7 “Safe Haven” Dividend Stocks for Turbulent Times

By StockNews.com

Introduction

Since March 2009 the U.S. stock market was riding the longest bull market in history. All was well with the investing world until February 2020 when the Coronavirus escaped beyond the Chinese borders and threatened the world economy.

Fears of a 2020 recession and bear market are mounting. This causes investors to be unsure what to do next:

- Aggressively buy the dip?

- Run to cash?

- Add safe dividend stocks to your portfolio?

This special report advocates the strategy shared in the last bullet point and that is to buy safe dividend paying stocks. This especially makes sense at this time in history when government bond rates are falling to historic lows. This drives income hungry investors to these safe dividend stocks bolstering their share price.

Here is the trick. Too often buying dividend stocks is just a way to lose “less money” while the market sinks. So our goal with this report is to present to you 7 stocks that actually have a chance to rise because they bring more to the party than just a high dividend yield.

That’s because this list consists of 7 companies in safe industries that also have surprisingly attractive growth prospects along with impressive value. This combination of elements gives these stocks a decided edge that should lead to outperformance.

In total you will find 7 safe, yet very attractive dividend stocks that should give you a smoother ride to outperformance this year. They should also help you sleep at night if the stock market continues to slide further into bear territory.

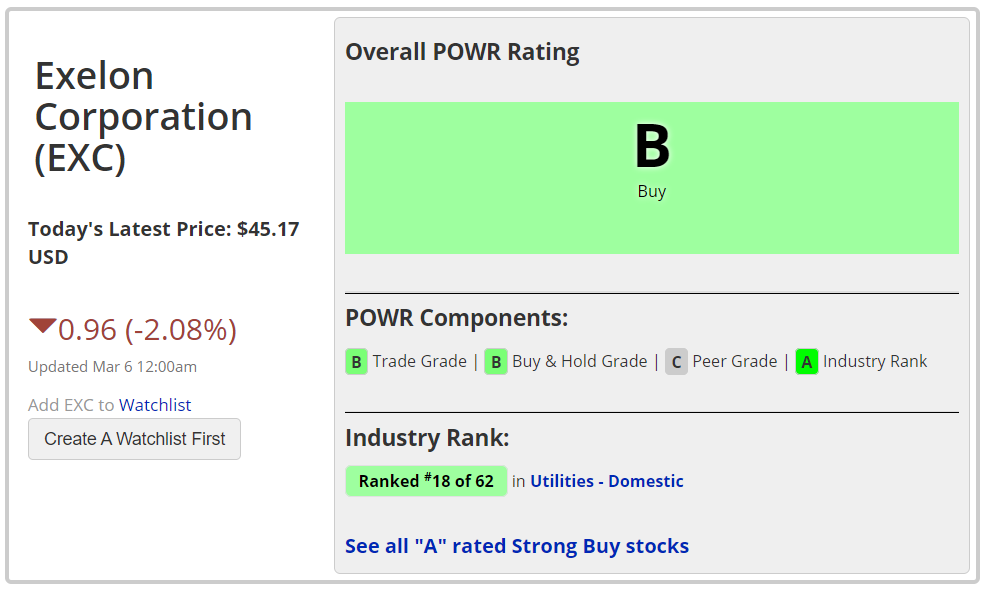

Stock #1 - Exelon (EXC)

The utilities sector is made up of companies that provide basic amenities, such as water, sewage services, electricity, dams, and natural gas. They are considered “recession proof” because they buck the downward slide of the market or have a relatively lower percentage decline as compared to other sectors or indices. That’s because they deal with basic services, which are not as affected by the vagaries of the economy. Utility companies are preferred picks for investors looking for stability and regular dividend payouts.

One such company is Exelon Corporation. This massive energy company has the largest number of electricity and natural gas customers in the U.S. Exelon does business in 48 states, the District of Columbia and Canada and had 2018 revenue of $36 billion. Exelon serves approximately 10 million customers in Delaware, the District of Columbia, Illinois, Maryland, New Jersey and Pennsylvania.

Utility stocks tend to fare well when interest rates decline. On March, 3, 2020, the Federal Reserve cut interest rates by 50 basis points, to just below 1.25 percent, down from about 1.75 percent. Which is one of the reasons we have chosen to add Exelon to this list.

Exelon has a market capitalization of around $45 Billion while providing a 3.3% dividend yield (more than 4X the rate of the 10 year US Treasury bond).

The company is focused on the future, making themselves cost efficient as possible. Since 2015, Exelon has announced more than $900 million of cost reductions. On Oct 31 2019, the company announced additional annual cost savings of nearly $100 million to be achieved by 2022.

They also have substantially invested in their future by investing in infrastructure projects. Exelon plans to invest nearly $22.6 billion over the 2019-2021 time frame in regulated operations. This is intended to improve the reliability of operations.

In February, EXC was started at an Outperform with a $56 price target at BMO Capital. And Suntrust raised their price target to $49 from $47 that same month.

The POWR rating in StockNews.com for Exelon is a ‘B’ which indicates a buy. Their industry group ranking is 18 out of 62 in the utilities category.

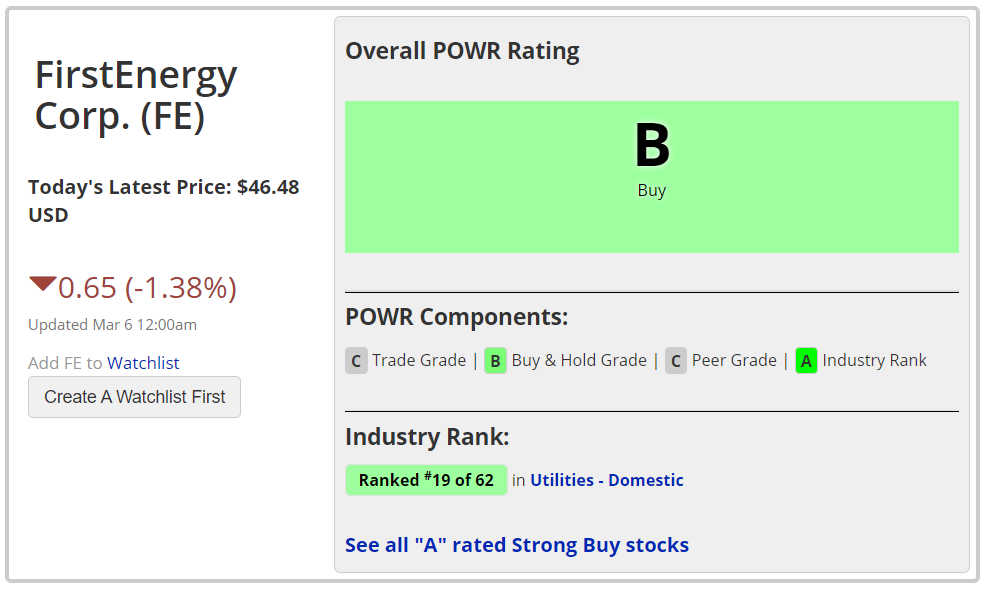

Stock #2 - FirstEnergy (FE)

FirstEnergy is also in the utility sector. The Akron, OH based company, through its subsidiaries, generates, transmits and distributes electricity in the United States.

The company has a $26 billion market cap and a 3.3% dividend yield in line with utility peer, Exelon.

We like FirstEnergy Corporation’s because it is investing in its future. The company recently made efforts to expand its regulated generation mix (a group of different primary energy sources from which secondary energy for direct use - usually electricity - is produced), which has provided stability to the company’s earnings trajectory.

A couple of years ago, the company set in motion a plan to spend nearly $6.2-$6.7 billion to strengthen its distribution network, from the 2018-2021 time period.

In addition, FirstEnergy is focused on modernization, in order to boost its service reliability and lead to customer retention. In Ohio, the company has started to implement the $516-million three-year Grid Modernization program, which was approved by the Public Utilities Commission in July. This includes the installation of 700,000 smart meters.

JPMorgan also is a fan of FirstEnergy. In February 2020 they boosted their price target for FE from $51 to $54.

The POWR rating in StockNews.com for FirstEnergy is a ‘B’ which indicates a buy. Note that the Industry Rank is an A given the current strength of the utility sector while most other sectors are showing signs of weakness.

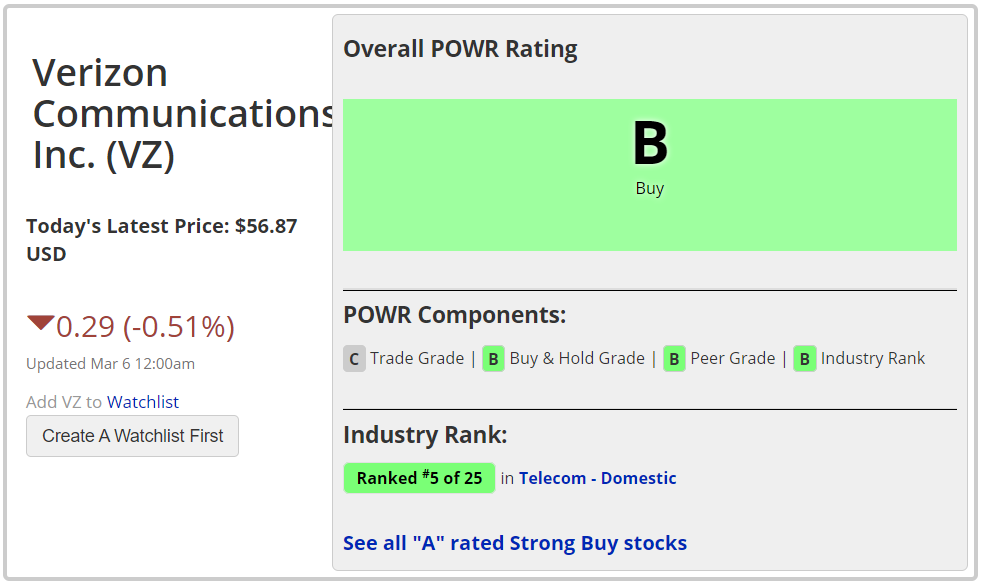

Stock #3 - Verizon Communications (VZ)

Verizon is a massive telecom company with a $240 billion market capitalization. The company engages in the provision of communications, information, and entertainment products and services to consumers, businesses, and governmental agencies.

Certainly you get the appeal of Verizon as a leading mobile telecom company. Even during rough times, people are not going to give up their phones. In fact, most of the time their phone is glued to their face checking every like and comment on social media.

This societal trend explains why VZ has been on a tear the last few years with impressive earnings growth and share price gains. The trend looks to continue as analysts are quite positive on VZ shares. As an added bonus you also get a very appealing dividend yield, of about 4.3%, which is about 4 times the safe return of government bonds. It’s easy to see how VZ will allow you to dial up attractive returns even when the overall market is rocky.

Verizon has positioned itself to be a leader in 5G that will be rolling out globally over the next 5-years. This should not only prevent any disruption to their massive base of customers but also drive growth.

Wall Street analysts' current price target on VZ is about $64.

(VZ is a recent addition to the Reitmeister Total Return portfolio).

The POWR rating in StockNews.com for Verizon Communications is a ‘B’ (Buy). Their industry group ranking is 5 out of 25.

Stock #4 - Procter & Gamble Co. (PG)

Consumer staples is one of the safe haven industries for sure and few manage this landscape better than PG with 100 years of leadership in the group. Their position within the industry and operational strength translates into more predictable earnings and dividend distributions and a healthier share price. That’s how they have grown to become a $300 billion market cap powerhouse. And that’s how you go 63 consecutive years raising a dividend (yes, that includes many recessionary periods).

Size and stability is the name of the game. They do that by having dominant market share positions in these product groups: household goods, such as diapers, toilet paper, toothpaste, shaving cream, detergent and health care products.

Currently, the average recommendation from Wall Street analysts on PG is firmly pressed to a Buy rating with an average price target of $132. Couple that with a healthy 2.6% dividend yield and you have the makings of a great value and income selection.

Momentum on shares is impressive as the POWR Rating for PG is a “B” (Buy). is a ‘B’ which indicates a Buy. That is on top of being a A rate industry where they rank #3 out of 33 companies in the group.

Add it all up and there are a lot of positives about these shares in any market environment, but most especially now as we enter bear market territory.

Stock #5 - Kimberly-Clark Corp. (KMB)

Kimberly-Clark is another consumer staples company that’s more than 100 years old. They have a significantly smaller market cap than Procter & Gamble, of “just” about $50 billion (not small by any other standard ;-). Here we have a slightly different product focus with a concentration on paper products such as Kleenex, Cottenelle, Pull-Ups, Kotex, Depend, and Huggies.

Their products are sold in more than 175 countries and they maintain offices and manufacturing facilities in 36 countries.

The company has delivered dividend-growth for 48 consecutive years and they currently have a yield of about 3.2%. (A nice notch above that of PG).

In January of 2020, Deutsche Bank and Citigroup both boosted their price target on Kimberly-Clark and Wall Street's current consensus price target is about $142. That is ample upside at this time for a quality stock that rarely goes on sale.

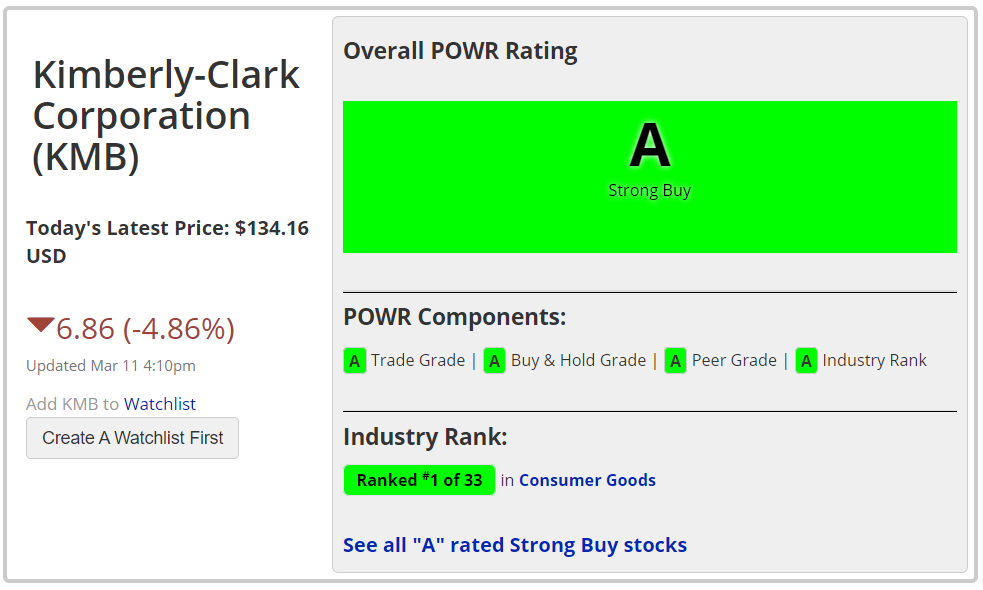

The POWR Ratings on StockNews.com for Kimberly-Clark is an ‘A’ (Strong Buy). More interesting, is that it has an ‘A’ rating in all 4 of the component ratings (Trade Grade, Buy & Hold Grade, Peer Grade, and Industry Rank). See the full ratings story below.

Stock #6 - AstraZeneca PLC (AZN)

Pharmaceutical stocks have long been a safe haven for investors when things get rough. But in particular this time around, with a health crisis as the main cause of market concern, the drug companies have an extra appeal.

What stands out the most with AstraZeneca is that they have the most impressive track record of earnings beats on the list. In fact, the last 4 quarters AZN has served up an average 36% earnings surprise. No doubt this explains the nearly 100% gain for AZN shares the past few years.

Looking ahead AZN, which has approximately a $125 billion market cap, provides a healthy 2.9% dividend to go along with nearly 10% upside in shares to the average Wall Street target price. However, some top rated analysts, like Andrew Berens of Leerink Partners, sees $58 as a more realistic price for AZN. If that comes true, then investors will be quite happy with their overall return this year.

On February 28, 2020, Cowen reiterated their Buy rating on AZN, with a $55 price target.

The POWR rating in StockNews.com for Astrazeneca is a ‘B’ which indicates a buy. Their peer group ranking is 15 out of 215. Noteworthy is that Alibaba ranks an ‘A’ in 2 of the four categories (see below).

Stock #7 - Philip Morris International (PM)

Philip Morris manufactures and sells cigarettes, tobacco and nicotine-containing products. In 2008, Alrtria (MO) spun off Philip Morris International, with Altria serving the U.S. and Philip Morris owning the international rights to all of Altria’s most famous brands.

The company has more than 150 million customers in over 180 countries and has close to 30% international market share (excluding China and the U.S.).

The company has a $135 billion market cap and a 5.3% dividend yield.

Some might wonder why this company is on our list, due to declining smoking rates worldwide. However, PM is offsetting those declines by raising prices, cutting costs, and expanding its higher-growth iQOS business, which are electronic devices that heat up a stick of tobacco instead of burning it. That balancing act is working, and analysts expect its revenue and earnings to rise 5% and 8%, respectively, this year.

PM has also had 8 straight earnings beats and 3X normal dividend yield. Add that to 11% upside to fair value and PM should be a prime safe haven pick with upside potential.

In February 2020, Cowen upgraded PM from Market Perform to Outperform and raised their price target from $90 to $102.

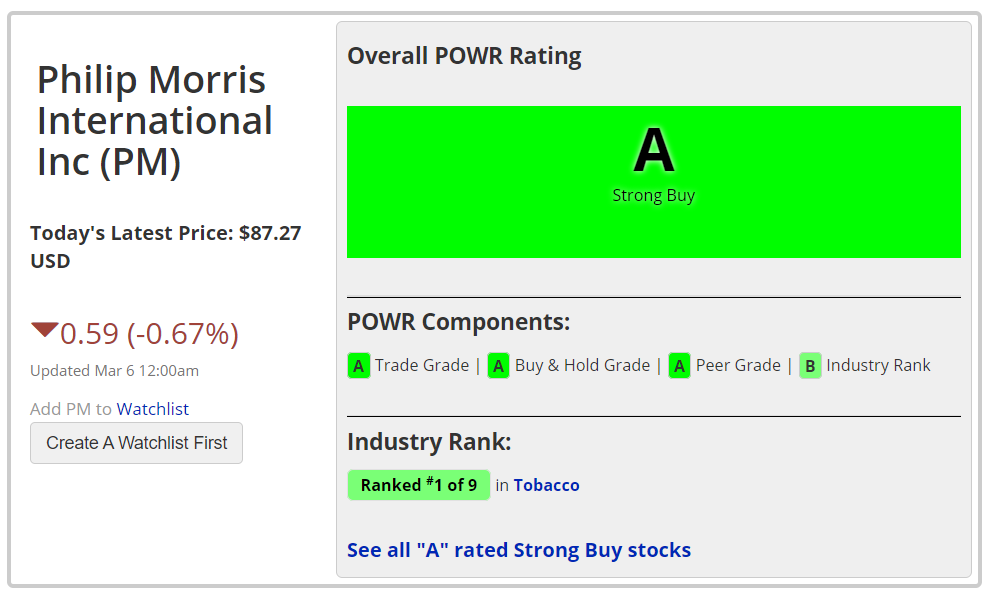

The POWR Ratings on StockNews.com for Philip Morris is an ‘A’ (Strong Buy). More interesting, is that its industry group ranking is the pick of the litter; 1 out of 9. (See the full ratings story below.)

What to Do Next?

Take advantage of all the investor resources on StockNews.com.

POWR Ratings

Our proprietary model is updated every market day to have you focused on the most timely stocks to buy. And the weakest stocks that need to be sold from your portfolio before incurring unnecessary losses. Learn more about the POWR Ratings and see all the Buy and Sells by visiting: https://stocknews.com/powr-ratings/

This is where StockNews.com CEO Steve Reitmeister shares his 40 years of investing experience to help you enjoy more investment success. As the name “total return” implies, this newsletter will help you make money no matter the market direction. That’s because Steve embraces the primary market trend and is willing to go bullish or bearish as needed to help generate stock market gains.

Discover Steve’s current market outlook and portfolio of top picks by starting a 30 day trial. Go to: stocknews.com/rtrtrial.