Athersys, Inc. (ATHX): Price and Financial Metrics

ATHX Price/Volume Stats

| Current price | $0.01 | 52-week high | $1.99 |

| Prev. close | $0.02 | 52-week low | $0.01 |

| Day low | $0.01 | Volume | 6,462,600 |

| Day high | $0.02 | Avg. volume | 1,765,480 |

| 50-day MA | $0.02 | Dividend yield | N/A |

| 200-day MA | $0.52 | Market Cap | 833.21K |

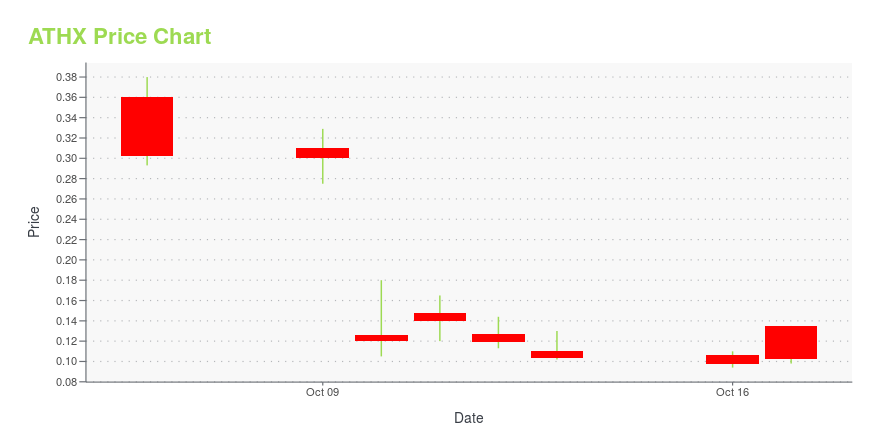

ATHX Stock Price Chart Interactive Chart >

Athersys, Inc. (ATHX) Company Bio

Athersys, Inc. focuses on the research and development activities in the field of regenerative medicine. The company was founded in 1995 and is based in Cleveland, Ohio.

Latest ATHX News From Around the Web

Below are the latest news stories about ATHERSYS INC that investors may wish to consider to help them evaluate ATHX as an investment opportunity.

Are Longevity Stocks the Next Trillion-Dollar Industry? 3 Anti-Aging PicksHere are the best longevity stocks to consider. |

Athersys Extends Near Term Liquidity with Proceeds from Warrant Inducement and Global ARDS License with Healios to Explore Strategic AlternativesCLEVELAND, October 16, 2023--Athersys, Inc. (Nasdaq: ATHX), ("Athersys" or the "Company") a cell therapy and regenerative medicine company developing MultiStem® (invimestrocel) for critical care indications, announces it has entered into a warrant exercise inducement offer letter to raise gross proceeds of up to approximately $3.9 million from the exercise of 28,124,590 warrants and received the first tranche payment of $1.5 million from HEALIOS K.K. ("Healios") under the acute respiratory distr |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayPre-market stock movers are a hot topic on Wednesday morning and we're covering all of the latest news investors need to know about! |

Athersys Reports Interim Analysis Results of MASTERS-2 Clinical Study with MultiStem in Ischemic Stroke, Signs Memorandum of Understanding (MOU) for Global ARDS License with HealiosCLEVELAND, October 10, 2023--Athersys, Inc. (Nasdaq: ATHX), a cell therapy and regenerative medicine company developing MultiStem® (invimestrocel) for critical care indications, announces that the independent data safety monitoring board (DSMB) has completed a pre-planned interim analysis of the Company’s ongoing Phase 3 MASTERS-2 pivotal clinical trial evaluating MultiStem® for the treatment of acute moderate-to-severe ischemic stroke, and concluded that the current sample size of 300 patients |

20 Foods Consumed By Longest Living People Every DayIn this article, we will be taking a look at the 20 foods consumed by longest living people every day. If you are not interested in the details about market insights on longevity, head straight to the 5 Foods Consumed By Longest Living People Every Day. The pursuit of longevity and vitality has captivated humankind […] |

ATHX Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -68.55% |

| 1-year | -98.77% |

| 3-year | -99.98% |

| 5-year | -99.98% |

| YTD | -50.00% |

| 2023 | -97.62% |

| 2022 | -96.28% |

| 2021 | -48.42% |

| 2020 | 42.28% |

| 2019 | -14.58% |

Continue Researching ATHX

Here are a few links from around the web to help you further your research on Athersys Inc's stock as an investment opportunity:Athersys Inc (ATHX) Stock Price | Nasdaq

Athersys Inc (ATHX) Stock Quote, History and News - Yahoo Finance

Athersys Inc (ATHX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...