Alta Equipment Group Inc. (ALTG): Price and Financial Metrics

ALTG Price/Volume Stats

| Current price | $11.65 | 52-week high | $17.98 |

| Prev. close | $11.43 | 52-week low | $8.76 |

| Day low | $11.48 | Volume | 21,544 |

| Day high | $11.72 | Avg. volume | 309,944 |

| 50-day MA | $11.90 | Dividend yield | 1.96% |

| 200-day MA | $12.33 | Market Cap | 382.18M |

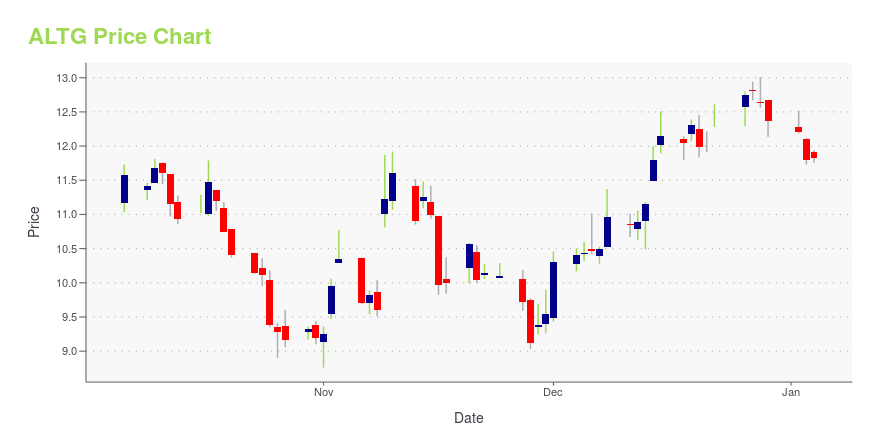

ALTG Stock Price Chart Interactive Chart >

Alta Equipment Group Inc. (ALTG) Company Bio

Alta Equipment Group Inc. owns and operates integrated equipment dealership platforms in the United States. The company operates through two segments, Industrial Equipment and Construction Equipment. It operates a branch network that sells, rents, and provides parts and service support for various categories of specialized equipment, including lift trucks and aerial work platforms, cranes, earthmoving equipment, and other industrial and construction equipment. Alta Equipment Group Inc. also offers repair and maintenance services for its equipment. The company was formerly known as B. Riley Principal Merger Corp. and changed its name to Alta Equipment Group Inc. in February 2020. Alta Equipment Group Inc. was founded in 1984 and is based in Livonia, Michigan.

Latest ALTG News From Around the Web

Below are the latest news stories about ALTA EQUIPMENT GROUP INC that investors may wish to consider to help them evaluate ALTG as an investment opportunity.

Alta Equipment Group Inc. (NYSE:ALTG) Q3 2023 Earnings Call TranscriptAlta Equipment Group Inc. (NYSE:ALTG) Q3 2023 Earnings Call Transcript November 11, 2023 Operator: Good afternoon and thank you for attending the Alta Equipment Group Third Quarter 2023 Earnings Conference Call. My name is Matt and I’ll be your moderator for today’s call. I will now turn the call over to Jason Dammeyer, Director, SEC […] |

Alta Equipment Group Announces Third Quarter 2023 Financial ResultsThird Quarter Financial Highlights: (comparisons are year over year) Total revenues increased 15.1% year over year to $466.2 millionConstruction and Material Handling revenues of $282.0 million and $168.6 million, respectivelyMaster Distribution with revenues of $18.1 millionProduct support revenues increased 12.1% year over year with Parts sales increasing to $69.5 million and Service revenues increasing to $60.6 millionNew and used equipment sales grew 20.7% to $253.6 millionNet income availab |

Alta Equipment Group Announces Common Stock DividendLIVONIA, Mich., Nov. 03, 2023 (GLOBE NEWSWIRE) -- Alta Equipment Group Inc. (NYSE: ALTG) (“Alta” or "the Company"), a leading provider of premium material handling, construction and environmental processing equipment and related services, today announced that its Board of Directors approved the quarterly dividend on its common stock in the amount of $0.057 per share. The dividend payment date is November 30, 2023, to shareholders of record at the close of business on November 15, 2023. About Alt |

Alta Equipment Group Acquires Ault Industries Expanding Construction Equipment Segment to CanadaExpands product portfolio with new OEMs, including an exclusive distributorship with McCloskeyDiversifies end markets with entrance into Ontario and Quebec’s aggregate and mining industriesAult generated approximately $50.3 million in revenue, $4.5 million in net income, and $7.5 million in adjusted EBITDA for the trailing twelve months through June 30, 2023 and is expected to be immediately accretive to the Company’s free cash flow conversion, profitability, and earnings per share ratios LIVONI |

Alta Equipment Group Announces Date of Third Quarter 2023 Financial Results Release, Conference Call and WebcastLIVONIA, Mich., Oct. 25, 2023 (GLOBE NEWSWIRE) -- Alta Equipment Group Inc. (NYSE: ALTG) (“Alta” or the “Company”), a leading provider of premium material handling, construction and environmental processing equipment and related services, today announced that it will report its financial results for the third quarter ended September 30, 2023, after the U.S. markets close on Wednesday, November 8, 2023. In conjunction with this announcement, Alta management will host a conference call and webcast |

ALTG Price Returns

| 1-mo | -8.70% |

| 3-mo | 10.07% |

| 6-mo | 26.86% |

| 1-year | -15.84% |

| 3-year | -16.20% |

| 5-year | 23.80% |

| YTD | -5.33% |

| 2023 | -4.66% |

| 2022 | -9.12% |

| 2021 | 48.18% |

| 2020 | -1.30% |

| 2019 | N/A |

ALTG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...