$155 million of those asset sales are now complete, with the REIT selling off (at a healthy profit) its lowest quality centers. Those located in secondary markets with less population density, lower average household incomes, and that generated 42% less average base rent per square foot.

Selling income producing assets means that Kite’s FFO/share decreased 1% in 2017 and management expects it to fall 2% in 2018. In 2019 the final $100 million in asset sales are expected to cause one final 2% FFO/share decline. Wall Street HATES negative growth, especially for three years. So if Kite is technically facing declining cash flow (dividend continues to rise, however), then why do I own it and recommend it? Because of what management is using the money for.

(Source: investor presentation)

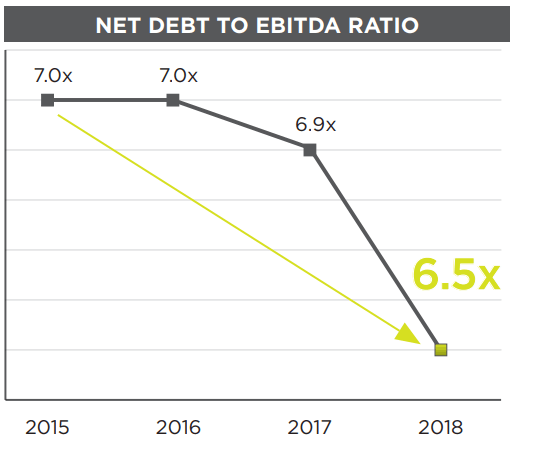

First, the REIT is paying down debt. In 2011 Kite’s net debt/EBITDA (net leverage ratio) peaked at 13.3, a dangerous level. High debt is what caused this REIT, as well as 56 others, to have to cut or eliminate their dividends during the Financial Crisis. Despite cash flow covering their payouts, credit markets slamming shut required most REITs to retain more cash, in case the credit crisis lasted for years. The entire industry has spent the last 10 years deleveraging (despite record low borrowing costs), and today the REIT sector’s debt/capital ratio is 30%, the lowest in its history (REITs were created by Congress in 1960).

Few REITs have deleveraged as aggressively as Kite, whose current leverage ratio is 6.7, down 50% from its dangerous peak seven years ago. That ratio is headed to 6.5 by the end of the year and management has said that further paying down debt is a top priority in 2019, when it completes its asset sales. Most likely that will mean Kite’s net leverage ratio falls to 5.9 to 6.1.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!