What other clues were out there that might have warned of the U.S. playing “catch up to the downside” rather than the rest of the world joining the bull market party?

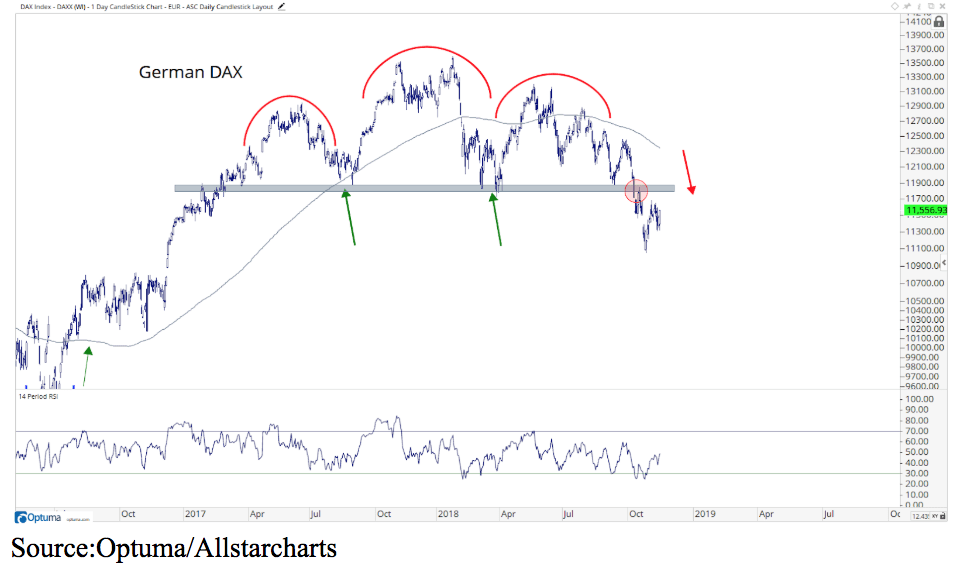

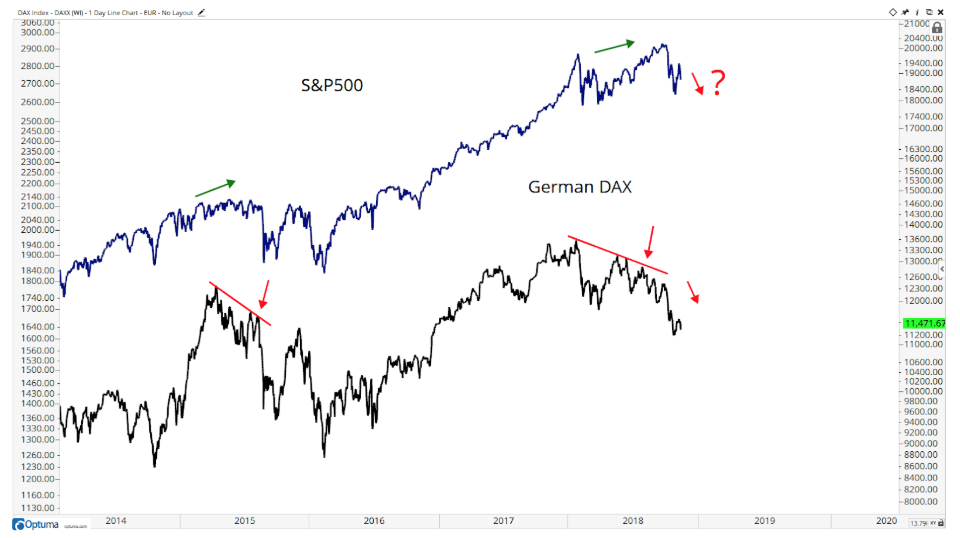

Germany, the most important economy in Europe, has been a great leading indicator in the past. We often see Germany rolling over prior to U.S. markets getting hit.

Here is a good example from the 2015 top: Germany peaked and started rolling over well in advance of the U.S., suggesting that there is more downside ahead.

Source: Optuma/Allstarcharts

The upshot is that the tone of the stock market has changed, and investors should adjust their game plan accordingly.

And it is the first time since 2002 that buying the dip on a week-to-week basis has resulted in a negative return.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!