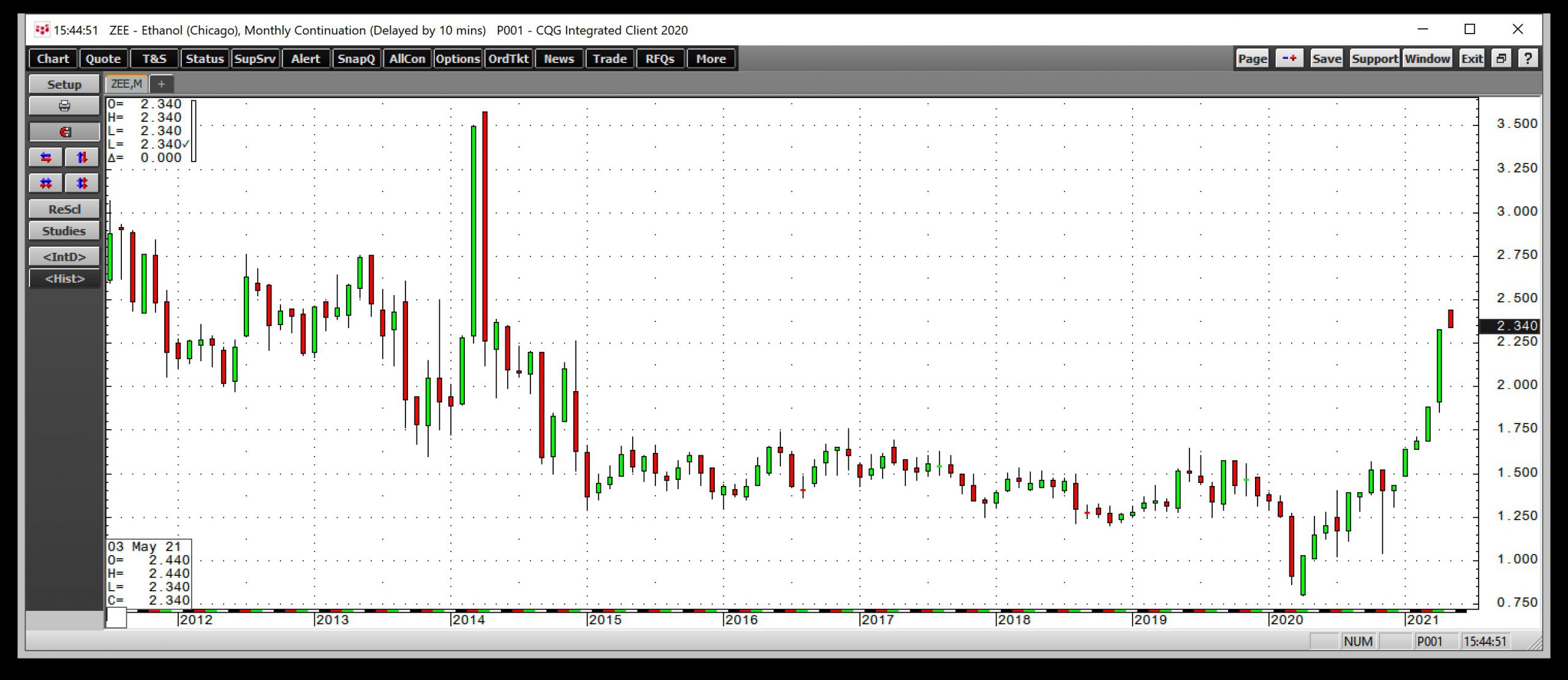

- Grain and agricultural commodity prices have exploded to the upside. In the US, corn is the primary ingredient in ethanol. In Brazil, sugar is the crucial input in biofuel. Rising corn and sugar prices have pushed ethanol to the highest price since late 2014.

Source: CQG

Source: CQG

The chart of nearby ethanol futures shows that at the most recent $2.44 per gallon high this month, biofuel prices have increased to the highest level since April and May 2014. During those months, nearby NYMEX and Brent crude oil futures were over the $100 per barrel level.

Goldman Sachs’ analysts have already forecast an $80 per barrel crude oil price by the third quarter of this year. Bull markets often take prices far higher than analysts believe possible. The last time crude oil was over $100, and gasoline prices were north of $3 per gallon was in June 2014. The XLE was trading at the $100 level during that month. The prospects for rising oil and gas prices make the XLE at $53.49 per share look inexpensive despite the 48% gain since last year at this time.

Commodity prices are trending high, and the XLE has lots of side room at its current price level.

Want More Great Investing Ideas?

XLE shares were trading at $53.92 per share on Monday morning, up $0.43 (+0.80%). Year-to-date, XLE has gained 43.78%, versus a 11.51% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| XLE | Get Rating | Get Rating | Get Rating |