Aravive, Inc. (ARAV): Price and Financial Metrics

ARAV Price/Volume Stats

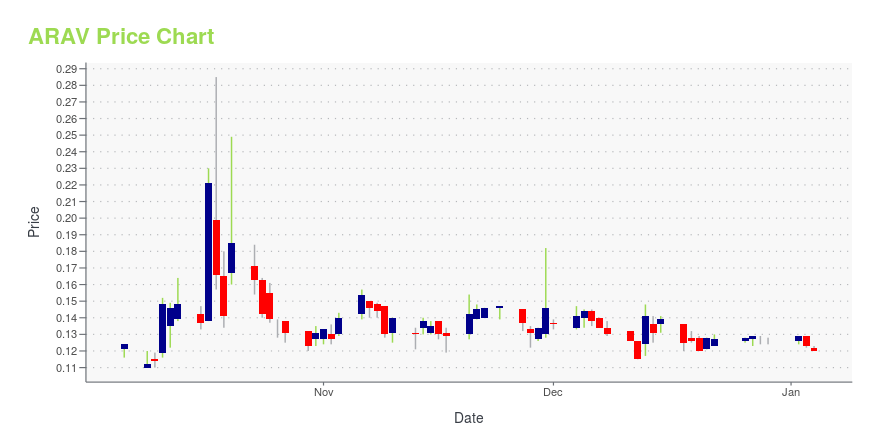

| Current price | $0.04 | 52-week high | $2.46 |

| Prev. close | $0.05 | 52-week low | $0.04 |

| Day low | $0.04 | Volume | 4,040,000 |

| Day high | $0.05 | Avg. volume | 4,251,645 |

| 50-day MA | $0.12 | Dividend yield | N/A |

| 200-day MA | $0.70 | Market Cap | 2.95M |

ARAV Stock Price Chart Interactive Chart >

Aravive, Inc. (ARAV) Company Bio

Aravive, Inc., a clinical-stage biopharmaceutical company, develops treatments for life-threatening diseases. Its lead product candidate is AVB-500, a decoy protein that targets the GAS6-AXL signaling pathway, which is in Phase Ib/II clinical trial for the treatment of platinum- resistant recurrent ovarian cancer, as well as for the treatment of clear cell renal cell carcinoma, triple negative breast cancer, acute myeloid leukemia, and pancreatic cancer. The company has a strategic collaboration agreement with WuXi Biologics to develop novel high-affinity bispecific antibodies targeting cancer and fibrosis. The company was formerly known as Versartis, Inc. and changed its name to Aravive, Inc. in October 2018. Aravive, Inc. is headquartered in Houston, Texas.

Latest ARAV News From Around the Web

Below are the latest news stories about ARAVIVE INC that investors may wish to consider to help them evaluate ARAV as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on FridayWe're closing out the trading week with a breakdown of the biggest pre-market stock movers worth watching on Friday morning! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic worth checking out on Wednesday and we have all the latest news happening this morning! |

Aravive (ARAV) Upgraded to Strong Buy: What Does It Mean for the Stock?Aravive (ARAV) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy). |

AppLovin upgraded, Genpact downgraded: Wall Street's top analyst callsAppLovin upgraded, Genpact downgraded: Wall Street's top analyst calls |

Aravive (ARAV) Reports Q2 Loss, Tops Revenue EstimatesAravive (ARAV) delivered earnings and revenue surprises of 60% and 27.40%, respectively, for the quarter ended June 2023. Do the numbers hold clues to what lies ahead for the stock? |

ARAV Price Returns

| 1-mo | N/A |

| 3-mo | -23.37% |

| 6-mo | -75.43% |

| 1-year | -97.65% |

| 3-year | -99.27% |

| 5-year | -99.36% |

| YTD | -67.66% |

| 2023 | -90.63% |

| 2022 | -39.73% |

| 2021 | -61.17% |

| 2020 | -58.74% |

| 2019 | 288.35% |

Continue Researching ARAV

Want to see what other sources are saying about Aravive Inc's financials and stock price? Try the links below:Aravive Inc (ARAV) Stock Price | Nasdaq

Aravive Inc (ARAV) Stock Quote, History and News - Yahoo Finance

Aravive Inc (ARAV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...