Altimmune, Inc. (ALT): Price and Financial Metrics

ALT Price/Volume Stats

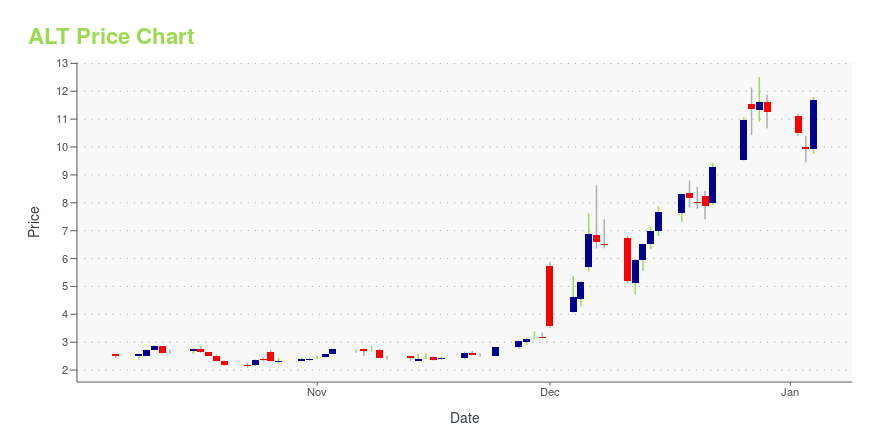

| Current price | $6.89 | 52-week high | $14.84 |

| Prev. close | $7.04 | 52-week low | $2.09 |

| Day low | $6.85 | Volume | 3,215,900 |

| Day high | $7.26 | Avg. volume | 5,529,400 |

| 50-day MA | $9.56 | Dividend yield | N/A |

| 200-day MA | $5.89 | Market Cap | 488.47M |

ALT Stock Price Chart Interactive Chart >

Altimmune, Inc. (ALT) Company Bio

Altimmune, Inc., a clinical stage biopharmaceutical company, focused developing treatments for liver disease, immune modulating therapies, and vaccines. The company develops HepTcell, an immunotherapeutic product candidate that has completed Phase I clinical trial for patients chronically infected with the hepatitis B virus; NasoShield, an anthrax vaccine to provide for protection after a single intranasal administration; NasoVAX, a recombinant intranasal vaccine product candidate; and AdCOVID, a single-dose intranasal vaccine to protect against COVID-19 Its preclinical stage products include ALT-801, a novel peptide-based dual GLP-1/Glucagon receptor agonist for the treatment of non-alcoholic steatohepatitis; and ALT-702, an investigational tumor immunostimulant for treating cancer. The company also develops veterinary product candidates. It has a collaboration with the University of Alabama at Birmingham for the development of AdCOVID. Altimmune, Inc. is headquartered in Gaithersburg, Maryland.

Latest ALT News From Around the Web

Below are the latest news stories about ALTIMMUNE INC that investors may wish to consider to help them evaluate ALT as an investment opportunity.

Why Is Altimmune (ALT) Stock Up 43% Today?Altimmune stock is rising higher on Friday with heavy trading of ALT shares after posting positive results form a clinical trial. |

Why Is Hub Cyber Security (HUBC) Stock Up 30% Today?Hub Cyber Security stock is rising higher on Friday as HUBC investors react to an expanded partnership with Blackswan Technologies. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayIt's the final day of trading this week and we're starting it with a breakdown of the biggest pre-market stock movers on Friday morning! |

Altimmune Announces Positive Topline Results from MOMENTUM 48-Week Phase 2 Obesity Trial of PemvidutideAchieved mean weight loss of 15.6% on 2.4 mg dose of pemvidutide at Week 48, with weight loss continuing at the end of treatmentOver 30% of subjects achieved 20% or more weight loss on 2.4 mg dose at 48 weeks Robust reductions in BMI and serum lipids and improvements in blood pressure without imbalances in cardiac events, arrhythmias or clinically meaningful increases in heart rate Altimmune to host conference call tomorrow at 8:30 am EST GAITHERSBURG, Md., Nov. 30, 2023 (GLOBE NEWSWIRE) -- Alti |

Altimmune Announces Third Quarter 2023 Financial Results and Provides a Business UpdateTop-line 48-week results from the MOMENTUM Phase 2 obesity trial expected Q4 2023 Pemvidutide granted Fast Track designation for the treatment of non-alcoholic steatohepatitis (NASH) Top-line results from the Phase 2 trial of HepTcell™ in chronic hepatitis B (CHB) expected Q1 2024 Webcast to be held today, November 7, 2023, at 8:30 am EST GAITHERSBURG, Md., Nov. 07, 2023 (GLOBE NEWSWIRE) -- Altimmune, Inc. (Nasdaq: ALT), a clinical-stage biopharmaceutical company, today announced financial resul |

ALT Price Returns

| 1-mo | -26.23% |

| 3-mo | -25.51% |

| 6-mo | 217.51% |

| 1-year | 20.24% |

| 3-year | -41.66% |

| 5-year | 151.46% |

| YTD | -38.76% |

| 2023 | -31.61% |

| 2022 | 79.59% |

| 2021 | -18.79% |

| 2020 | 496.83% |

| 2019 | -8.25% |

Continue Researching ALT

Here are a few links from around the web to help you further your research on Altimmune Inc's stock as an investment opportunity:Altimmune Inc (ALT) Stock Price | Nasdaq

Altimmune Inc (ALT) Stock Quote, History and News - Yahoo Finance

Altimmune Inc (ALT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...