What Investors Should Be Doing Now

It’s important to always remember that stocks are naturally volatile at times. At the very least investors need to accept and come to terms with this fact. But the best thing you can do is actually embrace volatility as you would a lover. That’s because stocks don’t do well over time despite volatility, but precisely because of it.

Times of peak volatility means not just crashing prices, and incredible bargains, but also is what actually drives all the market’s long-term gains.

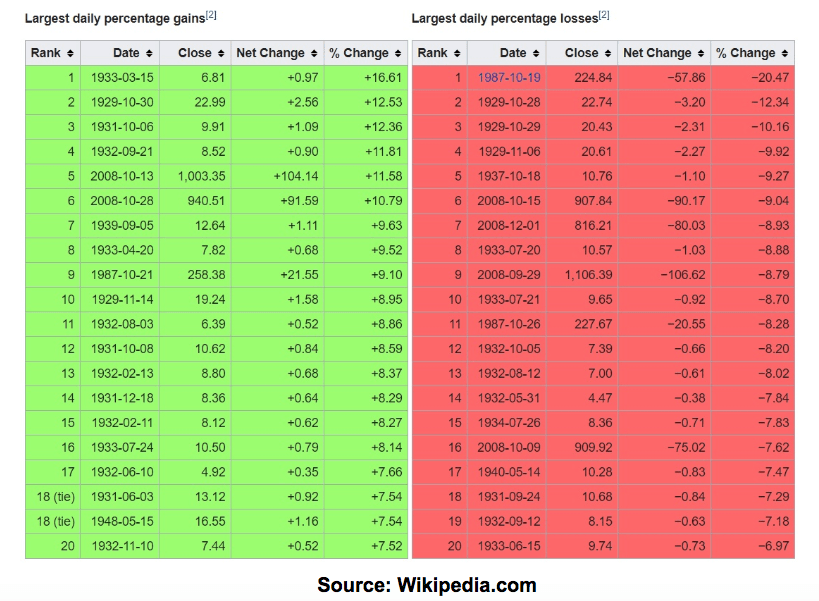

The market’s biggest single daily gains tend to come during bear markets when volatility is at its peak and stock valuations are at their lowest. Why does this matter? Because to earn the kind of great returns stocks deliver over time requires you to capitalize on those strong daily gains.

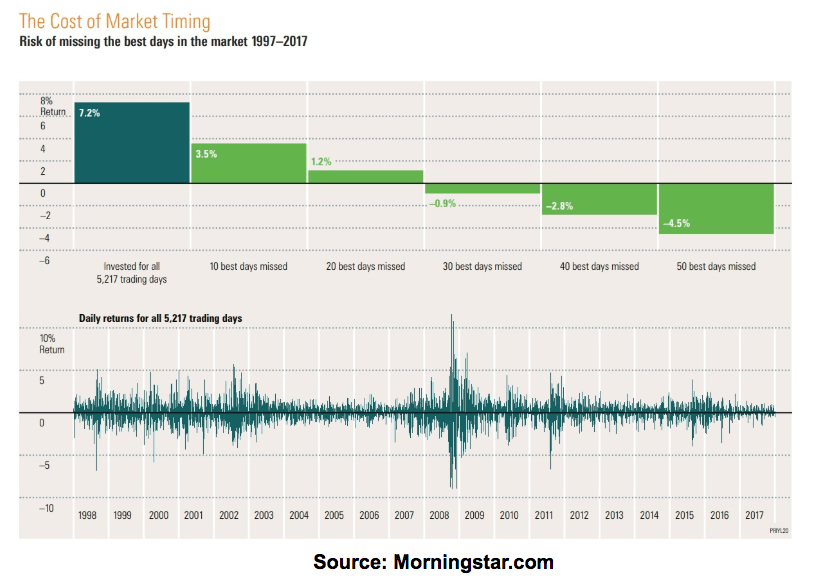

Over the past 20 years, there have been just over 5,200 trading days. Investors who tried to time the market and missed out on just the best 10 single days saw their total returns cut in half. Those that missed out on the best 30 days actually earned negative total returns. And missing the best 50 days, less than 1% of the total time the market was trading, meant stunning long-term losses. In fact, over the past 20 years missing those top 50 single best days would have meant your portfolio actually shrank 60% over half an investing lifetime. This means that for market timing to work means not merely avoiding bear markets. It actually requires pin point precision, by short-term trading in and out of markets during the very times of peak panic and fears most investors wish to avoid.

The good news is that buying and hold investing in quality companies (or passive index funds if you don’t have the desire to stock pick) is a great time-tested strategy for most investors. In order to protect your wealth and standard of living from the market’s periodic downturns, you should use the right asset allocation or mix of stocks/bonds/cash equivalents that’s right for you. Talk to a certified financial planner to work out the specifics, but in general, the idea is that you should have enough cash on hand to cover two to four years of expenses (if you’re retired). That way you can avoid becoming a forced seller of stocks at the worst possible time, but rather only sell when your investments have had time to recover.

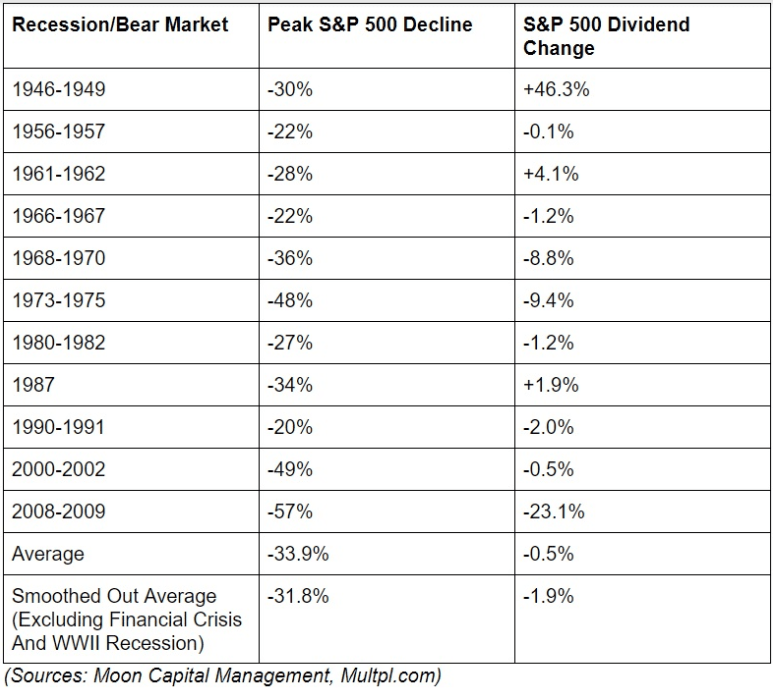

Bonds are a source of income, and generally either decline less during a bear market, or most of the time appreciate due to falling interest rates (during a recession) increasing their value. Thus the right asset allocation can help you to not just cover your expenses during a market downturn, but also provide you with some income and peace of mind. And of course, a quality dividend portfolio is also a great way to achieve your financial goals since dividends tend to be far less volatile than share prices.

That’s because companies know that income investors will often badly punish a stock that cuts its payout, and thus tend to avoid doing so unless absolutely necessary. Ideally, you can build up a large enough nest egg to live 100% off your safe and steadily rising dividends. If so then you can safely over allocate your portfolio in stocks knowing that your passive income will cover expenses no matter what share prices are doing. That’s my plan for my own high-yield income growth portfolio.

If your portfolio isn’t large enough to achieve this? Well, that’s where asset allocation comes in and can keep you on track to reach your financial goals even when the stock market plummets.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!