Anika Therapeutics Inc. (ANIK): Price and Financial Metrics

ANIK Price/Volume Stats

| Current price | $25.84 | 52-week high | $28.13 |

| Prev. close | $25.43 | 52-week low | $16.54 |

| Day low | $25.46 | Volume | 49,200 |

| Day high | $25.97 | Avg. volume | 81,717 |

| 50-day MA | $25.23 | Dividend yield | N/A |

| 200-day MA | $22.10 | Market Cap | 383.72M |

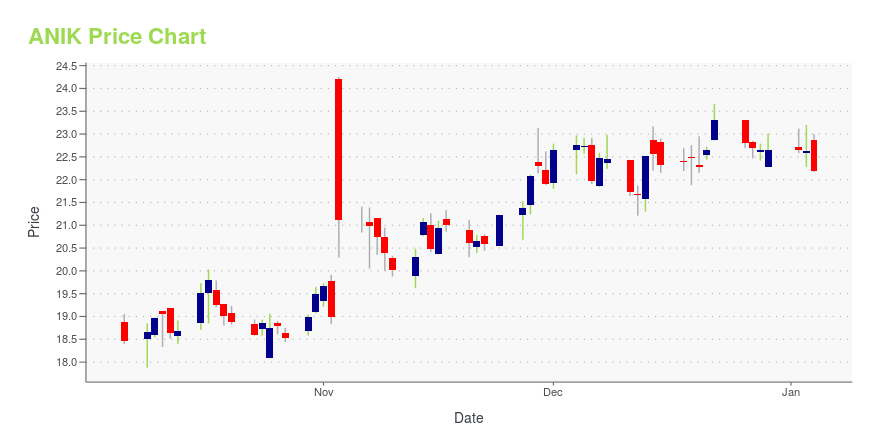

ANIK Stock Price Chart Interactive Chart >

Anika Therapeutics Inc. (ANIK) Company Bio

Anika Therapeutics develops, manufactures, and commercializes therapeutic products for tissue protection, healing, and repair. The company was founded in 1983 and is based in Bedford, Massachusetts.

Latest ANIK News From Around the Web

Below are the latest news stories about ANIKA THERAPEUTICS INC that investors may wish to consider to help them evaluate ANIK as an investment opportunity.

New Strong Buy Stocks for December 14thMUSA, AVTX, ANIK, CARG and WES have been added to the Zacks Rank #1 (Strong Buy) List on December 14, 2023. |

Anika Announces First Surgeries Performed using the Integrity™ Implant System, a Regenerative Hyaluronic Acid-Based Patch System for Rotator Cuff Repairs, Commencing Limited Market ReleaseIntegrity marks Anika’s entrance into the fast-growing $150 million+2 U.S. rotator cuff augmentation market and expansion of its proprietary hyaluronic acid (HA) regenerative portfolio BEDFORD, Mass., Nov. 28, 2023 (GLOBE NEWSWIRE) -- Anika Therapeutics, Inc. (NASDAQ: ANIK), a global joint preservation company focused on early intervention orthopedics, today announced that the first surgeries using the Integrity Implant System were successfully performed by Dr. Christopher Baker at the Florida O |

Anika to Participate in Upcoming Investor ConferencesBEDFORD, Mass., Nov. 07, 2023 (GLOBE NEWSWIRE) -- Anika Therapeutics, Inc. (NASDAQ: ANIK), a global joint preservation company in early intervention orthopedics, today announced that Dr. Cheryl Blanchard, President and Chief Executive Officer and Michael Levitz, Executive Vice President, Chief Financial Officer and Treasurer, will be participating at the following investor conferences: The Stephens Annual Investment Conference at the Grand Hyatt, Nashville, TN, on Wednesday, November 15, 2023. T |

Anika Therapeutics, Inc. (NASDAQ:ANIK) Q3 2023 Earnings Call TranscriptAnika Therapeutics, Inc. (NASDAQ:ANIK) Q3 2023 Earnings Call Transcript November 3, 2023 Operator: Good evening, ladies and gentlemen, and welcome to Anika’s Third Quarter 2023 Earnings Conference Call. All participants’ will be in a listen-only mode. [Operator Instructions] After today’s presentation, there will be an opportunity to ask questions. [Operator Instructions] Please note today’s event […] |

Q3 2023 Anika Therapeutics Inc Earnings CallQ3 2023 Anika Therapeutics Inc Earnings Call |

ANIK Price Returns

| 1-mo | 1.77% |

| 3-mo | 16.19% |

| 6-mo | 38.92% |

| 1-year | -4.54% |

| 3-year | -38.00% |

| 5-year | -18.84% |

| YTD | 14.03% |

| 2023 | -23.45% |

| 2022 | -17.39% |

| 2021 | -20.84% |

| 2020 | -12.71% |

| 2019 | 54.27% |

Continue Researching ANIK

Here are a few links from around the web to help you further your research on Anika Therapeutics Inc's stock as an investment opportunity:Anika Therapeutics Inc (ANIK) Stock Price | Nasdaq

Anika Therapeutics Inc (ANIK) Stock Quote, History and News - Yahoo Finance

Anika Therapeutics Inc (ANIK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...