Adobe Inc. (ADBE): Price and Financial Metrics

ADBE Price/Volume Stats

| Current price | $473.83 | 52-week high | $638.25 |

| Prev. close | $477.12 | 52-week low | $331.89 |

| Day low | $473.83 | Volume | 13,282 |

| Day high | $473.83 | Avg. volume | 3,483,047 |

| 50-day MA | $519.61 | Dividend yield | N/A |

| 200-day MA | $552.77 | Market Cap | 212.28B |

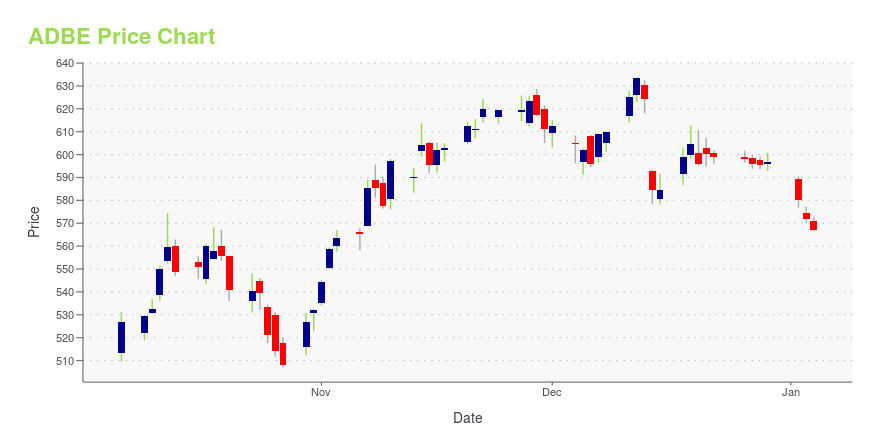

ADBE Stock Price Chart Interactive Chart >

Adobe Inc. (ADBE) Company Bio

Adobe Inc. is an American multinational computer software company. Incorporated in Delaware and headquartered in San Jose, California, it has historically specialized in software for the creation and publication of a wide range of content, including graphics, photography, illustration, animation, multimedia/video, motion pictures and print. The company has expanded into digital marketing management software. Adobe has millions of users worldwide. Flagship products include: Photoshop image editing software, Adobe Illustrator vector-based illustration software, Adobe Acrobat Reader and the Portable Document Format (PDF), plus a host of tools primarily for audio-visual content creation, editing and publishing. The company began by leading in the desktop publishing revolution of the mid-eighties, went on to lead in animation and multi-media through its acquisition of Macromedia, from which it acquired animation technology Adobe Flash, Developed inDesign and subsequently gained a leadership position in publishing over Quark and PageMaker, developed video editing and compositing technology in Premiere, pioneered low-code web development with Muse, and emerged with a suite of solutions for marketing management. Adobe offered a bundled solution of its products named Adobe Creative Suite, which evolved into a SaaS subscription offering Adobe Creative Cloud. (Source:Wikipedia)

Latest ADBE News From Around the Web

Below are the latest news stories about ADOBE INC that investors may wish to consider to help them evaluate ADBE as an investment opportunity.

AI Assimilation: 7 Stocks Leading in Artificial Intelligence AdoptionWager on these top AI stocks to buy, in this booming $200 billion sector, with the potential to grow to $1.85 trillion |

Top Research Reports for Visa, Adobe & TotalEnergiesToday's Research Daily features new research reports on 16 major stocks, including Visa Inc. (V), Adobe Inc. (ADBE) and TotalEnergies SE (TTE). |

Microsoft (MSFT), OpenAI Face Charges From The New York TimesMicrosoft (MSFT) and OpenAI face a copyright infringement lawsuit by The New York Times over the unauthorized use of published work to train artificial intelligence technologies. |

AI Stocks: Tech Giants, Cloud Titans, Chipmakers Battle For An EdgeAmid hype over artificial intelligence and ChatGPT, the best AI stocks generate sales or get a strategic edge from the fast maturing technology. |

Software Companies Finally Had to Care About Profit in 2023(Bloomberg) -- For much of the last decade, software companies just focused on growing as quickly as possible. That changed in 2023. Profit and operating margin became the industry’s watchwords. Most Read from BloombergThe Late-Night Email to Tim Cook That Set the Apple Watch Saga in MotionChinese Carmaker Overtakes Tesla as World’s Most Popular EV MakerBridgewater CEO’s Past Office Romance Led to Favoritism ClaimsL’Oreal Heir Francoise Bettencourt Meyers Becomes First Woman With $100 Billion Fo |

ADBE Price Returns

| 1-mo | -6.65% |

| 3-mo | -22.82% |

| 6-mo | -6.75% |

| 1-year | 30.51% |

| 3-year | -8.12% |

| 5-year | 68.05% |

| YTD | -20.58% |

| 2023 | 77.28% |

| 2022 | -40.65% |

| 2021 | 13.38% |

| 2020 | 51.64% |

| 2019 | 45.78% |

Continue Researching ADBE

Want to see what other sources are saying about Adobe Inc's financials and stock price? Try the links below:Adobe Inc (ADBE) Stock Price | Nasdaq

Adobe Inc (ADBE) Stock Quote, History and News - Yahoo Finance

Adobe Inc (ADBE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...