7 Best ETFs

for the NEXT

Bull Market

By Steve Reitmeister

Introduction

Bear markets may be scary at first as you see your net worth drop at a truly horrifying pace. However, long term investors also know it is one of the best times to load up for the next bull market.

Yes, you could just buy the dip with the main index ETFs like SPY, DOW or QQQ. However, it's important to remember that they are actually loaded up with the largest and safest stocks. Meaning they fell the least during the bear market and will likely rise the least when the new bull market is ready to run.

So this report takes into account the very unique aspects of the Coronavirus bear market. This had us focus on the 7 stock groups that were the most beaten down and thus offer the most upside potential as the economy gets back to normal.

1) Regional Banks - SPDR S&P Regional Banking ETF

2) Energy Production - SPDR S&P Oil & Gas Exploration & Production ETF

3) Retail - SPDR S&P Retail ETF

4) Leisure and Entertainment - Invesco Dynamic Leisure and Entertainment ETF

5) Airlines - U.S. Global Jets ETF

6) Autos - First Trust Nasdaq Global Auto Index Fund

7) Emerging Markets - iShares MSCI Emerging Markets ETF

Few of you will argue with the merit of the 7 groups selected and their respective ETFs. The bigger question mark surrounds “WHEN” to make the move into these positions?

Unfortunately nobody rings a bell at the bottom. So your best bet is a dollar cost averaging approach over 2 to 3 periods. In the end this will help you get a price close enough to bottom to enjoy ample gains in the months and years ahead.

Or to put it another way. Don’t overthink it too much. Just commit to the purchases when it seems good enough. Because really almost any entry point during the bear market will look attractive when you look back at your results a few years down the road.

OK the strategy is now set. All you have to do is read on to appreciate the virtue of each of these 7 ETFs then buy shares before it's too late.

Wishing you a world of investment success!

Steve Reitmeister

…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

1) Regional Banks - SPDR S&P Regional Banking ETF (NYSE: KRE)

Uncertainty surrounding the economic impact from the coronavirus crisis, along with near-record-low interest rates, a flat yield curve, expected loan-losses and weak consumer demand have caused the regional banking stocks to plummet. Regional banks are more vulnerable in this environment because they tend to have higher sector concentrations, on a relative basis, than large national banks. For example, if one bank reports a credit loss from energy companies, the market will immediately look for other lenders with exposure to the energy sector. This explains why regional banks took it harder on the way down...and should rise more on the way back up.

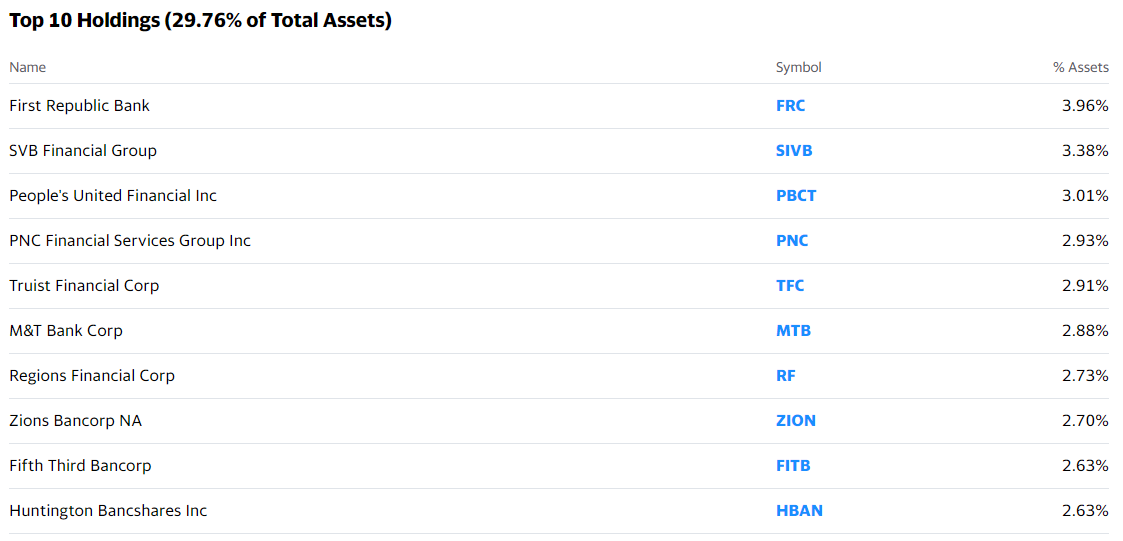

With net assets of over $1 billion and charging a 0.35% management fee, the SPDR S&P Regional Banking ETF (KRE) aims to provide similar returns to the S&P Regional Banks Select Industry Index – an equal-weighted benchmark comprising U.S. regional banking stocks. The fund's regional focus produces a tilt toward mid- and small-cap names. Ample daily trading volume of about 10 million shares combined with a small bid/ask spread suits both intraday and swing trading strategies. As of May 11, 2020, KRE issues a 4.11% dividend yield.

2) Energy Production - SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP)

It’s been quite a challenging year for the oil and gas industry. In February 2020, the International Energy Agency reset its full-year expectation for oil demand as COVID-19 ground China to a halt. In late-February Saudi Arabia and Russia went full-on price war, with plans to flood global oil markets and drive out low-cost supplies. Saudi Arabia doubled-down on its plans only a few weeks later. By March the world realized how big the COVID-19 pandemic had become, and global oil demand cratered far more than anyone expected.

The sum total of these things explains why those energy companies most closely tied to the price of oil are the most damaged. That is most certainly the stocks inside the S&P Oil & Exploration & Production ETF (XOP). And thus as the economy rebounds so too should demand. This is what will create higher energy prices and much higher XOP share price.

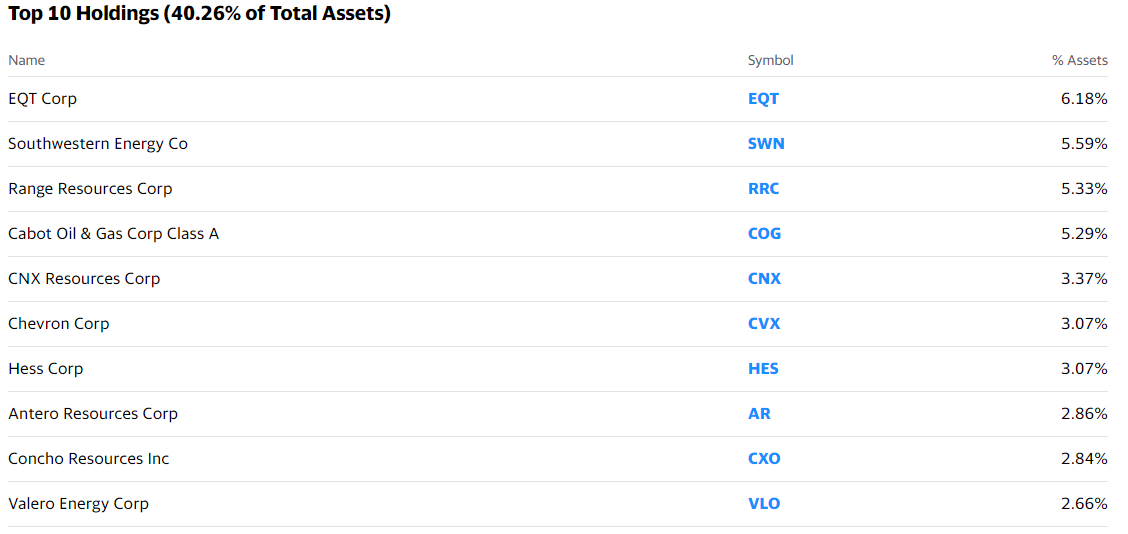

SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP) seeks to replicate the performance of an index derived from the oil and gas exploration segment of a U.S. total market composite index. The Fund uses a passive management strategy designed to track the total return performance of the S&P Oil & Gas Exploration & Production Select Industry Index. It has net assets of more than $2 billion and charges a 0.35% management fee. XOP offers an equal-weight approach to oil & gas exploration & production. Equal weighting provides diversified exposure to an industry normally dominated by a few big names, but also produces a massive bias to small and midcaps. Its average daily trading volume is 14 million shares and as of May 11, 2020, XOP had a 2.88% dividend yield.

3) Retail - SPDR S&P Retail ETF (XRT)

Among the industries most impacted by COVID-19, few have felt the adverse effects more so than retail. As states shut down their economies to prevent the spread of the virus, many non-essential stores had to temporarily shutter their doors. While some that remained open saw much lower levels of retail activity as is customary during recessionary times. That left many retail stocks in really bad shape.

So it is fair to assume that as the economy starts to normalize...so too will retail purchases and so too these stocks will rise back up from their current depths.

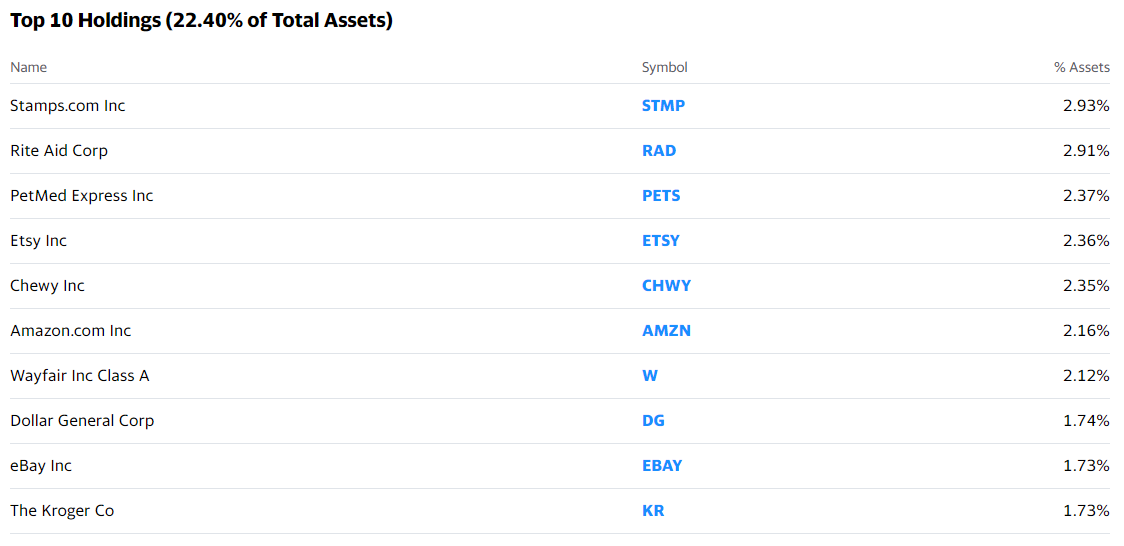

SPDR S&P Retail ETF (XRT) seeks to replicate the performance of an index derived from the retail segment of a U.S. total market composite index. The Fund uses a passive management strategy designed to track the total return performance of the S&P Retail Select Industry Index. XRT is different from its market-cap weighted peers in that it is an equal-cap weighted ETF. That means the ETF gives a broader representation of the retail industry as a whole, rather than a market-cap weighted index that would be primarily concentrated in the largest retailers like Amazon (AMZN) and Walmart (WMT). It has net assets of over $200 million and charges a 0.35% management fee. As of May 11, 2020, it pays a 2.05% dividend and trades about 7 million shares a day on average.

4) Leisure and Entertainment - Invesco Dynamic Leisure and Entertainment ETF (PEJ)

To limit the spread of the coronavirus disease, a total of 217 countries and territories worldwide have imposed travel restrictions, according to a report by the United Nations’ World Tourism Organization. Such travel curbs have turned the travel and tourism industry into one of the largest casualties of the coronavirus pandemic.

As for restaurants, the CEO of Opentable.com predicts a quarter of the restaurants in America may go out of business, due not only to the government forced shutdown but also their inability to make profits after they were allowed to reopen with social distancing rules in place.

You add up all this bad news and you understand the 40-70% haircuts for many of the stocks in this industry. Yet here too things will get better and thus long term investors will do well for themselves picking up shares of the group at current low levels.

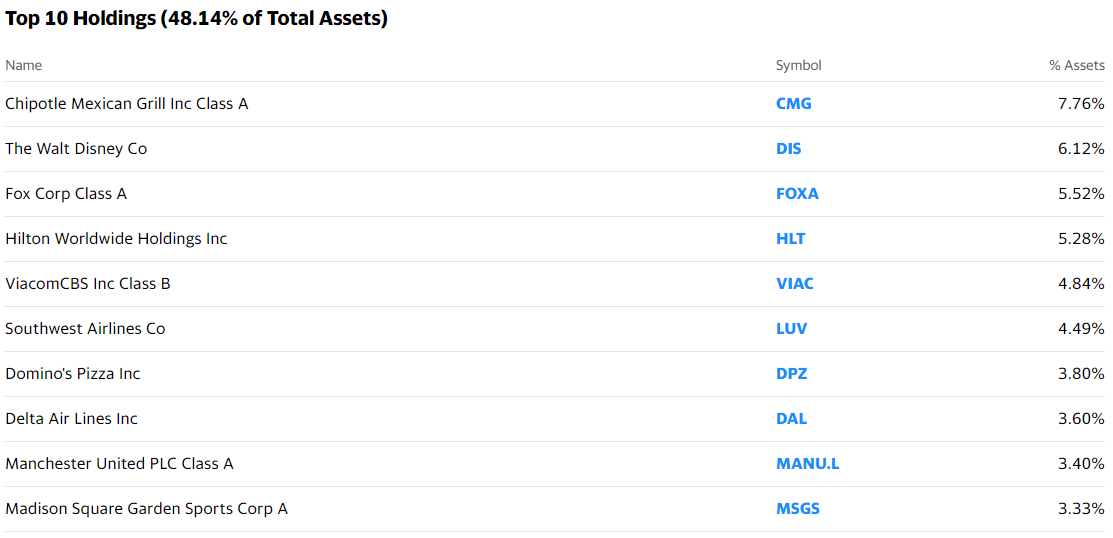

The Invesco Dynamic Leisure and Entertainment ETF (PEJ) seeks investment results that correspond generally to the price and yield of an equity index called the Dynamic Leisure and Entertainment Intellidex Index. The Fund will normally invest at least 90% of its total assets in common stocks of leisure companies and entertainment companies that comprise the Index. It has net assets of over just $100 million and its average daily trading volume is low, at just about 200,000. It also charges a 0.63% managerial fee. As of May 11, 2020, the PEJ paid a 0.95% dividend.

5) Airlines - U.S. Global Jets ETF (JETS)

In order to fight the spread of the coronavirus, governments around the world imposed severe travel restrictions on airline travel. As of early April 2020, the number of flights globally were down 80% compared to 2019 and the International Air Transport Association (IATA) predicts that the COVID-19 crisis will see airline passenger revenues drop by $314 billion in 2020.

Even when restrictions are lifted you can imagine that many would be travelers may limit how frequently they go on planes. This is why airline stocks had as cruel of a descent as experienced by the travel and leisure ETF noted above.

But as they say “this too shall pass”. So investing in this group at the trough will undoubtedly yield tremendous long term returns as life, and the airline industries, get back to normal.

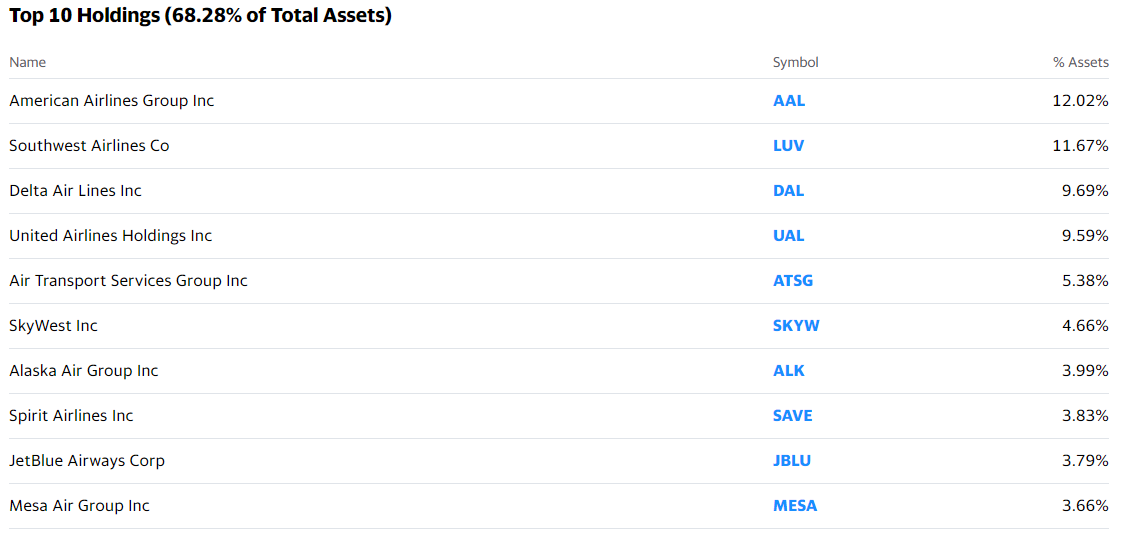

U.S. Global Jets ETF (JETS) is a fund that seeks to track the performance, before fees and expenses, of the U.S. Global Jets Index. The Index is composed of the common stock of U.S. and international passenger airlines, aircraft manufacturers, airports, and terminal services companies listed on well-developed securities exchanges across the globe. It has net assets of more than $600 million and a net expense ratio of 0.5%. JETS has an average daily volume of more than 2 million and as of May 11, 2020, and issues a 3.08% dividend yield.

The global automotive industry is expected to take a big hit from the Covid-19 outbreak. U.S. automakers have lost billions of dollars in March, April, and the majority of May 2020, with most American factories shuttered and dealer showrooms closed or running on a limited basis. Automakers and industry analysts have drastically lowered their sales expectations for the year due to the coronavirus. J.D. Power expects U.S. auto sales this year of about 12.6 million to 14.5 million vehicles, down from an estimated 16.8 million prior to the pandemic.

Just like any other recession we pull back on the big purchases. And a new automobile certainly fits in that category. Yet as the economy rebounds there will be demand for new cars once again. And likely it will be coupled with even lower interest rates than found before. That will help grease the skids of the next industry boon and investors should be prepared to get on board before the share prices race off.

With net assets of just $15 million and charging a 0.7% management fee, the First Trust Nasdaq Global Auto Index Fund (CARZ) seeks investment results that correspond generally to the price and yield of an equity index called the NASDAQ OMX Global Auto Index. The Index is designed to track the performance of the largest and most liquid companies engaged in manufacturing of automobiles. CARZ has an average daily trading volume of 550,000 shares and as of May 11, 2020, CARZ has a 3.75% dividend yield.

7) Emerging Markets - iShares MSCI Emerging Markets ETF (EEM)

The Covid-19 pandemic will be especially painful for emerging economies. Slower global trade, expected to fall by up to 30% in 2020, will decrease exports. Industries dependent on mobility, such as travel and tourism, will be impaired. Declines in commodities prices and lower volumes will affect many countries. Debt will compound the pressure. Over the past 10 years, official debt for the 30 largest emerging markets increased to over $70 trillion, a rise of 168%. Falling income, higher interest costs and capital flight will make servicing and refinancing this debt difficult. With a significant proportion of the debt denominated in foreign currency, the devaluation of emerging-market currencies exacerbates the problem.

Emerging Markets has always been a feast or famine trade. And the best possible advice is to buy in during the famine for the next feast ahead. With that in mind you understand why we are advocating shares of EEM at this time.

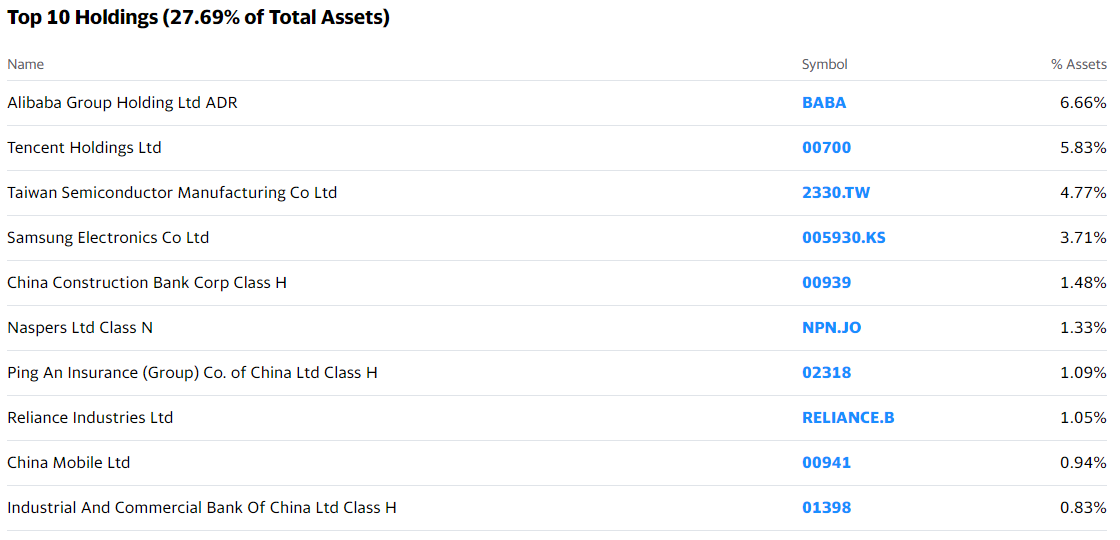

iShares MSCI Emerging Markets ETF (EEM) is large, with assets of more than $20 billion. The fund that seeks to track the investment results of an index composed of large- and mid-capitalization emerging market equities. The Fund invests, under normal circumstances, at least 90% of its assets in the securities of its Underlying Index and in depositary receipts representing securities in its Underlying Index. It charges a 0.68% management fee and has an average daily volume of more than 75 million. As of May 11, 2020 EEM issues a 2.67% dividend yield.

What Should You Do Next?

The 7 ETFs for this report were selected by Steve Reitmeister, CEO of Stock News Network which includes leading investment sites such as ETFDailyNews.com and StockNews.com.

Steve has been investing for over 40 years and enjoys sharing insights to help other investors enjoy more financial success. The best place to see his current market outlook and hand picked stock and ETF recommendations is the Reitmeister Total Return newsletter. Learn more about 30 Day trial offer by clicking the link below:

30 Day Trial to Reitmeister Total Return